Chapter 21

advertisement

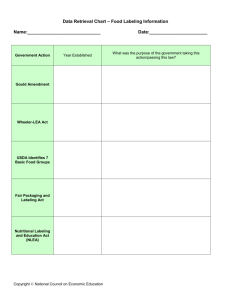

CHAPTER 21 Consumer Protection INTRODUCTION This chapter explores the major acts that focus on consumer protection and fairness. Issues of consumer health and safety are also covered. Additionally, which agencies handle consumer issues is addressed. 2 COMMISSIONS AND AGENCIES Independent federal regulatory agencies: the Federal Trade Commission, the Federal Communications Commission, the Securities and Exchange Commission, the Federal Reserve System, and the Consumer Product Safety Commission. Executive branch departments: The Food and Drug Administration, Environmental Protection Agency, and the National Highway Traffic Safety Administration. 3 CONSUMER HEALTH AND SAFETY Federal, state, and local regulatory agencies protect consumers’ health and safety, e.g., FDA, the Consumer Product Safety Commission). FTC regulates labeling and packaging. States regulate the availability of alcohol, tobacco, and gambling, no-smoking areas, and licensing of professional workers through the granting of various occupational licenses. 4 FOOD SAFETY AND LABELING Product Definition under FDCA: Food and Drug? Distinction is important because of different provisions of the Food, Drug, and Cosmetic Act (FDCA) that affect labeling and adulteration. – Drugs include (1) articles intended for use in the diagnosis, cure, mitigation, treatment, or prevention of disease; and (2) articles (other than food) intended to affect the structure or any function of the body. – Food is defined as (1) articles used for food or drink; (2) chewing gum; and (3) articles used for components of either. – Intent. FDA looks to intent to use a product as a drug in determining how to categorize it. 5 FOOD SAFETY AND LABELING FDA Standards for Food Condemnation – Depends on whether the product is a natural food or contains additives. – Additive - anything not inherent in the food product, including pesticide residue, unintended environmental contaminants, and unavoidably added substances from packaging. If the additive is injurious, the product is deemed “adulterated.” – Natural foods - adulterated if they consist of in whole in part of any filthy, putrid or decomposed substance. Adulterated natural foods are seized. Tainted food causes an estimated 6.5 million to 33 million illnesses and 9,000 deaths annually in the United States. – U.S. importers of food from international vendors are encouraging produce exporters to have their operations certified by private U.S. laboratories that inspect the fields, irrigation water and packing conditions, and the bathrooms workers use. 6 ROLE OF THE U.S. DEPARTMENT OF AGRICULTURE (USDA) USDA’s primary consumer protection activities all involve food and include inspecting facilities engaged in the slaughtering or processing of meat, poultry, and egg products; preventing the sale of mislabeled meat or poultry products; and offering producers a voluntary grading program for various agricultural products. 7 ROLE OF THE U.S. DEPARTMENT OF AGRICULTURE (USDA) Pesticides - under the FDCA, the FDA shares responsibility with the EPA for regulating pesticide residues on food. Genetically Modified Food - regulatory agencies are developing better methods for identifying potential allergens and regulatory agencies to monitor the environmental impact of genetically modified organisms (GMOs). Irradiated Foods - FDA authorized process where fresh and frozen red meat is passed through a sealed chamber, where it is exposed to gamma ray radiation. FDA regulations require conspicuous labels “”Treated with Radiation.” Organic Foods - USDA standards ban the use of pesticides, genetic engineering, growth hormones, and irradiation, and they require dairy cattle to have access to pasture. Foods grown and processed according to the standards bear the seal “USDA Organic.” 8 ROLE OF THE U.S. DEPARTMENT OF AGRICULTURE (USDA) Food Labeling - FDA has primary responsibility for regulating the packaging and labeling of food (except meat, poultry, and eggs, which are under the jurisdiction of the USDA), drugs, medical devices, and cosmetics. – Fair Packaging and Labeling Act: food label must contain the name and address of the manufacturer, packer, or distributor; the net quantity on the front panel, placed in a uniform location; the quantity given in servings, with the net quantity of each serving stated; and the quantity listed in certain ways, depending on how the product is classified. – Nutrition Labeling and Education Act - requires labeling of almost all foods through a nutrition panel entitled “Nutrition Facts” that includes ingredients, but restricts nutrient content claims and health claims. The FDA also regulates use of the words “light,” “fat free,” and “low calorie.” 9 DRUGS AND MEDICAL DEVICES FDA Standards for Drug Approval - FDA has authority to require that certain drugs be available only by prescription. DEA classifies drugs into one of five different schedules. Labeling of Medical Devices - FDA also has jurisdiction. However, even if a manufacturer provides the FDAmandated warnings, it still could be found liable under state product liability law for failure to warn if reasonable manufacturers would have done more. Drug Advertising - FDA recently relaxed rules for advertising of prescription drugs on television and radio. 10 HEALTH CLAIMS AND LABELING OF DIETARY SUPPLEMENTS The Dietary Supplement Health and Education Act. – Regulates the sale of dietary supplements only when the supplement contains a new dietary ingredient or poses a safety risk. – Dietary supplements include vitamins, minerals, herbs, and amino acids. – Dietary supplements can be characterized as drugs. 11 HEALTH CLAIMS AND LABELING OF DIETARY SUPPLEMENTS The Nutrition Labeling and Education Act – Creates a safe harbor for health claims on dietary supplements. – But FDA validates health claims only if there was substantial scientific agreement among experts. 12 LABELING OF OTHER PRODUCTS Clothing - FTC has primary responsibility for regulating the packaging and labeling of commodities to protect distributors and consumers against misbranding and false advertising. Alcohol - BATF regulations attach legal meanings to various statements made on wine labels, including the vintage year, grape variety, producer, and alcohol content, the disclosure of risks of birth defects, the impaired ability to drive a car and cautions against its use with machinery. 13 LABELING OF OTHER PRODUCTS “Made in USA”—regulated by FTC. – “All or virtually all” of the product must be made in the fifty states, the District of Columbia, or the U.S. territories and possessions. – “All or virtually all” means that all significant parts and processing that go into the product must be of U.S. origin. State Labeling Laws - many states, through their use of labeling laws, have taken steps to protect consumers from dangerous products. Historically, these laws have sought to protect consumers from risks that involved the danger of imminent bodily harm. 14 BROADCASTING AND THE INTERNET Broadcasting - by Federal Communications Commission (FCC) – FCC seeks to ensure that broadcast media are competitive and operate for the public’s benefit and use. – FCC enforcement is through license renewals. – Licenses cannot be transferred or assigned unless the FCC determines it is in the public interest. The Internet - has spawned new types of fraudulent schemes, such as online auction fraud, pyramid schemes, and securities fraud. The FTC, the U.S. Department of Justice, and the Securities and Exchange Commission are active in prosecuting offenders. 15 THE CONSUMER PRODUCT SAFETY COMMISSION (CPSC) Scope. Protect public against unreasonable risks of injury associated with consumer products (including infant products and toys) and assistance to consumers in evaluating the comparative safety of such products. – CPSC sets consumer product safety standards, such as performance or product-labeling specifications. – Any interested person may petition the CPSC to adopt a standard or begins a proceeding to develop a standard by publishing a notice in the Federal Register inviting any person to submit an offer to do the development. 16 THE CONSUMER PRODUCT SAFETY COMMISSION (CPSC) Penalties – Unlawful to manufacture for sale, offer for sale, distribute in commerce, or import into the United States a consumer product that does not conform to CPSC standards. – Violators are subject to civil penalties, criminal penalties, injunctive enforcement and seizure, private suits for damages, and private suits for injunctive relief. – The CPSC may require manufacturers to repair, modify, or replace the product, or refund the purchase price. 17 AUTOMOBILES The National Highway Traffic Safety Administration (NHTSA), an agency of the U.S. Department of Transportation, has the power to establish motor vehicle safety standards, engage in testing and development of motor vehicle safety, prohibit manufacture or importation of substandard vehicles, and develop tire safety. States refusing to comply with established federal standards are denied federal highway funds. 18 PRIVACY PROTECTIONS Technological developments, especially the Internet, have made it possible to amass large amounts of detailed personal information. Domestic. Federal and state governments introduced more than one hundred privacy bills in three general categories: – (1) bills aimed at the financial industry to prohibit or limit use of account-related information; – (2) bills to regulate the use of information collected by online service providers and Web sites; and – (3) bills to prevent state agencies from selling information about people who do business with the state, including obtaining driver’s licenses. 19 PRIVACY PROTECTIONS International. Russia passed a law to eavesdrop on all cellular telephone, pager communications and internet traffic. In contrast, a French court ruled on November 2, 2000, that e-mail is covered by French privacy laws. Britain adopted regulations in October 2000 empowering employers to monitor employees’ e-mails and Internet activity. 20 PRIVACY PROTECTIONS Financial Institutions - The Gramm-Leach-Bliley Act requires financial institutions (banks, debt collectors, credit counselors, retailers, and travel agencies) to provide privacy protections to consumers, including requiring notice before sharing personal information with other entities and restricting the right to give out personal information. The act also requires financial institutions to disclose annually their privacy policy and to give customers the right to opt-out of disclosures to third parties. 21 STATE OCCUPATIONAL LICENSING State departments of consumer affairs protect the public by examining and licensing firms and individuals who possess the necessary education and demonstrated skills to perform their services competently. Among the occupations generally regulated are accountants, architects, barbers, contractors, cosmetologists, dentists, dry cleaners, marriage counselors, nurses, pharmacists, physical therapists, physicians, and social workers. Attorneys are regulated by state bar associations and the courts. State departments of consumer affairs also investigate and resolve consumer complaints and hold public hearings involving consumer matters. 22 UNFAIRNESS, DECEPTION, AND FRAUD Regulatory agencies, such as the FTC, the FDA, the FCC and the SEC, are involved in the area of unfair and deceptive trade practices and consumer fraud. These federal agencies regulate advertising, packaging and labeling, pricing, warranties, and numerous sales practices. 23 ADVERTISING AND WARRANTIES Companies sometimes make claims that are deceptive or false. Legal solutions to this problem have historically involved three separate approaches: the common law, statutory law, and regulatory law. Common Law - provides two remedies for a consumer who has been misled by false advertising. – Consumer can sue for breach of contract. – Consumer can also sue for fraud (deceit) that requires knowledge by the seller that the misrepresentation is false. 24 ADVERTISING AND WARRANTIES Statutory Law - UCC and Lanham Act may protect consumers from false advertising. – UCC Express Warranty - any statement, sample, or model if it is part of the basis of the bargain. Consumer can sue for breach of express warranty. – Lanham Act - forbids the use of any false “description or representation” in connection with any goods or services and provides a private cause of action for any competitor injured by any other competitor’s false claims. 25 LANHAM ACT Case 21.1 Synopsis. Mead Johnson & Co. v. Abbott Laboratories. Abbott manufactures the infant formula Similac and advertises it as the “1st Choice of Doctors.” Mead Formula, which manufactures a competing infant formula (Enfamil), sued Abbott, alleging that its claim that Similac was the first choice of doctors was misleading and violated the Lanham Act. In support of its claims, Mead Johnson introduced evidence from a survey of women who had recently purchased or contemplated purchasing formula to determine how consumers interpreted the claim “1st Choice of Doctors.” The court ruled that Abbott could not claim that its product was the first choice because a majority of doctors did not prefer it. Accordingly, the court held that “1st Choice of Doctors” violated the Lanham Act. Abbott appealed. ISSUE: Did Abbott’s claim that its infant formula was the first choice of doctors violate the Lanham Act? HELD: REVERSED and DISMISSED. Abbott did not violate the Lanham Act so it could continue to advertise Similac as the first choice of doctors. 26 ADVERTISING AND WARRANTIES FTC Regulatory Law - The Federal Trade Commission is charged with preventing unfair and deceptive trade practices, including false advertising. – Deceptive Price - sale of advertised items at higher prices to customers unaware of the advertised price, bait and switch advertising rules if it refuses to show an advertised item, fails to have a reasonable quantity of the item in stock, fails to promise to deliver the item within a reasonable time, or discourages employees from selling the advertised item. – Quality Claims - made without any substantiation are deceptive. But obvious exaggerations and vague generalities are considered puffing and not deceptive. 27 FTC REGULATORY LAW Testimonials and Mock-ups - persons who endorse a product that do not, in fact, use or prefer it, are considered to be deceptive. Enforcement - FTC has the power to issue cease and desist orders to advertisers who employ deceptive or unfair advertising methods. A cease and desist order instructs advertisers to stop using the methods deemed unfair or deceptive. Remedies include civil damages, and affirmative or corrective advertising. Infomercials - advertisements generally presented in the format of half-hour television talk shows or news programs. Their very format, however, may present problems by blurring the line between advertising and regular television programming. 28 DECEPTIVE TRADE PRACTICE Case 21.2 Synopsis. L & F Products v. Proctor & Gamble Co. L & F manufactures Lysol cleaning products. P & G manufactures Spic and Span cleaner. P & G began using comparative ads against an unnamed competitor, intended to be Lysol. Among the items in the ad, P & G added substances to the soap scum for better filming, and used laboratory-developed soil instead of ordinary soil. L & F claimed this was a deceptive trade practice. The district court dismissed the compliant. ISSUE: Is it a deceptive trade practice (1) to make cleaning residue more easily filmed by adding substances, or (2) to simulate without disclosure the wiping of ordinary soil with the actual wiping of laboratory-developed soil? HELD: Dismissal AFFIRMED. Court of appeals stated that the substances added for filming were in some cleaning products, and there was nothing deceptive about the soil used in the ad. Therefore, there was nothing false or misleading about the ad. 29 ADVERTISING AND WARRANTIES Magnuson–Moss Warranty Act - designed to inform consumers about the products they buy. – Scope - when a seller offers a written warranty on goods costing more than $15, she must “fully and conspicuously disclose in simple and understandable language the terms and conditions of the warranty.” – Full vs. Limited Warranty. 30 FULL VS. LIMITED WARRANTY A full warranty: Must give the consumer the right to free repair of the product within a reasonable time or, After a reasonable number of failed attempts to fix the product, permit the customer to elect a full refund or replacement. Warrantor may not impose any time limit on the warranty’s duration, and CONTINUED 31 FULL VS. LIMITED WARRANTY Warrantor may not exclude or limit damages for breach of warranty unless such exclusions are conspicuous on the face of the warranty. Any warranty that does not meet these minimum federal standards must be designated as “limited.” A written warranty may not disclaim implied warranties, such as the implied warranty of merchantability. 32 ADVERTISING AND WARRANTIES State Lemon Laws - deal with warranties on new cars and new mobile homes. These lemon laws are designed to protect consumers from defective products that cannot be adequately fixed. For example, a new must conform to the warranty given by the manufacturer. If, after a reasonable number of attempts (usually four), the manufacturer or dealer is unable to remedy a defect that substantially impairs the value of the car, the car must be replaced or the purchase price refunded. 33 SALES PRACTICES Laws designed to protect consumers from unfair and deceptive trade practices often impose disclosure requirements of specific forms of sales practices: UCC provides for unconscionability, door-to-door sales require notice of a 3 day “cooling off” period during which the consumer can rescind the contract, pyramid schemes (multilevel marketing) involve the recruitment of additional sellers (or even receives commissions on the sales of the recruits) and telemarketing’s use of auto dialers and “900” numbers regulated by the Telephone Consumer Protection Act (TCPA) regulated by the FCC, requiring warranty labels on new and used cars, disclosures in real estate transactions. 34 CONSUMER CREDIT PROTECTION Truth-in-Lending Act (TILA) - requires clear disclosure of credit terms. – Applies only to credit transactions (for example, sales, loans, and leases) between creditors and consumers, not to credit transactions between two consumers. – Debtors must be natural persons - corporations and other entities are not protected. – Consumers may be required to arbitrate their claims if they agreed to do so when applying for credit. – improvement loans, and certain real estate loans in which the amount financed is less than $25,000. 35 TRUTH-IN-LENDING ACT (TILA) TILA has different requirements for Open-End vs. Closed-End Credit. – Open - occurs when the parties intend the creditor to make repeated extensions of credit (for example, Visa or MasterCard). – Closed - involves only one transaction (for example, a car or house loan). Regulation Z - applies to any credit contract in which payment is to be made in more than four installments and the credit is primarily for personal, family, or household purposes, e.g., car loans, student loans, home. 36 TRUTH-IN-LENDING ACT (TILA) Credit and Charge Cards - TILA limits the liability of credit card holders to $50 per card for unauthorized charges made before a card issuer is notified that the card has been lost or stolen. Once a card issuer has been notified, a card holder incurs no liability from unauthorized use. A credit or charge card company also cannot bill a consumer for unauthorized charges if the card was improperly issued by the card company. Home Equity Lending Plans - consumers a right of rescission generally available for three days if all procedures are properly followed by the lender, three years if they are not. 37 TRUTH-IN-LENDING ACT (TILA) Credit Advertising - any advertised specific credit terms must actually be available and that any credit terms (for example, finance charge or annual percentage rate) mentioned in the advertisement must be explained fully. Credit Billing - requires creditors, such as credit card companies, to respond to consumer complaints with an acknowledgment of the complaint, followed by a reasonable investigation to determine whether the complaint is justified. Companies cannot evade this requirement by canceling a cardholder’s account. 38 CONSUMER CREDIT PROTECTION Fair Credit Reporting Act (FCFA) - allows consumers to request all information (except medical information) on themselves, the source of the information, and any recent recipients of a report. The FCRA also gives consumers a right to have corrected copies of their credit reports sent to creditors. The FTC has primary responsibility for the enforcement of the FCRA. 39 CONSUMER CREDIT PROTECTION Use of Credit Reports in Employment Decisions - an employer must notify the individual in writing that a report may be used and obtain the individual’s consent. However, an employer may not rely on a credit report to take adverse action (defined as denying a job applicant a position, reassigning or terminating an employee, or denying a promotion), unless it first provides the individual with a “pre–adverse action disclosure.” 40 CONSUMER CREDIT PROTECTION Equal Credit Opportunity Act - prohibits discrimination in the granting of credit on the basis of race, color, religion, national origin, sex or marital status, age, applicants whose income derives from public assistance; and applicants who have exercised in good faith any right under the CCPA. 41 CONSUMER CREDIT PROTECTION Fair Debt Collection Practices Act - regulates debt collectors and debt-collection practices and provides a civil remedy for anyone injured by a violation of the statute. Electronic Fund Transfer Act (EFTA) and Debit Cards – On-Line Debit Cards (ATM cards) and Preauthorized Fund Transfers –PIN-protected cards issued by banks for use with automatic teller machines (ATMs) and point-of-sale transactions. Customer liability is usually limited to no more than $50 required to issue receipts with every ATM transaction. – Off-Line Debit Cards (which may bear the Visa or MasterCard logo) have the characteristics of both an ATM card and a credit card, and they can be used without a personal identification number. 42 FAIR DEBT COLLECTION PRACTICES ACT Case 21.4 Synopsis. Bartlett v. Heibel Heibel is an attorney hired by Micard Services, a credit card company, to collect a debt from Bartlett. Heibel sent Bartlett a “dunning” letter that stated what Bartlett needed to do to avoid litigation. The letter also contained close paraphrasing of the FDCPA language on the subject; Heibel then added additional language that was confusing or contradictory. Bartlett never read the letter. Bartlett sued Heibel claiming the confusing letter violated the FDCPA. Heibel’s defense was that Bartlett never read the letter. The trial court ruled for Heibel. ISSUE: Does a dunning letter violated the FDCPA by describing the debtor’s and collector’s respective rights in a way that confuses the debtor about his rights? HELD: REVERSED. The court of appeals ordered damages for Bartlett. The writing of the confusing letter violated the FDCPA. 43 STATE LAWS REGULATING CONSUMER CREDIT Uniform Consumer Credit Code (UCCC) - adopted in a few states. The UCCC is intended to replace a state’s consumer credit laws, including those that regulate usury, installment sales, consumer loans, truth in lending, and garnishment. Installment Sales - caps on the legal interest rate and permissible charges such as late charges and deferral charges. In addition, the state statutes discuss remedies and attorney’s fees, as well as any party’s right to assign the sales contract. Consumer Loans - generally, these statutes require compliance with the state’s usury statute, although often a lender may be granted an exemption from the usury statute by obtaining a specified license in the state. State Credit Card Regulation - usury statutes and credit card fee limits in effect in the state in which the credit card operation is located apply to all customers, regardless of where they live. 44 THE RESPONSIBLE MANAGER Complying with Consumer Protection Laws Managers should: – Ensure that employers are aware of, and in compliance with, various federal and state consumer protection regulations. – Procedures should be in place to educate employees about important consumer law topics, especially civil and criminal liabilities. – Product recalls may be necessary to correct a defective product. – Ethically issue a warning about a product defect it discovers after its product is sold. 45 THE RESPONSIBLE MANAGER Complying with Consumer Protection Laws Managers should: – Consider implementing and internal product safety committee to conduct regular product safety inspections. – Refrain from making claims that may be deceptive or false. – Be aware that many discriminatory practices in the extension of credit are illegal. – Endeavor to self-regulate or, at least, work closely with a regulatory agency to establish industry standards that meet the concerns of both the agency and the company. 46 REVIEW 1. Why does the TILA provide for a right of recission for home equity loans? 2. What can you, as a consumer, request under the Fair Credit Reporting Act? 3. What is “bait and switch” advertising? 47