Chapter 8 Pricing Decisions, Customer Profitability Analysis

Slide 8-2

CHAPTER 8

Pricing Decisions, Customer

Profitability Analysis, and

Activity-Based Pricing

Pricing Decisions

Pricing decisions are often the most difficult decisions that managers face

Pricing decisions examined in this chapter include

Profit-maximizing price from the standpoint of economic theory

Pricing of special orders

Marking up costs and target costing

Measuring customer profitability and activity based pricing

Slide 8-3

The Profit-Maximizing Price

Economic theory suggests that the quantity demanded is a function of the price that is charged

Generally, the higher the price, the lower the quantity demanded

If managers can estimate the quantity demanded at various prices, determining the optimal price is straightforward

Slide 8-4

Learning objective 1: Compute the profit-maximizing price for a product or service, and perform incremental analysis related to pricing a special order.

The Profit-Maximizing Price

To calculate the profit-maximizing price:

Subtract unit variable costs from price to obtain the contribution margin

Multiply the contribution margin by the quantity demanded

Subtract fixed costs and estimate profits

Select the price with the highest profit

Slide 8-5

Learning objective 1: Compute the profit-maximizing price for a product or service, and perform incremental analysis related to pricing a special order.

Estimating the Profit-Maximizing

Price

Slide 8-6

Learning objective 1: Compute the profit-maximizing price for a product or service, and perform incremental analysis related to pricing a special order.

Estimating Demand

The most difficult part of determining the profit-maximizing price is determining the demand function

A number of approaches can be used

Sales managers in various regions could estimate the total quantity demanded at various prices

The product could be test marketed with a number of potential customers at various prices

Slide 8-7

Learning objective 1: Compute the profit-maximizing price for a product or service, and perform incremental analysis related to pricing a special order.

Estimates of price and quantity demanded

Price = $6.95, quantity demanded = 20,000

Price = $5.95, quantity demanded = 25,000

Price = $4.95, quantity demanded = 32,000

Variable cost = $1.50 per unit

Fixed cost = $80,000

Find the profit-maximizing price

(Price - Variable) X Quantity- Fixed Cost = Profit

(6.95 - 1.50) X 20,000 - 80,000 = 29,000

(5.95 - 1.50)

(4.95 - 1.50)

X 25,000

X 32,000

- 80,000 =

- 80,000 =

31,250

30,400

$5.95 is the profit maximizing price

Slide 8-8

Learning objective 1: Compute the profit-maximizing price for a product or service, and perform incremental analysis related to pricing a special order.

Pricing Special Orders

Special orders are for goods and services not considered part of a company’s normal business

Price charged will not affect prices charged in the normal course of business

The company may be better off charging a price that is below full cost

Slide 8-9

Learning objective 1: Compute the profit-maximizing price for a product or service, and perform incremental analysis related to pricing a special order.

Pricing Special Orders

The special order decision presents two alternatives

Accept

Reject

Income from the main business is the same under both alternatives

It is not incremental and need not be considered in the special order

Slide 8-10

Learning objective 1: Compute the profit-maximizing price for a product or service, and perform incremental analysis related to pricing a special order.

Pricing Special Orders

Need to consider incremental revenues and incremental costs

The incremental revenue is the revenue associated with the special order

Incremental costs can include

Direct materials

Direct labor

Variable overhead

Incremental fixed costs

Slide 8-11

Learning objective 1: Compute the profit-maximizing price for a product or service, and perform incremental analysis related to pricing a special order.

Slide 8-12

Special Orders – Premier Lens

Example

Should Premier Lens accept special order of 20,000 lenses to be sold to Blix Camera for $73 per lens?

Below is the full cost of $75 per lens

Learning objective 1: Compute the profit-maximizing price for a product or service, and perform incremental analysis related to pricing a special order.

Special Orders – Premier Lens

Example

Perform incremental analysis

Fixed costs are not incremental, they will not change if the order is accepted

Slide 8-13

Learning objective 1: Compute the profit-maximizing price for a product or service, and perform incremental analysis related to pricing a special order.

Importance of Pricing Power

Slide 8-14

Learning objective 1: Compute the profit-maximizing price for a product or service, and perform incremental analysis related to pricing a special order.

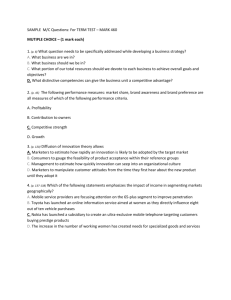

Which of the following is true?

a.

In pricing special orders, fixed costs typically are not relevant b.

In pricing special orders, fixed costs typically are relevant

Answer: a

Fixed costs typically are not relevant

Slide 8-15

Learning objective 1: Compute the profit-maximizing price for a product or service, and perform incremental analysis related to pricing a special order.

Cost-Plus Pricing

With a cost plus approach, the company starts with an estimate of product cost

Typically excluding any selling or administrative costs

Adds a markup to arrive at a price that allows for a reasonable level of profit

Slide 8-16

Learning objective 2: Explain the cost-plus approach to pricing and why it is inherently circular for manufacturing firms. Also, explain the target costing process for a new product.

Cost-Plus Pricing

Advantages

The cost plus approach is simple to apply

The company will earn a reasonable profit if a sufficient quantity can be sold at the specified price

The approach also has limitations

Slide 8-17

Learning objective 2: Explain the cost-plus approach to pricing and why it is inherently circular for manufacturing firms. Also, explain the target costing process for a new product.

Cost-Plus Pricing

Limitations

Determination of an appropriate markup requires considerable judgment

Experimentation with different markups may be necessary

Inherently circular for manufacturing firms

Need to estimate demand to determine fixed costs and the price, yet the price affects the quantity demanded

Slide 8-18

Learning objective 2: Explain the cost-plus approach to pricing and why it is inherently circular for manufacturing firms. Also, explain the target costing process for a new product.

Cost-Plus Pricing

Slide 8-19

Learning objective 2: Explain the cost-plus approach to pricing and why it is inherently circular for manufacturing firms. Also, explain the target costing process for a new product.

All of the following are limitations of cost plus pricing except a.

Determination of the markup percentage requires judgment b.

Is inherently circular for manufacturing firms c.

Experimentation may be necessary d.

Cost plus is simple to apply

Answer: d

Simplicity is an advantage of cost plus pricing

Slide 8-20

Learning objective 2: Explain the cost-plus approach to pricing and why it is inherently circular for manufacturing firms. Also, explain the target costing process for a new product.

Target Costing

Once a product is designed it is difficult to make changes that reduce costs

80% of a product’s costs cannot be reduced once it is designed

Product features drive costs

Target costing

Integrated approach to determine features, price, costs and design to ensure a profit

Slide 8-21

Learning objective 2: Explain the cost-plus approach to pricing and why it is inherently circular for manufacturing firms. Also, explain the target costing process for a new product.

Target Costing

The process begins with an analysis of competing products

This leads to a specification of features and price attractive to customers

The second step is to specify a desired level of profit

Then the engineering department with input from the cost accounting department develops a design that can be produced at a cost which will earn the desired level of profit

Slide 8-22

Learning objective 2: Explain the cost-plus approach to pricing and why it is inherently circular for manufacturing firms. Also, explain the target costing process for a new product.

Target Costing

Slide 8-23

Learning objective 2: Explain the cost-plus approach to pricing and why it is inherently circular for manufacturing firms. Also, explain the target costing process for a new product.

Target costing: a.

Requires specification of desired level of profit b.

Adds desired profit to existing costs c.

Is used primarily with products that are already in production d.

Leads to profit maximization

Answer: a

Requires specification of desired profit

Slide 8-24

Learning objective 2: Explain the cost-plus approach to pricing and why it is inherently circular for manufacturing firms. Also, explain the target costing process for a new product.

Analyzing Customer Profitability

Customer Profitability Measurement System

(CPM)

Indirect costs of servicing customers are assigned to cost pools

Indirect costs include processing orders, handling returns, and shipments

Costs are allocated to specific customers using cost drivers to determine customer profitability

Subtracting these costs and product costs from customer revenue yields a measure of customer profitability

Learning objective 3: Analyze customer profitability, and explain the activity-based pricing approach.

Slide 8-25

Customer profitability is measured as: a.

Revenue minus cost of goods sold b.

Revenue minus indirect manufacturing costs c.

Revenue minus cost of goods sold minus indirect service costs d.

Revenue minus cost of goods sold minus indirect manufacturing costs

Answer: c

Revenue minus cost of goods sold minus indirect service costs

Learning objective 3: Analyze customer profitability, and explain the activity-based pricing approach.

Slide 8-26

Slide 8-27

Customer Profitability Measurement

System

Learning objective 3: Analyze customer profitability, and explain the activity-based pricing approach.

Cost Pools and Cost Drivers to Service

Customers

Learning objective 3: Analyze customer profitability, and explain the activity-based pricing approach.

Slide 8-28

Customer Profitability Analysis

Cost

Revenue

Less COGS

Gross margin

Less indirect costs

Internet orders $1.20 / order

Fax orders $4.50 / order

Line items $0.90 / item

Miles

W eight

$0.36 / mile

$0.40 / pound

Items returned $0.80 / item

Profit

Profit as a percent of sales

Customer 1 Customer 2

Quantity Amount Quantity Amount

732,600

(666,000)

66,600

727,650

(661,500)

66,150

165

20

2,500

1,200

900

210

(198)

(90)

(2,250)

(432)

(360)

(168)

63,102

8.61%

0

320

5,100

3,300

870

910

0

(1,440)

(4,590)

(1,188)

(348)

(728)

57,856

7.95%

Learning objective 3: Analyze customer profitability, and explain the activity-based pricing approach.

Slide 8-29

A customer profitability measurement (CPM) system does all of the following EXCEPT: a.

Allocates indirect costs to individual customers b.

Traces revenue to individual customers c.

Traces cost of goods sold to individual customers d.

Traces costs to individual products

Answer: d

Traces costs to individual products

Learning objective 3: Analyze customer profitability, and explain the activity-based pricing approach.

Slide 8-30

Customer Profitability Analysis

Slide 8-31

Learning objective 3: Analyze customer profitability, and explain the activity-based pricing approach.

Customer Profitability and Performance

Measures

Some examples of performance measures that will drive managers to improve customer profitability

Percent of customers who are not profitable

Dollar loss for customers who are not profitable

Average profit per customer

Number of customer service requests per 100 customers

Percent of customers who return items

Dollar value of returned items

Learning objective 3: Analyze customer profitability, and explain the activity-based pricing approach.

Slide 8-32

Activity-Based Pricing

Customers are presented with separate prices for services they request in addition to the cost of goods purchased

Customers will carefully consider the services they request

May lead them to impose less cost on the supplier

Also called menu-based pricing

Learning objective 3: Analyze customer profitability, and explain the activity-based pricing approach.

Slide 8-33

Activity-Based Pricing

Customers might object as the price they pay should cover these costs

Ways to deal with this resistance

Lower prices slightly and then encourage customers to make fewer but larger purchases

Customers could be encouraged to limit the variety of goods they order

Activity-based pricing could be used only on the least profitable customers

Learning objective 3: Analyze customer profitability, and explain the activity-based pricing approach.

Slide 8-34

Slide 8-35

Pricing Decisions

Learning objective 3: Analyze customer profitability, and explain the activity-based pricing approach.

Copyright

© 2016 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States

Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John

Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.

Slide 8-36