2014-2015 Household Resources Worksheet

advertisement

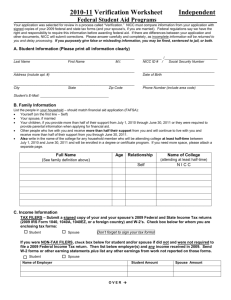

2014-2015 Household Resources Worksheet WHY YOU HAVE RECEIVED THIS FORM Your application was selected for review in a process called “verification.” We are required to compare your FAFSA information to certain 2013 financial documents, which may include your federal tax return transcript, and W-2 forms; as well as your spouse’s (if married), or your parents’ (if you are dependent). Federal regulations require us to collect this information before disbursing federal aid. If differences exist between your FAFSA and the verification documents, we will electronically submit the correct data to the federal student aid processor. Instructions 1. 2. 3. 4. 5. 6. There are seven sections to this form labeled A – G. Please complete all items on this form. Write “0.00” for items in section B that do not apply. DO NOT WRITE “N/A.” DO NOT LEAVE BLANK. Use black or blue ink only. Print clearly. These forms are scanned into your student account for record keeping required by the federal government. Include parent’s signature for dependent students (who were required to provide parental data on the FAFSA). Include spouse’s information if you were married when you filed the FAFSA. Include the name of the college for each household member planning to attend at least half-time (excluding parents). A) Student Information Last Name: Student ID: ______________________________ Date of Birth: First Name: / MI: / B) Untaxed Income Information Income Type Payments to tax deferred pension and savings plans (paid directly or withheld from earnings), including, but not limited to amounts reported on the W-2 forms in Boxes 12a through 12d, codes D,E,F,G,H and S. IRA deductions and payments to self-employment SEP, SIMPLE, Keogh and other qualified plans from IRS Form 1040 (line 28 + line 32) or IRS Form 1040A, line 17. Annual child support you have RECEIVED for all of your children. Do not include foster care or adoption payments. Full name of Child Support Payor(s) 1. 2. Full name of Child(ren) Supported by Child Support 1. 2. 3. 4. Tax exempt interest income from IRS Form 1040, line 8b or IRS Form 1040A, line 8b. Untaxed IRA Distributions from IRS Form 1040, lines (15a minus 15b) or Form 1040, lines (11a minus 11b). Exclude rollovers. If negative, enter a zero. Untaxed portions of pensions form IRS Form 1040, lines (16a minus 16b) or Form 1040A, lines (12a minus 12b). Exclude rollovers. If negative, enter a zero. Housing, food and other living allowances paid to members of the military, clergy and others (including cash payments and cash value of benefits). Do not include the value of on-base military housing or the value of a basic military allowance for housing. Veteran’s non-education benefits such as Disability, Death Pension, or Dependency & Indemnity Compensation (DIC) and/or VA Educational Work-study allowances. Other untaxed income not reported above, such as workers’ compensation, disability, Black Lung benefits, Railroad Retirement benefits, and untaxed portions of health savings accounts from IRS Form 1040–line 25. Do not include student aid, extended foster care benefits, earned income credit, additional child tax credit, welfare payments, untaxed Social Security benefits, Supplemental Security Income, Workforce investment Act educational benefits, onbase military housing or a military housing allowance, combat pay, benefits from flexible spending arrangements (e.g., cafeteria plans), foreign income exclusion or credit for federal tax on special fuels. Also do not include items reported or excluded in other sections above or below. Money you received, or that was paid on your behalf by someone else not reported elsewhere on this form. *See notes below for additional explanation. Total 2013 Amounts Student & Spouse Parent(s) $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ * Money received or paid on the student’s behalf: List any money received or paid on the student’s behalf (e.g., payment of student’s bills) and not reported elsewhere on this form. Enter the total amount of cash support the student received in 2013. Include support from a parent whose information was not reported on the student’s 2014–2015 FAFSA, but do not include support from a parent whose information was reported. For example, if someone is paying rent, utility bills, etc., for the student or gives cash, gift cards, etc., include the amount of that person's contributions unless the person is the student’s parent whose information is reported on the student’s 2014–2015 FAFSA. Amounts paid on the student’s behalf also include any distributions to the student from a 529 plan owned by someone other than the student or the student’s parents, such as grandparents, aunts, and uncles of the student. To ensure both pages of this record stay together, please relist your information: Last Name: First Name: MI: Student ID: ______________________________ C) Family Information If not required to provide parental data on the FAFSA, list yourself, your spouse (if you are married), and any children you or your spouse support if it accounts for more than half of their support from July 1, 2014, through June 30, 2015, even if the children do not live with you. If required to provide parental data on the FAFSA, list yourself, your supporting parent(s) (including stepparents) and anyone else if your parents provide more than half of that person’s support from July 1, 2014, through June 30, 2015, OR that person would be required to provide parental data on his or her own FAFSA. Attach a separate sheet if necessary. Full Name Age Relationship College (if attending at least half-time in 2014-2015) Self MISSOURI BAPTIST UNIVERSITY D) Tax Return Transcript & Income Information To request an official 2013 Tax Return Transcript from the IRS, you may call 1-800-908-9946 or request a transcript online at www.irs.gov/individuals/get-transcript Student Parent (Dependent Students Only) Check here if you are completing the IRS data match on www.FAFSA.gov. Check here if you are completing the IRS data match on www.FAFSA.gov. Check here if you are attaching a signed copy of your IRS Tax Return Check here if you are attaching a signed copy of your IRS Tax Return Transcript. (Account Transcripts are not acceptable). Transcript. (Account Transcripts are not acceptable). Check here if you did not, will not, and are not required to file a 2013 Check here if you did not, will not, and are not required to file a 2013 U.S. Income Tax Return. However, if you worked, attach copies of a U.S. Income Tax Return. However, if you worked, attach copies of a W-2 from each employer. If you did not receive W-2 statements, attach a W-2 from each employer. If you did not receive W-2 statements, separate page listing each employer and any income received attach a separate page listing each employer and any income from that employer. received from that employer. ***If no taxes were filed and the amount of income reported seems insufficient to provide for your household, additional documentation will be required.*** E) Child Support PAID If you (or your parent(s) if dependent) paid child support in 2013, please complete the following information. Attach a separate sheet if necessary. Child Support Recipient: ___________________________________ Name of Child(ren): ________________________________________________________ 2013 Annual Amount Paid: _________________________________ Signature of Person Paying Support: ___________________________________________ F) Food Stamps (SNAP) I (or my parent(s) if dependent) received SNAP benefits (formerly known as the Food Stamp Program) in 2012 or 2013. Recipient: ______________________ G) Sign This Worksheet By signing this worksheet, I (we) certify that all of the information to qualify for federal financial aid is complete and correct. I understand that purposely giving false or misleading information on this worksheet can result in a fine, jail sentence, or both. ____ Student Signature __________ Date If you need help completing this document, download Instructions & Guides at http://goo.gl/nYBcY6 Parent Signature (Dependent Students) ____ Date