BL Chapter 12 Worksheet Answer Section

advertisement

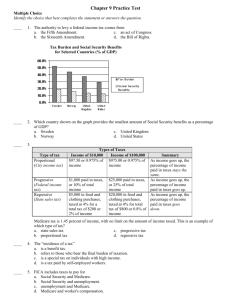

BL Chapter 12 Worksheet True/False Indicate whether the statement is true or false. ____ 1. All debts may be discharged under the Bankruptcy Act. ____ 2. If a debtor defaults on a loan, the creditor does not have the right to withhold money from the worker’s paycheck. ____ 3. The Consumer Credit Protection Act is also known as the Truth in Lending Law. ____ 4. A lawyer’s duty of confidentiality to a client is essential to establish trust and protect the interests of the client. ____ 5. Debts caused by fraud or back taxes still have to be repaid even if you qualify for bankruptcy. ____ 6. Debit cards can no longer be used the minute a petition for bankruptcy is filed. ____ 7. Involuntary bankruptcy is when the debtor files for bankruptcy even though he or she wants to retain some assets. ____ 8. Bankruptcy law is not found in federal statutory law; instead, it is found in each state’s statutes. ____ 9. When filing for Chapter 7 bankruptcy, the debtor must have a family income below the state’s average family income. ____ 10. There are only two reasons a creditor may deny credit: low income or large current debts. Multiple Choice Identify the choice that best completes the statement or answers the question. ____ 11. If you believe an error has been made on your credit card bill, how long do you have to notify the creditor from the date of the credit card statement? a. one week c. 30 days b. 60 days d. 90 days ____ 12. To assist consumers who receive bills for charges they dispute, Congress passed the a. Fair Credit Billing Act. c. Fair Credit Reporting Act. b. Fair Debt Collection Practices Act. d. Disputed Charges Reform Act. ____ 13. The Fair Debt Collection Practices Act makes it illegal for a. creditors to report you as being delinquent because you are disputing a bill. b. you to seek the services of a credit repair organization. c. debt collectors to impersonate government officials. d. banks and businesses to discriminate against potential creditors. ____ 14. The moment a petition for bankruptcy is filed in the court, a. all debts are cleared. b. your credit cards no longer work. c. lawsuits involving divorce and child custody are suspended. d. an automatic stay goes into effect. ____ 15. Ordinary bankruptcy is also called a. Chapter 7. b. Chapter 11. c. Chapter 12. d. Chapter 13. ____ 16. The form of bankruptcy that lets family farmers develop a plan for debt repayment and keep their business running is called a. Chapter 7. c. Chapter 12. b. Chapter 11. d. Chapter 13. ____ 17. During the period of repayment under Chapter 13 bankruptcy, a. businesses can keep 50% of their debt. b. creditors may expect a minimum of $500 per month in repayment. c. creditors may not continue collection activities. d. businesses must reorganize their financial structure. ____ 18. When the debtor’s property is sold to obtain cash, which debts are paid first? a. alimony and support c. taxes b. secured debts d. unsecured debts ____ 19. Which of the following is NOT one of the national credit reporting agencies in the United States? a. Equifax c. Experian b. Trans Union d. Trans Credit ____ 20. Under old English law, people who could not pay their bills were a. put into debtor’s prisons. b. put to work on farms until the debt was paid off. c. sent out of the country. d. sentenced to death. Completion Complete each statement. 21. Creditors have a right to ____________________ property when a debtor defaults on a loan. 22. The ____________________ Law requires that lenders tell you both the finance charge and the annual percentage rate (APR) of the loan. 23. Under the ____________________ Act, you have the right to know anyone who has received a copy of your credit report in the past year. 24. ____________________ bankruptcy offers a method for businesses to reorganize their financial affairs and still remain in business. 25. As part of the "fresh start" policy of the Bankruptcy Act, some assets, called ____________________, can be kept by the debtor. 26. The ____________________ Act requires creditors to correct billing errors that are brought to their attention. 27. The nonprofit organization that provides confidential debt-counseling services is called the Consumer ____________________ Service. 28. Some debts, such as student loans (except in cases of extreme hardship) or back taxes, cannot be ____________________ because of bankruptcy. 29. A bankruptcy filing remains on a debtor’s credit report for ____________________ years. Matching Match each term with its definition. a. garnishment b. usury law c. Consumer Credit Protection Act d. Fair Credit Reporting Act e. Equal Credit Opportunity Act f. g. h. i. j. Fair Credit Billing Act Chapter 7 bankruptcy Chapter 11 bankruptcy repossession bankruptcy ____ 30. A law that grants people the right to know their own personal information that is in a credit reporting agency’s files ____ 31. A law that makes it illegal to discriminate against credit applicants ____ 32. A law restricting the amount of interest that can be charged ____ 33. Allows individual debtors to discharge their debts and get a fresh start ____ 34. Requires creditors to correct billing errors brought to their attention ____ 35. Also known as the Truth in Lending Law ____ 36. A legal procedure through which a worker’s earnings are withheld to pay a debt ____ 37. When a creditor reclaims property on which it was a lien ____ 38. Allows businesses to reorganize their financial affairs and still remain in business ____ 39. The legal process by which a debtor can make a fresh start through the sale of assets to pay off creditors BL Chapter 12 Worksheet Answer Section TRUE/FALSE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. ANS: ANS: ANS: ANS: ANS: NAT: ANS: ANS: NAT: ANS: NAT: ANS: NAT: ANS: F PTS: 1 F PTS: 1 T PTS: 1 T PTS: 1 T PTS: 1 NBEA VID T PTS: 1 F PTS: 1 NBEA VID | NBEA VID3b F PTS: 1 NBEA VID T PTS: 1 NBEA VID F PTS: 1 DIF: DIF: DIF: DIF: DIF: 2 2 1 2 1 REF: REF: REF: REF: 265 266 280 274 DIF: 1 DIF: 2 REF: 273 REF: 273 DIF: 2 REF: 273 DIF: 2 REF: 273 DIF: 2 REF: 267 DIF: 1 DIF: 2 REF: 255 REF: 269 DIF: 2 REF: 269 DIF: 2 REF: 273 DIF: 1 REF: 273 DIF: 1 REF: 274 DIF: 2 REF: 274 DIF: 2 REF: 275 DIF: 1 DIF: 1 REF: 266 REF: 271 MULTIPLE CHOICE 11. ANS: B PTS: 1 12. ANS: A PTS: 1 NAT: NBEA IIC3a 13. ANS: C PTS: 1 NAT: NBEA IIC3a 14. ANS: D PTS: 1 NAT: NBEA VID 15. ANS: A PTS: 1 NAT: NBEA VID | NBEA VID3a 16. ANS: C PTS: 1 NAT: NBEA VID | NBEA VID3a 17. ANS: C PTS: 1 NAT: NBEA VID | NBEA VID3a 18. ANS: B PTS: 1 NAT: NBEA VID | NBEA VID3c 19. ANS: D PTS: 1 20. ANS: A PTS: 1 COMPLETION 21. ANS: Repossess PTS: 1 DIF: 2 22. ANS: Truth in Lending REF: 265 PTS: 1 DIF: 2 23. ANS: Fair Credit Reporting REF: 266 NAT: NBEA IIC3a PTS: 1 24. ANS: Chapter 11 DIF: 2 REF: 266 NAT: NBEA IIC3a PTS: 1 25. ANS: exemptions DIF: 2 REF: 274 NAT: NBEA VID | NBEA VID3a PTS: 1 DIF: 2 26. ANS: Fair Credit Billing REF: 274 NAT: NBEA VID | NBEA VID3a PTS: 1 DIF: 2 27. ANS: Credit Counseling REF: 269 NAT: NBEA IIC3a PTS: 1 28. ANS: discharged DIF: 2 REF: 272 PTS: 1 29. ANS: ten DIF: 2 REF: 274-275 DIF: 1 REF: 275 PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: DIF: DIF: DIF: DIF: DIF: DIF: DIF: DIF: DIF: DIF: PTS: 1 NAT: NBEA VID MATCHING 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: D E B G F C A I H J 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 NAT: NBEA IIC3a NAT: NBEA IIC3a NAT: NBEA VID3a NAT: NBEA IIC3a NAT: NBEA IIC3a NAT: NBEA VID | NBEA VID3a