View/Open - San Diego State University

advertisement

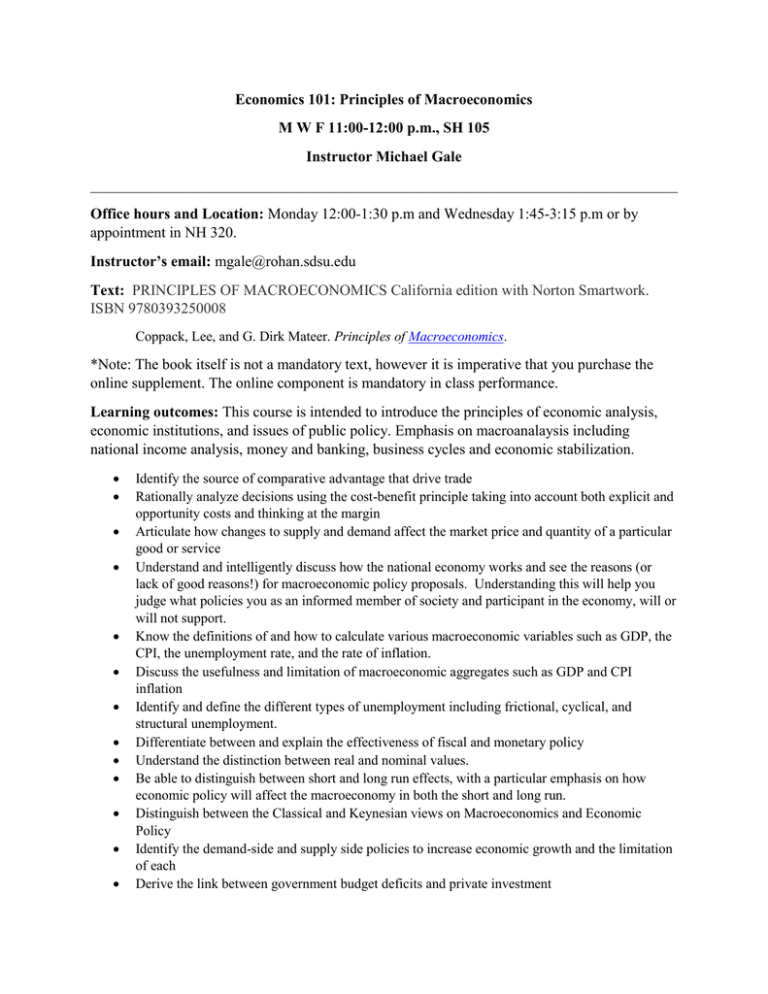

Economics 101: Principles of Macroeconomics M W F 11:00-12:00 p.m., SH 105 Instructor Michael Gale ______________________________________________________________________________ Office hours and Location: Monday 12:00-1:30 p.m and Wednesday 1:45-3:15 p.m or by appointment in NH 320. Instructor’s email: mgale@rohan.sdsu.edu Text: PRINCIPLES OF MACROECONOMICS California edition with Norton Smartwork. ISBN 9780393250008 Coppack, Lee, and G. Dirk Mateer. Principles of Macroeconomics. *Note: The book itself is not a mandatory text, however it is imperative that you purchase the online supplement. The online component is mandatory in class performance. Learning outcomes: This course is intended to introduce the principles of economic analysis, economic institutions, and issues of public policy. Emphasis on macroanalaysis including national income analysis, money and banking, business cycles and economic stabilization. Identify the source of comparative advantage that drive trade Rationally analyze decisions using the cost-benefit principle taking into account both explicit and opportunity costs and thinking at the margin Articulate how changes to supply and demand affect the market price and quantity of a particular good or service Understand and intelligently discuss how the national economy works and see the reasons (or lack of good reasons!) for macroeconomic policy proposals. Understanding this will help you judge what policies you as an informed member of society and participant in the economy, will or will not support. Know the definitions of and how to calculate various macroeconomic variables such as GDP, the CPI, the unemployment rate, and the rate of inflation. Discuss the usefulness and limitation of macroeconomic aggregates such as GDP and CPI inflation Identify and define the different types of unemployment including frictional, cyclical, and structural unemployment. Differentiate between and explain the effectiveness of fiscal and monetary policy Understand the distinction between real and nominal values. Be able to distinguish between short and long run effects, with a particular emphasis on how economic policy will affect the macroeconomy in both the short and long run. Distinguish between the Classical and Keynesian views on Macroeconomics and Economic Policy Identify the demand-side and supply side policies to increase economic growth and the limitation of each Derive the link between government budget deficits and private investment Discuss the importance of a Central Bank and the banking system in general to the monetary system Reconstruct the series of events that led to the current financial crisis Assess the effectiveness of the various fiscal and monetary policies implemented to alleviate the global economic recession. Debate the arguments for and against a national sales tax, privatizing social security, and national health care. Identify the causes and effects of trade deficits. Discuss the merits and costs of foreign investment. Compute exchange rates and interpret the impact of appreciations and depreciations on different sectors of the economy. Attendance: Attendance will not be taken for this course, as it is not mandatory. However, bear in mind that class lectures and discussions will prove to be useful resources in the preparation for your exams. Blackboard: This course has a dedicated blackboard site which you should have access to. To obtain access to blackboard, go to http://blackboard.sdsu.edu and login by entering your red id and password (the same one you use for WebPortal). Please let me know if you do not have access to the site as soon as possible. Exams: There will be three midterms and one final during the semester. The dates of the exams are noted in the table below. They will all be held in the classroom and it is imperative that you arrive on time, as you only have the scheduled class period for the test. The midterms are NOT cumulative. No makeup exams will be offered. If you do miss one of the midterms, then the final becomes mandatory and the weight of the missed exam will be added to the final. If a student takes all three midterms and does not take the final, then each midterm will be worth 25% of the student's grade, with homework counting for the remaining 25%. If a student takes all three midterms and does take the final, then the three midterms and the final will each be worth 20% of the student's grade, with homework counting as the remaining 20%. Finally, if a student misses a midterm, then final will count for 40% of the grade, the two midterms the student did complete will be 20%, and homework will fill out the remaining 20% Exams Exam Exam #1 Exam #2 Exam #3 Final Exam Chapters Covered ** Subject to Change ** 1-5 6-10 11, 12, 13, 18, 20 1-13, 18, 20 Date of Examination September 26th October 31st December 10th December 15th 10:30-12:30 In the same classroom PLEASE NOTE: THERE ARE NO MAKE-UP EXAMS. TAKE THE TESTS ON THE DAY THAT THEY ARE GIVEN. THERE ARE NO DROPPED EXAMS. THERE ARE NO EXCEPTIONS TO THESE OR ANY OTHER RULES LISTED IN THE SYLLABUS. Homework: We will be utilizing the online homework program, Norton Smartwork. Each assignment will be posted at least a week in advance of the due date and will correspond to the material discussed in class. You will have the opportunity to attempt each assignment twice before your grade is recorded. The homework on Norton Smartwork is intended to be a fair way for you to improve your grade while keeping up with the course material. Economics is very much a cumulative discipline and if you fall behind, you'll have a difficult time catching up. Completing the Connect homework on time is a good way to make sure you don't fall behind. Grading Grades will be based on the following allocation: Homework Assignments Exam #1 Exam #2 Exam #3 Final Exam 20% 20% 20% 20% 20% Due by Sunday by Midnight September 26, 2014 October 31, 2014 December 10, 2014 December 15, 2014 Academic Integrity: Academic integrity is one of the fundamental principles of a university community. San Diego State University expects the highest standards of academic honesty from all students. Violations of academic integrity include the following: (1) unauthorized assistance on an examination, (2) falsification or invention of data, (3) unauthorized collaboration on an academic exercise, (4) plagiarism, (5) misappropriation of research materials, (6) unauthorized access of an instructor’s files or computer account, and (7) any other serious violation of academic integrity as established by the instructor. If your academic integrity is not maintained on a test or assignment, you will automatically receive an F in the class and you will be reported to the Academic Affairs Office, in accordance with SDSU academic integrity policy. Penalties can be severe. More specific information is available in the SDSU Bulletin, both in print and online at http://studentaffairs.sdsu.edu/SRR/academics1.html Students with Disabilities: If you are a student with a disability and believe you will need accommodations for this class, it is your responsibility to contact Student Disability Services at (619) 594-6473 or http://go.sdsu.edu/student_affairs/sds/Default.aspx . To avoid any delay in the receipt of your accommodations, you should contact Student Disability Services as soon as possible. Please note that accommodations are not retroactive, and that I cannot provide accommodations based upon disability until I have received an accommodation letter from Student Disability Services. Your cooperation is appreciated. Course Schedule *This schedule is tentative and may be modified at the instructor’s discretion. Dates Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 Week 9 Week 10 Week 11 Week 12 Week 13 Week 14 Week 15 Topic The Five Foundations of Economics Model Building and Gains from Trade The Markets at work: Supply and Demand Price Controls The Efficiency of Markets and the Cost of Taxation Introduction to Macroeconomics and Gross Domestic Product Unemployment The Price Level and Inflation Saving, Interest Rates, and Market for Loanable Funds Financial Markets and Securities Economic Growth and the Wealth of Nations Growth Theory Aggregate Demand-Aggregate Supply Model Monetary Policy International Finance Reading Chapter 1 Chapter 2 Chapter 3 Chapter 4 Chapter 5 Chapter 6 Chapter 7 Chapter 8 Chapter 9 Chapter 10 Chapter 11 Chapter 12 Chapter 13 Chapter 18 Chapter 20