Income Tax

advertisement

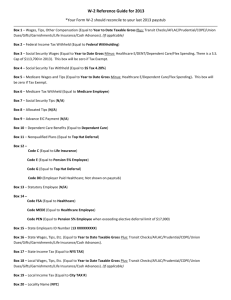

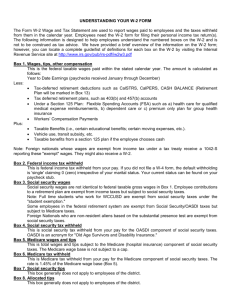

Income Tax Applied Business Practice Taxes and Your Paycheck Income Taxes Taxes you pay on most types of income Not a fixed percentage Dependent on financial and family situation You are responsible for calculating the taxes you owe Taxes and Your Paycheck FICA Federal Insurance Contributions Act Social Security and Medicare Withholding Deducting money from your wages to collect payroll taxes How does withholding benefit you? It spreads tax payment over time, to avoid one huge payment Warm-Up Why is it required for workers to pay income tax? Taxes and Your Paycheck Gross Income Amount you earn before taxes are withheld Net Income Amount you receive after withholdings are deducted from your gross pay. PAYCHECK STUB ABC Company 144 E. Central Ave. Hometown, ST 32122 Check No Employee Name: Jane Smith Employee Address: 986 Park St. Hometown, ST 32122 Check Date: 07/22/05 Earnings 0556789 Employee Social Security Number: 433-211-1234 Pay Period Ending:07/22/05 Hours: Rate: 20 6.25 $ Gross Pay $125.00 Deductions Federal Income Tax Social Security Tax Medicare Tax State Tax $18.75 $ 7.75 $ 1.81 $ .50 Total Withholding $28.81 Gross Pay Total Deductions $125.00 $ 28.82 Net Pay $ 96.19 Taxes and Your Paycheck Form W-4 Provides the information of the amount to withhold from your paycheck. Completed by the Employee IRS Internal Revenue Service Federal agency that collects income taxes Taxes and Your Paycheck Allowances Number that reduces the amount of money withheld from your pay Larger number of allowances, smaller amount withheld Warm-Up Should you reduce your allowances (on your W-4) to force yourself to save? Why or why not? Warm-up 1. How do you and other taxpayers benefit from the taxes you pay? 2. What is the purpose of Form W-4? 3. What is an allowance on form W-4? 4. What is your main goal in determining how many allowances to claim? A Bit of History What amendment established the current income tax system? 16 When was this amendment ratified? Feb 3, 1913 Why was it necessary to make this part of the constitution? Taxes and Your Paycheck Withholding too much Students who work part-time during school, but full time during summer may have more withheld Results in a refund Withholding too little Results in a tax bill May need to lower your allowances Taxes and Your Paycheck Overwithholding as a way to save Force a savings plan Claiming too few allowanced guarantees a refund Is this a good savings plan? It is not a good savings plan because the government does not pay interest File a Tax Return Tax Return Set of forms used by taxpayers to calculate tax obligation Minimum Income to file a return If you worked and had Federal income taxes taken out – file If you are self employed and earned $400 - file Filing must be in by April 15th every year! File a Tax Return Income Wages Tips Earned Interest Cash earned for jobs File a Tax Return Form W-2 Summary of your earnings and withholdings for the year for a job Must send in a copy with your W-2 Employer sends a copy to IRS a Control Number 2233 void For office use only ► OMB No. 1234-0001 b Employer Identification number 1. Wages, Tips, other compensation 78-65412 2. Federal Income Tax Withheld 5,001.88 c Employers name, address and zip code ABC Company 144 E. Central Ave. Hometown, ST 32122 975.00 3. Social security wages and tips 4. Social Security Tax Withheld 5. Medicare wages and tips 6. Medicare Tax Withheld 7. Social Security Tips 8. Allocated Tips 5,001.88 403.00 5,001.88 d Employee’s Social Security Number 433-211-1234 94.12 9. Advanced EIC payment e Employees Name (first, middle initial, last) Jane Smith 986 Park St. Hometown, ST 32122 F Employee’ address and ZIP code 16 State ST Employer’s State ID no. 78-65412 10. Dependent Care Benefits 11 Non-Qualified Plans 12. Benefits included in box 1 13. See instrs. for box 13 14. Other 15 statutory employee deceased 17 State Wages, tips, etc 5001.88 pension plan legal rep. 18 State income tax 26.00 deferred compensation File a Tax Return Form 1099-INT Statement of interest your bank paid on your savings that year Banks send this information to the IRS Income Tax Forms 1040 EZ Simplest of the tax forms To Qualify to use the EZ form: No dependents You and spouse under age 65 No blindness Income less than $50,000 Earned no more than $400 in interest No income other than wages, interest, tips, scholarships, or unemployment compensation Warm-Up Why would the IRS require you to send a copy of your W-2 with your tax return when you file your taxes? Filling Out the 1040 EZ Identifying yourself Social Security Number Unique number used to identify you throughout your entire life a Control Number 2233 void For office use only ► OMB No. 1234-0001 b Employer Identification number 1. Wages, Tips, other compensation 78-65412 2. Federal Income Tax Withheld 5,001.88 c Employers name, address and zip code ABC Company 144 E. Central Ave. Hometown, ST 32122 975.00 3. Social security wages and tips 4. Social Security Tax Withheld 5. Medicare wages and tips 6. Medicare Tax Withheld 7. Social Security Tips 8. Allocated Tips 5,001.88 403.00 5,001.88 d Employee’s Social Security Number 433-211-1234 94.12 9. Advanced EIC payment e Employees Name (first, middle initial, last) Jane Smith 986 Park St. Hometown, ST 32122 F Employee’ address and ZIP code 16 State ST Employer’s State ID no. 78-65412 10. Dependent Care Benefits 11 Non-Qualified Plans 12. Benefits included in box 1 13. See instrs. for box 13 14. Other 15 statutory employee deceased 17 State Wages, tips, etc 5001.88 pension plan legal rep. 18 State income tax 26.00 deferred compensation Income Tax Forms Form 1040 More complex form Deductions Expenses you can legally subtract from your income when figuring your taxes. Own a home Children Run a small business Stocks Dependent Someone you financially support File a Return Refund When your withholding is more than the taxes owed (Government pays you the overage amount paid) Amount You Owe When your withholding is less than the taxes owed (you pay the remaining amount due) Taxes and Government Sources of Federal Government Income Personal Income Tax Social Security, Medicare, Unemployment, & Other Retirement Tax Borrowing Corporate Income Tax Excise, Custom, Estate, Gift, & Misc. Tax Sources of Fed. Gov’t. Income Social Sec., Medicare, Unemployment, other retirement tax 33% 42% Personal Income Tax Taxes and The Government Where does the government get its money? 42% Personal Income Taxes 33% Social Security Taxes, Medicare, and unemployment taxes Who contributes to pay Medicare and Social Security? Employees (pays a max of 7.65%) Employers (pays a max of 7.65%) Warm-Up Why should you check your work before filing your tax return? Principles of Taxation Benefit Principle Those who use a good or service provided by the government should pay for it Example: toll roads Ability to Pay Principle Those who have larger incomes should pay a larger share of what they receive As your income increases your rate of tax increases from 15 – 39.9% How Taxes Are Collected Direct Taxes Paid directly to the government Examples: income, property Indirect Taxes Taxes you pay that are included in the cost of a good/service Examples: Hair care services How Taxes Are Collected Pay-As-You-Earn Tax Taxes paid as you earn income Example: withholdings on your paycheck Types of Taxes Sales Tax Taxes added to the price of goods and services Property Tax Taxes on the value of real estate property Types of Taxes Excise Tax Collected on sale of specific goods or services Tobacco Gas Alcohol Oil Firearms Air travel Types of Taxes Estate Taxes Taxes on property received when someone dies (value must exceed $2.5 million) Gift Tax Paid for by the giver of gifts that exceed $12,000 (for 2008) Types of Taxes Business (License) Tax Tax paid for certification May be accompanied by a test Warm-up Gross Pay = $800 Federal Tax = 14% State Tax = 4.5% Social Sec. = 6.2% Medicare = 1.6% What is the total Withholdings? What is the Net Pay? Government Spending Sin Taxes Taxes on items that can be harmful to your health Tobacco Alcohol How you can reduce tax obligation # 1 way to lower taxes Give to charities Government Spending Federal Government Spends on: Social Security, Medicare, other retirement National Defense, veterans, foreign affairs Social Programs Interest on Debt Community Development Government Spending State and Local government spends on: Buildings and roads Police, Fire protection services Criminal Justice system Schools Colleges, University Sewage treatment plants Unemployment compensation plans