Squaring ERISA Long Term Disability Insurance Coverage with

advertisement

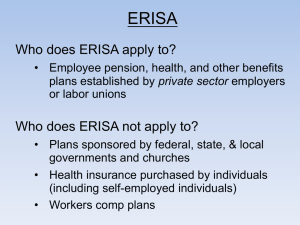

SQUARING ERISA LONG TERM DISABILITY INSURANCE COVERAGE WITH WORKERS’ COMPENSATION CLAIMS Jonathan M. Feigenbaum Jonathan M. Feigenbaum Phillips & Angley One Bowdoin Square Boston, MA 02114 617-367-8787 JonF@phillips-angley.com www.phillips-angley.com Discovering LTD Coverage You are representing a client in a workers’ compensation claim. You learn that the client was provided long term disability benefits insurance through the employer. Now you have an opportunity to recover additional income or benefits for your client. You must examine the benefits and detriments of seeking long term disability coverage for your client with great care. Why is LTD Coverage Important? More benefits to client. Could pay to normal social security retirement age. Not work related dependent. Sometimes easier proof. Often integrates with other benefits, health, life etc. ERISA On September 2, 1974 (Labor Day) Congress enacted the Employee Retirement Income Security Act (ERISA). Although the statute uses the word retirement in its title, ERISA governs both retirement benefits (pensions) and employee welfare benefit plan. Those are benefits that private sector employers provide to employees; government employees and those employed by churches are not subject to ERISA. ERISA – How Does It Work? ERISA long term disability litigation is truly a creature of its own. It ‘s a blend of: trust law contract law disability insurance law federal common law of its own ERISA Protects Employees, right? This must be good for employees! It is hereby declared to be the policy of this chapter to protect interstate commerce and the interests of participants in employee benefit plans and their beneficiaries, by requiring the disclosure and reporting to participants and beneficiaries of financial and other information with respect thereto, by establishing standards of conduct, responsibility and obligation for fiduciaries of employee benefit plans, and by providing for appropriate remedies, sanctions, and ready access to the Federal courts. ERISA Sec. 2., 29 U.S.C. 1001(b) ADAM A 16th Century Interpretation of Adam What Is ERISA? "Everything Ridiculous Imagined Since Adam." This court does not take so dim a view of the Employee Retirement Income Security Act of 1974. Instead, this court is willing to believe that ERISA has lurking somewhere in it a redeeming feature. Florence Nightingale Nursing Service, Inc. v. Blue Cross/Blue Shield of Alabama, 832 F.Supp. 1456, 1457 (N.D.Ala. 1993). We Hate It, Insurers Love it, Why? Because We Have Polar Opposite Goals! We can’t be touched! Told you so! It’s Simply Unfair to the Injured. No Jury Trial No Damages – All actions are equitable No Consequential Damages No Punitive Damages No Make Whole Remedies Federal Court Jurisdiction Almost Suspension of Fed. Rules of Civil Procedure Extremely Difficult Burden to Obtain Discovery Rarely Live Testimony Claims Usually Decided on Cross Motions Insurers are treated as fiduciaries and their decisions will only be overturned if “arbitrary and capricious,” not just unfair or probably wrong Semien v. Life Ins. Co. of America, 436 F.3d 805, 815 (7th Cir. 2006). Congress has not provided Article III courts with the statutory authority, nor the judicial resources, to engage in a full review of the motivations behind every plan administrator's discretionary decisions. To engage in such a review would usurp plan administrators' discretionary authority and move toward a costly system in which Article III courts conduct wholesale reevaluations of ERISA claims. Imposing onerous discovery before an ERISA claim can be resolved would undermine one of the primary goals of the ERISA program: providing "a method for workers and beneficiaries to resolve disputes over benefits inexpensively and expeditiously." Perry v. Simplicity Eng'g, 900 F.2d 963, 967 (6th Cir. 1990) (internal citation omitted). ERISA PREEMPTION, IT DOESN’T GET MUCH BROADER Section 514(a) of ERISA states that the statute "shall supersede any and all State laws insofar as they may now or hereafter relate to any employee benefit plan" that is covered by ERISA. Section 514(b)(2)(A) The Savings Clause 29 U.S.C. § 1144(a). The saving clause states as follows: Except as provided in subparagraph (B) [the deemer clause], nothing in this subchapter shall be construed to exempt or relieve any person from any law of any State which regulates insurance, banking, or securities. The Deemer Clause 29 U.S.C. § 1144(b)(2)(A). The deemer clause states as follows: Neither an employee benefit plan... nor any trust established under such a plan, shall be deemed to be an insurance company or other insurer, bank, trust company, or investment company or to be engaged in the business of insurance or banking for purposes of any law of any State purporting to regulate insurance companies, insurance contracts companies., banks, trust companies, or investment The Genesis of the Trouble 'The six carefully integrated civil enforcement provisions found in 502(a) of the statute as finally enacted ... provide strong evidence that Congress did not intend to authorize other remedies that it simply forgot to incorporate expressly.' "Pilot Life Ins. Co. v. Dedeaux,, 481 U.S. 41, 54 (1987). The Hidden Menace. Would a reasonable employer pay premiums to an insurer if that employer really understood how long term disability benefits are calculated and paid? Would an employee make a partial or full payment toward the premium? The Nightmare, offsets and other recoveries. Who wants reimbursement? -Health Plan -Comp Insurer -LTD Insurer -All or some of the above. The Real World Issue To figure the amount of monthly benefit: 1. Multiply the Insured's basic monthly earnings by the benefit percentage shown in the policy specifications. 2. Take the lesser of the amount: a. determined in step (1) above; or b. of the maximum monthly benefit shown in the policy specifications; and 3. Deduct other income benefits, shown below, from this amount Other Income Benefits Other income benefits means those benefits as follows. 1. The amount for which the insured is eligible under: a. Workers' or Workmen's Compensation Law; b. occupational disease law; or c. any other act or law of like intent. 2. The amount of any disability income benefits for which the insured is eligible under any compulsory benefit act or law An Illustration of Benefits and Offsets. $4000.00 monthly wage. LTD payment 60% or $2400.00 per month Comp payment $2000 per month. SSDI payment $1000.00 per month. A portion of the recovery from the third party tortfeasor. After offsets, client receives minimum which is sometimes $50 per month. Trujillo v. Cyprus Amax Minerals Co. Retirement Plan Committee, 203 F.3d 733 (10th Cir. 2000). Victory for the insurer, defeat for worker. The Supreme Court Speaks Again. Sereboff v. Mid Atlantic Medical Services, Inc., 126 S.Ct. 1869, 1874 (2006). A Partial Win for the Injured. Popowski v. Parrott, 461 F.3d 1367 (11th Cir. 2006). The Eleventh Circuit (combined into one opinion)--interpreted Sereboff and held that one type of reimbursement/subrogation provision could be enforced while another could not. What Does One Do? Read the documents. Plan Ahead. Advise your client well. Get other counsel involved as necessary. Negotiate a settlement that that your client can accept. Tell your client about Sereboff. Warn your client that repaying $$ does not equate with continued benefit payments. Fight back! Help your clients achieve justice. Sleep well at night!