Chapter 1

advertisement

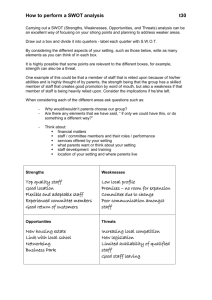

Chapter 20 Completing the Process 1 Chapter Goals 2 Complete the financial planning project. Explain the importance of planning integration. Demonstrate how PFP theory can improve the practice of financial planning. Use overall planning tools such as SWOT, scenario and sensitivity analysis. List the keys to a successful plan. Overview 3 Integration: The process of combining, of making something into a completed whole. In personal financial planning it means evaluating costs and benefits over time to find the best path to our goals. Integration is often overlooked or given less emphasis than is warranted. Given limited resources, you cannot make correct choices without weighing alternatives for spending your monies. PFP Theory Concepts underlying PFP theory: – – – – – – – 4 The household is an enterprise that operates like a business. The goal of PFP is to provide the highest standard of living possible for household “member-owners” over their life cycle. For a given time devoted to work, the goal becomes maximization of discretionary expenditures. Household finance supports the enterprise, which needs cash flow and appropriate methods for allocating its limited resources over time. Personal financial planning provides the strategic approach for solving household financial decisions. Personal financial planning decisions are made on an integrated basis that takes into account all household assets and liabilities. Total Portfolio Management provides the solution for personal financial planning’s overall objective and the household’s overall goal. PFP Theory, cont. 5 Distinguishing features and benefits of PFP theory: The Financial Plan 6 PFP theory explains how the PFP process should ideally be done. The financial plan, using the theory as an underpinning, is a mapping out of the practical steps through which a particular goal or goals are to be accomplished. For comprehensive financial planning, a detailed written financial plan is desirable. The Financial Plan, cont. A financial plan has several advantages: – – – – 7 It imposes overall structure on the process through specific steps that should be taken. It compels you to order your priorities and provide a specific financial solution using integrative techniques. In other words, it aids decision making. It presents a document to refer back to so that you can compare actual with projected results and refresh your memory as thoughts of the original steps fade. It provides a numerical base for adjustments as goals and resources change in the future. The need for the plan to integrate all financial actions arises from the limited resources households have. Actions in one area often affect planning for other activities. The Financial Plan, cont. 8 The need for the plan to integrate all financial actions arises from the limited resources households have. Actions in one area often affect planning for other activities. Before making final judgments it is advisable to examine your work by reviewing each step in the financial planning process and adding new tools that can help you in making integrated decisions. The series of questions we will next consider helps assure that you will complete the process properly. The Financial Plan, cont. Establish the Scope of the Activity – – Have you analyzed all areas that you intended to? Is the scope established broad enough? Gather the Data and Identify Goals – – Has all information been gathered and is it available for use? Has the true goal been ascertained? 9 For example, in a comprehensive plan, if provisions have been made for retirement, has long-term care insurance been considered? For example, the statement “I am satisfied with my current life style; my main goal is to have a roof over my head” can mask larger goals. The Financial Plan, cont. Compile and Analyze the Data – – – 10 Has all relevant data been analyzed? Have you given that data the depth of analysis it merits? Have SWOT, sensitivity and scenario analysis been considered? The evaluation process is the heart of planning integration in practice. The household is faced with many choices as to how to prorate its limited resources. The financial plan is the response. It specifies what the household intends to do with its current and future resources. The Financial Plan, cont. 11 Operating parts of the financial plan: The Financial Plan, cont. 12 The household resource problem can be viewed as a series of integrated capital expenditure decisions. Each part of the financial plan competes for capital. The household has to decide which capital expenditures to fund and in what amounts. Importantly, the plan looks at these decisions not only as current ones but as those that will take place over the entire life cycle. The following slide provides a visual portrayal of the planning process. The Financial Plan, cont. 13 Life cycle source and use of cash: SWOT Analysis SWOT analysis represents an appraisal of all the major factors that can enhance or detract from the outlook for goal achievement. SWOT: Strengths, Weaknesses, Opportunities, Threats. – – 14 Strengths and weaknesses are part of the internal household analysis. Opportunities and threats are identified through an examination of the external environment. SWOT analysis provides an overall assessment of the household’s situation. SWOT Analysis, cont. The external environment has an impact on the household. It includes political, legal, tax, social, economic, and technological variables closer to home as well as the industry you work in. Opportunities could arise from new regulations that result in a decline in income tax rates. Threats could incorporate: – – – 15 The distinct possibility of higher energy prices, which could result in a decline in your discretionary outlays. A movement toward larger houses, which could make your modest sized home less valuable. Involvement in an industry with declining prospects. SWOT Analysis, cont. SWOT analysis is intended to uncover new information and form a realistic appraisal for the planning future. It can also lead to changes in projections or practices. Our first choice is to overcome our threats by changing our practices. Yet we cannot deal with all threats directly nor do we want to. – 16 For example, if we have a job that is lucrative and enjoyable but it is in a highly risky industry, we may counter the threat by accumulating extra savings in case our income drops or we are laid off. We compare the SWOT assessment with our goals and plans. We may then provide for contingencies by taking additional risk management steps. SWOT Analysis, cont. 17 SWOT analysis by planning area: SWOT Analysis, cont. 18 Sensitivity Analysis Sensitivity analysis is identifying those factors that could significantly alter anticipated planning results. – – Perhaps the most popular form of this type of analysis is Monte Carlo simulation. – 19 It may be performed as part of SWOT analysis or as a standalone supporting analysis. Sensitivity analysis is sometimes more quantitatively based than SWOT. Monte Carlo isolates some key planning variables such as investment return and inflation and assesses how these affect planning outcomes. Scenario Analysis Scenario analysis observes the effect of changes in multiple variables or in one variable that influences many situations. – – – – – 20 Its stress on creating an overall changed environment distinguishes it from one-variable scenario analysis. For example, our projections of financial and other asset returns may be based on historical returns and the continuation of a normal economic environment. We may want to look at the impact of an alternative scenario. Given that scenario, our ability to save will be altered and we may have to consider the possibility of a temporary work layoff. In the event of such an economic outcome, the result could be a higher level of liquid savings to be drawn down. Develop Solutions and Complete the Plan Have all feasible solutions been considered? Some solutions may not give the highest revenues or result in the lowest risk but may cost significantly less to implement and therefore be the preferred course of actions. – 21 For example, the purchase of a disability policy that doesn’t cover some less important benefits upon disability but costs 25 percent less may be the best choice. Once the solutions have been completed in all areas of the plan and made to agree with current and projected resources, the plan is almost ready to be written. At this point a behavioral review can be helpful. Behavioral Review It is often not sufficient to identify a number, a required annual savings pattern to assure financial success. – – Financial plans need not be restricted entirely to numbers-oriented goals but can incorporate whatever goals people may have. Now is the moment to ask, perhaps for the last time: – – – 22 The financial plan must take into account human behavioral shortcomings. It can help prospects for ultimate success if the financial plan deals with all of these factors. – Does this plan make sense? Is it feasible to do? In reality, will it be carried out? If not, what can be changed to make it more practical? Writing the Plan Plans depend on the style of the writer. – Whatever the approach, a plan must be descriptive enough to refer back to and to be communicated to others. – – – – 23 Some people prefer long detailed plans with explanations for each recommendation while others prefer to get right to the point. Recommendations should be linked to goals. Provide the advantage and disadvantages of advice. Provide the type of future events that could change these recommendations. Provide a road map for implementation. Writing the Plan, cont. An ideal financial plan should have: – – – – 24 A summary at the beginning, Detail in each planning part, and A summary perhaps more oriented toward implementation at the end. A mix of: written information, numbers through tables, and figures that illustrate and enliven the text. Delivery of Plan 25 Where the plan is to be presented to others the relationship between recommendations and goals should be highlighted. An assessment of the person’s understanding of the plan should be made and assistance provided when necessary. Where it is apparent that the findings have not been fully comprehended, it is often advisable to let the person read the plan and “digest it.” Another face to face or phone meeting may be set up. Components of the Financial Plan 26 Components of the Financial Plan, cont. 27 Keys to a Successful Plan Keys: – – – – – 28 A specific statement is made indicating whether the goals are doable and the current household course is financially consistent with those goals. The important assumptions in the plan such as salary growth, financial investment returns, cost increases, retirement age, and longevity have been separately disclosed. Growth rates and inflation rates are coordinated. Steps have been taken to help with any human shortcomings and nonfinancial goals are given. Where appropriate, alternative solutions have been weighed. Before completing the plan, a review process has been undertaken that confirms that the financial figures and recommendations make sense and are attainable, given the personalities of the individuals. Monitoring the Financial Plan People’s lives can undergo significant change so financial plans should be reviewed periodically. In addition, plans should be reviewed periodically to measure actual results versus projected ones. – – Reviews should identify systematic, not cyclical, differences. – 29 When figures are materially different, reasons for the discrepancy should be found. If the reason stems from unrealistic plan assumptions, they should be changed. For that reason, reexamining plans too often can be counterproductive. Chapter Summary 30 PFP theory helps understand and sharpen actual practices. Integration of all household resources as performed through TPM or other methods can improve decision making and household performance. SWOT, scenario, and sensitivity analysis add other dimensions to the overall review process by providing “what if” analysis. All steps in the process should be reviewed prior to completion of the plan with relevant questions asked in each step. A behavioral review at decision time can provide a reality check on what can realistically be accomplished. A financial plan should incorporate among other things clear specific recommendations made after careful review procedures, state important assumptions, and weight alternative solutions to be successful. Periodic review can assure that initial plans remain relevant.