mr. lipman's ap government powerpoint chapter 18

advertisement

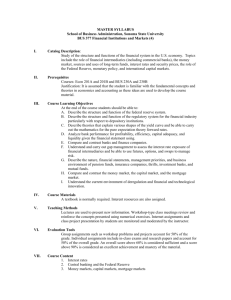

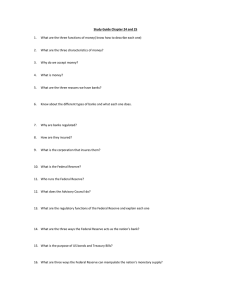

MR. LIPMAN’S AP GOVERNMENT POWERPOINT CHAPTER 18 The Government and Economic Policy WHAT SHOULD GOVERNMENTS ROLE IN THE ECONOMY BE? • Business Cycles • Laissez-Faire • Adam Smith and the Invisible Hand Theory of the Marketplace • John Maynard Keynes and the Theory of Deficit Spending • Ronald Reagan and the Theory of Deregulation Question: Keynesian economic contends that: • the market works best when left to the invisible hand • government spending is necessary to reduce the deficit • governments work best when they work the least • government intervention is always an obstacle to efficiently functioning economies. • government intervention is often necessary to resolve the inefficiencies of the private sector. Question: Keynesian economic contends that: • the market works best when left to the invisible hand • government spending is necessary to reduce the deficit • governments work best when they work the least • government intervention is always an obstacle to efficiently functioning economies. • government intervention is often necessary to resolve the inefficiencies of the private sector. During which era did the U.S. government first adopt interventionist policies? • • • • • the 19th century the Progressive era the Great Depression and the New Deal the 1960s the 1980s During which era did the U.S. government first adopt interventionist policies? • • • • • the 19th century the Progressive era the Great Depression and the New Deal the 1960s the 1980s FDR CHANGES EVERYTHING • The Depression of the 1930s required drastic action and the following was done: 1. Glass-Steagall Act (FDIC) 2. SEC 3. AAA 4. Wagner Act (collective bargaining and right to organize) THE NEW DEAL MEANS THAT GOVERNMENT WOULD NOW BE PRIMARY SOURCE OF ECONOMIC SOLUTIONS INSTEAD OF THE MARKETPLACE • Economic Regulation is government regulation of business practices • Social Regulation is government regulation of safety of products and conditions of production • Four Reasons for surge of these regulations: – 1. 1960s/70s increase in activism – 2. More public awareness of dangers and safety – 3. Congress wants visibility and prominence – 4. Presidents support them BUT IN THE 1980S A REVERSE TREND WILL TAKE PLACE (Deregulation) Income Security Programs Today • Many income security programs are entitlement programs • Non-means-tested programs – Social security – Unemployment insurance • Means-tested programs – Supplemental security income (SSI) – TANF and SNAP – Earned Income tax credit program How many Americans benefit from income security programs? Which of the following is a non-means-tested program? • • • • • TANF SSI SNAP unemployment insurance earned income tax credit program Which of the following is a non-means-tested program? • • • • • TANF SSI SNAP unemployment insurance earned income tax credit program Fiscal Policy in a Global Context • Globalization and income – minimum wage v. wages abroad • Increasing interdependence – 2008 economic crisis spread swiftly abroad THE BUSINESS CYCLES • • • • Growth (economic stability) Inflation Recession Depression – THE TOOLS USED TO COMBAT OR ASSIST THESE ARE: • MONETARY POLICY (Federal Reserve Bank) • FISCAL POLICY (Executive Branch) Monetary and Fiscal Policy • Gross Domestic Production (GDP) is the total market value of all goods and services produced in one year in a country – (a negative GDP is an indication of no economic growth) • Revenue is how much the government has taken in • Expenditures is how much the government has spent How does the federal government raise and spend money? MONETARY POLICY • The Federal Reserve System – 12 Regional Banks (private but leaders appointed by government and stock owned by large commercial banks) ---These are the bankers bank – Establish monetary policy by: 1. Setting Reserve Requirements for Banks; 2. Controlling the Discount and FOMC rates for lending; 3. Open Market Operations (buying and selling of government securities-bonds) 4. Controlling supply of money (paper) existing Question: The discount rate is? • the rate at which discounts are given to Federal Reserve member banks when purchasing goods and services. • the interest rate at which the Federal Reserve lends money to member banks. • the discount given to citizens on welfare when they purchase goods and services. • the normal discount given to U.S. banks over foreign banks when borrowing money from the Federal Reserve • the reserve requirements for Federal Reserve member banks. Question: The discount rate is • the rate at which discounts are given to Federal Reserve member banks when purchasing goods and services. • the interest rate at which the Federal Reserve lends money to member banks. • the discount given to citizens on welfare when they purchase goods and services. • the normal discount given to U.S. banks over foreign banks when borrowing money from the Federal Reserve • the reserve requirements for Federal Reserve member banks. Seeking to Repair the Economy in 2009 Where did the economic stimulus funds go? Question: The purpose of TARP was to: • stimulate the economy. • reduce the federal debt. • help families unable to make their mortgage payments. • buy “clunker” cars to trade for newer, more fuel efficient cars. • set limits on CEO pay Question: The purpose of TARP was to: • stimulate the economy. • reduce the federal debt. • help families unable to make their mortgage payments. • buy “clunker” cars to trade for newer, more fuel efficient cars. • set limits on CEO pay The Key Players in Fiscal Policy • OMB= Office of Management and Budget works for the executive branch • CBO= Congressional Budget Office works for legislative branch • Entitlement Spending has grown at a much faster pace than discretionary spending • Balanced Budget- Probably will no longer see it in your lifetime Who holds U.S. debt as of 2010? ENVIRONMENTAL REGULATION • Used to be controlled by states but now controlled by Federal Government • Change began with creation of EPA in 1970 and the power of this agency has grown so large that it now is directly involved in almost all matters of potential governmental spending for construction or production