Amund Holmsen 16 May 2009 - Federal Reserve Bank of Atlanta

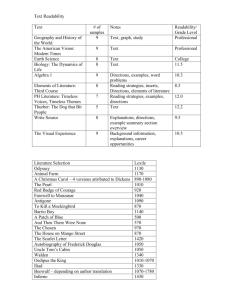

advertisement

Communicating Monetary Policy Intentions - the Case of Norges Bank Amund Holmsen 16 May 2009 (with Jan F. Qvigstad, Øistein Røisland and Kristin Solberg-Johansen) Overview 1. What do we communicate? 2. Interest rate forecasts four years on – a review of pros and cons 3. Challenges Conclusion It seems to work well in Norway. Talking about the future… “…strong vigilance is therefore of the essence...” (Trichet, August 2007) “...and anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period." (FED, April 2009) “...the target overnight rate can be expected to remain at its current level until the end of the second quarter of 2010...” (BoC, April 2009) Changes in Norges Bank’s interest rate assumption 2001 - 2002 Constant interest rate 2003 - 2005 Markets’ interest rate expectations …with comments 2005 Our own interest rate forecast Ingredient 1: Baseline scenario (MPR 2/08) 90% 70% 50% 9 8 Key policy rate 7 6 5 4 3 2 1 0 2006 2007 2008 2009 2010 2011 7 30% 6 5 9 8 7 6 5 4 3 2 1 0 4 7 CPI 6 Output gap 5 4 3 3 2 2 1 1 0 0 -1 -1 -2 -2 -3 2006 2007 2008 2009 2010 2011 -3 5 4 5 CPI excl taxes and energy 4 5 5 4 4 3 3 3 3 2 2 2 2 1 1 1 1 0 2006 0 0 2006 2007 2008 2009 2010 2011 0 2007 2008 2009 2010 2011 Ingredient 2: Shift scenarios 9 Key policy rate 8 7 Higher inflation 6 5 4 3 2 1 0 2006 2007 2008 2009 9 8 7 6 5 4 3 2 1 0 2010 2011 5 5 Output gap 4 4 3 3 2 2 1 1 Higher inflation 0 0 -1 -1 -2 -2 -3 2006 5 -3 4 90% 2007 2008 2009 2010 2011 5 CPI x taxes/energy 4 Higher inflation 3 3 2 2 1 1 0 2006 0 70% 50% 30% 2007 2008 2009 2010 2011 Projected interest rate path 9 9 8 8 MPR 2/08 7 7 6 6 5 5 4 4 MPR 1/08 3 3 2 2 1 0 2006 90% 70% 50% 1 30% 0 2007 2008 2009 2010 2011 Ingredient 3: Delta accounting of the interest rate path 2,0 2,0 1,5 1,5 1,0 1,0 0,5 0,5 0,0 0,0 -0,5 -0,5 Higher demand in Norw ay Higher inflation in Norw ay Higher interest rates abroad Higher risk premium in the money market Low er grow th abroad Changes in the interest rate path -1,0 -1,5 -1,0 -1,5 -2,0 -2,0 08 Q3 09 Q1 09 Q3 10 Q1 10 Q3 11 Q1 11 Q3 Pros and cons – revisited Reviewing some counter-arguments Is conditionality misunderstood? Are policy makers constrained? Is it possible to decide on a whole path? The yield curve moves on economic news 8 7 July 2008 6 5 4 3 Key policy rate Norges Bank forecast Norges Bank forecast in the previous report Implied forward rates day before report 2 1 Implied forward rates after previous report 0 2005 2006 2007 2008 2009 2010 2011 2012 Reviewing some counter-arguments Is conditionality misunderstood? Are policy makers constrained? Is it possible to decide on a whole path? Interest rate forecasts with fan chart from MPR 3/2008 Percent 30% 50% 70% 90% Reviewing some counter-arguments Is conditionality misunderstood? Are policy makers constrained? Is it possible to decide on a whole path? Reviewing some pro-arguments Is the reaction function better anchored? Test 1: Are market rates reasonably aligned with our forecast? Test 2: Are there smaller jumps in market rates around policy announcements? a) November 2005 b) June 2006 8 8 7 7 6 6 5 5 Forward rates 4 4 3 3 2 2 Baseline scenario 1 1 0 0 2006 2007 2008 2009 8 7 6 5 4 3 2 1 0 2006 c) June 2007 d) March 2008 8 7 6 5 4 3 2 1 0 2006 Baseline scenario Forward rates 2007 2008 2009 2010 8 7 6 5 4 3 2 1 0 8 7 6 5 4 3 2 1 0 2007 Baseline scenario Forward rates 2007 2008 2009 Baseline scenario Forward rates 2008 8 7 6 5 4 3 2 1 0 2009 8 7 6 5 4 3 2 1 0 70 60 50 40 Market rates as exogenous assumptions 30 Interest rate forecasts 20 10 0 4.4.01 27.2.02 22.1.03 28.1.04 15.12.04 2.11.05 27.9.06 15.8.07 25.6.08 Change in 12-month LIBOR krone rate from the day of a policy announcement to the following day, and averages for the two periods. Basis points. Reviewing some more pro-arguments Fewer misunderstandings Easier to talk about the future Exit strategy as integrated part of the communication Credible interest rate forecast vs quantitative easing Challenges Modelling optimal monetary policy Consistency Over time and accross states of the economy Alternative approaches Simple interest rate rule rt = art-1 + (1-a)[b1(Etpt+k -p*)+b2yt +b3Dyt] Optimal policy: Minimizing a loss function L = (π - π*)2 + λy2 + δ(r - r-1)2 Simple rule rt = art-1 + (1-a)[b1(Etpt+k -p*)+b2yt +b3Dyt] Two approaches Coefficients optimized over unconditional loss Coefficients optimized over conditional loss We faced the “rules vs discretion” issue and had to take a stand! Forward looking Taylor rule vs Timeless 7 In 2006 we were able to reproduce our forward-looking Taylor-rule forecast with optimal policy under timeless perspective with the loss function: 7 Interest rate 6 Timeless 5 5 MPR 2/2006 4 4 3 3 L E t bk pt k p* 0.3y 2t k 0.2(i t k i t k 1 ) 2 2 k 0 3 2 Inflation 3 3 2 1 1 0 2006 0 2007 2008 3 Timeless 2 2 2009 Output gap Timeless 2 6 MPR 2/2006 1 2 1 MPR 2/2006 1 0 2006 0 0 -1 -1 -2 2006 -2 1 0 2007 2008 2009 2007 2008 2009 Ramsey and Timeless (baseline scenario) Key policy rate 7 7 Ramsey 6 6 5 5 Timeless 4 Inflation 3 4 3 3 2 2 1 1 0 2006 0 2007 3 2008 2009 2010 3 Output gap 3 Timeless Timeless 2 2 2 1 Ramsey 1 0 2006 2 1 0 0 2007 2008 2009 2010 0 Ramsey 1 -1 -1 -2 2006 -2 2007 2008 2009 2010 Timeless with different λ’s Key policy rate 7 7 λ=0.40 6 Timeless and Ramsey: - λ=0.30 - Weight change in interest rate=0.2 6 5 5 4 4 λ=0.20 3 2 2 1 1 0 2006 0 Inflation 3 3 Baseline scenario 2007 3 λ=0.20 2008 2009 2010 Output gap 3 λ=0.20 2 2 2 2 1 λ=0.40 0 1 Baseline scenario 1 λ=0.40 0 1 Baseline scenario 0 2006 3 0 2007 2008 2009 2010 -1 -1 -2 2006 -2 2007 2008 2009 2010 Alternative approaches to commitment Current approach: Forecasts, alternative scenarios and ”interest rate account” Publish loss function (Svensson) Interest rate rule Target criterion (Woodford&Giannoni) (π - π*) + θ(y-y-1)=0 Conclusions The experience is good The conditionality and the uncertainty in the forecast seem well understood Monetary policy appears to have become more predictable The policy discussion is brought closer to the research frontier Still early. If nothing else – better economists Communicating Monetary Policy Intentions - the Case of Norges Bank Amund Holmsen 16 May 2009 (with Jan F. Qvigstad, Øistein Røisland and Kristin Solberg-Johansen)