Navigating Your Financial Future: The Joy of Compound Interest

advertisement

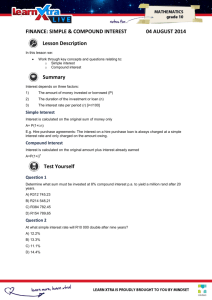

Navigating your Financial Future The Joy of Compound Interest Mary Stinnett Associate Professor of Mathematics Umpqua Community College Disclaimers: • I am a “mathematics educator” more than a “mathematician” Math Educator You invested money in two funds. Last year, the first fund paid a dividend of 8% and the second a dividend of 5%, and you received a total of $1330. This year, the first fund paid 12% dividend and the second only 2%, and you received a total of $1500. How much money did you invest in each fund? Math Educator •Simple Interest • 𝐼 = 𝑃𝑟𝑡 •Compound Interest •𝐴 = 𝑃 ∙ 1 + .10 𝑛𝑡 𝑛 •Boring… Math Educator • Simple Interest • How interest is calculated on your Credit Card • How to calculate monthly payments on your car loan • OR: How much are you paying the bank in interest for that car loan??? • Rent To Own (ouch!) Math Educator • Compound Interest • Pawn Shops • Paycheck Loans • Savings • Short Term CD • Retirement Accounts • College Savings Accounts Math Educator • What is “average daily balance”? • What is the difference between “APR” and “effective APR”? • What is an amortization table? • What if I don’t ask to put my extra payments “towards principle”, what could a lending company do with that money? Disclaimers: • I am a “mathematics educator” more than a “mathematician” • I am NOT a financial planner, nor do I claim to have the ability to guide anyone through financial help Disclaimers: • I am a “mathematics educator” more than a “mathematician” • I am NOT a financial planner, nor do I claim to have the ability to guide anyone through financial help • I am not up to par on how to cite my sources “properly” within a PowerPoint Disclaimers: • I am a “mathematics educator” more than a “mathematician” • I am NOT a financial planner, nor do I claim to have the ability to guide anyone through financial help • I am not up to par on how to cite my sources “properly” within a PowerPoint • I will give you a list of all my resources at the end of the presentation Dave Ramsey • Personal finance is 80 percent behavior, and only 20 percent head knowledge Did you know: About 80 percent of the millionaires in the United States are first-generation affluent? “Millionaire Next Door” (Stanley and Danko) Portrait of a Millionaire: - Many of the types of businesses we are in could be classified as dullnormal. We are welding contractors, auctioneers, rice farmers, owners of mobile-home parks, pest controllers, coin and stamp dealers, and paving contractors. Portrait of a Millionaire: - About half of our wives do not work outside the home. The number-one occupation for those wives who do work is teacher. Portrait of a Millionaire: - Our household's total annual realized (taxable) income is $131,000 (median, or 50th percentile) Portrait of a Millionaire: - We live well below our means. We wear inexpensive suits and drive Americanmade cars. Only a minority of us drive the current-model-year automobile. Only a minority ever lease our motor vehicles. Portrait of a Millionaire: - Most of our wives are planners and meticulous budgeters. Think about this… 1. How many people are their in the world? 7,327,624,830 2. In comparison to the 7-Plus Billion people in the world, where do you think your income ranks in comparison? Think about this… 3. What is the median household income in the US? (according to the US Census) $50,502 Go to: www.globalrichlist.com • Select location: USA (Dollar) • Enter Annual Net Income: $50,502 Dave Ramsey Personal finance is 80 percent behavior, and only 20 percent head knowledge Thomas Stanley and William Danko: About 80 percent of the millionaires in the United States are first-generation affluent? Navigating your Financial Future The Joy of Compound Interest Mary Stinnett Associate Professor of Mathematics Umpqua Community College Simple Interest… • You want to pay off the mortgage to Boardwalk. Simple Interest… • You want to pay off the mortgage to Boardwalk. • Mortgage is $200 and interest rate is 10% • Math = $200 x .10 = $20 mortgage fee • Total: $200 + $20 = $220 Simple Interest Formula 𝐼 = 𝑃𝑟𝑡 I = Interest P = Principle (original amount invested or borrowed) r = percent interest rate, rewritten as a decimal t = time, measured in years Simple Interest Formula 𝐼 = 𝑃𝑟𝑡 Now, to pay off mortgage of Boardwalk after 2 years…. 𝐼 = $200 .10 2 𝐼 = $40 Simple Interest Formula To pay off mortgage of Boardwalk after 3 years…. 𝐼 = 𝑃𝑟𝑡 𝐼 = $200 .10 3 𝑰 = $𝟔𝟎 To pay off mortgage of Boardwalk after 5 years…. 𝐼 = 𝑃𝑟𝑡 𝐼 = $200 .10 5 𝑰 = $𝟏𝟎𝟎 To pay off mortgage of Boardwalk after 10 years…. 𝐼 = 𝑃𝑟𝑡 𝐼 = $200 .10 10 𝑰 = $𝟏𝟎𝟎𝟎 What is Compound Interest? Compound interest is interest that is paid on both the principal and also on any interest from past years… What does this mean? After one year, the mortgage pay-off was $220. What if you had to pay 10% of this $220 instead of the original $200? 𝐼 = 𝑃𝑟𝑡 𝐼 = $220 .10 1 𝐼 = $22 Making the final payment: $220 + $22 = $242 (compared to the $240 from Simple interest) And Compound again… In year three, you would have to pay 10% of the $244… 𝐼 = 𝑃𝑟𝑡 𝐼 = $244 .10 1 𝐼 = $24.40 Making the final payment: $240 + $24.40 = $264.40 (compared to the $260 from Simple interest) And Compound again… Years Principle Interest New Principle Simple Interest 0 1 2 3 $200 $220 $242 $266.20 $20 $22 $24.20 $26.62 $220 $242 $266.20 $292.82 $220 $240 $260 $280 5 $322.10 $32.21 $354.31 $300 10 $518.74 $51.87 $570.62 $400 What do I mean by “Compound Interest” exactly? • Take a piece of paper What do I mean by “Compound Interest” exactly? • Take a piece of paper • Create at Table: Number of Folds Number of Layers 0 1 1 2 What do I mean by “Compound Interest” exactly? Number of Folds Number of Layers 0 1 1 2 2 4 3 8 What do I mean by “Compound Interest” exactly? Number of Folds Number of Layers 0 1 1 2 2 4 3 8 4 16 5 32 Number of Folds Number of Layers 0 1 1 2 2 3 4 4 8 16 5 32 6 64 7 128 8 256 Number of Folds Number of Layers For the fun of it… • https://www.youtube.com/watch?v=kRAEBbotuIE Compound Interest Rate • George Washington threw a silver dollar across the Potomac River in 1776. • What if Martha took that dollar and invested it instead. How much would the investment be worth today? • 𝐼 = 𝑃𝑟𝑡 • P = Principle = $1 • t = time in years: 2014 – 1776 = 238 years • r = interest rate: 10% .10 Compound Interest Rate • George Washington threw a silver dollar across the Potomac River in 1776. What if Martha took that dollar and invested it instead. How much would the investment be worth today? • Simple Interest: 𝐼 = 𝑃𝑟𝑡 • 𝐼 = 1 0.10 (238) = $23.80 • Investment: $1 + $23.80 = $24.80 George Washington’s $1 • Compound Interest • n = number of times compounded in one year •𝐴 = 𝑃∙ 1+ .10 𝑛𝑡 𝑛 • When t = 238 years •𝐴 = 1∙ 1+ 0.10 238𝑛 𝑛 George Washington’s $1 • Compound Interest •𝐴 = 1 ∙ 1 + 0.10 238𝑛 𝑛 Suppose n = 1 (compounded once a year) 𝐴=1∙ 1+ 0.10 238𝑥1 = 1 $7,103,000,000 George Washington’s $1 Suppose n = 12 (compounded monthly) 𝐴 =1∙ 1 0.10 (238)(12) + = 12 $19,650,740,100 Suppose n = 52 (compounded weekly) 𝐴 =1∙ 1 0.10 (238)(52) + = 52 $21,197,406,620 Suppose n = 365 (compounded daily) 𝐴 =1∙ 1 0.10 (238)(365) + = 365 $21,616,879,780 George Washington’s $1 y 2E10 1E10 x 5 10 15 20 25 30 George Washington’s $1 y 2E10 1E10 x 50 100 150 200 250 300 350 The number e…. • 𝑒 = lim 1 + 𝑛→∞ 1 𝑛 𝑛 ≈ 2.71828182845905 … • Irrational number like π and 2 • First studied by the Swiss mathematician Leonhard Euler in the 1720s • Sometimes referred to as the “natural number”. The number e…. • 𝑒 = lim 1 + 𝑛→∞ •𝐴 = 𝑃 ∙ 1 + • 𝐴 = 𝑃𝑒 𝑟𝑡 1 𝑛 𝑛 𝑟 𝑛𝑡 𝑛 George Washington’s $1 • Continuous Compound Interest • 𝐴 = 𝑃𝑒 𝑟𝑡 (0.10)(238) • 𝐴 = 1𝑒 = • $𝟐𝟏, 𝟔𝟖𝟕, 𝟒𝟓𝟖, 𝟗𝟏𝟎 • Compared to Simple Interest: $24.80 Video… • https://www.youtube.com/watch?v=hBqZh2suZMM Compound Interest!!! • Ben and Arthur were friends who grew up together. They both knew that they needed to start thinking about the future. • At age 19, Ben decided to invest $2,000 every year for eight years. He picked investment funds that averaged a 12% interest rate. Compound Interest!!! • Ben and Arthur were friends who grew up together. They both knew that they needed to start thinking about the future. • At age 19, Ben decided to invest $2,000 every year for eight years. He picked investment funds that averaged a 12% interest rate. • Then, at age 26, Ben stopped putting money into his investments. So he put a total of $16,000 into his investment funds. Compound Interest!!! • Now Arthur didn’t start investing until age 27. • Just like Ben, he put $2,000 into his investment funds every year until he turned 65. • He got the same 12% interest rate as Ben, but he invested 23 more years than Ben did. • So Arthur invested a total of $78,000 over 39 years. Compound Interest!!! • When both Ben and Arthur turned 65, they decided to compare their investment accounts. • Who do you think had more? Ben, with his total of $16,000 invested over eight years, or • Arthur, who invested $78,000 over 39 years? After 7 years, Ben put out $14000 and now has $27551 After 7 years, Arthur put out $14000 and now has $27,551 BUT!!! Ben now has $68,216!!!! And he did not put in another penny… Recall, Ben only invested $16,000 Arthur invested $78,000 Your Dollar! • When a person invests P dollars into a retirement account monthly for t years: •𝐴=𝑃 12 𝑟 1 𝑟 12𝑡 + 12 −1 • Or if it is compounded continuously: •𝐴 = 𝑃 𝑒 𝑟𝑡 −1 𝑟 𝑒 12 −1 Lottery Dollars Tax on the Poor? • Suppose you play $5 a week on the lottery from the day you are 21 years old into a retirement account • with average annual return of 15%. • How much would you have when you retire at age 65? Lottery Dollars Tax on the Poor? • P = $20 ($5 a week) • t = 65-21=44 years • r = 0.15 •𝐴 = 𝑃 12 𝑟 1+ 𝑟 12𝑡 12 −1 Lottery Dollars Tax on the Poor? • 𝐴 = 20 12 0.15 1+ 0.15 (12)(44) 12 •$1,127,407 −1 What about your retirement goals? What about your retirement goals? Not just Retirement… What about College Funds? Not just Retirement… What about College Funds? Did you notice… But 100 BUCKS!!!! How much does a LARGE coffee and something to eat at Starbucks cost? How often do you “grab” something extra at the grocery store, convenience store, etc. How much does it cost for a family to go to the movies? Did you really need that 5-gallon bucket of mayonnaise at Costco? How much money could you save smoking a half a pack instead of one pack of cigarettes a day? Do you play the lottery?!? Personal finance is 80 percent behavior, and only 20 percent head knowledge Resources to get you started: • Local Community College Community Education Classes Resources to get you started: • Local Community College Community Education Classes • Dave Ramsey (DaveRamsey.Com) • Financial Peace University • Legacy Journey • Foundations in Personal Finance (School Curriculum) • Podcast • Radio Show Resources to get you started: • Local Community College Community Education Classes • Dave Ramsey • “The Millionaire Next Door” by Stanley and Danko Resources to get you started: • Local Community College Community Education Classes • Dave Ramsey • “The Millionaire Next Door” by Stanley and Danko • Chris Hogan: Retired Inspired • https://www.chrishogan360.com/ Resources to get you started: • Local Community College Community Education Classes • Dave Ramsey • “The Millionaire Next Door” by Stanley and Danko • Chris Hogan: Retired Inspired • Financial Planners who have a HEART OF A TEACHER Resources to get you started: • Local Community College Community Education Classes • Dave Ramsey @ DaveRamsey.com • “The Millionaire Next Door” by Stanley and Danko • Chris Hogan: @ chrishogan360.com • Financial Planners who have a HEART OF A TEACHER • Mary.Stinnett@Umpqua.edu Resources to get you started: • Local Community College Community Education Classes • Dave Ramsey @ DaveRamsey.com • “The Millionaire Next Door” by Stanley and Danko • Chris Hogan: @ chrishogan360.com • Financial Planners who have a HEART OF A TEACHER • Mary.Stinnett@Umpqua.edu