Corporations Act

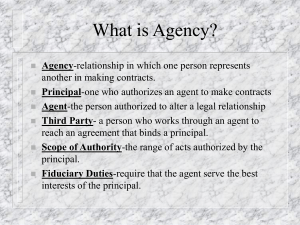

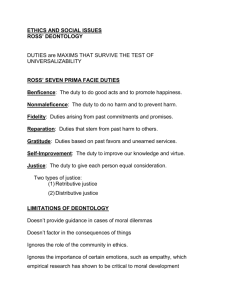

advertisement

Nonprofit Law in Plain English Board Legal Responsibilities and Liability Issues by Myles McGregor-Lowndes Centre of Philanthropy and Nonprofit Studies Building Better Boards, Saturday 11.30-1pm 13/7/02 Further Information • • The information from which these slides are drawn come from the following working papers from the Centre: Waller CPNS 2 Sievers PONC 7 McGregor-Lowndes PONC 11 To obtain an order form, visit the web site at http://cpns.bus.qut.edu.au Corporate Governance is NOT just •Duties under the Corporations Act 2001, Associations Acts, Trust Law •Fiduciary Duties •Due care and attention - negligence Paradoxes • • • • • • Does it really matter? Who is responsible? Independence vs Team? Knowledge ? Representation? Does Conformance bring Performance? SO – JUST TELL ME! • Sources of Liability • General Laws • Specific Entity Laws – Company – Trust • How to manage your legal duties and liabilities JUDGES FAIL THE COMMON SENSE TEST • Judges have failed to recognise the reality of associations of people • They adhere rigidly to ancient protocols • Causes problems for all types of nonprofit associations GIFT OF THE CROWN • The gift of “persona” is reserved for the Crown • Delegated to government departments • But judges still see nothing but a crowd of people without it! What is the legal form of your association? • • • • • • • Unincorporated association Incorporated association Company limited by guarantee Company limited by guarantee and shares Charitable Trust Co-operative Special Act of Parliament Sources of Liability 1. General Statutes/Legislation 2. Specific Entity Law • Common Law • Statute Law General Statutes • Use of Corporation to catch “for profit” and “non-profit” organisations. • Environmental, tax, workplace health and safety, collections, Trade Practices Act • Officers as liable as the corporation An Act of Parliament Place Names Act Executive officers must ensure corporation complies with Act (1) The executive officers of a corporation must ensure that the corporation complies with this Act. (2) If a corporation commits an offence against a provision of this Act, each of the corporation’s executive officers also commits an offence “executive officer”, of a corporation, means a person who is concerned with, or takes part in, the corporation’s management, whether or not the person is a director or the person’s position is given the name of executive officer. • However, it is a defence for an executive officer to prove— –the officer exercised reasonable diligence to ensure the corporation complied with the provision. Defences and Mitigation • Usual to have a due diligence defence – Use of standards and legal compliance plans • Requires documentation and evidence to show that there was an implementation process and monitoring. • Line Managers sign off on a regular basis • Use of computer programs to assist control major areas of exposure. SPECIFIC ENTITY LAWS • Entity is liable from its property –Members, directors, committee not primarily liable • Trustees are liable –It is a relationship not an entity Common Law Exception • Piercing the Corporate Veil – Fraud – Avoid legal obligations – Groups History of Duties • The Charitable Corporation v Sir Robert Sutton 1742 • Trustee standards – Imposed a high standard – All 50 responsible for breaches of trust, even though some did not participate – non-attendance – No excuse that honorary – Not a subjective test Victorian Era Directors • A director need not in the performance of his duties exhibit a greater degree of skill than reasonably expected of a person of his knowledge and experience • Not bound to give continuous attention to the affairs of the company • Director justified in trusting management to perform their duties honestly • SUBJECTIVE Australian 1990 Judicial Reform • • • • • • • More objective standard General understanding of the business General financial understanding Friedrich’s case Daniels v Anderson Voluntary/executive/non-executive Statutory reforms Daniels v Anderson 1. Directors keep abreast and exercise control – obvious risks cannot be blindly left to others 2. Monitor business, policies and finances – duty to inquire if suspicions. 3. Directors must be capable of monitoring – ignorance no excuse – suspicions must act 4. Added tort of negligence - carelessness Specific Corporations Act Duties • Public Company • Duty to exercise the degree of care and diligence that a reasonable person would exercise in the same position in a company in the same circumstances ( s180 Corporations Act) • Duty to exercise powers in good faith in the best interests of the company and for a proper purpose – Trustee exception (s181 Corporations Act) • Duty not to make improper use of their position as a director to gain advantage for the director or for anyone else s182 Corporations Act • Duty not to make improper use of information obtained as a director to gain an advantage for the director or for anyone else s183 Corporations Act • Duty not to delegate their discretionary powers to anyone else • Duty to avoid conflicts of interest • The relevant provisions of the Corporations Act require, of a director of a company limited by guarantee in such a position, that: – the director discloses to the other board members the “material personal interest” which the director has in the subject matter of the discussion. – to fulfil this duty directors to make an initial standing disclosure of all material interests which are then taken, on an ongoing basis, to have been notified to all other board members. Conflicts • Corporate opportunities • Misuse confidential information • Personal profits • Competing • Bribes Business Judgment Rule • Defence against breaches of duty of care • Directors should not be liable for decisions made in an HONEST, INFORMED and RATIONAL WAY. • Good faith, proper purpose, no conflict, appropriately informed, rational • Rational unless “no reasonable person” There is more! • Insolvent trading provisions – s 588G Corporations Law – Coy incurs a debt + there were reasonable grounds for suspecting that the company was insolvent or would become insolvent – confined to directors - but note wide def of directors – National Safety Council Case • It is expected that board members acting carefully and diligently must: • be well prepared – read board papers in advance of meetings (and require staff to provide them) • attend all meetings with only limited exceptions • ask questions at those meetings and seek further information, especially if they do not understand the information presented • attend the office of the company to see that it operates as they are told it operates • attend functions and activities of the company, for the same reason • put in place systems to check the compliance by the company with laws, policies of the board and industry standards Incorporated Associations • • • • Duties vary Some States already have the 588G test Part 5.7 body argument may be applicable Those Inc assoc which trade interstateARB Trusts • Trustees are personally liable for improper actions • In certain circumstances the trustees may be indemnified from the trust fund • Pure fiduciary duties • Standard – “ordinary prudent man (sic) of business”– higher for investments! • Loyalty to the trust deed and purposes • Duty to adhere to the terms of the trust • Duty to keep and render accounts • Duty to act personally • Undivided loyalty – No conflict of interest and duty – No unauthorised benefit – No conflict of duty and duty • Investment duties Risk Management • Risk Management is the term applied to a logical and systematic method to minimise losses and maximise opportunities. • COMMON SENSE • AS 4360 Aust Standard Compliance Programs • Primary aim is to fully comply with the law and eliminate all risk of breaching the law. • Identify the specific penalties • Determine how breaches could occur • Design a program to eliminate breaches • Ensure that the program is working and revised • AS 3806 Australian Standard RM • Reduces and manages risk • control with an eye on costs • set your own standards vs Compliance • Eliminates and prevents • Can’t decline on the grounds of cost • Standards set by Law and Courts Director’s and Officer’s Insurance • Part of a risk management strategy • Usual for a $5m cap • For the company in indemnification of its officers, officers directly and legal expense insurance • Often officers pay some portion personally • Who is covered? What is covered? • Claims made policy • Run off cover -50% of cost • Exclusions – – – – – – Professional capacity Personal injury Claims by the organisation Fraud & dishonesty Fines Environment Disclosure • Full disclosure of all relevant facts and circumstances must be made • One mistake may void the whole policy for all concerned • Be very careful • • • • You should fully understand the nature and extent of the cover provided by the policy of insurance. Be aware of the obligations imposed upon them by the policy and take steps to ensure that they comply with those obligations. Seek appropriate advice from the organisation's lawyers and insurance brokers and ensure that those providing the advice have a sufficient understanding of the issues involved. Implement procedures to ensure that full disclosure is made to the insurer prior to taking out or renewing D&O insurance. • • • Implement procedures for identification of claims and potential claims and notification of claims and potential claims prior to expiry of the policy. As the protection provided by the policy is personal to the officer, they should take independent advice if they are uncertain about the nature and extent of cover provided or if they are not satisfied with arrangements made by their organisation. Importantly, be aware that if the organisation decides not to renew the insurance, the officer will not be covered in respect of claims subsequently made. • Dr Myles McGregor-Lowndes • Centre of Philanthropy and Nonprofit Studies – – – – Phone (07) 38642936 FAX (07) 38641812 E-mail m.mcgregor@qut.edu.au http://cpns.bus.qut.edu.au