Residential Real Estate - Value After the Subprime Crisis

advertisement

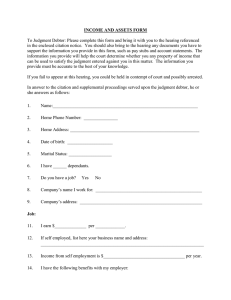

Residential Real Estate – Value After the Subprime Crisis Britt Gwinner, CFA Principal Financial Specialist International Finance Corporation Viña del Mar, 7 May, 2010 1 Contents 1. The Basic Picture – housing demand around the world 2. How was mortgage finance linked to the recent crisis? 3. Going forward 2 The International Finance Corporation • Goal: Improve lives and raise living standards through sustainable private sector development • Member of the World Bank Group, owned by 179 shareholder countries, assets USD 51.4 billion, capital USD 16.1 billion Global—for more than 50 years has focused on developing countries Local—full time presence in more than 80 countries and activities in many others • Housing Finance Investment Services: Loans for mortgage lending; Collateralized mortgage lines of credit; Warehouse lines of credit; Credit enhancement for MBS; Structured finance; Equity investments; Construction finance • Housing Finance Advisory Services: Policy and regulatory infrastructure, mortgage toolkit and training, capacity building 3 3 Section 1 THE BASIC PICTURE 4 Growth and urbanization • World Bank Data Visualizer • http://devdata.worldbank.org/DataVisualizer/ 5 Real estate: a tale of many markets • Real estate: more than 1/3 of the value of all the underlying physical capital in the world • Developed countries: mature residential real estate markets Populations are stable or shrinking – demand for financing from turnover, renovation, aging population, regional growth dynamics >90% of housing units in developed countries are of adequate quality • Emerging markets: large pent-up demand for housing As countries develop, they urbanize Emerging markets urbanization has been poorly planned - housing and infrastructure inadequate, housing demand is strong Self-built houses on squatted land lack connections to sewage or water, built of inadequate materials 44.7% of households in Africa, 25.6% in South Asia lack access to improved sanitation 20 to 30 million housing units in Latin America lack a basic amenity such as running water, or are built of substandard materials Inadequate housing compounds the cycle of poverty – health, social investment, wealth-building 6 6 Mortgages mostly unavailable in emerging markets But as real incomes rise, so does capacity to make a mortgage payment Mortgage Debt as Percent of GDP Selected Countries 100% Developed countries 40-100% 80% Emerging markets < 20% Chile 18% in 2009 60% 40% 20% Russia Argentina Peru Senegal Guatemala Indonesia Ukraine Kazakhstan Turkey Colombia Poland Mexico Lithuania China Chile Morocco Thailand Italy Panama Korea Malaysia Japan Germany Spain United States Denmark 0% country 7 7 Housing Finance and Growth In emerging markets, housing finance is related to new construction and as a result fixed investment, and generally with domestic inputs, both labor and materials In developed markets, housing finance is more linked to trading of existing housing and economic cycles In the U.S., there are 7 million new loans each year, 6 million of which are for existing housing In developed markets, real estate and related services count for between 2% and 4% of PIB In the U.S., 8 of 10 recessions since 1949 were proceded by reductions in residential investment 8 8 Mortgages and Fixed Investment In the initial phase of development, mortgage finance can add 0.5% of fixed investment as a percent of GDP for each increment in the size of the market Source: Duebel (2008) 9 Real estate as an asset class • Traditional roles: inflation protection, diversification Securities backed by inflation-indexed mortgages are natural inflation hedges (Chile, Mexico, Colombia) Real estate investments can decrease the cost of inflation insurance for long-horizon investors (Amenc , Martellini, & Ziemann, Journal of Portfolio Management, 2009) IRR of about 11 percent for 60/40 stock/bond portfolio with a varying investment in real estate over time. (Performance of Real Estate Portfolios, Fisher and Goetzmann, Journal of Portfolio Management, 2005) International real estate can reduce portfolio risk (Chua, Journal of Real Estate Portfolio Management, 1999) • A recent comment from Prof. Robert Shiller: “After prices fall, the media begins to publish stories of investor foolishness. Investors, feeling stupid or betrayed, have a “betrayal aversion” that causes them to react intensely and sell in anticipation of future price drops.” 10 Investment vehicles for residential real estate (1) • Fixed Income Residential Mortgage Backed Securities (RMBS) – True sale to special purpose vehicle (SPV) that issues bonds • Long duration, some uncertainty in principal amortization (prepayments), varying structures, stand-alone credit rating, almost no replacement of assets, no recourse to loan originator • In Peru, AAA local scale RMBS provides 32bp over 3y AAA corporate (when corporates are available, it’s a thin market), 202bp over 3y sovereign Covered bonds – general obligation bonds with contractual and/or legal backing from a portfolio of mortgages • Long duration, prepayments may be mitigated, credit profile a function of issuer’s balance sheet and security portfolio, assets may be replaced, complete recourse to bond issuer • Yields comparable to AAA corporates 11 Investment vehicles for residential real estate (2) • Equity Rental apartment buildings, property developers, land banks, private equity Residential rental - works best where laws permit a reasonable balance of tenant and landlord rights and responsibilities Rental reforms recently passed in Brazil, considered in Mexico, others have stronger market traditions (Uruguay) • Hybrid Real Estate Investment Trusts or Funds – United States, Asia, increasingly in emerging markets – while tax advantages not relevant to most pension fund investors, return may be 12 Section 2 WHAT HAPPENED WITH THE CRISIS? 13 U.S. subprime boom and bust – finance driven, excessive leverage, weak credit underwriting U.S. House Prices and Mortgage Originations 4,500 190 4,000 170 3,500 150 3,000 2,500 130 2,000 110 House Prices 1,500 90 Subprime 70 FHA/VA 50 1,000 500 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Year Sources: S&P Case-Shiller, Inside Mortgage Finance 14 Dollars in Millions S&P/Case-Shiller National House Price Index Total Mortgage Originations (Right Hand Scale) What have mortgage defaults looked like? 35% 30% 25% 20% 15% 10% 5% 0% 15 15 A largely external crisis • There are no subprime mortgages in emerging markets Lending generally to high income borrowers, with low LTVs and full documentation • Emerging sovereigns and corporates benefitted from low borrowing spreads during the boom But, macro management has broadly been strong, emerging markets come out of the crisis with relatively low decline in GDP, many cases of growth • At the worst of the crisis, funding retreated to New York, London, Madrid, etc. • Limited development of some capital markets mitigated bad effects – e.g., Egypt, Guatemala • Relatively strong economic performance protected others – China, India, Brazil, Peru 16 16 Section 3 GOING FORWARD 17 What haven’t private pension funds invested more in real estate? • Constraints Macroeconomic volatility – inflation, inconsistent policies, financial crises - Mexico ‘95, Russia ‘98, Argentina ’01 • High real rates + volatility make government debt more attractive Lack of long term fixed-income instruments, lack of secondary market liquidity, yield curves Investment channeled through personal rather than institutional means • Uruguay rental apartment buildings built & owned by individuals, family firms Informal markets flourish because of faulty legal and regulatory structures 18 18 How to boost private pension fund real estate investments? • Lower real rates make private fixed income issues more attractive Recent history in Chile, Mexico, Brazil, Colombia, Indonesia, India, China, etc. • Promote a range of long term fixed-income instruments, and a range of credit ratings – move away from incentives to pure triple-A markets Permit securitization, covered bonds, funds, REITs – issuer chooses best execution Chile as a model – 1980s reforms created AFPs, letras hipotecarias Wider range of pension, insurance benchmarks • Promote secondary bond market liquidity Benchmark government yield curves – extend maturity, issue to promote liquidity Strengthen exchanges transparency, efficiency • Improve legal and regulatory structures of real estate markets More efficient land use planning, title registration, contract enforcement 19 19 THANK YOU 20 Annex - LAC RMBS during the crisis Reliance on local investors, mostly low mortgage delinquencies, persistent demand from private pensions and insurers • Chile – Structured issuances up 6 times in 2009 v. 2008, of this, 9% was RMBS • Panama – La Hipotecaria 9 RMBS issues through 2008, securitized consumer loans 9/08, rolls commercial paper through 3/09, issues MTNs 4/09 – all to local investors • Peru – corporate issuances, structured finance for auto, consumer, leasing, and Titulizadora Peruana issues RMBS 02/10, USD 34.5 million, oversubscribed • Mexico – Severely affected by the crisis, downgrades in RMBS issues by failed lenders, but strong performance by RMBS from major banks, Infonavit, Fovissste 21 21 Annex - LAC RMBS during the crisis (cont.) Colombia • USDeq 2.4 billion issued since 2002, trading at average price of 104.6 at end March, 2010 • UVR (inflation-adjusted), increasingly nominal fixed-rate peso • Prepayment rates have run 10.5% UVR, 14% peso, defaults < 2% • Structured finance volume 2009 almost twice 2008 • TC placed USDeq 791 million in RMBS 2009, more than half of recent issues purchased by domestic pension funds 22 22 Contact Info: W. Britt Gwinner Principal Financial Specialist International Finance Corporation Miguel Dasso 104, Piso 5 San Isidro, Lima 27, Perú +51 1 611-2573 wgwinner@ifc.org 23