Health Savings Account (HAS) - Monroe County Community School

High Deductible Health Plan

(HDHP)

&

Health Savings Account (HSA)

Monroe County Community School Corporation

2009

Click here for Audio on each slide

What is an HSA?

Qualified High Deductible Health Plan

Example Plan - In Network Coverage

Lifetime Maximum - $5,000,000

Health Plan Pays

After you reach the out-of-pocket maximum, the health plan pays 100% of covered charges

You Pay

100% of the deductible

$3,000 - Single / $6,000 - Family

Preventive Care covered at 100%

•

Intended to cover serious illness or injury

• IRS sets parameters on plan design

Examples: Minimum deductible levels;

no copayments for office visits

•

Preventive care can be covered at 100%

Health Savings Account

HSA funds can be used for qualified medical expenses

•

Tax free growth

• Tax free distributions (for qualified expenses)

What are Health Savings Accounts?

• Congress created Health Savings Accounts

(HSAs) to help individuals save for qualified medical and retiree health expenses on a taxfree basis.

• Pairs a qualified high deductible health plan with a savings account for eligible individuals to help pay for qualified medical expenses

• Combines the pre-tax treatment of a health flexible spending account, the portability and carry-over characteristics of a 401(k) plan, and the tax-free distribution of a Roth IRA

What are Health Savings Accounts?

For eligible individuals it is:

• Very similar to a personal checking/savings account that is owned by you, the account holder, and used to pay for qualified medical expenses

• You can elect an amount to be payroll deducted pre-tax from MCCSC to fund the account

• The HSA is a “custodian account” held at a trustee/bank/Insurance company

• Account balances can be carried over year to year

Who is Eligible?

• To be eligible to contribute to an HSA you:

– Must be covered by a qualified high deductible health plan (HDHP) – MCCSC Medical Plan 3 only

– Cannot be enrolled in Medicare (generally age 65)

– Cannot be covered by other health insurance that is not an HDHP

• Additional coverage for dental and vision is allowed

• Cannot have a broad based health Flexible Spending

Account through employer or spouse’s employer

– Cannot be eligible to be claimed as a dependent on another persons taxes

– May not participate in both Section 125 FSA (Medical) &

HSA

• Can participate in a Dependent Care FSA & HSA

How Does the HSA Work?

• You enroll in the qualified high deductible health plan

• MCCSC will have established the banking account for your

HSA

• You make contributions to the account through payroll deduction (pre-taxed)

• You receive health care services

• You pay your out of pocket costs associated with your health plan (deductible and coinsurance)

• You decide whether to take money out of your HSA account to reimburse yourself for “qualified” expenses

• The money in your HSA account that you do not use stays with you and is available to use for future costs

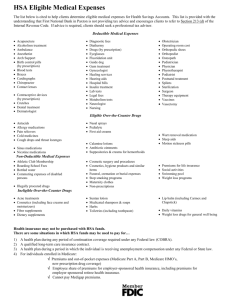

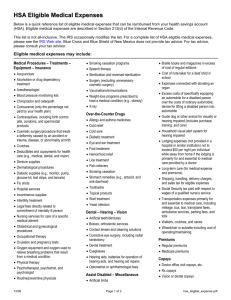

What are “Qualified” Expenses?

• Qualified Medical Expenses are described in section

213(d) of the Internal Revenue Service code

– Refer to IRS Publication 502 for examples

• Health insurance premiums are not a qualified medical expense except:

– For HSAs, the following can be reimbursed taxfree:

• COBRA premiums

• Qualified long term care premiums

• Health insurance premiums while unemployed and receiving unemployment

• Medicare premiums (Part A, B, C, & D)

What expenses can be paid by an HSA?

Your HSA covers a wide variety of medical expenses. These medical expenses must be necessary for the treatment or alleviation of a specific illness or injury. They may include hospital or clinic services, prescription drugs and medications, certain over-the-counter drugs, and many other health related expenses as defined by Section 213(d) of the Internal Revenue Code. Medical expenses covered under the

HSA can include expenses that are not covered under the high deductible health plan such as chiropractic, dental, orthodontia, or vision expenses. For more information about eligible expenses, please consult Publication 502 available at your local IRS office or from the IRS website: www.irs.qov

.

Your HSA can also be used to pay premiums for COBRA, Medicare, long-term care insurance (federal limits apply), and health plan coverage you may have while receiving unemployment compensation.

The following are examples of qualified medical expenses:

Acupuncture

Alcoholism Treatment

Ambulance

Artificial Limbs/Teeth

Aspirin

Bandages

Birth Control Pills

Dentures

Diabetic Supplies

Diagnostic Services

Drug Treatment

Drugs/Medicines

Egg Donor Fees

Eye Exams/Glasses

Blood Pressure Monitoring Devices Fertility Treatment

Blood Sugar Test Kit Flu Shots

Body Scan

Chelation (EDTA) Therapy

Glucose Monitoring Devices

Guide Dog

Chiropractors

Circumcision

Copays/Deductibles

Condoms

Hearing Aids

Home Care

Hormone Replacement Therapy

Hospital Services

Contact Lenses/Related Material

Contraceptives

Counseling (excludes marriage)

Crutches

Dental Treatment

Immunizations lnclinator

Insulin

Laboratory Fees

Laser Eye Surgery

Learning Disability

Medical Records Charge

Medical Services

Medications/Drugs

Nursing Services

Obstetrical Expenses

Occlusal Guards

Psychiatric Care

Psychoanalysis

Psychologist

Reading Glasses

Screening Tests

Sleep Deprivation Treatment

Smoking Cessation Programs

Operations

Optometrist

Organ Donors

Orthodontia

Sterilization Procedures

Supplies for Medical Condition

Surgery

Therapy

Osteopath Transplants

Over-the-counter Drugs/Medicines Vaccines

Ovulation Monitor

Oxygen

Vasectomy

Vision Correction Procedures

Physical Exams

Physical Therapy

Pregnancy Test

Prescription Drugs

Prosthesis

Wheelchair

X-Ray Fees

How Much Can I Contribute to an HSA?

The IRS determines the annual contribution limits for HSA. These are based on either single or family enrollment. The contribution limits can change from year to year. For 2010 you may contribute up to:

$3,050 Single

$6,150 Family

*Individuals age 55 and older can also make additional “catch-up” contributions of $1,000 per year.

Pros to Consider:

• Pros

– Tax savings

– Potential retirement savings

– More control over how you choose to spend your health care dollars

– Can help cover health expenses for periods of unemployment

– Lower health plan premiums

– HSA belongs to you and is portable –

Employees currently contributing to Section

125 FSA could deposit that same amount in an

HSA. With the HSA, there is no “use it or lose it” rule

Cons to Consider

• Cons

– Employee is responsible for tracking expenses, monitoring HSA contributions/distributions

– Must become better healthcare consumer

– Could result in higher out-of-pocket expenses, especially if you don’t fully fund your HSA

In Summary

• Individuals must be eligible to contribute to an

HSA; not required for distributions

• The individual is responsible for compliance with

IRS rules

• If you don’t use your HSA money, you keep it for future years.

• Contributions are subject to limits determined in reference to HDHP annual deductible and statutory limits

• Contributions are tax free, earnings are tax free, and distributions are tax free if used for qualifying medical expenses

Flow Chart for HSA Process

Qualified High Deductible Plan 3 + HSA

Pre-Tax Payroll

Deductions

Filing of Medical/Dental Claims and Use of HSA account

Employee goes to Dr

Premium for

Plan 3

HSA Employee

Contribution

*

Any elected amount by employee up to the max of

$3050 for single plan and

$6150 for family plan

Provider files the claim with Anthem as normal

Anthem processes with in-network discount

There must be funds available through your contributions to pay for the qualified medical expenses

*You only have available what you have contributed – very different from a FSA

Employee receives EOB explaining their responsibility

*Which is 100% after Anthem discount up to the deductible: $3,000 single plan and $6,000 for the family plan

Employee receives bill from provider

Employee pays bill through HSA funds (Debit card or checks) *Just like personal checking account