HEALTH SAVING ACCOUNTS New Planning Opportunities For

advertisement

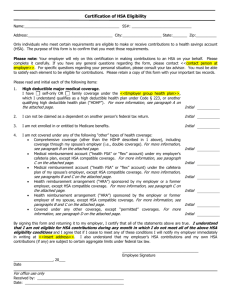

HEALTH SAVINGS ACCOUNTS New Planning Opportunities For Employer Health Plans By Jim Griffin Jackson Walker L.L.P. 214-953-5827 Jgriffin@jw.com Medicare Prescription Drug, Improvement, and Modernization Act of 2003 Pub. L. No. 103-173 December 8, 2003 Effective beginning January 1, 2004 NEW LAW • New Code Section 223 • New Code Section 4980G LEGISLATIVE POLICY • Allows employees to save for health needs in retirement • Contain medical inflation by giving employees incentive to forego unneeded care • Reduce waste and bureaucracy by giving patients a stake in the savings WHAT IS AN HSA? • Tax - exempt trust or custodial account • Qualified medical expenses • Eligible account beneficiary • High–deductible health plan CONTRIBUTIONS • Employee • Employer • Both • Cafeteria Plan CARRIERS AND PRODUCTS • Aetna • Fortis Health • United Health Group • Lumenos IMPROVEMENT OVER MSAs • First introduced in 1996 • Expand availability • No “small employer” requirement (50 or fewer) • No distinction between corporations, L.L.C.s, partnerships and self employed • No employer involvement required • Make permanent in the tax code • Loosen MSA restrictions WHO IS AN ELIGIBLE ACCOUNT BENEFICIARY? • • • • • Monthly Determination Covered by HDHP Not covered by any other plan Not entitled to Medicare Not a dependent of someone else HIGH – DEDUCTIBLE HEALTH PLAN In – Network Amounts Annual Deductible Out of Pocket 2004 Contribution Limit Self Only At least $1,000 Not more than $5,000 Lesser of annual deductible or $2,600 Family At least $2,000 Not more Lesser annual than $10,000 deductible or $5,150 Indexed in $50 increments EXCLUSIONS FROM THE DEDUCTIBLE • • • • • • Preventive care services Accident coverage Disability coverage Dental care Vision care Long term care OUT – OF – POCKET EXPENSES • Deductible • Co-payments • Other amounts TAX TREATMENT OF CONTRIBUTIONS • • • • Contributions are tax – deductible Above the line Not an itemized deduction Amounts paid from an HSA are not also deductible as Section 213 medical expenses • Employer contributions are excludable from the employee’s income • Not subject to FICA taxes TAX BENEFIT CHART Here are the tax savings for a $2,000 contribution to an HSA for families* of various income levels: INCOME (AGI) TAX BENEFIT $25,000 $35,000 $50,0000 $150,000 $500,000 $1,000,000 $0** $200 $300 $615 $721 $721 * Married couple with two children in tax year 2004 ** No tax benefit because at this income level all tax liability would be eliminated by the child tax credit HIGH – DEDUCTIBLE HEALTH PLAN • Fully insured • Self - funded HIGH – DEDUCTIBLE HEALTH PLAN PERMITTED INSURANCE • • • • Workers Compensation Tort Liabilities Property Insurance (for example, car insurance) Specific disease or illness (for example, cancer insurance) • Fixed amount per day of hospitalization EMBEDDED DEDUCTIBLES The XYZ Company health plan has an individual deductible of $750 and a family deductible of $2,250. If Employee A incurs covered medical expenses in a year of $1,500, the Plan would pay $750, even if the family’s covered medical expenses do not exceed $2,000. The Plan is NOT a HDHP. CATCH-UP CONTRIBUTION • Eligibility: Ages 55 to 65 • Catch-up Limit: 2004 2005 2006 2007 2008 2009 and later $500 $600 $700 $800 $900 $1,000 CONTRIBUTION LIMIT: CO-ORDINATION WITH OTHER PLANS • Reduced by amount paid to MSAs • Reduced by employer contributions CONTRIBUTION LIMIT • Computed monthly • Spouses • If either spouse has family coverage, then both spouses are treated as having family coverage • If both spouses have family coverage under different plans, both spouses are treated as having family coverage with the lowest annual deductible • Both spouses may make catch-up contributions, if age 55 but not 65 CONTRIBUTION LIMIT • Excess contributions are subject to a 6% excise tax, unless removed from the HSA CONTRIBUTION LIMIT: SPOUSES H and W are married. H is 58 and W is 53. Both work and have separate HDHP family coverage. H’s deductible is $3,000. W’s deductible is $2,000. H’s HSA contribution limit is $1,500 W’s HSA contribution limit is $1,000 ADDITIONAL CONTRIBUTION REQUIRMENTS • • • • Must be made in cash Not stock or other property April 15 deadline Entire contribution amount may be made on 1st day of the year EMPLOYER CONTRIBUTIONS DISCRIMINATION RERQUIREMENTS • Comparable contributions • Same dollar amount • Same percentage • Comparable participating employees • Applied separately to part time employees (<30 per week) • 35% excise tax DISTRIBUTIONS • May be made at anytime • If used for qualified medical expenses, distributions are excluded from gross income and are not subject to penalty tax DISTRIBUTIONS • Other distributions are includable in income and are also subject to a 10% penalty tax unless the account holder has • Attained age 65; • Becomes disabled; or • dies QUALIFIED MEDICAL EXPENSES • For account beneficiary, that person’s spouse and dependents • Defined in Internal Revenue Code Section 213(d) • Includes over-the-counter drugs as permitted by Revenue Ruling 2003-102 QUALIFIED MEDICAL EXPENSES • Other insurance premiums: • • • • • • Qualified long-term care insurance Cobra premiums Health coverage while receiving unemployment benefits Medicare premiums, if over 65 Not Medigap Retiree health insurance premiums after account holder reaches age 65 DISTRIBUTIONS • Debit, credit or stored-value cards are ok • HSA may be divided in connection with the account holder’s divorce DISPOSITION OF HSA UPON DEATH OF ACCOUNT HOLDER • Spousal beneficiary – account continues tax-free for spouse • Non spousal beneficiary – account terminates and is taxed as income to the recipient • Taxable amount is reduced by amounts incurred before the account holder’s death and paid within 1 year after date of death HSA TRUSTEE/ CUSTODIAN • • • • Insurance company Bank Similar financial institution Any trustee or custodian for • IRAs • MSAs • Not required to be connected to institution that provides HDHP HSA INVESTMENTS • NOT life insurance • No commingled ownership, except • Common trust fund • Common investment fund • Held in U.S. • Non forfeitable; not subject to “use it or lose it” • Subject to UBTI ROLLOVERS • MSA to HSA: OK • Need not be in cash • Not subject to contribution limits • • • • IRA: Not OK HRA: Not OK 125 Account: Not OK HSA to HSA: OK • 60 day rule • 1 time per year RECORDKEEPING • Burden is on employee • Not employers • Not HSA trustee or custodian SIMILARITIES BETWEEN HSA, HRA AND FSA • Pre tax • Employee and employer contributions permitted • Unused balances may be carried over to later years (except for FSA) DIFFERENCES BETWEEN HSA, HRA AND FSA • • • • • HSA assets must be held in trust HSAs are completely portable HSA limits are subject to inflation adjustments HSA have more liberal distribution rules HRA do not have to be combined with HDHP FIRST ROUND OF GUIDANCE IRS NOTICE 2004-2 Issued December 22, 2003 • HDHP requirements • Trustee requirements • Tax Treatment • Contributions • Distributions • Transfers • MSAs • others FURTHER GUIDANCE • • • • • • Relationship between HSAs, HRAs, and 125 plans Definition of preventive care Corrective procedures HDHP requirements IRS Notice 96-53 regarding MSAs Interplay between HDHP and state mandated coverage CO-ORDINATION WITH CAFETERIA PLANS • Is FSA coverage considered other disqualifying coverage? • FSA coverage for dental or vision benefits • Applicability of nondiscrimination rules • Ability to fund long term care through HSA funded through FSA • Election changes SOME OBSERVATIONS • • • • • • • Boost for consumer driven health plans Equalizer for self-employed individuals New retirement savings vehicle Cost control technique Impact on current plan designs and premiums Impact on low deductible plans Predictability in employer costs SOME OBSERVATIONS • Cap on employer expenses • Impact on Health Reimbursement Accounts • IRS Notice 2002-45 • Rev. Rul 2002-41 • Applicability of ERISA, COBRA, HIPAA • Substantiation requirements TARGET MARKETS • Individuals • Younger, healthier people • Upper income people • Middle aged, middle class (?) • Small groups • Large groups (?)