Warm-up - Mr. Le Peau

advertisement

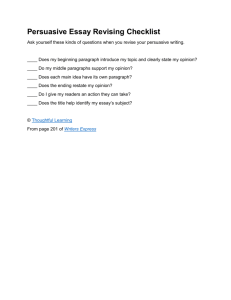

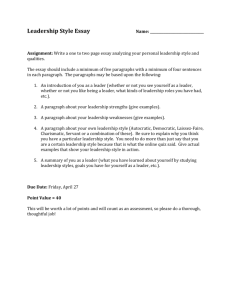

Evaluate ways that debt can negatively affect your financial future and how to overcome personal debt. Timeline Warm Up: 5 min. Video 2.6: 15 min. Rent to Own Activity: 30 min. o Partners o Computers The Colbert Report: 5 min. Warm-up: Fact: There are roughly 1.2 billion credit cards in use in the United States. What does this tell you about our countries spending habits? Explain the elements of a credit score and credit report. Timeline Warm Up: 5 min. Video 3.1: 10 min. Debunking the Credit Myth Activity: 30 min. o Computers Broke: 10 min. Warm-up: Fact: Studies show the average consumer is exposed to more than 3,000 marketing messages every day. In the last decade, it's been estimated, solicitations jumped from 1.52 billion annually to 4.29 billion. Do you think marketing and advertising has any effect on you? Explain. Pick one of the myths presented in the Debt chapter. Write a persuasive essay to someone who believes that particular myth to be true. Remember that a persuasive essay attempts to convince someone that your point of view is valid. In your essay, be sure to discuss both sides of the position so you can effectively counter the opposing view. Use one other source of information besides your student text to support your argument. You can search for information at daveramsey.com or use a search engine and type a summary of your myth in the search box (for example, “lottery tax on poor”). Your persuasive essay will include the following five paragraphs: Introductory paragraph: Provide a clear statement of your position in the topic sentence. Give two clear arguments that support this position. Two supporting paragraphs: Each argument stated above should be covered in a separate paragraph. Support each paragraph with specific examples, facts and reasoning. One paragraph stating the opposite viewpoint: Use an opposing statement and then refute it. For example, you might say, “One could argue that (state opposite viewpoint), but I believe that (state your viewpoint).” Closing paragraph: Restate the position. Reaffirm the most compelling argument. Do not introduce new arguments in the conclusion. Identify organizations that maintain consumer credit records. Summarize major consumer credit laws. Timeline Warm Up: 5 min. Video 4.1: 15 min. Debt Snowball Activity: 25 min. Warm-up: o Small Groups Take away? Broke: 10 min. Fact: The average interest rate on credit cards is 18.9 percent. Fact: A typical American family today pays about $1,200 annually in credit card interest. Fact: In 2003 the credit card industry took in $43 billion in card fees. How much money would you have if you invested $1,200 a year at 18.9 percent interest for 10, 20 and 30 years? Answer: o 10 years = $50,566.54 o 20 years = $372,563.89 o 30 years = $1,472,819.25 Review credit myths. Timeline Warm Up: 5 min. Review Key Terms: 10 min. Money in Review: 20 min. Broke: 20 min. Home Work: Study for Test Warm-up: Fact: A typical credit card purchase ends up costing 112 percent more than if cash were used. Fact: About 60 percent of active credit card accounts are not paid off monthly. Fact: Average credit card debt among all American households is $8,400. If everyone knew these facts, why would anyone have a credit card? Assess student learning through a test. Timeline Warm Up: 5 min. Chapter 4 Test: 30 min. Four Corner Cool Down for Debt Lesson: 5 min. Broke: 15 min. Warm-up: Fact: The personal savings rate in the United States has dropped from 8 percent in the 1980s to just under 2 percent since 2000. Why do you think the above is true?