Stock Trading 102 Seminar

advertisement

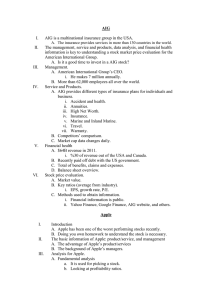

Stock Market Success Understand goal Generate idea Avoid gambling mentally Follow economic indicators Company Analysis Management Service/Products Financial Health Stock Price Evaluation LOOK AT YOUR LIST OF TERMS!!! Company Overview • Multinational, operates in more than 130 countries. • 88 million customers. 62,000 employees. • “Together, we’re working to help see, build, and secure a better future for everyone.” Management Robert H. Benmosche President and Chief Executive Officer. 7M Annually 2009 Alfred University New York Services and Products Accident and health. Annuities. High Net Worth. Insurance. Marine and Inland Marine. Travel. Warranty. Competition Met Life, Inc. $36.43 Traveling Companies, Inc. $81.46 Manulife Financial Corp. $14.95 Aflac, Inc. $51.01 Financial Health $64B revenue in 2011. 30% of revenue out of the USA and Canada. Recently paid off debt with the US government. Total of benefits, claims and expenses. $65,302 (2011) $59,590 (2010) Financial Health cont. Year-end balance sheet data: Total assets 555,773 Total investments 410,438 Total liabilities 441,444 Total AIG shareholders’ equity 104,951 Total equity 105,806 Stock Price Evaluation Previous close 38.07 Today’s open 38.28 Day’s range 38.21 - 38.90 Stock Price Evaluation cont. Earnings growth (last year) -18.48% Earnings growth (this year) +271.81% Earnings growth (next 5 years) P/E ratio 2.5 EPS $1.64 +10.00% Methods Public information – Financial Stocks, Finances, Market, Investments. Apple, in the past 6 Months “you should never invest in any idea that you cannot illustrate with a crayon.” “ The only value of stock forecasters is to make fortune tellers look good. “ --Warren Buffett Apple: product, service More innovative Sleek design Novel software Good quality Product integration Perfect service Apple: Management Analyses for Apple Fundamental analysis—used for test if you pick the right stock Technical analysis—appropriate the right time and price to buy it Analysis for apple Fundamental analysis Profitability ratios ROA may not used for personal computer industry Valuation Rank Compares earning, cash flows and sales to market value (intrinsic value & market value) Apple vs. Google Apple vs. Industry leader Technical analysis Technical analysis Extremely complicated MACD, KDJ, BOLL, etc Affected by psychology of shareholders Data only, no industry background needed MACD Background What is Home Depot? Current chairman and CEO HD Supply Competitors Major shareholders Recent Activity Key Statistics Fiscal year ends: Feb. 2nd Total market capitalization for all publically traded companies: $15,640,707,100,000 Total market capitalization for Home Depot, Inc.: $103.80B Price/Earnings Ratio: 23.39 Number of shares of common stock outstanding: $1,523,263,533 Industry Sector: Services Industry: Home Improvement Stores- 11 Stocks Home Depot vs. the industry leader (KGF.L) 1. 2. 3. Market Cap comparison Price per share Price/Earnings Ratio Industry Continued Financial Health Total Revenue- $70,395,000 Total Liabilities- $22,620,000 Cost of Revenue- $46,133,000 Total Stockholder Equity$17,898,000 = Gross Profit= $24,262,000 Total Current Assets$14,520,000 Total Assets- $40,518,000 Total Current Liabilities$9,376,000 Total Operating Expense$18,755,000 Total Debt- $10,788,000 Total Cash Flow- $6,651,000 Determining Financial Health Total Cash Flow- $6,651,000 Cash Flow Growth Rate- 10.28% Earnings Growth Rate- 13.40% Debt-to-equity ratio- 0.6073(2012)0.6027(2011)0.5161(2010) Return on equity- 25.42% Gross Profit Margin34.37%(2012)34.27%(2011)33.87%(2010) Smith and Wesson History of the Company: Horace Smith and Daniel B. Wesson First partnership in 1852 Second in 1856 Introduced the Model 10 Revenue-Pass Earnings Per Share-Pass Return on Equity (ROE)Fail Analyst Recommendations-Pass Positive Earnings Surprises-Pass Earnings Forecast-Fail Earnings Growth-Pass PEG Ratio-Pass Industry Price-Earnings Days to Cover-Fail Insider Trading-Pass Weighted Alpha Strength of Company Stock Pass: 8 Fail: 4 8:4 Moderate