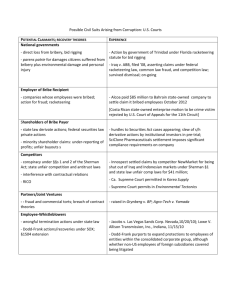

Cause I'm the Taxman: Louisiana's Ad Valorem Tax Litigation

advertisement

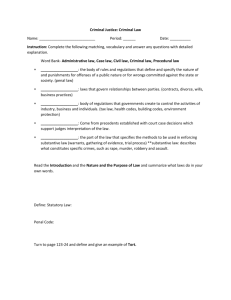

Aimee Williams Hebert & Sara Mouledoux Louisiana does not tax oil & gas in place Parish-level property tax on movables, based on a uniform percentage of assessed fair market value (La. R.S. § 47:1701-2332) Fair market value is “the price for property which would be agreed upon between a willing and informed buyer and a willing and informed seller under usual and ordinary circumstances.” (La. R.S. § 47:2321) Statutory Guidelines for Oil & Gas Properties Louisiana Administrative Code Title 61, Part V, Chapter 9 Self-report taxable property on LAT12 form (April 1) Official assessment based on LAT12 data Notice to taxpayer on day 1 of 15-day mandatory inspection period (between August 15 and September 15) Possible meeting with assessor to discuss assessment Challenge at Board of Review (7 days prior to hearing, held after inspection period above) Possible appeal to La. Tax Commission (10 days) Possible appeal to La. District Court (30 days) Assessor files for collection by sheriff (November 15) Louisiana allowed the oil & gas industry to self report taxable property beginning in the 1990s, following recommendations from LOGA. The state also shifted from a well-by-well valuation scheme to a total field valuation scheme. A decade later, enter VLS… Owned vs. rented equipment Component Economic Public parts of field equipment obsoleteness services (i.e. interstate pipelines) Reliance on state records 2009 taxes: Reassessments according to Louisiana statutory procedure, based on both under-reported and unreported property 2006-2008 taxes: One-page settlement agreements largely based on unreported property only, but limited to those tax years --“Premium” penalty Bonvillain v. Louisiana Land & Exploration Company: leading case filed May 14, 2009 Named defendants: LL&E Employees who signed the LAT12 Subsequent suits also name corporate officers 31 suits filed against oil & gas companies and executives as of Oct 12, 2009 Three counts common to all 31 suits: Seeking to recover unreported and/or underreported parish ad valorem taxes since 1994 RICO violations seeking treble damages Fraud seeking damages “in the nature of” taxes • • • • Criminal and Civil lawsuits… A "person damaged in his business or property" can sue one or more "racketeers" for treble damages resulting from a “pattern of racketeering activity.” A “racketeer” is a person who is a member of a “criminal enterprise” engaged in “a pattern of racketeering activity.” A “pattern of racketeering activity” is defined as the commission of two or more acts of certain state or federal offenses, within a period of ten years. • • • • • • • • Any violation of state statutes against gambling, murder, kidnapping, extortion, arson, robbery, bribery, dealing in obscene matter, or dealing in a controlled substance or listed chemical (as defined in the Controlled Substances Act); Any act of bribery, counterfeiting, theft, embezzlement, fraud, dealing in obscene matter, obstruction of justice, slavery, racketeering, gambling, money laundering, commission of murder-for-hire, wire fraud, and several other offenses covered under the Federal criminal code (Title 18); Embezzlement of union funds; Bankruptcy fraud or securities fraud; Drug trafficking; Money laundering and related offenses; Bringing in, aiding or assisting aliens in illegally entering the country (if the action was for financial gain); Acts of terrorism. Employees were the “racketeers.” LL&E was the “criminal enterprise.” Using LL&E to mail false LAT12 tax forms to the assessor over several years was the RICO-predicate criminal act under U.S. wire-fraud laws. Bonvillain seeks all taxes, treble damages under RICO, and damages under a fraud theory. "I think four or five more assessors are going to file shortly.” Gene Bonvillain, Terrebonne Parish Tax Assessor