Expressiveness in mechanisms and its relation to efficiency

advertisement

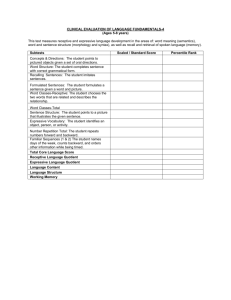

Expressiveness in mechanisms and its relation to efficiency: Our experience from $40 billion of combinatorial multiattribute auctions, and recent theory Tuomas Sandholm Professor Computer Science Department Carnegie Mellon University Founder, Chairman, Chief Scientist CombineNet, Inc. Outline • Practical experiences with expressiveness • Domain-independent measure of expressiveness – Theory on how it relates to efficiency • Application of the theory to sponsored search • Expressive ad (e.g., banner) auction that spans time Sourcing before 2000 Pros Manual negotiation Cons Expressive => win-win Unstructured, nontransparent Implementable solution Sequential => difficult, suboptimal decisions 1-to-1 => lack of competition Basic reverse auction Structured, transparent Simultaneous negotiation with all suppliers Global competition Bidding on predetermined lots is not expressive => ~ 0-sum game Lotting effort Small suppliers can’t compete Unimplementable solution Bidding complexity & exposure Expressive commerce • Expressive bidding • Expressive allocation evaluation Expressive bidding • Package bids of different forms • Conditional discount offers of different forms (general trigger conditions, effects, combinations & sequencing) • Discount schedules of different forms • Side constraints, e.g. capacity constraints • Multi-attribute bidding – alternates • Detailed cost structures • All of these are used in conjunction – Don’t have to be used by all Benefits of expressive bidding Pareto improvement in allocation 1. Finer-grained matching of supply and demand (e.g. less empty driving) 2. Exposure problems removed => better allocation & lower cost 3. Capacity constraints => suppliers can bid on everything 4. No need to pre-bundle => better bundling & less effort 5. Fosters creativity and innovation by suppliers 6. Collaborative bids => lower prices and better supplier relationships Academic bidding languages unusable (in this application) • • • • • • OR [S. 99] XOR [S. 99] Fully expressive OR-of-XORs [S. 99] XOR-of-ORs [Nisan 00] OR* [Fujishima et al. 99, Nisan 00] Recursive logical bidding languages [Boutilier & Hoos 01] Expressive allocation evaluation • Side constraints – – – – – Counting constraints Cost constraints Unit constraints Mixture constraints … • Expressions of how to evaluate bidder and bid attributes Example of expressive allocation evaluation Benefits of expressive allocation evaluation 1. Operational & legal constraints captured => implementable allocation 2. Can honor prior contractual obligations 3. Speed to contract: months weeks – $ savings begin to accrue earlier – Effort savings Clearing (aka. winner determination) problem • Allocate (& define) the business – so as to minimize cost (adjusted for buyer’s preferences) – subject to satisfying all constraints • Even simple subclass NP-complete & inapproximable [S., Suri, Gilpin & Levine AAMAS-02] • We solve problems ~100x bigger than competitors, on all dimensions: • • • • > 2,600,000 bids > 160,000 items (multiple units of each) > 300,000 side constraints > 1,000 suppliers • Avg 20 sec, median 1 sec, some instances take days • Speed & expressiveness: huge competitive advantage CombineNet events so far • > 500 procurement events – $2 million - $1.6 billion – The most expressive auctions ever conducted • Total transaction volume > $40 billion • Created 12.6% savings for customers – Constrained; Unconstrained was 15.4% • Suppliers also benefited – Positive feedback (win-win, expression of efficiencies, differentiation, creativity) – Un-boycotting – They recommend use of CombineNet to other buyers Applied to many areas Chemicals Marketing Transportation Aromatics Solvents Cylinder Gasses Colorants Media buy Corrugate Displays Printed Materials Promotional Items Packaging Technology Cans & Ends Corrugated Boxes Corrugated Displays Flexible Film Folding Cartons Labels Plastic Caps/Closures Shrink/Stretch Film Security Cameras Computers Airfreight Ocean Freight Dray Truckload Less-than-truckload (LTL) Bulk Small Parcel Intermodal 3PLs Ingredients/Raw Mat. Medical Sugars/Sweeteners Meat/Protein Services Pre-press Temporary Labor Shuttling/Towing Warehousing Pharmaceuticals Medical/surgical supplies Miscellaneous Office Supplies Industrial Parts/Materials Bulk Electric Fasteners Filters Leased Equipment MRO Pipes/Valves/Fittings/Gauges Pumps Safety Supplies Steel Broader trend toward expressiveness Amazon.c & New Egg o offer bundles of items (ca. 2000) Facebook increases expressiveness of privacy control (2006) “…we did a bad job of explaining what the new features were and an even worse job of giving you control of them…. This is the same reason we have built extensive privacy settings — to give you even more control over who you share your information with.” CD+Tunes adds option for users to rent movies (2007) Airlines charge extra for baggage, food & choice seats (2008) Prediction/insurance markets becoming more expressive Is more expressiveness always better? • Not always for revenue! Expressive mechanism: vi( )? vi ( )? vi ( An inexpressive mechanism: vi ( )? )? Is more expressiveness always better for efficiency? • And what is expressiveness, really? [Benisch, Sadeh & S. AAAI-08] What makes a mechanism expressive? A straw man notion Item bid auction $5 $2 Expression space 2 Combinatorial auction $5 $2 $6 Expression space 3 What makes a mechanism expressive? Prop: Dimensionality of expression space does not suffice Proof intuition [based on work of Georg Cantor, 1890] : a Expression space 3 Mapping b Expression space 1 Work on informational complexity in mechanisms [Hurwicz, Mount, Reiter 1970s…] puts technical restrictions that preclude such mappings Our notion: Expressive mechanisms allow agents more impact on outcome An agent’s impact is a measure of the outcomes it can choose between by altering only its own expression $Y $4 A C B D $6 $X $Y $X $4 $6 Uncertainty introduces the need for greater impact $Y A,A A,C C,C A,B A,D C,D B,B B,D D,D $4 $6 $X $X $Y $4 $6 Uncertainty introduces the need for greater impact… $Y A,A A,C C,C A,B A,D C,D B,B B,D D,D $X $Y $7 $3 $X $7 $3 Uncertainty introduces the need for greater impact… $Y A,A A,C C,C A,B A,D C,D B,B B,D D,D $X $Y $7 $4 $3 $6 $4 $6 $7 $3 $X • 10 outcome pairs but only 9 regions • In this example the impact vector B,C can’t be expressed Expressive mechanisms $Y $Y $Z $Y A,A Some Z>0 $Y A,A Z=0 A,C Region B,C B,B B,D A,C C,C A,B A,D C,D B,B C,C B,D D,D B,BD,D $X $X $Y $Z $X $X A,BExtra A,D A,B A,A C,D • In combinatorial auction all 10 pairs can be B,D D,D expressed $4 $6 $7 $3 $X • Our measure of expressiveness for one agent (semi-shattering): how many combinations of outcomes can he choose among • Not just for combinatorial allocation problems because outcomes can be anything • Captures multi-attribute considerations as well An upper bound on a mechanism’s best-case efficiency • We study a mechanism’s efficiency when agents cooperate • It bounds the efficiency of any equilibrium • It allows us to avoid computing equilibrium strategies • It allows us to restrict our analysis to pure strategies only ? ? Theorem: the upper bound on efficiency for an optimal mechanism increases strictly monotonically as more expressiveness (# of expressible impact vectors) is allowed (until full efficiency is reached) Proof intuition: induction on the number of expressible impact vectors; each time this is increased at least one more efficient outcome is allowed Theorem: the upper bound on efficiency for an optimal mechanism can increase arbitrarily when any increase in expressiveness (# of expressible impact vectors) is allowed Proof intuition: construct preference distributions that ensure at least one type makes each combination of outcomes arbitrarily more efficient than any others The bound can always be met Theorem: for any outcome function, there exists at least one payment function that yields a mechanism that achieves the bound's efficiency in Bayes-Nash equilibrium Proof intuition: if agents are charged their expected imposed externality (i.e., the inconvenience that they cause to other agents in the potentially inexpressive mechanism), then making expressions that maximize social welfare is an optimal strategy for each agent given that the others do so as well Application to sponsored search [Benisch, Sadeh & S. Ad Auctions Workshop 2008] Heterogeneous bidder preferences Bidder utility $0.25 $0.15 Prototypical value advertiser Prototypical brand advertiser $0.05 -$0.05 0% -$0.15 20% 40% 60% 80% 100% Rank percentile Mechanisms we compared Google, Yahoo!, Microsoft, … Inexpressive Rank mechanism 1 2 $4 3 4 Our proposal 1 2 3 4 Premium mechanism $5 $4 Expressiveness Fully expressive mechanism 1 $5 2 $4 3 $3 4 $2 Best-case expected efficiency 100% 90% 80% 70% 60% 50% Inexpressive mechanism Premium Fully expressive mechanism mechanism Expressive ad (e.g., banner) auctions that span time, and model-based online optimization for clearing [Boutilier, Parkes, S. & Walsh AAAI-08] Prior expressiveness • Typical expressiveness in existing ad auctions – Acceptable attributes – Per-unit bidding (per-impression/per-clickthrough (CT)) – Budgets – Single-period expressiveness (e.g., 1 day) • Most prior research assumes this level of expressiveness Campaign-level expressiveness • Advertising campaigns express preferences over a sequence of allocations – – – – – – – Minimum targets: pay only if 100K impressions in a week Tiered preferences: $0.20 per impression up to 30K, $0.50 per impression for more Temporal sequencing: at least 20K impressions per day for 14 days Substitution: either NYT ($0.90) or CNN ($0.50) but not both Smoothness: impressions vary by no more than 20% daily Long-term budget: spend no more that $250k in a month Exclusivity • Additional forms of expressiveness – Advertiser’s choice of impression/CT/conversion pricing (or combination) – Target audience (e.g., demographics) rather than indirectly via web site properties Value of optimization under sequential expressiveness • Bidder 1: bids $1 on A, $0.50 on B, budget $50k • Bidder 2: bids $0.50 on A, budget $20k • Traditional first-price auction: $52.3k revenue Bidder 1: 45.45k Supply of A 50k t0 Supply of B Bidder 2: 4.55k 0 t1 10k Bidder 1: 9.09k ... t2 10k ... Value of optimization under sequential expressiveness • Bidder 1: bids $1 on A, $0.50 on B, budget $50k • Bidder 2: bids $0.50 on A, budget $20k • Optimal allocation: $70k revenue Bidder 2: 40k Bidder 1: 10k Supply of A 50k t0 Supply of B 0 t1 10k t2 10k Bidder 1: 80k ... ... Stochastic optimization problem • • • • • • Advertising channels C Supply distribution of advertising channels PS Set of campaigns B Spot market demand distribution PD Time horizon T Can be modeled as Markov Decision Process (MDP) – But how do we make it scale? Scalable optimization with real-time response • Huge number of possible events => infeasible to compute full policy contingent on all future states • Cannot reoptimize policy in real time at every event • Optimize-and-dispatch architecture [Parkes and S., 2005] – Periodically compute policies with limited contingencies (e.g., stop dispatching when budget reached) – Dispatch in real time • Policy form: xti,j - fraction of channel i allocated to campaign j at time t • Optimize over coarse time periods (e.g., minutes, hours) – Tradeoff between optimization speed and optimality – Finer-grained in near-term, coarse-grained in long-term Channels • A channel is an aggregation of properties (web pages or spots on them) • Constructed automatically based on campaigns • Lossless aggregation: two web pages are in the same channel if indistinguishable from the point of view of bids • Example: – – – – Bid 1: NY Times (NYT) Bid 2: Medical article (Med) Channels: (NYT ∧ Med), (NYT ∧ ¬Med), (¬ NYT ∧ Med) Non-NYT pages grouped together, non-Med pages grouped together • We can also perform lossy abstraction to avoid exponential blowup Algorithms for stochastic problem • Infeasible to solve the MDP – Huge state space – cross product of individual campaign states – High-dimensional continuous action space • Our approaches: – Deterministic optimization – Online stochastic optimization Deterministic optimization • • • • Replace uncertain channel supply with expectations Formulate the problem as a mixed-integer program (MIP) Solving a MIP is much faster than an MDP Our winner determination algorithms can solve very large problems [S. 2007] • Solutions may be far from optimal if supply distributions have high variance – Does not adequately account for risk – Can be mitigated by periodic reoptimization Sample-based online stochastic optimization [van Hentenryck & Bent 06] • Compute only next action, rather than entire policy – Informed by what we might do in the future – Recompute at each time period • Sample-based – Solve w.r.t. samples from distributions • Extremely effective when good deterministic algorithms exist • Requires that domain uncertainty is exogenous – Distribution of future events doesn’t depend on decisions – Roughly true for advertising: allocation of ads should have little effect on supply of channel REGRETS algorithm [Bent & van Hentenryck 04] λ1t Time t Action Value xt,1 f(xt,1) xt,2 f(xt,2) xt,3 . . . xt,n f(xt,n) ... λ1T Sample λ1 Optimal solution x1t , x1t 1 ,, x1T λ2t λ2t+1 λ2t+2 λ2t+3 λ2t+4 ... λ2T Sample λ2 Optimal solution x 2t , x 2t 1 , , x 2T f(xt,3) . . . λ1t+1 λ1t+2 λ1t+3 λ1t+4 Choose xt,i that maximizes f(xt,i) . . . λKt λKt+1 λKt+2 λKt+3 λKt+4 ... Sample λK Optimal solution x Kt , x Kt 1 , , x KT λKT REGRETS algorithm [Bent & van Hentenryck 04] Lower bound on Q-values for action xt at time t λ1t Q1t ( x t ) λ2t λ1T λ2t+1 λ2t+2 λ2t+3 λ2t+4 ... λ2T Sample λ2 Optimal solution x 2t , x 2t 1 , , x 2T x t , x2t 1 ,, x2T Q2t ( x t ) . . . ... Sample λ1 Optimal solution x1t , x1t 1 ,, x1T x t , x1t 1 ,, x1T f ( xt ) λ1t+1 λ1t+2 λ1t+3 λ1t+4 . . . λKt λKt+1 λKt+2 λKt+3 λKt+4 ... x t , x Kt 1 , , x KT Sample λK Optimal solution QKt ( x t ) x Kt , x Kt 1 , , x KT λKT REGRETS doesn’t apply to ad auctions • Requires set of possible first-period decisions to be small • Our dispatch policies are continuous • Even a discretization of our continuous decision space would be huge: dimensionality = |C||B||Discretization| Our extension of REGRETS to continuous action spaces Combining MIP λ1t x t , x1t 1 ,, x1T Q1t ( x t ) 1 max xt K t t Q ( x k ) k K Q2t ( x t ) . . . ... λ1T Sample λ1 Optimal solution from MIP: x1t , x1t 1 ,, x1T λ2t x t , x2t 1 ,, x2T λ1t+1 λ1t+2 λ1t+3 λ1t+4 λ2t+1 λ2t+2 λ2t+3 λ2t+4 ... λ2T Sample λ2 Optimal solution from MIP: x 2t , x 2t 1 , , x 2T . . . λKt λKt+1 λKt+2 λKt+3 λKt+4 ... λKT x t , x Kt 1 , , x KT Sample λK Optimal solution from MIP: QKt ( x t ) x Kt , x Kt 1 , , x KT Revenue: Flat bids Method Unimodal supply Bimodal supply Bid-all 25,687 ± 436 14,004 ± 141 Myopic 30,256 ± 437 15,890 ± 175 Deterministic 42,365 ± 581 22,385 ± 227 Stochastic 42,237 ± 581 22,774 ± 238 Revenue: Bonus bids Method Unimodal supply Bimodal supply Deterministic 100,266 ± 3,555 55,901 ± 1,887 Stochastic 149,423 ± 3,204 65,065 ± 2,356 Conclusions & future research • • Expressive mechanisms are practical & provide huge benefits Needed to develop natural concise expressiveness forms – Prior academic bidding languages not usable • For efficiency, can add any expressiveness forms – Will help & can help an arbitrary amount; Bound can be met in BNE • Uncertainty about others => need more expressiveness – Unlike in work solely on dominant-strategy mechanisms [Ronen 01], [Holzman et al. 04], [Blumrosen & Feldman 06] • Sponsored search – GSP seems to run at a large inefficiency – Most of it fixable by our “premium mechanism” • Expressive (banner) ad auctions that span time – – – – – – • Optimize-and-dispatch framework Channel aggregation Deterministic optimization with re-optimization Online sample-based optimization – extended to continuous action space Optimization provides significant benefits, even with no added expressiveness Stochastic especially beneficial with non-linear preferences Most helpful expressiveness forms for other apps? – Agents’ preferences as input, our methodology can be used to evaluate different mechanisms – Psychological burden: expressing more vs. expressing strategically (e.g., chopsticks)