some notes - Notes in the cloud

Notes related to the SEMICO example

Model variables:

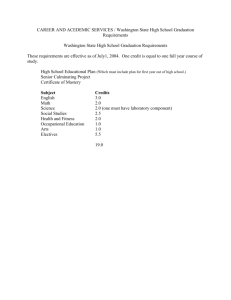

Average revenue growth in the rapid growth phase: to calculate this value we can use industry statistics to know that in the semiconductor industry the average revenue growth is

-1.3%. We can use the graph average revenue/years after IPO. We focus on the 75 th percentile. We observe that the revenue after 7 years is 114.9% the revenue at the exit, or annualized growth of 26.5%. From the industry statistics we know that the semiconductor industry is growing at an average of -1.3%, we can then assume that the 75 th percentile for rapid growth is 26.5%-1.3%=25.2%

Revenue at T is provided by the business plan: 100

Operating margin at T is provided by the business plan: 10%

Tax rate at T is provided by the business plan: 40%

Discount rate is provided by the industry statistics: 16.2%

We assume depreciation to be 10%

Assets at T is provided by the business plan: 100

We can now start to build the CF model:

Revenue: the initial revenue will be 100, and after 7 years we will have: Initial

Revenue*(1+av. Rapid growth)^(T-S)=100*(1+25.2%)^C5=482.2. We will assume that the revenue growth will develop in equal increments of 482.2-100/7=54.6

Operating margin: we will check the operating margin from the industry statistics, 24.65%, and calculate the increments: 24.65%-10%/7

Assets: we know that the starting operating assets are 100, we can calculate that in year 7 the E=71.3, and considering that, R(old)=24.65%, we can calculate the final operating assets=71.3/24.65%=285.8. We can now calculate the NI that we need to have to reach the value of operating assets 285.8 in year 7: 285.8-100/7=26.5

We can now build the CF for years 0 to 7. To build the CF for year 8 we need to make some different assumption:

Revenue: the growth will be the stable growth comparable with inflation 3%

Assets: the NI is now calculated from NI=E*g/R(new)=13.6

Following some notes that will help to understand the framework:

Assumptions related to the company financials: 1) All-equity structure, 2) No amortization costs (often this costs is related to the acquisition of assets from other companies), 3) No non-operating assets (e.g.: excess cash, marketable securities)

Cash Flow calculation: CF = EBIT(1-t) + depreciation – Capital expenditures – Δ NWC, where,

CF = cash flow, EBIT = earnings before interest and taxes, t = corporate tax rate, and Δ NWC

= Δ net working capital = Δ net current assets – Δ net current liabilities. We can define Net

Investments (NI), NI= capital expenditures + Δ NWC – depreciation. We can express NI as a function of earnings (E), via the investment rate (IR) = Plowback ratio = reinvestment rate =

NI / E. We can now rewrite CF = E – NI = E – IR * E = (1 – IR) * E, having assumed that the

EBIT(1-t)=E because the I=0 in the case of no debt

Net Present Value of the Cash Flows: to calculate the value of the company we need to sum the actualized CF of the company in the different stages of its evolutions. NPV of firm at exit= CF

T+1

/1+r + … + CF

T+n

/(1+r) n + … + CF s

+ GV /(1+r) S-T . Some definitions: T, is the exit year,

S, is the graduation year or the year after which we assume a stable growth, GV, is the graduation value, this is calculated as a perpetuity, assuming that CF are growing at a rate g from year S+1, GV= CF s+1

/r-g . An important consideration regards the relation between assumptions and the value that we use for g. When we give a value to g, we are assuming that the company CF are growing indefinitely at g rate, to sustain this growth the company will need to reinvest, but using perpetuity means that we are assuming that the reinvestment is constants. For this reason we need to do some more analysis on GV and g

GV: we can define return of capital as, R = E

N+1

- E

N

/ NI

N

. We can also assume that CF growth and earnings growth is the same value, g, so we have: g = E

N+1

- E

N

/ E

N

= R * NI

N

/ E

N

, being NI

N

= IR * E

N

, g= R * IR. We can now calculate GV = ( 1 – g/R) * E / (r – g). This formula remind us that if g is increasing, CF decreases, because the need of new investments in capital. For this reason in the model there is a distinction between capital in place at the time of graduation

(old capital) and capital created by new investments after graduation (new capital). The returns on old capital are R(old), and the returns on new capital are R(new)

On the exit date: 1) Revenue is forecast for the average success case, 2) Other accounting ratios are estimated using comparable companies, 3) the discount rate is estimated from industry average or comparable

On graduation date: 1) the growth rate is the expected inflation, 2) the return on new capital is the cost of capital, 3) the return on old capital is the industry average, 4) operating margin is the industry average, 5)the cost of capital is the industry average

During the rapid growth period: 1) length is 5-7 years, 2) average revenue growth is set to be

75 th percentile of growth for new IPO firms in the same industry, 3) margins, tax rates and cost of capital all change in equal increments across years so that exit values reach graduation values in the graduation year

With this background we are prepared to sketch a DCF model that can be used as starting point for exit valuation.