Ch 4B

advertisement

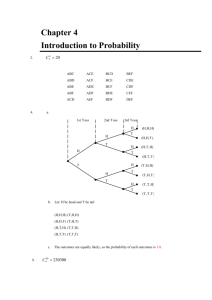

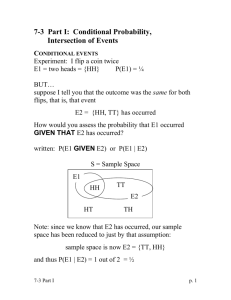

Anderson Sweeney Williams QUANTITATIVE METHODS FOR BUSINESS 8e Slides Prepared by JOHN LOUCKS © 2001 South-Western College Publishing/Thomson Learning Slide 1 Chapter 4 Decision Analysis, Part B Expected Value of Perfect Information Decision Analysis with Sample Information Developing a Decision Strategy Expected Value of Sample Information Slide 2 Example: Burger Prince Burger Prince Restaurant is contemplating opening a new restaurant on Main Street. It has three different models, each with a different seating capacity. Burger Prince estimates that the average number of customers per hour will be 80, 100, or 120. The payoff table for the three models is as follows: Average Number of Customers Per Hour s1 = 80 s2 = 100 s3 = 120 Model A Model B Model C $10,000 $ 8,000 $ 6,000 $15,000 $18,000 $16,000 $14,000 $12,000 $21,000 Slide 3 Example: Burger Prince Expected Value Approach Calculate the expected value for each decision. The decision tree on the next slide can assist in this calculation. Here d1, d2, d3 represent the decision alternatives of models A, B, C, and s1, s2, s3 represent the states of nature of 80, 100, and 120. Slide 4 Example: Burger Prince Decision Tree Payoffs 2 d1 d3 .4 .2 10,000 15,000 .4 14,000 d2 1 s1 s2 s3 3 s1 s2 s3 .4 .2 8,000 18,000 .4 12,000 4 s1 s2 s3 .4 6,000 .2 16,000 .4 21,000 Slide 5 Example: Burger Prince Expected Value For Each Decision d1 EMV = .4(10,000) + .2(15,000) + .4(14,000) = $12,600 2 Model A 1 Model B Model C d2 EMV = .4(8,000) + .2(18,000) + .4(12,000) = $11,600 3 d3 EMV = .4(6,000) + .2(16,000) + .4(21,000) = $14,000 4 Choose the model with largest EV, Model C. Slide 6 Expected Value of Perfect Information Frequently information is available which can improve the probability estimates for the states of nature. The expected value of perfect information (EVPI) is the increase in the expected profit that would result if one knew with certainty which state of nature would occur. The EVPI provides an upper bound on the expected value of any sample or survey information. Slide 7 Expected Value of Perfect Information EVPI Calculation • Step 1: Determine the optimal return corresponding to each state of nature. • Step 2: Compute the expected value of these optimal returns. • Step 3: Subtract the EV of the optimal decision from the amount determined in step (2). Slide 8 Example: Burger Prince Expected Value of Perfect Information Calculate the expected value for the optimum payoff for each state of nature and subtract the EV of the optimal decision. EVPI= .4(10,000) + .2(18,000) + .4(21,000) - 14,000 = $2,000 Slide 9 Example: Burger Prince Spreadsheet for Expected Value of Perfect Information A B C D E 1 PAYOFF TABLE 2 3 Decision State of Nature Expected 4 Alternative s1 = 80 s2 = 100 s3 = 120 Value 5 d1 = Model A 10,000 15,000 14,000 12600 6 d2 = Model B 8,000 18,000 12,000 11600 7 d3 = Model C 6,000 16,000 21,000 14000 8 Probability 0.4 0.2 0.4 9 Maximum Expected Value 14000 10 11 Maximum Payoff EVwPI 12 10,000 18,000 21,000 16000 F Recommended Decision d3 = Model C EVPI 2000 Slide 10 Risk Analysis Risk analysis helps the decision maker recognize the difference between: • the expected value of a decision alternative and • the payoff that might actually occur The risk profile for a decision alternative shows the possible payoffs for the decision alternative along with their associated probabilities. Slide 11 Example: Burger Prince Risk Profile for the Model C Decision Alternative .50 Probability .40 .30 .20 .10 5 10 15 20 25 Slide 12 Sensitivity Analysis Sensitivity analysis can be used to determine how changes to the following inputs affect the recommended decision alternative: • probabilities for the states of nature • values of the payoffs If a small change in the value of one of the inputs causes a change in the recommended decision alternative, extra effort and care should be taken in estimating the input value. Slide 13 Bayes’ Theorem and Posterior Probabilities Knowledge of sample or survey information can be used to revise the probability estimates for the states of nature. Prior to obtaining this information, the probability estimates for the states of nature are called prior probabilities. With knowledge of conditional probabilities for the outcomes or indicators of the sample or survey information, these prior probabilities can be revised by employing Bayes' Theorem. The outcomes of this analysis are called posterior probabilities or branch probabilities for decision trees. Slide 14 Computing Branch Probabilities Branch (Posterior) Probabilities Calculation • Step 1: For each state of nature, multiply the prior probability by its conditional probability for the indicator -- this gives the joint probabilities for the states and indicator. • Step 2: Sum these joint probabilities over all states -- this gives the marginal probability for the indicator. • Step 3: For each state, divide its joint probability by the marginal probability for the indicator -- this gives the posterior probability distribution. Slide 15 Expected Value of Sample Information The expected value of sample information (EVSI) is the additional expected profit possible through knowledge of the sample or survey information. Slide 16 Expected Value of Sample Information EVSI Calculation • Step 1: Determine the optimal decision and its expected return for the possible outcomes of the sample or survey using the posterior probabilities for the states of nature. Step 2: Compute the expected value of these optimal returns. • Step 3: Subtract the EV of the optimal decision obtained without using the sample information from the amount determined in step (2). Slide 17 Efficiency of Sample Information Efficiency of sample information is the ratio of EVSI to EVPI. As the EVPI provides an upper bound for the EVSI, efficiency is always a number between 0 and 1. Slide 18 Example: Burger Prince Sample Information Burger Prince must decide whether or not to purchase a marketing survey from Stanton Marketing for $1,000. The results of the survey are "favorable" or "unfavorable". The conditional probabilities are: P(favorable | 80 customers per hour) = .2 P(favorable | 100 customers per hour) = .5 P(favorable | 120 customers per hour) = .9 Should Burger Prince have the survey performed by Stanton Marketing? Slide 19 Example: Burger Prince Influence Diagram Legend: Decision Chance Consequence Market Survey Market Survey Results Avg. Number of Customers Per Hour Restaurant Size Profit Slide 20 Example: Burger Prince Posterior Probabilities Favorable State 80 100 120 Prior .4 .2 .4 Conditional .2 .5 .9 Total Joint .08 .10 .36 .54 Posterior .148 .185 .667 1.000 P(favorable) = .54 Slide 21 Example: Burger Prince Posterior Probabilities Unfavorable State 80 100 120 Prior .4 .2 .4 Conditional .8 .5 .1 Total Joint .32 .10 .04 .46 Posterior .696 .217 .087 1.000 P(unfavorable) = .46 Slide 22 Example: Burger Prince Formula Spreadsheet for Posterior Probabilities A B Market Research Favorable Prior State of Nature Probabilities s1 = 80 0.4 s2 = 100 0.2 s3 = 120 0.4 C D 1 2 Conditional Joint 3 Probabilities Probabilities 4 0.2 =B4*C4 5 0.5 =B5*C5 6 0.9 =B6*C6 7 P(Favorable) = =SUM(D4:D6) 8 9 Market Research Unfavorable 10 Prior Conditional Joint 11 State of Nature Probabilities Probabilities Probabilities 12 s1 = 80 0.4 0.8 =B12*C12 13 s2 = 100 0.2 0.5 =B13*C13 14 s3 = 120 0.4 0.1 =B14*C14 15 P(Unfavorable) = =SUM(D12:D14) E Posterior Probabilities =D4/$D$7 =D5/$D$7 =D6/$D$7 Posterior Probabilities =D12/$D$15 =D13/$D$15 =D14/$D$15 Slide 23 Example: Burger Prince Solution Spreadsheet for Posterior Probabilities A B Market Research Favorable Prior State of Nature Probabilities s1 = 80 0.4 s2 = 100 0.2 s3 = 120 0.4 C D 1 2 Conditional Joint 3 Probabilities Probabilities 4 0.2 0.08 5 0.5 0.10 6 0.9 0.36 7 P(Favorable) = 0.54 8 9 Market Research Unfavorable 10 Prior Conditional Joint 11 State of Nature Probabilities Probabilities Probabilities 12 s1 = 80 0.4 0.8 0.32 13 s2 = 100 0.2 0.5 0.10 14 s3 = 120 0.4 0.1 0.04 15 P(Favorable) = 0.46 E Posterior Probabilities 0.148 0.185 0.667 Posterior Probabilities 0.696 0.217 0.087 Slide 24 Example: Burger Prince Decision Tree (top half) s1 (.148) 4 d1 s2 (.185) s3 (.667) $10,000 $15,000 $14,000 s1 (.148) d2 2 I1 (.54) 5 d3 6 1 $8,000 s2 (.185) $18,000 s3 (.667) $12,000 s1 (.148) $6,000 s2 (.185) $16,000 s3 (.667) $21,000 Slide 25 Example: Burger Prince Decision Tree (bottom half) 1 s1 (.696) I2 (.46) d1 d2 3 7 s2 (.217) s3 (.087) 8 s1 (.696) s2 (.217) s3 (.087) $10,000 $15,000 $14,000 $8,000 $18,000 $12,000 d3 9 s1 (.696) s2 (.217) s3 (.087) $6,000 $16,000 $21,000 Slide 26 Example: Burger Prince d1 $17,855 d2 2 4 EMV = .148(10,000) + .185(15,000) + .667(14,000) = $13,593 5 EMV = .148 (8,000) + .185(18,000) + .667(12,000) = $12,518 6 EMV = .148(6,000) + .185(16,000) +.667(21,000) = $17,855 7 EMV = .696(10,000) + .217(15,000) +.087(14,000)= $11,433 8 EMV = .696(8,000) + .217(18,000) + .087(12,000) = $10,554 9 EMV = .696(6,000) + .217(16,000) +.087(21,000) = $9,475 d3 I1 (.54) 1 d1 I2 (.46) d2 3 $11,433 d3 Slide 27 Example: Burger Prince Expected Value of Sample Information If the outcome of the survey is "favorable" choose Model C. If it is unfavorable, choose model A. EVSI = .54($17,855) + .46($11,433) - $14,000 = $900.88 Since this is less than the cost of the survey, the survey should not be purchased. Slide 28 Example: Burger Prince Efficiency of Sample Information The efficiency of the survey: EVSI/EVPI = ($900.88)/($2000) = .4504 Slide 29 The End of Chapter 4, Part B Slide 30