Putnam 529 for America - Corporate

advertisement

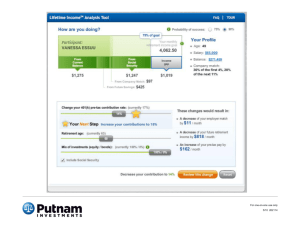

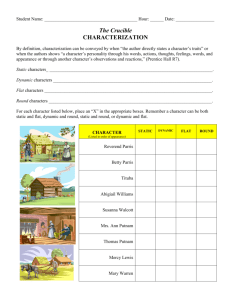

EO003 299271 2/16 |1 What is a 529 plan? • • • • A way for families to save for college Available to investors nationwide Proceeds can be used for any college An investment account with tax advantages EO003 299271 2/16 |2 Benefits of a 529 plan • Anyone can contribute to the account • You can change beneficiaries at any time • You have other options if the child does not attend college • Control of the account will not shift to the child EO003 299271 2/16 |3 The tax-smart way to save • You pay no federal income taxes – On your earnings while the account is invested – When you withdraw money to pay for college expenses Withdrawals of earnings not used to pay for qualified higher education expenses are subject to tax and a 10% penalty. State taxes may apply. Withdrawals for qualified higher education expenses subject to tax if American Opportunity Credit or Lifetime Learning Credit is claimed for same expenses. If withdrawing funds for qualified higher education expenses from both a 529 account and a Coverdell Education Savings Account, a portion of the earnings distribution may be subject to tax and penalty on amounts that exceed qualified higher education expenses. Read the offering statement for details. EO003 299271 2/16 |4 The tax-smart way to save • Gift tax benefits: Make five years’ worth of gifts without triggering the federal gift tax • Maximum for individuals: $70,000 for 2016 • Maximum for married couples: $140,000 EO003 299271 2/16 |5 The tax-smart way to save A 529 account can help decrease your taxable estate Grandparents $700,000 $140,000 $140,000 $140,000 $140,000 $140,000 Ω Ω Ω Ω Ω Ω Married couples filing jointly may contribute up to $140,000 per beneficiary. Individuals may contribute up to $70,000. Contributions are generally treated as gifts to the beneficiary for federal gift tax purposes and are subject to annual federal gift tax exclusion amount ($14,000 for 2016). Contributor may elect to treat contribution in excess of that amount (up to $70,000 for 2016) as pro-rated over 5 years. Election is made by filing a federal gift tax return. While contributions are generally excludable from contributor’s gross estate, if electing contributor dies during 5-year period, amounts allocable to years after death are includible in contributor’s gross estate. Consult your tax advisor for more information. EO003 299271 2/16 |6 EO003 299271 2/16 |7 $500 monthly contributions at a hypothetical 6% annual growth rate $193,677 Hypothetical 529 account value Your savings accumulate faster because account is not taxed $81,940 $34,885 $75,007 $163,477 Hypothetical taxable account value $33,446 5 years 10 years 18 years This example assumes contributions of $500 per month, a hypothetical 6% nominal rate of return compounded monthly with an effective return of 6.17%, and a 28% tax bracket for the taxable account. Performance shown is for illustrative purposes and is not related to an actual investment. Regular investing does not ensure a profit or protect against loss in a declining market. Capital gains, exemptions, deductions, and local taxes are not reflected. Certain returns in a taxable account are subject to capital gains tax, which is generally a lower rate than ordinary income tax rates and would make the investment return for the taxable investment more favorable than reflected on the chart. Investors should consider their personal investment horizon and income tax brackets, both current and anticipated, when making an investment decision. These may further impact the results of the comparison. EO003 299271 2/16 |8 Start early, contribute often The Jones family starts saving today, contributing $340 every month The Smith family waits 10 years to start saving, contributing $1,219 every month Total contribution $73,440 Total contribution $117,024 Earnings Account value $89,714 $163,154 after 18 years Earnings $46,130 Account value $163,154 after 8 years This chart is for illustrative purposes only and is not intended to be representative of past or future performance. The Jones family saves $340 monthly for 18 years. The Smith family saves $1,219 monthly for 8 years. Assumes a hypothetical 8% annual return compounded monthly. EO003 299271 2/16 |9 Let the whole family contribute The Jones grandfather makes an initial contribution of $14,000 Total contribution $62,816 Earnings $104,491 Account value $167,307 after 18 years The Jones parents contribute $226 every month This chart is for illustrative purposes only and is not intended to be representative of past or future performance. The Jones grandfather makes a lump-sum contribution of $14,000 today. The Jones parents contribute $226 each month. Assumes a hypothetical 8% annual return compounded monthly. EO003 299271 2/16 | 10 EO003 299271 2/16 | 11 A wide range of investment choices • Age-based portfolios • Goal-based portfolios • Individual fund options from Putnam and other firms • Putnam Absolute Return Funds EO003 299271 2/16 | 12 Age-based portfolios Actively managed and adjusted over time, becoming more conservative as your child approaches college age Newborn Stocks 15% Bonds Cash 85% 4 8 12 18 14% 26% 60% Asset allocations shown are target allocations. Actual allocations may vary. The age-based and goal-based options invest across four broad asset categories: short-term investments, fixed-income investments, U.S. equity investments, and non-U.S. equity investments. Within these categories, investments are spread over a range of asset allocation portfolios that concentrate on different asset classes or reflect different styles. Each age-based portfolio has a different target date, which is based on the year in which the beneficiary of an account was born. The principal value of the funds is not guaranteed at any time, including age-based portfolios closest to college age. EO003 299271 2/16 | 13 Goal-based portfolios Actively managed and keep the same allocation mix, regardless of the child’s age Stocks Bonds Cash Balanced Growth 34% 15% Aggressive growth 100% 60% 85% 6% Balanced Option • • • Putnam 529 GAA Growth Portfolio Putnam 529 Balanced Portfolio Putnam 529 Money Market Portfolio Growth Option • Invests in the Putnam 529 GAA Growth Portfolio and Putnam 529 All Equity Portfolio Aggressive Growth Option • Invests in the Putnam 529 GAA All Equity Portfolio Allocations shown are target allocations; actual allocations may vary. See the offering statement for details. EO003 299271 2/16 | 14 Individual investment options Build your own portfolio with a range of choices Stocks • Putnam Equity Income Fund Option • Putnam International Capital Opportunities Fund Option Bonds • Putnam High Yield Trust Option • Putnam Income Fund Option Cash Capital preservation money market: Putnam Money Market Fund Option* • Federated U.S. Government Securities Fund: 2-5 years Option • Putnam Voyager Fund Option • Putnam Small Cap Value Fund Option • MFS Institutional International Equity Fund Option • Principal MidCap Blend Fund Option • SSgA S&P 500® Index Fund Option * Although a money market fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund. Money market funds are not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other governmental agency. The plan involves investment risk, including the loss of principal. EO003 299271 2/16 | 15 Absolute Return Funds • Putnam 529 for America is the only 529 account to offer a suite of absolute return funds as an investment option • The funds target positive 3-year returns of 1%, 3%, 5%, +7% or 7% above inflation as measured by T-bills and +5% with lower relative volatility Absolute return investing can be an ally in helping to navigate today’s market volatility +1% Putnam Absolute Return 100 ® +3% Putnam Absolute Return 300 ® Putnam Absolute Return 500 ® Putnam Absolute Return 700 ® Chart does not represent the performance of Putnam Absolute Return Funds. Actual performance can be found on putnam.com. The funds’ strategies are designed to be largely independent of market direction, and the funds are not intended to outperform stocks and bonds during strong market rallies. There is no guarantee that the funds will meet their objectives. EO003 299271 2/16 | 16 Putnam Absolute Return Funds Putnam Absolute Return 100 Fund option Putnam Absolute Return 300 Fund option Putnam Absolute Return 500 Fund option Putnam Absolute Return 700 Fund option For investors considering short-term securities. Invests in bonds and cash instruments. For investors considering a bond fund. Invests in bonds and cash instruments. For investors considering a balanced fund. Can invest in bonds, stocks, or alternative asset classes. For investors considering a stock fund. Can invest in bonds, stocks, or alternative asset classes. ® ® ® ® The funds’ strategies are designed to be largely independent of market direction, and the funds are not intended to outperform stocks and bonds during strong market rallies. Consider these risks before investing: Our allocation of assets among permitted asset categories may hurt performance. The prices of stocks and bonds in the funds’ portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including both general financial market conditions and factors related to a specific issuer or industry. Our active trading strategy may lose money or not earn a return sufficient to cover associated trading and other costs. Our use of leverage obtained through derivatives increases these risks by increasing investment exposure. Bond investments are subject to interest-rate risk, which means the prices of the funds’ bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. The use of derivatives involves additional risks, such as the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. The funds may not achieve their goal, and they are not intended to be a complete investment program. The funds’ effort to produce low volatility returns may not be successful and may make it more difficult at times for the funds to achieve their targeted return. In addition, under certain market conditions, the funds may accept greater volatility than would typically be the case, in order to seek their targeted return. For the 500 Fund and 700 Fund, these risks also apply: REITs involve the risks of real estate investing, including declining property values. Commodities involve the risks of changes in market, political, regulatory, and natural conditions. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. Additional risks are listed in the funds’ prospectus. EO003 299271 2/16 | 17 EO003 299271 2/16 | 18 How much can you contribute? • No minimum investment • Contributions can occur until the account value reaches $370,000* • Contribute five years’ worth of gifts in a single year A gift of $70,000 in 2016 would constitute five years’ worth of gifts. Additional gifts made for the same beneficiary in the same five-year period would be subject to federal gift taxes. Election is made by filing a federal gift tax return. If the electing contributor dies during the 5-year period, amounts allocable to year after death are inducible in the contributor’s gross estate. * Contribution limit as of 1/1/16. Subject to periodic review. EO003 299271 2/16 | 19 Many ways to contribute • Invest a lump sum • Establish a dollar cost averaging program • Establish a systematic investment program from your bank • Encourage contributions with gift certificates Systematic investing and dollar cost averaging do not assure a profit or protect against loss in a declining market. You should consider your ability to continue investing during periods of low prices. EO003 299271 2/16 | 20 Withdrawals are easy • You tell us how to make out the check • Mail the completed form to Putnam Investments Withdrawals of earnings not used to pay for qualified higher education expenses are subject to tax and a 10% penalty. State taxes may apply. EO003 299271 2/16 | 21 Easy to set up • Call a Putnam Implementation Specialist – To complete a 529 employer information form – To determine how contributions will be made: – Payroll deduction – Systematic employee bank draft • Provide employees with information about Putnam 529 for America – Generate awareness using Putnam announcement letter – Schedule enrollment meetings – Employees can enroll online or by mailing an application to Putnam EO003 299271 2/16 | 22 ERISA • By its design, Putnam 529 for America is not intended to be subject to ERISA • Employers should consult legal counsel to ensure product implementation does not subject their plan to ERISA EO003 299271 2/16 | 23 Putnam.com/corporate 529 EO003 299271 2/16 | 24 Putnam is here to help Corporate 529 Implementation Specialist for setup and ongoing service: 1-800-634-1591 EO003 299271 2/16 | 25 EO003 290484 9/14 | 27