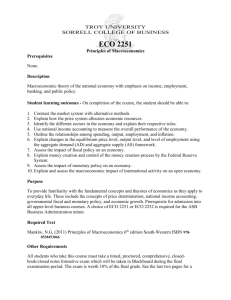

The Economic Approach

advertisement