Lecture 3

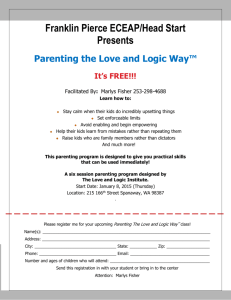

advertisement

Lecture 4 Strategy Formulation – Corporate Strategy Relationship between various strategic decisions Where and What? How? What is the current strategy, implicit or explicit? What assumptions have to hold for the current strategy to be viable? What is happening in the larger, social, political, technical and financial environments? What are our growth, size, and profitability goals? In which markets will we compete? In which businesses? In which geographic areas? Related to Competitive Strategy What do we do? Why are we here? What kind of company are we? What kind of company do we want to become? What kind of company must we become? What is our objective? What are the ends we seek? What is our current strategy, implicit or explicit? What courses of action might lead to the ends we seek? What are the means at our disposal? How are our actions restrained and constrained by the means at our disposal? What risks are involved and which ones are serious enough that we should plan for them? Related to Corporate Strategy Who are we? Related to Strategy in General Related to Mission & Vision Relationship between various strategy thoughts What is the current strategy, implicit or explicit? What assumptions have to hold for it to be viable? What is happening in industry, competitors, and in general? What are growth, size, and profitability goals? What products and services will we offer? To what customers or users? How will selling/buying decisions be made? How will we distribute our products and services? What capabilities and capacities will we require? Which ones are core? What will we make, what will we buy, and what will we acquire through alliance? What are our options? On what basis will we compete? Corporate Strategy Key issues to be dealt with in corporate strategy ◦ Directional Strategy ◦ Portfolio Strategy ◦ Parenting Strategy Includes decisions regarding the flow of financial and other resources to and from a company’s product lines and businesses Directional Strategy Key Questions ◦ Should we expand, cut back or continue our operations unchanged? ◦ Should we concentrate our activities within our current industry or should we diversify into other industries? ◦ How do we grow? Through internal development or through external acquisitions, mergers or strategic alliances? General orientations ◦ Growth strategies ◦ Stability strategies ◦ Retrenchment strategies Directional Strategy Growth • Concentration • Vertical Growth • Horizontal Growth • Diversification • Concentric • Conglomerate Stability • Pause/ Proceed with caution • No change • Profit Retrenchment • Turnaround • Captive company • Sell-out/ Divestment • Bankruptcy/ Liquidation Growth Strategies Most widely used strategies Companies can grow in 2 ways ◦ Internally by expanding operations both globally and domestically ◦ Externally through Mergers: similar size, mostly friendly, Acquisitions: one party is large, either friendly or hostile Strategic alliances: To obtain technology and/ or manufacturing capabilities To obtain access to specific markets To reduce financial risk To reduce political risk To achieve or ensure competitive advantage Mutual Service Consortia JV/ Licensing Arrangement Value Chain Partnership Continuum of strategic alliance Weak and Distant Strong and Close Growth Strategies Growth is a very attractive strategy for the following reasons: ◦ Growth typically masks weaknesses, provides organizational slack (unused resources), larger firms have more bargaining power ◦ More opportunities for employee advancement, exciting and ego-enhancing for CEOs Basic growth strategies ◦ Concentration Vertical Integration Horizontal Integration ◦ Diversification Concentric Conglomerate Vertical Integration Vertical growth can be achieved by taking over a function previously done by a supplier or by a distributor resulting in vertical integration Key drivers of vertical growth: gain control over resources, guarantee quality of a key input, access to potential customers Vertical integration types ◦ Backward or forward Transaction cost economics ◦ Transaction costs of buying goods on the open market vs. costs of managing the internal transactions Vertical integration continuum: Full Integration Taper Integration Quasi Integration Long-term Contract Vertical integration especially backward reduces agility of the company Horizontal Integration Expanding the firms products into other geographic locations and/or by increasing the range of products/ services offered to current markets Diversification Strategies Concentric diversification ◦ Strong competitive position ◦ Search for synergy to generate more profits together than they could separately ◦ Common thread through all businesses Conglomerate diversification ◦ Primary concern is with financial considerations of cash flow or risk reduction ◦ Cash-rich company with few opportunities to grow in the current industry ◦ Smoothening out of seasonal business, prevent threat to the current business Which growth strategy is the best? International Entry Options Exporting Licensing Franchising Joint Ventures Acquisitions Green-field development Production sharing (combining higher labor skills with low cost operations e.g. outsourcing) Turnkey operations (production setup) BOT concept (govt. contracts) Management Contracts (e.g. TCIL) Stability Strategies Pause/ proceed with caution strategy No change strategy Profit strategy Retrenchment strategies Turnaround strategy ◦ Contraction to quickly stop the bleeding ◦ Consolidation ◦ Frequently involves management change, ->situation analysis -> emergency action plan -> business structuring -> return to normalcy Captive company strategy: become a supplier to a larger company Sell-out/ Divestment strategy Bankruptcy/ Liquidation strategy Portfolio Analysis BCG Growth-share matrix GE Business Screen International Portfolio analysis BCG Growth share matrix GE Business Screen Market Attractiveness ◦ ◦ ◦ ◦ ◦ ◦ ◦ Growth Rate Mkt Size Demand variability Industry profitability Industry rivalry Global opportunities Macroenvironmental factors Business Unit strength ◦ ◦ ◦ ◦ ◦ ◦ Market Share Growth in Mkt share Brand equity Distribution channel access Production capacity Profit margin relative to competitors Hold Corporate Parenting Primarily for multi-business organizations Focus on core competencies of the parent organization Primarily driven by the corporate headquarters Not only define what new businesses to start but also defining the way the businesses will be managed Obtain synergy with various businesses Role is to facilitate and transfer the knowledge assets from the corporate company to the individual businesses Developing a corporate parenting strategy First examine each business unit (or target firm) in terms of its strategic factors Second examine each business unit (or target firm) in which performance can be improved Third, analyze how well the parent corporation fits with the business unit (or target firm) ◦ Corporate hq must be aware of its strengths and weaknesses in terms of skills, resources and capabilities Parenting-fit matrix Misfit between strategic factors and parenting characteristics High Ballast e.g. Laptop biz for IBM Alien Territory Heartland Heartland Edge of Heartland Value Trap Low FIT between parenting opportunities and parenting characteristics High