Chapter 4

Inventory Control Subject to

Known Demand

McGraw-Hill/Irwin

Copyright © 2005 by The McGraw-Hill Companies, Inc. All rights reserved.

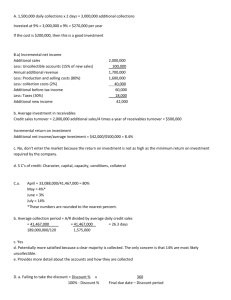

Breakdown of the Total

Investment in Inventories in the U.S. Economy (1999)

4-2

4-3

Reasons for Holding Inventories

Economies of Scale

Uncertainty in delivery leadtimes

Speculation. Changing Costs Over Time

Smoothing.

Demand Uncertainty

Costs of Maintaining Control System

4-4

Characteristics of Inventory Systems

Demand

May Be Known or Uncertain

May be Changing or Unchanging in Time

Lead Times - time that elapses from placement of order until it’s

arrival. Can assume known or unknown.

Review Time - Is system reviewed periodically or is system state

known at all times?

Treatment of Excess Demand.

Backorder all Excess Demand

Lose all excess demand

Backorder some and lose some

Inventory that changes over time

perishability

obsolescence

4-5

Relevant Costs

Holding Costs - Costs proportional to the

quantity of inventory held. Includes:

a) Physical Cost of Space (3%)

b) Taxes and Insurance (2 %)

c) Breakage Spoilage and Deterioration (1%)

*d) Opportunity Cost of alternative investment. (18%)

(Total: 24%)

Note: Since inventory may be changing on a continuous

basis, holding cost is proportional to the area under the

inventory curve. (See examples.)

Inventory as a Function of Time

4-6

4-7

Relevant Costs (continued)

Ordering Cost (or Production Cost).

Includes both fixed and variable components.

slope = c

K

C(x) = K + cx for x > 0 and =0 for x = 0.

4-8

Relevant Costs (continued)

Penalty or Shortage Costs. All costs

that accrue when insufficient stock is

available to meet demand. These

include:

Loss of revenue for lost demand

Costs of bookeeping for backordered demands

Loss of goodwill for being unable to satisfy

demands when they occur.

Generally assume cost is proportional to

number of units of excess demand.

4-9

Simple EOQ Model

Assumptions:

1. Demand is fixed at l units per unit time.

2. Shortages are not allowed.

3. Orders are received instantaneously. (this will be relaxed

later).

4. Order quantity is fixed at Q per cycle. (can be proven

optimal.)

5. Cost structure:

a) Fixed and marginal order costs (K + cx)

b) Holding cost at h per unit held per unit time.

Inventory Levels for the EOQ Model

Saw structure is typical. First order when inventory is 0.

Reordering Q everytime when inventory is 0 must be optimal

4-10

4-11

The EOQ Model: Notation

D

= λ is the demand rate (in units per year)

c

= unit production cost, not counting setup or inventory costs

(in dollars per unit)

K

= setup costs (per placed order) in dollars

h

= holding cost (in dollars per unit per year), if the holding cost

consists entirely of interest on money tied up in inventory,

h = ic, where i – is an annual interest rate

Q

= lot size (order size) in units

T

= time between orders (cycle length)

G(Q) = average annual cost

T

Q

l

Q K cQ

G Q h

2 T

T

Inventory (I(t))

4-12

Relationships

Ordering Costs: (Order amount Q)

Assume Constant

Demand

slope = -l

Q

C(Q) = K + cQ

Time (t)

T

Instantaneous

Time between orders

Replenishment

Holding Cost:

h = Ic =(Interest Rate)(Cost of Inv.)

Average Inventory Size?

Under constant demand: Q/2

Time Between Orders:

l Q/T

T = Q/l

Q

Rate of consumption

l

T

4-13

Total Costs

What is the average annual cost?

G(Q) = average order cost + average holding

cost

K cQ hQ

G(Q)

T

2

Average ordering

cost per time T

Average inventory

level at any time

4-14

Total Costs

What is the average annual cost?

K cQ hQ

G (Q)

T

2

K cQ hQ

Q

2

l

hQ Kl

lc

2

Q

The Average Annual Cost Function G(Q)

GQ h

Q K cQ hQ Kl

cl

2 T

T

2

Q

4-15

4-16

The Average Annual

Cost Function G(Q)

Minimize Annual Costs

4-17

GQ non linear function of Q

Take the derivative of G(Q)

Kl

hQ

G (Q)

lc

Q

2

Kl h

G(Q)

2

Q

2

Is this a minimum?

2Kl

G (Q) 3 0,Q 0

Q

EOQ:

YES!

Kl h

2Kl

0 Q*

2

Q

2

h

4-18

4-19

Properties of the EOQ Solution

2K l

Q

h

Q is increasing with both K and l and decreasing

with h

Q changes as the square root of these quantities

Q is independent of the proportional order cost,

c. (except as it relates to the value of h = Ic)

Properties of the EOQ Solution

hQ Kl

GQ

cl

2

Q

2 Kl

Q

h

This formula is well-known economic order quantity, is also

known as economic lot size

This is a tradeoff between lot size and inventory

“Garbage in, garbage out” - usefulness of the EOQ formula for

computational purposes depends on the realism of input data

Estimating setup cost is not easily reduced to a single invariant

cost K

4-20

4-21

Example

Uvic requires 3600 gallons of paint annually for

scheduled maintenance of buildings. Cost of

placing an order is $16 and the interest rate

(annual) is 25%. Price of paint is $8 per gallon.

How much paint should be ordered, and how often?

2 Kl

2(16)(3600)

Q*

57,600 240

h

.25(8)

Q

240

.07 years* (250 workingdays/year)

T

l 3600

= 17.5 workingdays = 18 days

Order Point for the EOQ Model

4-22

Does it matter if

τ < T or τ > T ?

Keep track of

time left to zero

inventory or set

automatic reorder

at a particular

inventory level, R.

τ

τ

τ

τ

R = λ*τ, if τ < T

R = λ*MOD(τ/T),

if τ > T

Assumption: Delivery is immediate

There is no time lag between production and availability to satisfy

demand

Relax this assumption! Let the order lead time to be equal to τ

Sensitivity Analysis

Let G(Q) be the average annual

holding and set-up cost

function given by

hQ Kl

G Q

2

Q

G 2hKl

4-23

independent

of Q

GQ

hQ Kl

cl

2

Q

Holding & Setup costs

2 Kl

Q

h

6.000

5.000

and let G* be the optimal

average annual holding and

setup cost. Then it can be

shown that:

G (Q) 1 Q * Q

G*

2 Q Q *

4.000

3.000

2.000

1.000

0.000

0

2

4

6

8

10

Cost penalties are quite small

Finite Replenishment Rate:

Economic Production Quantity (EPQ)

4-24

Assumptions for EOQ:

Production is instantaneous

There is no capacity constraint, and entire lot is produced simultaneously

Delivery is immediate

There is no time lag between production and availability to satisfy demand

Example:

Parts produced at the same factory –

production rate is P (P > λ),

arriving continuously.

Inventory Levels for Finite

Production Rate Model

4-25

The EPQ Model: Notation

D

c

K

h

Q

T

= λ is the demand rate (in units per year)

= unit production cost, not counting setup or inventory

costs (in dollars per unit)

= setup costs (per placed order) in dollars

= holding cost (in dollars per unit per year), if the

holding

cost consists entirely of interest on money tied up in

inventory, h=ic, where i is an annual interest rate

= size of each production run (order) in units

= time between initiation of orders arrival (cycle length)

T1 = production (replenishment) time

T2 = downtime

T T1 T2

H = maximum on-hand inventory

G(Q) = average annual setup & holding cost

4-26

4-27

The EPQ Model: Formula

T T1 T2

H K

G Q h

2 T

Q

T1

P

Q Q

T2 T T1

l P

Pl

H P l T1

Q

P

2 Kl

H K

h l Kl

l

Q

,

where

h

h

G Q h Q 1

1

H

slope P l

T1

2

For EOQ:

T

2

P

h

Q

hQ Kl

G Q

2

Q

2 Kl

Q

h

P

Quantity Discount Models

4-28

One of the most severe assumptions: the unit variable cost c did not

depend on the replenishment quantity

In practice: quantity discounts exist based on the purchase price or

transportation costs – take advantage of these can result in

substantial savings

All Units Discounts: the discount is applied to ALL of the units in the

order. Gives rise to an order cost function such as that pictured in

Figure 4-9 in Ch. 4.7

Incremental Discounts: the discount is applied only to the number of

units above the breakpoint. Gives rise to an order cost function such

as that pictured in Figure 4-10

All-Units Discount Order Cost Function

C 499 $149.70

C (500) $145.00

C (516) $149.64

0.30Q

C Q 0.29Q

0.28Q

for 0 Q 500

for 500 Q 1,000

for 1,000 Q

4-29

All-Units Discount

Average Annual Cost Function

G(Q)

0.30Q

C Q 0.29Q

0.28Q

4-30

for 0 Q 500

for 500 Q 1,000

for 1,000 Q

G0(Q)

G1(Q)

G2(Q)

Gmin(Q)

500

1,000

Q

Incremental Discount Order Cost Function

for 0 Q 500

0.30Q

C Q 150 0.29Q 500 5 0.29Q

for 500 Q 1,000

295 0.28Q 1,000 15 0.28Q for 1,000 Q

4-31

4-32

Average Annual Cost Function

for Incremental Discount Schedule

Properties of the Optimal Solutions

For all units discounts, the optimal will occur

at the minimum point of one of the cost

curves or at a discontinuity point

One compares the cost at the largest realizable

EOQ and all of the breakpoints succeeding it

For incremental discounts, the optimal will

always occur at a realizable EOQ value.

Compare costs at all realizable EOQ’s.

4-33

4-34

Example

Supplier of paint to the maintenance department

has announced new pricing:

$8 per gallon if order is < 300 gallons

$6 per gallon if order is ≥ 300 gallons

Data remains as before:

K = 16, I = 25%, l = 3600

Is this a case of all units or incremental

discount?

4-35

Solution

Step 1: For Price 1:

(1)

Q

2Kl

Ic1

2(16)(3600)

240 gallons

(.25)(8)

Step 2: As Q(1) < 300, EOQ is realizable.

Step 3: Price 2:

2Kl

2(16)(3600)

Q

277 gallons

Ic2

(.25)(6)

Step 4: As Q(2) < 300, EOQ is not realizable.

(2)

4-36

Cost Function

C(Q)

Realizable

G(Q|p1)

G(Q|p2)

Not

Realizable

240 277

300

Q

4-37

C(Q)

Cost Function

Only possible solutions G(Q|p )

1

G(Q|p2)

240 277

300

Q

4-38

Solution

Step 5: Compare costs of possible

solutions.

lK Ic jQ

G(Q) lc j

Q

2

For $8 price, Q=240:

(3600)(16) (.25)(8)(240)

G(240) (3600)(8)

$29,280 per year

240

2

For $6 price, Q=300:

(3600)(16) (.25)(6)(300)

G(300) (3600)(6)

$22,017 per year

300

2

Q=300 is the optimal quantity.

Q 300

1

Q* 300 and T

year

l 3600 12

Resource Constrained

Multi-Product Systems

Classic EOQ model is for a single item. Setup plan for n items.

Option A:

Treat one system with multiple items as multiple

systems with one item

Works if:

There are no interactions among items, such as

sharing common resources – budget, storage

capacity, or both

Option B:

Modify classic EOQ to insure no violation of the

resource constraints

Works if:

Have not made any mistakes and know how to use

Lagrange multipliers

4-39

Resource Constrained

Multi-Product Systems

4-40

Consider an inventory system of n items in which the total amount

available to spend is C and items cost respectively c1, c2, . . ., cn. Then

this imposes the following budget constraint on the system

n

, where Qi is the order size for product i

c Q

i 1

i

i

n

w Q

i

i 1

i

W

, where wi is the volume occupied by product i

Q Kl

For EOQ: G Q h

2 Q

Minimize

s.t.

C

Qi K i li

GQ1 ,..., Qn hi

2

Qi

i 1

and n

Qi K i li

GQ1 ,..., Qn hi

2

Qi

i 1

n

n

wi Qi W

ciQi C

i 1

i 1

n

Resource Constrained

Multi-Product Systems

4-41

Qi K i li

Minimize GQ1 ,..., Qn hi

2

Qi

i 1

n

Budget constraint

ciQi C

n

s.t.

i 1

n

w Q

i 1

i

i

Space constraint

W

Lagrange multipliers method: relax one or more constraints

Minimize

n

n

Qi K i li

GQ1 ,..., Qn , 1 , 2 hi

1 C ci Qi 2 W wi Qi

2

Qi

i 1

i 1

i 1

n

G

G

0

,

0 for i 1,..., n; j 1,2

by solving necessary conditions:

Qi

j

Resource Constrained Multi-Product Systems:

Steps to Find Optimal Solution

4-42

Single constraint:

1.

Solve the unconstrained problem. If constraint is satisfied, this

solution is the optimal one.

2.

If the constraint is violated, rewrite objective function using Lagrange

multipliers

3.

Obtain optimal Qi* by solving (n+1) equations

G

G

0,

0 for i 1,..., n;

Qi

Resource Constrained Multi-Product Systems:

Steps to Find Optimal Solution

4-43

Double constraints:

1.

Solve the unconstrained problem. If both constraints are satisfied, this

solution is the optimal one.

2.

Otherwise rewrite objective function using Lagrange multipliers by including

one of the constraints, say budget, and solve one-constraint problem to find

optimal solution. If the space constraint is satisfied, this solution is the

optimal one.

3.

Otherwise repeat the process for the only space constraint.

4.

If both single-constraint solutions do not yield the optimal solution, then

both constraints are active, and the Lagrange equation with both

constraints must be solved.

n

n

Qi K i li

GQ1 ,..., Qn , 1 , 2 hi

1 C ci Qi 2 W wi Qi

2

Qi

i 1

i 1

i 1

n

5.

Obtain optimal Qi* by solving (n+2) equations

G

G

0,

0 for i 1,..., n; j 1,2

Qi

j

EOQ Models for Production Planning

4-44

Problem: determine optimal procedure for producing n products on a

single machine

Consider n items with known demand rates

, production rates

,

l j is to minimize the

holding costs , and set-up costs . The objective

Pj cost of holding and

h j setups, and to have noKstock-outs.

For the problem

j

to be feasible we must have that

n

j

l

P

j 1

1.

j

Assumption: rotation cycle policy – exactly one setup for each product in

each cycle; production sequence stays the same in each next cycle

4-45

The method of solution is to express the average

annual cost function in terms of the cycle time, T to

assure no stock-outs. The optimal cycle time has the

following mathematical form, where sj is a setup time

n

n

T*

2 K j

j 1

n

h

j 1

j

'lj

Tmin

s

j 1

j

n

lj

j 1

Pj

1

And the optimal production quantities are given by:

Q j l jT , where T = max {T*, Tmin},

see pp.216-217

Homework:

Read Ch. 4

Problems

4.5, 4.12, 4.15, 4.16

4.17, 4.18, 4.22, 4.24, 4.25

4.26, 4.27, 4.28, 4.30

Work on appendix 4-A,

4-46

4-47

References

Presentations by McGraw-Hill/Irwin and by Wilson,G.R.

“Production & Operations Analysis” by S.Nahmias

“Factory Physics” by W.J.Hopp, M.L.Spearman

“Inventory Management and Production Planning and

Scheduling” by E.A. Silver, D.F. Pyke, R. Peterson

“Production Planning, Control, and Integration” by D. Sipper

and R.L. Bulfin Jr.

Reorder Point Calculation for Example 4.1

4-48

Reorder Point Calculation for Lead Times

Exceeding One Cycle

4-49

4-50

Sensitivity Analysis

Let G(Q) be the average annual holding and

cost function given by

set-up

G (Q) K l / Q hQ / 2

and let G* be the optimal average annual cost. Then it

can be shown that:

G (Q) 1 Q * Q

G*

2 Q Q *

4-51

EOQ With Finite Production Rate

Suppose that items are produced internally at a

rate P > λ. Then the optimal production quantity

to minimize average annual holding and set up

costs has the same form as the EOQ, namely:

2k l

Q

h'

Except that h’ is defined as h’= h(1- λ/P)

4-52

Inventory Levels for Finite

Production Rate Model

4-53

Quantity Discount Models

All Units Discounts: the discount is applied to

ALL of the units in the order. Gives rise to an

order cost function such as that pictured in

Figure 4-9

Incremental Discounts: the discount is

applied only to the number of units above the

breakpoint. Gives rise to an order cost

function such as that pictured in Figure 4-10.

All-Units Discount

Order Cost Function

4-54

4-55

Incremental Discount

Order Cost Function

4-56

Properties of the Optimal Solutions

For all units discounts, the optimal will occur at the

bottom of one of the cost curves or at a breakpoint.

(It is generally at a breakpoint.). One compares the

cost at the largest realizable EOQ and all of the

breakpoints succeeding it. (See Figure 4-11).

For incremental discounts, the optimal will always

occur at a realizable EOQ value. Compare costs at

all realizable EOQ’s. (See Figure 4-12).

All-Units Discount Average

Annual Cost Function

4-57

4-58

Average Annual Cost Function

for Incremental Discount Schedule

4-59

Resource Constrained Multi-Product

Systems

Consider an inventory system of n items in which the total amount

available to spend is C and items cost respectively c1, c2, . . ., cn. Then

this imposes the following constraint on the system:

c1the

Q1 condition

c2Q2 that

... cnQn

When

C

c / h c / h ... c / h

is met,

is straightforward.

If the condition is not

1 the1solution

2 procedure

2

n

n

met, one must use an iterative procedure involving Lagrange

Multipliers.

4-60

EOQ Models for Production Planning

Consider n items with known demand rates,

production rates, holding costs, and set-up costs.

The objective is to produce each item once in a

production cycle. For the problem to be feasible we

must have that

n

lj

P

j 1

j

1.

4-61

The method of solution is to express the average annual cost

function in terms of the cycle time, T. The optimal cycle time

has the following mathematical form.

n

T*

2 K j

j 1

n

h

j 1

j

'lj

And the optimal production quantities are given by:

Q j * l jT *