ppt file - Aykut Kibritçioğlu

advertisement

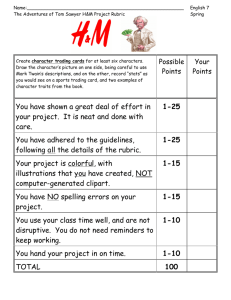

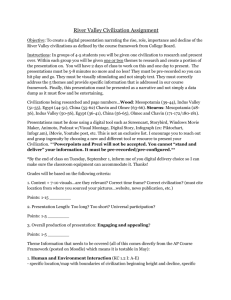

An Overview of Macroeconomic Developments in Turkey with special reference to the AK-Party Era (2002-04) Aykut Kibritçioğlu Associate Professor of Economics Ankara University, Turkey Tel.: (+90-312) 319 77 20, ext. 340 Fax: (+90-312) 319 77 36 E-Mail: kibritci@politics.ankara.edu.tr Homepage: http://dialup.ankara.edu.tr/~kibritci/wiiw.html Vienna, 1-15 November 2004 Kibritçioğlu, November 1-15, 2004, (1/79) Outline of the Presentation General Facts and Figures, 1970-2004 Political Climate, 1969-2004 Market for Goods: Inflation & Disinflation Market for Goods: Production & Productivity Labor Market: Employment & Real Wages Foreign Exchange Market: Exchange Rates, and Currency Substitution Balance of Payments and External Debts Public Sector: Deficits and Debts Financial Sector Statistical Sources Appendix: Selected Macroeconomic Indicators for Turkey (1970-2003) Kibritçioğlu, November 1-15, 2004, (2/79) General Facts and Figures, 1970-2004 Kibritçioğlu, November 1-15, 2004, (3/79) The 1980-1989 Transformation 1978 - 1980: Balance-of-payments crisis, productivity slowdown and accelerating inflation January 1980: Announcement of a substantial stabilization and structural adjustment program in order to gradually liberalize the economy 1980 - 1982: Domestic financial liberalization May 1981: Abandonment of the fixed exchange-rate regime June 1984 - August 1989: Capital account liberalization and convertibility of the Turkish lira Kibritçioğlu, November 1-15, 2004, (4/79) Post-1989 Macroeconomic Developments December 1993 - April 1994: A major currency crisis and acceleration in the inflation August 1999: Negative macroeconomic impacts of the Marmara earthquake December 1999: Announcement of an exchangerate-based stabilization program for 2000-2002 November 2000 & February 2001: Two successive banking and currency crises and political instability in Turkey May 2001: Announcement of the new economic program Kibritçioğlu, November 1-15, 2004, (5/79) Selected Macroeconomic Indicators [1] annual period averages Change in Consumer Real GDP Nominal Price TL/US$ Growth Inflation Exchange (%) (%) Rate (%) Foreign JP Morgan's Absolute Change Change in Exchange in Central Bank's Real Average Deposits to Gross Foreign Effective Crude Oil Money Exchange Exchange Import Supply M2 Reserves (millions Rate Price (%) (%) of USD) (1990=100) 1970-1979 23.3 4.7 14.0 151.4 53 30.5 0.0 1980 110.2 - 2.4 144.3 87.7 419 110.5 0.0 1981-1988 42.4 5.4 44.9 113.4 154 - 8.3 12.8 1989-1993 65.1 4.9 51.4 105.6 781 2.8 46.0 1994 106.3 - 5.5 169.9 137.1 899 - 2.1 94.9 1995-1999 80.7 4.0 70.2 129.9 3 213 5.3 90.5 2000-2001 54.7 - 0.1 72.5 121.4 - 2 195 21.5 103.6 2002-2003 35.1 6.9 11.0 113.1 7 414 8.8 103.5 1970-2003 49.9 4.1 46.7 126.2 985 13.2 38.1 Source: State Institute of Statistics (SIS), Central Bank of Republic of Turkey (CBRT), State Planning Organization (SPO), the IMF and J.P.Morgan; Kibritçioğlu’s calculations. Kibritçioğlu, November 1-15, 2004, (6/79) Selected Macroeconomic Indicators [2] annual period averages Istanbul Change in Capacity Stock Public Sector Official Nominal Utilization in Exchange's Borrowing UnemployMoney the Manufac- Composite Requirement ment Rate Supply M2 turing Industry 100 Index in to GDP (%) (%) (%) (%) USD (1986=1.0) 1970-1979 31.4 6.1 1980 74.5 8.9 1981-1988 53.3 1989-1993 Actual Current Short-Term Foreign Account Capital Direct Balance Inflow Investment (millions (millions of Inflow of USD) USD) (millions of USD) 56.9 - 986 97 8.3 55.2 - 3 408 - 2 35 4.5 7.9 67.8 2.4 - 992 53 125 59.9 9.2 8.1 75.6 5.2 - 1 769 757 727 1994 123.2 7.9 8.1 72.9 4.2 2 631 - 5 190 608 1995-1999 104.7 9.4 6.8 77.0 6.7 - 1 355 1 726 827 2000-2001 45.2 14.4 7.5 73.4 9.2 - 3 215 - 3 561 2 124 2002-2003 32.3 10.6 10.5 76.9 4.6 - 4 165 1 495 440 1970-2003 56.4 7.8 7.9 71.6 5.5 - 1 440 138 606 Source: State Institute of Statistics (SIS), Central Bank of Republic of Turkey (CBRT), State Planning Organization (SPO), the IMF and J.P.Morgan; Kibritçioğlu’s calculations. Kibritçioğlu, November 1-15, 2004, (7/79) Political Climate, 1969-2004 Kibritçioğlu, November 1-15, 2004, (8/79) Governments & Political Instability in Turkey, 1969-2004 The Frequency of General Elections and Government Changes in Turkey (Jan. 1969 - Dec. 2004) 75 70 65 60 55 Government Changes (28 times) ICRG's Political Risk Index for Turkey 2003.01 2004.01 2002.01 2000.01 2001.01 1999.01 1997.01 1998.01 1995.01 1996.01 1994.01 1992.01 1993.01 1990.01 1991.01 1989.01 1987.01 1988.01 1985.01 1986.01 1984.01 1982.01 1983.01 1981.01 1979.01 1980.01 1977.01 1978.01 1976.01 1974.01 1975.01 1972.01 1973.01 1971.01 1969.01 1970.01 50 45 40 35 General Elections (9 times) 1969-2004 = 36 years = 432 months Average period between two general elections = 48 months = 4 years Average life of governments = 15.4 months = 1.3 years (ICRG=International Country Risk Guide; a declining PR index indicates an increase in the political risk.) Kibritçioğlu, November 1-15, 2004, (9/79) Selected Events Marked as Black Columns in the Following Figures are: January 1999: 4. Ecevit-Government starts... May 1999: 5. Ecevit-Government starts... January 2000: 2000-2003 Program introduced... November 2000 and February 2001: Financial crisis occurred... November 2002: General elections & AK-Party-Government starts... Kibritçioğlu, November 1-15, 2004, (10/79) Market for Goods: Inflation & Disinflation Kibritçioğlu, November 1-15, 2004, (11/79) Global Inflation & Disinflation and Turkey 100000.0 Annual Consumer Price Inflation (%, log scale) Maximum Inflation Rate (worldwide) 10000.0 Turkey 1000.0 Developing Countries 100.0 World Average 10.0 United States 1.0 Austria 2003 2001 1999 1997 1995 1993 1991 1989 1987 1985 1983 1981 1979 1977 1975 1973 1971 1969 1967 1965 1963 1961 1959 1957 1955 1953 1951 1949 0.1 In the late 1990s, Turkey was not able to join the global disinflation process observed explicitly... Kibritçioğlu, November 1-15, 2004, (12/79) Relative Inflation Rates: Turkey's CPI Inflation vs. Foreign CPI Inflation 65 60 55 50 Turkey / Industrial Countries 45 40 Turkey / World Average 35 30 Turkey / Middle East 25 20 15 Turkey / Developing Countries 10 5 2003 2001 1999 1997 1995 1993 1991 1989 1987 1985 1983 1981 1979 1977 1975 1973 1971 1969 0 In terms of the length of the period, Turkish high-inflation experience is “unique” in the world... Kibritçioğlu, November 1-15, 2004, (13/79) Annual & Monthly Consumer Price Inflation (%, Feb.1969-Sep.2004) 145 135 125 annual 115 105 95 85 75 65 55 45 35 25 15 monthly 5 1969.01 1970.01 1971.01 1972.01 1973.01 1974.01 1975.01 1976.01 1977.01 1978.01 1979.01 1980.01 1981.01 1982.01 1983.01 1984.01 1985.01 1986.01 1987.01 1988.01 1989.01 1990.01 1991.01 1992.01 1993.01 1994.01 1995.01 1996.01 1997.01 1998.01 1999.01 2000.01 2001.01 2002.01 2003.01 2004.01 -5 Turkey suffered from high and persistent inflation since more than three decades. But, finally, it’s declining now... Kibritçioğlu, November 1-15, 2004, (14/79) Annual Changes in Wholesale and Consumer Price Indices (SIS, percent) 90 80 70 60 50 40 30 20 11.9 10 WPI 2004.07 2004.04 2004.01 2003.10 2003.07 2003.04 2003.01 2002.10 2002.07 2002.04 2002.01 2001.10 2001.07 2001.04 2001.01 2000.10 2000.07 2000.04 2000.01 1999.10 1999.07 1999.04 1999.01 1998.10 1998.07 1998.04 1998.01 Selected Events 2004.10 7.5 0 CPI Annual inflation rates fell below 15 percent as end of September 2004. (Official target for Dec. 2004: 12 percent) Inflationary expectations in the country are also changing in a positive direction. Kibritçioğlu, November 1-15, 2004, (15/79) Market for Goods: Production & Productivity Kibritçioğlu, November 1-15, 2004, (16/79) Indicators of Long-Run Growth in Turkey 30 8000 7414 Growth in Real GDP ($) Per Capita, % 25 Population Growth, % 7000 Real GDP (TL) Growth, % 20 Real GDP ($) per Capita [right axis] 6000 15 5000 10 4000 5 2.9 1.5 3000 0 2000 -5 1000 -10 340 PWT6.1 0 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 -15 Turkey’s economic growth performance was highly volatile. Real GDP per capita rose 22 times between 1950 and 2000. Kibritçioğlu, November 1-15, 2004, (17/79) Industrial Production Index (1980=100) 750 700 650 South Korea 600 Turkey 550 Israel 500 USA 450 Cyprus 400 Hungary 350 Japan 300 UK 250 Industrial Countries 200 Germany 150 Greece 100 Romania 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 50 Turkish industrial sector demonstrated a remarkable growth performance since 1980. Kibritçioğlu, November 1-15, 2004, (18/79) GDP per capita ($): Turkey & Selected Countries 31000 USA Japan 26000 Germany UK 21000 Israel Cyprus 16000 South Korea Greece 11000 Hungary Turkey Romania 6000 PWT6.1 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 1972 1970 1968 1966 1964 1962 1960 1958 1956 1954 1952 1950 1000 In an international context, however, Turkey’s economic growth performance is relatively poor. Kibritçioğlu, November 1-15, 2004, (19/79) Annual Real GDP Growth (SIS, percent) 15 12 9 6 3 0 -3 -6 -9 -12 2004Q4 2004Q3 2004Q2 2004Q1 2003Q4 2003Q3 2003Q2 2003Q1 2002Q4 2002Q3 2002Q2 2002Q1 2001Q4 2001Q3 2001Q2 2001Q1 2000Q4 2000Q3 2000Q2 2000Q1 1999Q4 1999Q3 1999Q2 1999Q1 1998Q4 1998Q3 1998Q2 1998Q1 13.4 In recent years, growth rate of the real GDP has significantly fluctuated. The Turkish real sector is recovering from the 2000-2001 crisis, which is one of the four deepest economic crises after 1950. Kibritçioğlu, November 1-15, 2004, (20/79) Industrial Production Index (SIS, 1997=100) 130 125 120 115 110 105 100 95 90 85 80 2004.09 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 m ov.ave. During the AK-Party era, the industrial production index increased again up to the pre-crisis level. Kibritçioğlu, November 1-15, 2004, (21/79) Annual Increases in the Industrial Production Index (SIS, %) 30 25 20 15 10 5 0 -5 -10 -15 -20 2004.09 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 m ov.ave. Annual increases in the industrial production index sharply fluctuate around an average annual growth of 10 percent, during the AK-Party era. Kibritçioğlu, November 1-15, 2004, (22/79) Capacity Utilization Ratio in Manufacturing Industry (SIS, %) 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 2004.09 84.8 86 84 82 80 78 76 74 72 70 68 Capacity utilization ratio in manufacturing industry also increased up to the pre-crisis level in recent months. Kibritçioğlu, November 1-15, 2004, (23/79) Ratio of the Number of New Firms to the Number of Closed Firms (SIS, %) 30 25 20 15 10 mov.ave. 5 2004.09 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 0 The monthly ratio of the number of new firms established to the number of the closed ones was fluctuating around 16 within the last two years. Kibritçioğlu, November 1-15, 2004, (24/79) Partial Productivity per Worker in Manufacturing Industry (1997=100) 160 150 140 130 120 110 100 2004Q4 2004Q3 2004Q2 2004Q1 2003Q4 2003Q3 2003Q2 2003Q1 2002Q4 2002Q3 2002Q2 2002Q1 2001Q4 2001Q3 2001Q2 2001Q1 2000Q4 2000Q3 2000Q2 2000Q1 1999Q4 1999Q3 1999Q2 1999Q1 1998Q4 1998Q3 1998Q2 1998Q1 90 The manufactuing industry exhibits a remarkable increase in labor productivity. The reasons for that are still not investigated by economists sufficiently. Kibritçioğlu, November 1-15, 2004, (25/79) Labor Market: Employment & Real Wages Kibritçioğlu, November 1-15, 2004, (26/79) Employment Index for the Manufacturing Industry (1997=100) 105 100 95 90 mov.ave. 85 80 2004Q4 2004Q3 2004Q2 2004Q1 2003Q4 2003Q3 2003Q2 2003Q1 2002Q4 2002Q3 2002Q2 2002Q1 2001Q4 2001Q3 2001Q2 2001Q1 2000Q4 2000Q3 2000Q2 2000Q1 1999Q4 1999Q3 1999Q2 1999Q1 1998Q4 1998Q3 1998Q2 1998Q1 75 The increases in manufacturing production are not fully accommodated by increases in employment. Turkey has still to solve the unemployment problem that has been deepened after the 2000-2001 financial crisis. Kibritçioğlu, November 1-15, 2004, (27/79) Real-Wage per Hour-Worked in Manufacturing Industry (1997=100) 120 115 110 105 100 95 90 2004Q4 2004Q3 2004Q2 2004Q1 2003Q4 2003Q3 2003Q2 2003Q1 2002Q4 2002Q3 2002Q2 2002Q1 2001Q4 2001Q3 2001Q2 2001Q1 2000Q4 2000Q3 2000Q2 2000Q1 1999Q4 1999Q3 1999Q2 1999Q1 1998Q4 1998Q3 1998Q2 1998Q1 85 80 Real wages in manufacturing industry declined significantly following the 2000-2001 crisis. They shrinked about 18 percent during the crisis. Kibritçioğlu, November 1-15, 2004, (28/79) Foreign Exchange Market: Exchange Rates, and Currency Substitution Kibritçioğlu, November 1-15, 2004, (29/79) “Black-Market” Exchange Rates (BMER) vs. Official Exchange Rates (OER) and Annual Increases in OER (1950-2004) 9 BMER / OER (left axis) Annual Increases in OER (right axis) 245 8 210 7 175 6 04.01 02.01 00.01 98.01 96.01 94.01 92.01 90.01 88.01 86.01 84.01 82.01 80.01 78.01 76.01 74.01 72.01 -35 70.01 0 68.01 0 66.01 1 64.01 35 62.01 2 60.01 70 58.01 3 56.01 105 54.01 4 52.01 140 50.01 5 Since May 1981, Turkey has a relatively flexible exchange rate system. This gradually removed the “black-market” for FX in Turkey. In 2000, the monthly growth rates of nominal exchange rates were predetermined to gradually disinflate the economy. Kibritçioğlu, November 1-15, 2004, (30/79) Nominal Exchane Rates (TL/USD and TL/Euro) 2000000 1800000 1600000 1400000 1200000 1000000 800000 600000 400000 200000 Selected Events TL/USD Exchange Rate 2004.09 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 0 TL/Euro Exchange Rate During the last 27 months, nominal exchange rates seems to float around a specific level, without showing any tendency towards a sharp increase. Kibritçioğlu, November 1-15, 2004, (31/79) Annual Changes in Nominal Exchange Rates (percent) 150 135 120 105 90 75 60 45 30 9.9 15 0 5.4 -15 Selected Events TL/USD Exchange Rate 2004.10 2004.07 2004.04 2004.01 2003.10 2003.07 2003.04 2003.01 2002.10 2002.07 2002.04 2002.01 2001.10 2001.07 2001.04 2001.01 2000.10 2000.07 2000.04 2000.01 1999.10 1999.07 1999.04 1999.01 1998.10 1998.07 1998.04 1998.01 -30 TL/Euro Exchange Rate Note that annual growth rate of nominal USD exchange rates turned to negative values between May 2003 and April 2004. Kibritçioğlu, November 1-15, 2004, (32/79) Central Bank's Gross Foreign Exchange Reserves (billion USD) 36 33 33.7 30 27 24 October 2000 level 21 18 2004.10 2004.07 2004.04 2004.01 2003.10 2003.07 2003.04 2003.01 2002.10 2002.07 2002.04 2002.01 2001.10 2001.07 2001.04 2001.01 2000.10 2000.07 2000.04 2000.01 1999.10 1999.07 1999.04 1999.01 1998.10 1998.07 1998.04 1998.01 15 Following the 2000-2001 crisis, gross FX reserves of the Turkish Central Bank increased significantly. They are now about 38 percent higher than the level of reserves prior to the crisis. Kibritçioğlu, November 1-15, 2004, (33/79) Foreign Exchange Market Pressure and Banking Sector Fragility 8.0 6.0 4.0 2.0 0.0 -2.0 Selected Events Foreign Exchange Market Pressure Index 2004.10 2004.07 2004.04 2004.01 2003.10 2003.07 2003.04 2003.01 2002.10 2002.07 2002.04 2002.01 2001.10 2001.07 2001.04 2001.01 2000.10 2000.07 2000.04 2000.01 1999.10 1999.07 1999.04 1999.01 1998.10 1998.07 1998.04 1998.01 -4.0 Banking Sector Fragility Index The so-called foreign exchange market pressure index does not send any signs of an increase in pressure in the market, while it is observed that banking sector is acting more and more risky again. Kibritçioğlu, November 1-15, 2004, (34/79) CPI-Based Real Effective Exchange Rates (CBRT, 1995=100) increases: real depreciation decreases: real appreciation inverse of the CBRT's original index 2004.10 2004.07 2004.04 2004.01 2003.10 2003.07 2003.04 2003.01 2002.10 2002.07 2002.04 2002.01 2001.10 2001.07 2001.04 2001.01 2000.10 2000.07 2000.04 2000.01 1999.10 1999.07 1999.04 1999.01 1998.10 1998.07 1998.04 m ov.ave. 1998.01 105 100 95 90 85 80 75 70 65 60 The real appreciation of the Turkish lira against major foreign currencies following the 2000-2001 crisis seems to have stopped within the last 12 months. Kibritçioğlu, November 1-15, 2004, (35/79) Currency Substitution in Turkey (1985-2004) 1.40 1.20 1.00 0.80 0.60 0.40 0.20 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1985 1986 FX Deposits to M2 0.00 High inflation and low credibility of government policies in the 1990s created a strong currency substitution. But it’s changing now... Kibritçioğlu, November 1-15, 2004, (36/79) Two Indicators of Currency Substitution in Turkey (% ) 150 130 110 90 70 50 Selected Events Foreign Exchange Deposits / TL-denominated Deposits 2004.10 2004.07 2004.04 2004.01 2003.10 2003.07 2003.04 2003.01 2002.10 2002.07 2002.04 2002.01 2001.10 2001.07 2001.04 2001.01 2000.10 2000.07 2000.04 2000.01 1999.10 1999.07 1999.04 1999.01 1998.10 1998.07 1998.04 1998.01 30 (M2Y - M2) / M2 There is a tendency towards reverse currency substitution during the AK-Party era. Government’s success in disinflating the economy and its increasing credibility may significantly be contributing to this process. Kibritçioğlu, November 1-15, 2004, (37/79) Balance of Payments and External Debts Kibritçioğlu, November 1-15, 2004, (38/79) History of Taxation in Turkish International Trade in Goods (1925-2002) 90 80 60 50 40 30 20 Uruguay (1986-1993) GATT (1947) 70 Customs Union with the EU (1996) 100 Tokyo (1979) Kennedy (1967) 110 10 0 2000 1995 1990 1985 1980 1975 1970 1965 1960 1955 1950 1945 1940 1935 1930 1925 Custom Duties / Imports (%) Taxes on Foreign Trade / Imports (%) Foreign trade liberalization in Turkey is closely associated to Turkey’s relations to the GATT/WTO and the European Union (EU). Kibritçioğlu, November 1-15, 2004, (39/79) 1.25 1.00 0.75 0.50 0.25 1969-1980: import-substituion era 1979-1980: real-sector and balance-of-payments crises 1980-1984: current-account liberalization and exports promotion May 1981: abondonment of fixed exchange rates 1989: capital-account liberalization 1994: major currency crisis 2000-2001: triple crises (banking, currency & real-sector) 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 1974 1973 1972 1971 1970 1969 0.00 Bilateral (TL/USD) Real Exchange Rates (1995=1.0) Official Exchange Rates / Black-Market Exchange Rates Exports-to-Imports Ratio in Manufacturing Import Penetration Ratio Tax-Rebate Ratio for Exports Taxes on Foreign-Trade to Imports Ratio Customs-Duties to Imports Ratio Foreign trade liberalization in the 1980s positively affected Turkey’s trade in goods with the rest of the world. Kibritçioğlu, November 1-15, 2004, (40/79) 1923 1925 1927 1929 1931 1933 1935 1937 1939 1941 1943 1945 1947 1949 1951 1953 1955 1957 1959 1961 1963 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 Exports to Imports Ratio in Turkey (1923-2003, annual) 2.00 1.80 1.60 1.40 1.20 1.00 0.80 0.60 0.40 0.20 0.00 Kibritçioğlu, November 1-15, 2004, (41/79) Exports to Imports Ratio in Turkey (1950-2004, monthly) 2.00 1.80 1.60 1.40 1.20 1.00 0.80 0.60 mov.ave. 0.40 0.20 04.01 02.01 00.01 98.01 96.01 94.01 92.01 90.01 88.01 86.01 84.01 82.01 80.01 78.01 76.01 74.01 72.01 70.01 68.01 66.01 64.01 62.01 60.01 58.01 56.01 54.01 52.01 50.01 0.00 The share of the agricultural products on exports decreased in Turkey, and the volatility of exports to imports ratio in Turkey declined since early 1980s. Kibritçioğlu, November 1-15, 2004, (42/79) Exports to Imports Ratio (SIS, percent, as of 12-monthly totals) 95 90 85 80 75 70 65 60 55 50 45 m anufacturing 73.6 total 2004.09 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 64.4 The developments in the exports to imports ratio show that foreign trade deficits are increasing since early 2002. Kibritçioğlu, November 1-15, 2004, (43/79) Export and Import Price Indices (1982=100, monthly averages) 130 120 110 100 90 80 External Terms of Trade Export Price Index Import Price Index 2004.12 2003.12 2002.12 2001.12 2000.12 1999.12 1998.12 1997.12 1996.12 1995.12 1994.12 1993.12 1992.12 1991.12 1990.12 1989.12 1988.12 1987.12 1986.12 1985.12 1984.12 1983.12 1982.12 70 1982=100 Kibritçioğlu, November 1-15, 2004, (44/79) Goods Composition of Turkish Exports and Imports (1969-2003, ISIC, percent) 1.00 1.00 0.90 0.90 0.80 0.80 Manufacturing 0.70 0.30 0.30 Agriculture 0.20 Exports 2001 2003 1997 1999 1991 1993 1995 1987 1989 1983 1985 0.00 1977 1979 1981 0.00 1973 1975 0.10 1969 1971 0.10 Mining & Quarrying Agriculture 1973 1975 0.20 2001 2003 0.40 1997 1999 0.40 1993 1995 0.50 1989 1991 0.50 Manufacturing 1985 1987 0.60 1981 1983 0.60 1977 1979 Mining & Quarrying 1969 1971 0.70 Imports Kibritçioğlu, November 1-15, 2004, (45/79) Goods Composition of Turkish Exports and Imports (1969-2003, BEC, percent) Inv.G. 1.00 0.90 0.90 0.80 0.80 0.70 Intermediate Goods 0.70 0.60 0.60 0.50 0.50 0.40 0.40 0.30 0.30 0.20 Consumption Goods 0.10 0.00 0.00 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 Intermediate Goods 0.20 0.10 Exports Investment Goods Consumption Goods 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 1.00 Imports Kibritçioğlu, November 1-15, 2004, (46/79) Country Composition of Turkish Exports (1980-2003, percent) 100 90 80 70 Other Countries Developing Western Hemisphere 60 Developing Middle East Developing Europe 50 Developing Asia Developing Africa 40 EU15 30 Industrial Countries (excl. EU15) 20 10 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 0 Kibritçioğlu, November 1-15, 2004, (47/79) Country Composition of Turkish Imports (1980-2003, percent) 100 90 80 70 Other Countries Developing Western Hemisphere 60 Developing Middle East 50 Developing Europe Developing Asia 40 Developing Africa EU15 30 Industrial Countries (excl. EU15) 20 10 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 0 Kibritçioğlu, November 1-15, 2004, (48/79) Current Account Balance: Selected Indicators (SIS, billion USD, monthly) 1.30 0.65 0.00 -0.65 -1.30 -1.95 Selected Events Net Exports of Goods (billion TL) Net Exports of Goods and Services (billion TL) Current Account Balance (billion TL) 2004.09 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 -2.60 The increasing deficit in net exports of goods is eliminated by an increasing surplus in net exports of services, and hence the CAB deficits are declining since March 2004. Kibritçioğlu, November 1-15, 2004, (49/79) Current Account Balance: Selected Indicators (SIS, billion USD, cumulative) 8 4 0 -4 -8 -9.8 -12 -12.3 -16 -21.9 -20 Selected Events Net Exports of Goods (billion TL) Net Exports of Goods and Services (billion TL) Current Account Balance (billion TL) 2004.10 2004.07 2004.04 2004.01 2003.10 2003.07 2003.04 2003.01 2002.10 2002.07 2002.04 2002.01 2001.10 2001.07 2001.04 2001.01 2000.10 2000.07 2000.04 2000.01 1999.10 1999.07 1999.04 1999.01 1998.10 1998.07 1998.04 1998.01 -24 However, the cumulative BoP data shows that the recent improvements have not fully translated into the annual data yet. In 2003, the CAB/GDP ratio amounted to -2.8%. However, it will possibly climb to -4% in 2004. Kibritçioğlu, November 1-15, 2004, (50/79) Erratic Nature of Net Short-Term Capital Inflows (billion USD, annual data) 6 4 2 0 -2 -4 -6 -10 -12 capital account liberalization 2000-01 crisis 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 -8 1994 crisis Kibritçioğlu, November 1-15, 2004, (51/79) Net Short-Term Capital Inflows (billion USD) 8 6 4 2 0 -2 -4 -6 -8 -10 -12 -14 monthly 2004.01 2003.01 2002.01 2001.01 2000.01 1999.01 1998.01 1997.01 1996.01 1995.01 1994.01 1993.01 1992.01 1991.01 1990.01 1989.01 1988.01 1987.01 1986.01 capital account liberalization 12-monthly One indication that Turkey’s policies are on the right track would be a return to positive short-term inflows at a steady and sustainable level. But a substantial increase in longer term capital inflows is not observed in Turkey. Kibritçioğlu, November 1-15, 2004, (52/79) Net Short-Term Capital Inflows (billion USD) 6 5.4 5.4 3 2.6 0 -3 -6 -9 -12 -12.3 Selected Events Monthly 2004.10 2004.07 2004.04 2004.01 2003.10 2003.07 2003.04 2003.01 2002.10 2002.07 2002.04 2002.01 2001.10 2001.07 2001.04 2001.01 2000.10 2000.07 2000.04 2000.01 1999.10 1999.07 1999.04 1999.01 1998.10 1998.07 1998.04 1998.01 -15 12-monthly Short-term capital outflows that rose following the 2000-2001 financial crisis declined significantly after January 2002. Net short-term capital inflows (in terms of cummulative data) are positive in 2004. Kibritçioğlu, November 1-15, 2004, (53/79) Current Account Balance to GDP & Net Short-Term Capital Inflows to GDP (%) 3 2 1 0 -1 -2 -3 -4 -5 -6 CAB to GDP 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 capital account liberalization 1985 1984 1983 1980 1979 1978 1977 1976 1975 -9 1982 -8 1981 current account liberalization -7 Net Short-Term Capital Inflows to GDP The effects of both current and capital account liberalizations realized in the 1980s can roughly be followed by the fluctuations in the CAB to GDP and net short term capital inflows to GDP ratios. Kibritçioğlu, November 1-15, 2004, (54/79) Current Account Balance to Output & Net Short-Term Capital Inflows to Output (January 1999 = 1.0; as of 12-monthly cummulatives) 10 5 2.1 1.0 0 -5 -2.8 -10 -15 -20 Selected Events Current Account Balance to Output 2004.09 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 -25 Net Short-Term Capital Inflows to Output The monthly data shows that the volatility of the CAB to nominal industrial output is significantly lower than that of the net shortterm capital inflows to output ratio. Kibritçioğlu, November 1-15, 2004, (55/79) “Hot Money” Mechanism in Turkey Political Process It‘s not only “capital account liberalization” itself which caused macroeconomic problems in Turkey after 1989. (Voters, Political Parties & Bureaucrats) High Public Sector Deficits High Real International Interest Rate Differential high inflation upward pressure on FX rates Decreasing or Stable Nominal Exchange Rates interest rate parity Net Short-Term Capital Inflows from Abroad ... But everything changes, if there is a CC at the door… Kibritçioğlu, November 1-15, 2004, (56/79) Cumulative Annual FDI FDI Permits Permits Years (million (million USD) USD) 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 * 97 435 602 704 976 1210 1574 2229 3050 4562 6423 8390 10210 12274 13751 16690 20525 22204 23850 25550 29027 31752 33995 35203 97 338 167 103 271 234 364 655 821 1512 1861 1967 1820 2063 1478 2938 3836 1678 1646 1700 3477 2725 2243 1208 Share of Number of Total Capital of Realized FDI Realized FDI Manufacturing Foreign Foreign Capital Inflows Outflows Industry on Capital Companies (million (million Authorized FDI Companies (bill. TL) USD) USD) (%) 91.5 78 28390 73.0 109 47400 141 46 59.0 147 100196 103 48 86.6 166 147109 87 41 68.5 235 254775 113 0 60.9 408 464981 99 0 53.2 619 707164 125 0 44.9 836 960035 115 0 59.8 1172 1597103 354 0 62.8 1525 4847832 663 0 65.2 1856 7943775 684 0 55.7 2123 13101036 907 97 70.0 2330 23441214 911 67 76.0 2554 36737050 746 110 74.9 2830 62449964 636 28 68.0 3161 113013790 934 49 16.7 3582 235971182 914 192 52.0 4068 458968459 852 47 61.8 4533 823560554 953 13 66.1 4950 1446503 813 30 31.8 5328 3063464 1707 725 45.7 5841 6184411 3288 22 39.8 6280 10092737 590 5 58.8 6511 12605285 414 8 Net FDI Inflows (million USD) 95 55 46 113 99 125 115 354 663 684 810 844 636 608 885 722 805 940 783 982 3266 585 406 FDI inflows into Turkey are far from being sufficient to improve the economy: Only 16.1 billions of USD within 23 years... Kibritçioğlu, November 1-15, 2004, (57/79) Selected Indicators of External Debts of Turkey (percent) 90 80 70 60 50 40 30 20 10 0 61.9 53.9 Selected Events Public Sector's Share on Total Debts Total External Debts to GDP 2004Q4 2004Q3 2004Q2 2004Q1 2003Q4 2003Q3 2003Q2 2003Q1 2002Q4 2002Q3 2002Q2 2002Q1 2001Q4 2001Q3 2001Q2 2001Q1 2000Q4 2000Q3 2000Q2 2000Q1 1999Q4 1999Q3 1999Q2 1999Q1 1998Q4 1998Q3 1998Q2 1998Q1 17.6 Short-Term to Total Debts In 2003, Turkey’s GDP amounted to 240 billion USD, while its total external debts reached to 147 billion USD. 95 out of 147 billion USD amounting total debts are created solely by the public sector. Kibritçioğlu, November 1-15, 2004, (58/79) Reserves vs. External Debts (percent) 280 260 240 220 200 180 160 140 120 100 80 60 40 20 0 250.5 174.1 113.3 Selected Events Net International Reserves to Total External Debts Central Bank's FX Reserves to Public Sector's External Debts Net International Reserves to Short-Term External Debts 2004Q4 2004Q2 2004Q1 2003Q4 2003Q3 2003Q2 2003Q1 2002Q4 2002Q3 2002Q2 2002Q1 2001Q4 2001Q3 2001Q2 2001Q1 2000Q4 2000Q3 2000Q2 2000Q1 1999Q4 1999Q3 1999Q2 1999Q1 1998Q4 1998Q3 1998Q2 1998Q1 2004Q3 36.8 30.7 29.4 The ratio of international reserves to short-term external debts increased significantly after the 2000-2001 financial crisis, but in the AK-Party era it declined again slightly. Kibritçioğlu, November 1-15, 2004, (59/79) Public Sector: Deficits and Debts Kibritçioğlu, November 1-15, 2004, (60/79) Public Sector Borrowing Requirement (PSBR) and Consolidated Budget Balance (CBB) 12 9 6 3 0 -3 -6 -9 -12 -15 Non-interest PSBR to GDP PSBR to GDP Non-interest CB to GDP CB to GDP 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 -18 The PSBR is a better indicator of the public sector in Turkey because it also covers the non-CB public institutions. The PSBR is diminishing since three years, while the noninterest PSBR is improving. Kibritçioğlu, November 1-15, 2004, (61/79) Cumulative Consolidated Budget Balance / Average Nominal Industrial Production 75 50 25 0 -25 -50 -75 -100 -125 Selected Events Primary Balance to Nominal Output 2004.10 2004.07 2004.04 2004.01 2003.10 2003.07 2003.04 2003.01 2002.10 2002.07 2002.04 2002.01 2001.10 2001.07 2001.04 2001.01 2000.10 2000.07 2000.04 2000.01 1999.10 1999.07 1999.04 1999.01 1998.10 1998.07 1998.04 1998.01 -150 CB Balance to Nominal Output Non-interest (primary) consolidated budget balance (CBB) seems to be stabilized with respect to nominal output growth, while the CBB (incl. interest payments) is diminishing since late 2003 again. Kibritçioğlu, November 1-15, 2004, (62/79) Compound, Weighted Auction Interest-Rates (Treasury, percent) & Confidence Index 200 193.7 180 160 140 120 100 80 60 25.4 40 20 0 15.1 Selected Events Nominal Reel (ex ante) Reel (ex post) 2004.10 2004.07 2004.04 2004.01 2003.10 2003.07 2003.04 2003.01 2002.10 2002.07 2002.04 2002.01 2001.10 2001.07 2001.04 2001.01 2000.10 2000.07 2000.04 2000.01 1999.10 1999.07 1999.04 1999.01 1998.10 1998.07 1998.04 1998.01 -20 Real Sector Confidence Index As a result of both the successful disinflationary policies and the Government’s increasing political credibility, Turkish Treasury pays now lower interest rates in domestic borrowing. Kibritçioğlu, November 1-15, 2004, (63/79) Domestic Debt Stock of the Public Sector (billion TL) 250000000 200000000 150000000 100000000 50000000 Selected Events nominal, billion TL 2004.09 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 0 real, billion TL Public sector’s domestic debts increased sharply following the 2000-2001 crisis, both in nominal and real terms. Kibritçioğlu, November 1-15, 2004, (64/79) Domestic Debt Stock of the Public Sector (billion USD) 160 140 120 100 80 60 40 2004.09 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 20 Public sector’s domestic debts in terms of USD are also increasing sharply... Kibritçioğlu, November 1-15, 2004, (65/79) Ave. Domestic Debt Stock of the Public Sector to Ave. Industrial Output (%) 2004.09 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 260 240 220 200 180 160 140 120 100 80 Public sector’s domestic debts seem to be stabilized with respect to changes in industrial production index within the last two years. Kibritçioğlu, November 1-15, 2004, (66/79) Domestic and External Debts of the Public Sector (billion USD) 180 160 140.4 140 120 92.2 84.9 100 80 53.4 60 40 79.9 Domestis Debts of the Public Sector 2004Q4 2004Q3 2004Q2 2004Q1 2003Q4 2003Q3 2003Q2 2003Q1 2002Q4 2002Q3 2002Q2 2002Q1 2001Q4 2001Q3 2001Q2 2001Q1 2000Q4 2000Q3 2000Q1 1999Q4 1999Q3 1999Q2 1999Q1 1998Q4 1998Q3 1998Q2 1998Q1 Selected Events 2000Q2 45.2 20 0 External Debts of the Public Sector Since the latest general elections in November 2002, the public sector’s domestic debts increased more than 65 percent in terms of USD, while its external debts expanded only around 15 percent. Kibritçioğlu, November 1-15, 2004, (67/79) Financial Sector Kibritçioğlu, November 1-15, 2004, (68/79) Banking Sector Fragility in Turkey 3.5 Aug. '82 Dec. '82 3.0 2.5 1.5 Aug. '97 Feb. '87 1.0 Oct. '93 Nov. '90 0.5 Jun. '79 Nov. '83 Oct. '94 Feb. '02 High Fragility BSF3 Jan-00 Jan-99 Jan-98 Jan-97 Jan-96 Jan-95 Jan-94 Jan-93 Jan-92 Jan-91 Jan-90 Jan-89 Jan-88 Jan-87 Jan-86 Jan-85 Jan-84 Jan-83 Jan-82 Jan-81 Jan-80 Jan-79 -2.0 Jan-04 Sep. '88 May '80 -1.5 Jul. '99 Jan-03 -1.0 Apr. '94 Jan-02 Jan. '86 Jan-01 -0.5 Nov. '91 0.0 Oct. '00 Feb. '01 2.0 BSF2 Turkish banking sector experienced difficulties many times within the last 25 years, as a result of their own excessive risk-taking behavior in the past. For Methodology: see Kibritçioğlu (2003), “Monitoring ...”. Kibritçioğlu, November 1-15, 2004, (69/79) Banking Sector Fragility Index 1.5 1.0 0.5 0.0 -0.5 -1.0 -1.5 2004.09 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 -2.0 The Turkish banking sector is recovering from the 20002001 crisis, and according to the BSF index, it is taking excessive risk again... (The BSF3 index is a weighted average of real annual changes in foreign liabilities, claims on private sector, and total deposits.) For Methodology: see Kibritçioğlu (2003), “Monitoring ...”. Kibritçioğlu, November 1-15, 2004, (70/79) Banking Sector Fragility in Turkey Deposit Banks: Foreign Liabilities to Foreign Assets (percent) 2004.09 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 160 150 140 130 120 110 100 90 80 70 The recent developments in the FL to FA ratio indicate that the external open (short) position of Turkish banking system is decreasing now... Kibritçioğlu, November 1-15, 2004, (71/79) Weighted Deposit Interest Rates: Ratio of 1-Month to 12-Months Interest Rates (percent) 2004.09 2004.05 2004.01 2003.09 2003.05 2003.01 2002.09 2002.05 2002.01 2001.09 2001.05 2001.01 2000.09 2000.05 2000.01 1999.09 1999.05 1999.01 1998.09 1998.05 1998.01 235 215 195 175 155 135 115 95 75 The ratio of 1-month to 12-month deposit interest rates exhibits a different pattern after the 2000-2001 financial crisis: It is very close to 100 percent now... Kibritçioğlu, November 1-15, 2004, (72/79) Istanbul Stock Exchange’s National 100 Index 100000 10000 1000 100 10 January 1986 = TL 1 2004.01 2003.01 2002.01 2001.01 2000.01 1999.01 1998.01 1997.01 1996.01 1995.01 1994.01 1993.01 1992.01 1991.01 1990.01 1989.01 1988.01 1987.01 1986.01 1 January 1986 = USD 1 Kibritçioğlu, November 1-15, 2004, (73/79) Annual Increases in ISE’s National 100 Index 900 800 700 600 500 400 300 200 100 0 January 1986 = TL 1 2004.01 2003.01 2002.01 2001.01 2000.01 1999.01 1998.01 1997.01 1996.01 1995.01 1994.01 1993.01 1992.01 1991.01 1990.01 1989.01 1988.01 1987.01 -100 January 1986 = USD 1 Kibritçioğlu, November 1-15, 2004, (74/79) 12-Monthly Increases in Istanbul Stock Exchange's National 100 Index 600 500 400 300 200 100 0 Selected Events 1986 = 1 TL 2004.10 2004.07 2004.04 2004.01 2003.10 2003.07 2003.04 2003.01 2002.10 2002.07 2002.04 2002.01 2001.10 2001.07 2001.04 2001.01 2000.10 2000.07 2000.04 2000.01 1999.10 1999.07 1999.04 1999.01 1998.10 1998.07 1998.04 1998.01 -100 1986 = 1 USD ISE’s (İMKB) National 100 index increased mostly during the AK-Party era. Since spring 2004, however, it follows a relatively stable path. Kibritçioğlu, November 1-15, 2004, (75/79) Concluding Remarks Inflation and interest rates are declining gradually. In the Turkish manufacturing industry, the labor productivity is increasing and real wages remain low, while the industrial production index is rising again. There is still a deep unemployment problem in Turkey. Production increases are not fully translated into employment increases yet. Excessive risk taking behavior of the banking system (in terms of the BSF index) is expected to decline towards historical averages. Real effective exchange rates do not show an appreciation of Turkish lira anymore. Further structural reforms, stronger privatization efforts and continuity in political stability are needed in the country. In Turkey, it is expected that a decision of the heads of EU governments next month in favor of the start of the accession talks for full-membership in early 2005 will positively affect the Turkish economy, particularly in terms of the FDI inflows. Kibritçioğlu, November 1-15, 2004, (76/79) Statistical Sources for Figures and Tables CBRT/TCMB, Electronic Data Distribution System. SPO/DPT, Main Economic Indicators. UT/HM, Treasury Statistics. ISE/İMKB, Annual Yerabook. IMF/IFS, IFS & DOTS. Penn World Table (PWT), 6.1 Pick’s/World Currency Yearbook Kibritçioğlu, November 1-15, 2004, (77/79) Appendix: Selected Macroeconomic Indicators for Turkey, 1970-2003 Kibritçioğlu, November 1-15, 2004, (78/79) Consumer Real GDP Price Growth (%) Inflation (%) Change in Nominal TL/US$ Exchange Rate (%) Absolute Change JP Morgan's Change in in Central Bank's Real Effective Average Gross Foreign Exchange Crude Oil Exchange Rate Import Price Reserves (millions (1990=100) (%) of USD) Foreign Exchange Deposits to Money Supply M2 (%) Change in Nominal Money Supply M2 (%) Public Sector Borrowing Requirement to GDP (%) Istanbul Actual Stock Current Foreign Official Capacity Short-Term Exchange's Account Direct Unemploy- Utilization in the Capital Inflow Composite Balance Investment ment Rate Manufac-turing (millions of 100 Index in (millions of Inflow (%) Industry (%) USD) USD USD) (millions of (1986=1.0) USD) 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003* 6.9 15.7 11.7 15.4 15.8 19.2 17.4 27.1 45.3 58.7 110.2 36.6 30.8 31.4 48.4 45.0 34.6 38.8 73.7 63.3 60.3 66.0 70.1 66.1 106.3 88.1 80.3 85.7 84.6 64.9 54.9 54.4 45.0 25.3 3.2 5.6 7.4 3.3 5.6 7.2 10.5 3.4 1.5 - 0.6 - 2.4 4.9 3.6 5.0 6.7 4.2 7.0 9.5 2.1 0.3 9.3 0.9 6.0 8.0 - 5.5 7.2 7.0 7.5 3.1 - 4.7 7.4 - 7.5 7.9 5.8 26.4 31.1 - 5.5 - 0.1 - 1.6 3.8 10.9 12.3 35.0 27.9 144.3 46.8 45.9 39.2 61.9 42.6 29.3 27.2 66.4 48.6 22.9 60.2 64.6 60.5 169.9 53.7 78.0 86.8 71.6 61.0 48.5 96.5 22.9 - 0.8 220.4 259.7 208.3 173.9 131.9 123.1 118.2 107.4 96.2 74.9 87.7 93.1 104.1 110.0 122.4 122.9 119.7 119.3 115.4 105.3 100.0 102.8 112.2 107.7 137.1 131.7 134.2 127.2 127.6 128.6 113.9 128.9 112.8 113.5 176 322 564 716 - 433 - 561 57 - 331 163 - 143 419 - 149 151 174 - 14 - 219 348 351 589 2 524 1 141 - 1 054 1 198 97 899 5 279 3 882 2 146 1 302 3 456 - 1 005 - 3 385 8 020 6 809 - 0.7 21.8 5.8 39.9 159.0 21.4 8.2 12.5 - 1.0 37.8 110.5 - 0.2 - 9.7 - 9.7 - 5.5 - 1.2 - 49.5 27.5 - 18.4 17.9 33.1 - 20.6 - 1.6 - 14.8 - 2.1 7.6 21.4 - 8.8 - 35.3 41.6 58.7 - 15.7 2.8 14.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 5.1 9.0 22.3 31.5 34.6 29.5 30.4 44.4 55.6 69.9 94.9 99.7 89.8 97.1 83.8 82.2 79.4 127.9 120.7 86.4 21.9 28.1 26.0 28.4 25.7 28.0 23.4 33.8 36.5 61.7 74.5 85.0 56.7 29.8 58.0 55.5 42.5 45.0 54.1 73.3 51.8 63.6 62.9 48.1 123.2 99.4 132.8 93.5 101.9 96.1 42.5 48.0 31.0 33.7 n.a. n.a. n.a. n.a. n.a. 4.9 6.9 8.2 3.2 7.3 8.9 4.0 3.6 5.0 5.4 3.6 3.7 6.1 4.8 5.4 7.5 10.2 10.7 12.1 7.9 5.0 8.8 7.9 9.7 15.8 12.6 16.2 12.6 8.6 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. 8.3 7.3 7.2 7.9 7.8 7.3 8.1 8.5 8.7 8.7 8.2 7.8 8.0 7.7 8.1 6.9 6.0 6.4 6.8 7.6 6.6 8.4 10.4 10.6 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. 56.9 55.2 56.7 59.4 60.3 74.3 70.3 70.0 77.1 74.8 72.8 75.2 74.0 76.4 79.6 72.9 78.6 78.0 79.4 76.5 72.4 75.9 70.9 75.4 78.4 1970-1979 1980 1981-1988 1989-1993 1994 1995-1999 2000-2001 2002-2003 1970-2003 23.3 110.2 42.4 65.1 106.3 80.7 54.7 35.1 49.9 4.7 - 2.4 5.4 4.9 - 5.5 4.0 - 0.1 6.9 4.1 14.0 144.3 44.9 51.4 169.9 70.2 72.5 11.0 46.7 151.4 87.7 113.4 105.6 137.1 129.9 121.4 113.1 126.2 53 419 154 781 899 3 213 - 2 195 7 414 985 30.5 110.5 - 8.3 2.8 - 2.1 5.3 21.5 8.8 13.2 0.0 0.0 12.8 46.0 94.9 90.5 103.6 103.5 38.1 31.4 74.5 53.3 59.9 123.2 104.7 45.2 32.3 56.4 6.1 8.9 4.5 9.2 7.9 9.4 14.4 10.6 7.8 8.3 7.9 8.1 8.1 6.8 7.5 10.5 7.9 56.9 55.2 67.8 75.6 72.9 77.0 73.4 76.9 71.6 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. 1.0 4.0 2.3 2.6 8.9 5.3 3.4 5.6 4.2 5.3 5.0 7.8 7.3 8.0 13.2 5.1 4.2 4.9 - 171 - 109 - 8 484 - 561 - 1 648 - 2 029 - 3 140 - 1 265 - 1 413 - 3 408 - 1 936 - 952 - 1 923 - 1 439 - 1 013 - 1 465 - 806 1 596 938 - 2 625 250 - 974 - 6 433 2 631 - 2 338 - 2 437 - 2 638 1 984 - 1 344 - 9 819 3 390 - 1 522 - 6 808 n.a. n.a. n.a. n.a. n.a. 40 73 968 402 - 1 000 - 2 121 98 798 - 652 1 479 812 50 - 2 281 - 584 3 000 - 3 020 1 396 2 994 - 5 190 3 635 2 665 - 7 1 313 1 024 4 200 - 11 321 - 1 279 4 269 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. 35 95 55 46 113 99 125 115 354 663 684 810 844 636 608 885 722 805 940 783 982 3 266 585 294 2.4 5.2 4.2 6.7 9.2 4.6 5.5 - 986 - 3 408 - 992 - 1 769 2 631 - 1 355 - 3 215 - 4 165 - 1 440 97 - 2 53 757 - 5 190 1 726 - 3 561 1 495 138 35 125 727 608 827 2 124 440 606 Source: State Institute of Statistics (SIS), Central Bank of Republic of Turkey (CBRT), State Planning Organization (SPO), the IMF and J.P.Morgan; Kibritçioğlu’s calculations. Kibritçioğlu, November 1-15, 2004, (79/79)