Leveraged Buyouts and Management Buyouts

advertisement

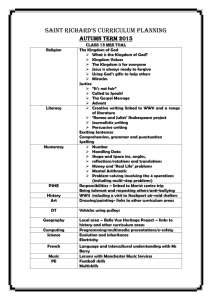

Leveraged Buyouts and Management Buyouts Using OPM to Buy a Firm (Other People’s Money) Leveraged Buyout • Small group of investors borrows money to buy the stock of a public corporation. • LBO transaction is expected to be reversed with a public offering within three to five years. • Sometimes only a segment, a division or subdivision of the firm is bought. Management • Buyout: – An LBO where management plays a significant role. • Buyin: – An LBO where outside management plays a significant role. LBO and MBO Sponsors • Leveraged buyout specialist (KKR) • Venture capitalists • Investment bankers FORBES TOP 25 PRIVATE COMPANIES Source: www.forbes.com Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Name Cargill Koch Industries Mars Publix Super Markets PricewaterhouseCoopers Ernst & Young Bechtel C&S Wholesale Grocers Meijer HE Butt Grocery TRW Automotive Huntsman Fidelity Investments Swift & Co JM Family Enterprises Enterprise Rent-A-Car Science Applications Intl Unisource Marmon Group Advance Publications Menard SC Johnson & Son MDFC Holding International Steel Group Alticor State MN KS VA FL NY NY CA VT MI TX MI UT MA CO FL MO CA GA IL NY WI WI CA OH MI Industry Crops Oil & Gas Operations Food Processing Retail (Grocery) Business Services Business Services Construction Services Retail (Grocery) Retail (Grocery) Retail (Grocery) Auto & Truck Parts Chemical Manufacturing Investment Services Food Processing Auto & Truck Manufacturers Business Services Aerospace & Defense Forestry & Wood Products Misc Fabricated Products Printing & Publishing Retail (Home Improvement) Personal & Household Prods -Iron & Steel Personal & Household Prods Revenues ($mil) Employees 59,894 98,000 40,000 17,000 16,800 31,000 16,027 123,000 15,900 125,000 13,100 106,000 11,600 47,000 11,300 9,000 10,900 84,000 10,700 56,000 10,630 63,000 9,000 15,000 8,937 29,142 8,380 21,300 7,600 3,500 6,900 53,500 5,902 38,700 5,900 8,000 5,756 30,000 5,565 27,585 5,500 33,300 5,372 12,000 5,105 60,500 5,000 11,600 4,900 11,500 THE 25 LARGEST LBOs, Jan 2000 - Dec 2003 Source: Securities Data Corporation Date Announced Target Name Target Industry Sector Target Nation Acquiror Name Acquiror Nation 29-Jul-02 11-Jun-03 4-Sep-03 20-Aug-02 6-Oct-03 2-Oct-00 17-Oct-03 17-Jun-02 26-May-01 23-Jun-00 8-Mar-02 12-Sep-03 20-Mar-02 22-Feb-00 20-Aug-02 25-May-01 24-Nov-03 29-Jun-01 12-May-03 3-Jan-01 7-Aug-00 20-Mar-01 28-Jan-03 12-Sep-01 Legrand SA Seat Pagine Gialle-Directories Ondeo Nalco Co Qwest Commun Intl Inc-QwestDex Scottish & Newcastle-Ret Bus IBP Inc Chelsfield PLC Jefferson Smurfit Group PLC Yell Group Johns Manville Corp Southern Water(Scottish Power) Debenhams PLC Unique Pub Co,Voyager Pub Co Deutsche Telekom AG-North Qwest Comm Intl-QwestDex Le Meridien Hotels Warner Music Group Eircom PLC Debenhams PLC Messer Griesheim GmbH VEBA Electronics Inc(VEBA AG) Fairbar Ltd Deutsche Telekom-Cable TV Cos Cognis BV(Henkel KGaA) Electronic and Electrical Equipment Printing, Publishing, and Allied Services Chemicals and Allied Products Printing, Publishing, and Allied Services Food and Kindred Products Food and Kindred Products Investment & Commodity Firms,Dealers,Exchanges Paper and Allied Products Printing, Publishing, and Allied Services Stone, Clay, Glass, and Concrete Products Electric, Gas, and Water Distribution Retail Trade-General Merchandise and Apparel Retail Trade-Eating and Drinking Places Radio and Television Broadcasting Stations Printing, Publishing, and Allied Services Hotels and Casinos Electronic and Electrical Equipment Telecommunications Retail Trade-General Merchandise and Apparel Chemicals and Allied Products Wholesale Trade-Durable Goods Retail Trade-Eating and Drinking Places Radio and Television Broadcasting Stations Chemicals and Allied Products France Italy United States United States United Kingdom United States United Kingdom Ireland-Rep United Kingdom United States United Kingdom United Kingdom United Kingdom Germany United States United Kingdom United States Ireland-Rep United Kingdom Germany United States United Kingdom Germany Netherlands Investor Group Silver SpA Investor Group Investor Group Spirit Amber Bidco Ltd DLJ Merchant Banking Partners Duelguide PLC MDP Acquisitions Investor Group Investor Group First Aqua Ltd Baroness Retail Ltd Investor Group Investor Group Investor Group Grand Hotels(M)Acquisition Co1 Investor Group Valentia Group Laragrove Ltd Investor Group Investor Group Shopgood Ltd(Morgan Grenfell) Investor Group Investor Group France United Kingdom United States United States United States United States United Kingdom Ireland-Rep United Kingdom United States United Kingdom United Kingdom United Kingdom United States United States United Kingdom United States Ireland-Rep United Kingdom Germany United States United Kingdom United Kingdom Germany Value of Transaction ($mil) 5,059.72 4,367.53 4,350.00 4,300.00 4,173.88 3,766.98 3,413.40 3,315.01 3,043.08 3,028.45 2,927.61 2,912.78 2,865.91 2,784.61 2,750.00 2,675.96 2,600.00 2,560.70 2,492.84 2,467.96 2,350.00 2,327.98 2,282.29 2,266.00 THE 25 LARGEST LBOs, 1980-2003 Target Name Target Industry Sector Target Nation Acquiror Name Acquiror Nation RJR Nabisco Inc Beatrice Companies Inc Safeway Stores Inc Legrand SA Hospital Corp of America Borden Inc Seat Pagine Gialle-Directories Ondeo Nalco Co Qwest Commun Intl Inc-QwestDex Borg-Warner Corp Scottish & Newcastle-Ret Bus Southland Corp Montgomery Ward & Co Inc Tobacco Products Machinery Retail Trade-Food Stores Electronic and Electrical Equipment Health Services Food and Kindred Products Printing, Publishing, and Allied Services Chemicals and Allied Products Printing, Publishing, and Allied Services Electronic and Electrical Equipment Food and Kindred Products Retail Trade-Food Stores Retail Trade-General Merchandise and Apparel Stone, Clay, Glass, and Concrete Products United States United States United States France United States United States Italy United States United States United States United Kingdom United States United States Kohlberg Kravis Roberts & Co BCI Holdings Corp SSI Holdings Corp Investor Group HCA-Hospital Corp of America Kohlberg Kravis Roberts & Co Silver SpA Investor Group Investor Group Borg-Warner Holdings Corp Spirit Amber Bidco Ltd JT Acquisition Corp BFB Acquisition Corp United States United States United States France United States United States United Kingdom United States United States United States United States United States United States United States Owens-Illinois Holdings Corp United States 3,640.00 Air Transportation and Shipping Paper and Allied Products Retail Trade-General Merchandise and Apparel Food and Kindred Products Paper and Allied Products Health Services Retail Trade-Food Stores Printing, Publishing, and Allied Services Electric, Gas, and Water Distribution Retail Trade-General Merchandise and Apparel United States United States United States Wings Holdings Inc FH Acquisition Corp Macy Merger Corp United States United States United States 3,580.00 3,579.40 3,523.30 Australia Ireland-Rep United States United Kingdom United Kingdom United Kingdom United Kingdom Harlin Holdings Pty Ltd MDP Acquisitions IMA Holdings Corp Isosceles PLC(Gateway Corp) Investor Group First Aqua Ltd Baroness Retail Ltd Australia Ireland-Rep United States United Kingdom United Kingdom United Kingdom United Kingdom 3,434.34 3,315.01 3,307.85 3,292.36 3,043.08 2,927.61 2,912.78 Owens-Illinois Inc NWA Inc Fort Howard Corp RH Macy & Co Inc Elders IXL Ltd Jefferson Smurfit Group PLC American Medical International Gateway Corp PLC Yell Group Southern Water(Scottish Power) Debenhams PLC Value of Transaction ($mil) 30,598.78 6,095.00 5,335.00 5,059.72 4,915.00 4,643.42 4,367.53 4,350.00 4,300.00 4,202.60 4,173.88 4,055.00 3,800.00 LBO Financing • Secured Debt – Secured debt is also called asset-based lending, and it can be either senior or intermediate term debt. • Senior Debt – Comprises loan secured by liens on particular assets of the company. – The collateral includes physical assets such as land, plant and equipment, accounts receivable, and inventories. • Lenders will usually advance 85% of the value of the accounts receivable and 50% of the value of the target inventories. • The process of determining the collateral value of the LBO candidate's assets is sometimes called qualifying the assets. Private companies outperform relative to the market. Source: McKinsey Quarterly, 2001, n. 2. LBO companies remain private only for a few years. Financial Acquirers (LBOs) negotiate better than Corporate Acquirors (Mergers & Tender Offers). Intermediate Term Debt • Is usually subordinate, and often backed up by fixed assets such as land and plant and equipment. • The collateral value of theses assets is usually based on their liquidation value. • Debt backed up by equipment typically has a term of six months to one year. • Loans backed up by real estate tend to have a one- to two-year term. Unsecured Debt Financing • It is usually referred to as subordinated and junior subordinated debt. • The term mezzanine layer financing is often applied to this financing because it has both debt and equity characteristics: it is equity like in that lenders typically receive warrants that may be converted into equity in the target. • When the warrants are exercised, the share of ownership of the previous equity holders is diluted. It is important to be aware of the role of the warrants in computing the return to the providers of mezzanine layer financing. Buyout Benefits • Tax savings – Stepped up asset base. • Approximately half of the companies involved in LBOs stepped up their asset base in 1980's (Kaplan, Journal of Financial Economics, 1989) – Tax shields from interest payments. • One should realize, however, that these benefits should be relatively low when all of the costs and benefits are factored in. Most likely the LBO companies do not have the optimal capital structure in the first few years after the LBO - why would they otherwise not keep those high debt levels? The next two tables are from Kaplan, S. (1989), “Management Buyouts: Evidence on Taxes as a Source of Value”, Journal of Finance, 611-632. Buyout Benefits Continued • Managerial incentives and other agency issues. – Managers own a larger fraction of the equity. – Separation of ownership and control has been reduced. As a result managers have larger incentives to worry about shareholders value. • Often they also get a larger fraction of their compensation tied to company performance. – Monitoring benefits. • Fewer and larger external shareholders (institutional investors) have an incentive to monitor managerial behavior. – Debt-bonding effect. • The debt payments reduce managerial discretion in the spending of free cash flows. “Debt provides discipline.” Buyout Benefits Continued • Expropriation of “old” bondholders – LBOs increase riskiness of old debt without increasing their promised interest payments. – A bond with covenants to protect against this are said to have “event risk protection.” • Bonds with event risk protection were common in the early 1990’s. – Response to several large investment grade bond issues that were reduced to high yield status overnight via leveraged buyouts. • Few bonds now carry event risk protection. Buyout Benefits Continued • Expropriation of employees – Anecdotal evidence: easier layoffs and reduction in over-funded pension plans. Buyout Benefits Continued • Exploiting undervaluation. – Management has more information about future cashflows than outside owners. Although selling shareholders are receiving high premiums, managers are possibly paying a too low price. – Evidence: • Median annualized rate of return on equity to post-buyout shareholders in a firm that goes public again was 286% in 1980-1987. – This gain was positively related to managerial ownership. • However, there also exists evidence that stock prices fall back to their pre-buyout levels in failed MBOs. Buyout Benefits Continued • Reducing costs of being a public company. – These costs include administrative costs inside the company as well as regulatory costs to the stock exchange. Buyout Costs • Cost of financial distress. • Managers become undiversified and may be less willing to take risks. • Inappropriate investment policy (underinvestment) because of high leverage. Good LBO Candidates • High potential benefits: – Potentially high agency costs: • Small managerial ownership currently • Large excess cash – High marginal tax rate and stable earnings. • Makes debt financing attractive. – Low current leverage. – No need for new equity financing. Good LBO Candidates Continued • Low potential costs: – Low investment needs - underinvestment and non risk-taking behavior do not pose a threat. – Parts of the assets can be sold if necessary.