acc6ch05 - ucsc.edu) and Media Services

advertisement

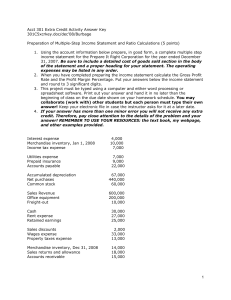

Merchandising Operations and the Accounting Cycle Chapter 5 Income Statements Service Co. Income Statement Year ended June 30, 20xx Service revenue $xxx Expenses: Salary expense x Depreciation expense x Income tax expense x Net income $ xx Merchandising Co. Income Statement Year ended June 30, 20xx Sales revenue $xxx Cost of goods sold x Gross profit xx Operating expenses: Salary expense x Depreciation expense x Net income $ xx Objective 1 Account for the purchase of inventory. Purchase of Inventory Merchant prepares purchase order Compares Suppliers send merchandise and a bill Purchase of Inventory Example On May 1, the Sporting Store acquired on account $2,000 of various items for resale. The supplier sent the merchandise along with a bill stating the quantity, price, and terms of sale. What is the journal entry? Purchase of Inventory Example May 1 Inventory $2,000 Accounts Payable $2,000 Purchased inventory on account Inventory Accounts Payable 2,000 2,000 Recording Purchase Returns and Allowances Example Assume that on May 4 a $100 item was returned prior to payment of the invoice. What is the journal entry? May 4 Accounts Payable 100 Inventory 100 Merchandise was returned Recording Purchase Returns and Allowances Example Assume that one of the items of merchandise is slightly damaged, and the store was given a $10 allowance. What is the journal entry? May 4 Accounts Payable 10 Inventory 10 Received a purchase allowance Recording Purchase Returns and Allowances Example Inventory 2,000 100 10 Bal. 1,890 Accounts Payable 100 2,000 10 Bal. 1,890 Purchase Discounts Credit terms are stated in expressions such as: 2/10, N/30, meaning that a discount of 2% is allowed if the invoice is paid within 10 days; otherwise the full (net) amount is due within 30 days. Purchase Discounts Example Assume the Sporting Store purchased merchandise for $1,000 with terms of 2/10, N/30. The store paid within the discount period. The 2% discount ($20) is deducted from the amount due ($1,000) and $980 is remitted. Purchase Discounts Example What is the journal entry? Accounts Payable 1,000 Cash 980 Inventory 20 To record payment of invoice within the discount period Recording Transportation Costs Transportation costs are the cost of moving inventory from seller to buyer. FOB stands for Free on Board and governs the passing of title of the goods. Selling/buying agreements usually specify FOB terms. Recording Transportation Costs FOB Shipping Point FOB Destination Freight Charges Example Assume that on May 9 the Sporting Store paid $60 for freight. What is the journal entry? May 9 Inventory 60 Cash Paid a freight bill 60 Objective 2 Account for the sale of inventory Sale of inventory The amount a business earns from selling merchandise is called sales revenue Inventory that has been sold to customers is called cost of goods sold Sporting Store Example Assume that on May 11 the store sold merchandise costing $1,800 for $2,600 in cash. What are the journal entries? Sporting Store Example May 11 Cash 2,600 Sales Revenue 2,600 To record sale of merchandise May 11 Cost of Goods Sold 1,800 Inventory 1,800 To record the cost of merchandise sold Sporting Store Example On May 15, the store sold to Maria Gym $5,000 worth of merchandise with a cost of $3,000. Terms are 2/10, N/30. Maria Gym Total Invoice Terms 2/10, N/30 $5,000 Sales Discounts and Sales Returns and Allowances Example On May 17, Maria Gym returned $1,500 worth of goods that cost $900. In addition, a credit of $100 was allowed for merchandise that was damaged. What are the journal entries? Sales Discounts and Sales Returns and Allowances Example May 17 Sales Returns and Allowance 1,500 Accounts Receivable 1,500 Received returned merchandise May 17 Inventory Cost of Goods Sold Returned goods to inventory 900 900 Sales Discounts and Sales Returns and Allowances Example May 17 Sales Returns and Allowance 100 Accounts Receivable 100 Credit granted for damaged goods There is no entry required for inventory since the goods were not returned. Sales Discounts and Sales Returns and Allowances Example On May 20, the store received a check from Maria Gym for the balance due. What is the balance due? Accounts Receivable May 15 = $5,000 Less May 17 returns and allowances $1,600 Equals May 20 balance due of $3,400 Sales Discounts and Sales Returns and Allowances Example Maria took advantage of the sales terms – 2/10, N/30. May 20 Cash 3,332 Sales Discounts 68 Accounts Receivable 3,400 Cash collected within the discount period Objective 3 Use sales and gross profit to evaluate a company. Sales Revenue Net sales = Sales Revenue less Sales Returns and Sales Discounts Gross Profit or Gross Margin Target Corporation Income Statement (Adapted) Year Ended December 31, 2000 Net sales revenue (same as Net sales) Cost of goods sold (same as Cost of sales) Gross profit (same as Gross margin) Expenses: Selling, general, administrative 7,490 Depreciation expense 854 Interest expense 393 Other expenses, net 302 Total operating expenses Net earnings (same as Net income) Millions $33,212 23,029 10,183 9,039 $ 1,144 Operating Cycle of a Merchandising Business Purchase and Cash Sale Purchase and Sale on Account Cash Cash Accounts Receivable Inventory Inventory Inventory Systems Perpetual Periodic Objective 4 Adjust and close the accounts of a merchandising business. Adjustments to Inventory Example Book Inventory Balance $255,000 Physical Count $252,500 $2,500 difference Adjustments to Inventory Example What is the journal entry? December 31 Cost of Goods Sold 2,500 Inventory 2,500 To adjust inventory to physical count Closing Entries for a Merchandising Business Revenues Income Summary 2,760,000 7,348 C.G.S. 1,490,400 1,884,348 2,767,348 883,000 Sales Discount 22,824 Returns and A. Capital Account 32,605 Other Exp. 338,519 883,000 Objective 5 Prepare a merchandiser’s financial statements. Income Statement Formats There are two basic formats for the income statement: 1 Multi-step 2 Single-step Multi-Step Format Sporting Store Income Statement Year Ended December 31, 2002 Sales revenue $2,760,000 Sales discounts – 22,824 Returns and allowances – 32,605 Net sales revenue $2,704,571 Cost of goods sold –1,490,400 Gross margin $1,214,171 Multi-Step Format Gross margin Operating expenses: Wage expense Rent expense Insurance expense Depreciation expense Supplies expense $1,214,171 Operating income $ 876,652 – 166,285 – 137,000 – 16,302 – 9,781 – 8,151 Multi-Step Format Operating income Other revenue and expenses: Interest revenue Interest expense $876,652 Net income $883,000 7,348 – 1,000 Single-Step Format Sporting Store Income Statement Year Ended December 31, 2005 Revenues: Net sales (net of sales discounts) $2,704,571 Interest revenue 7,348 Total revenues $2,711,919 Single-Step Format Expenses: Cost of goods sold Wage expense Rent expense Interest expense Insurance expense Depreciation expense Supplies expense Total expenses Net income $1,490,400 166,285 137,000 1,000 16,302 9,781 8,151 $1,828,919 $ 883,000 Objective 6 Use the gross margin percentage and the inventory turnover ratio to evaluate a business. Using the Financial Statements for Decision Making Gross profit percentage = Gross profit ÷ Net sales revenue Inventory turnover = Cost of goods sold ÷ Average inventory Gross Profit on $1 for Three Merchandisers $1.00 — $0.75 — $0.50 — $0.25 — Gross margin $0.45 Cost of goods sold $0.55 Gross margin $0.42 Gross margin $0.21 Cost of goods sold $0.58 Cost of goods sold $0.79 $0.00 Austin Sound Target Wal-Mart Corporation Stores, Inc. Rate of Inventory Turnover for Three Merchandisers 7.0 times per year Wal-Mart Stores, Inc. 1 2 3 4 5 6 7 Target Corporation 1 2 3 5.4 times per year 4 5 Austin Sound 2.3 times per year 1 Jan Mar 2 Jun Sep Dec End of Chapter 5