Notes - Holly High School

advertisement

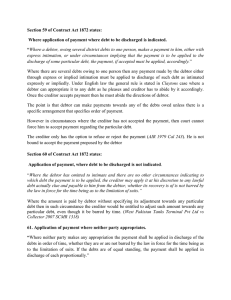

Chapter 33 Section 1 Tom Loshinskie Pledge ● Creditor may use debtor’s personal property as security ● Can be sold in case of a default ● Can be repledged, as long as debtor gets it back when debt is paid Pawn ● Legally regulated pledge ● Pawnbroker lends money and takes tangible property as security ● Pawnbrokers must be licensed Liens ● Allow creditor to sell debtor’s property ● Mechanic’s Lien: Allows someone who has not been paid to file a claim, the property will then be sold and the holder of the lien will be paid the amount they are owed Liens (cont.) ● Artisan’s Lien o Someone who has not been paid for a service, such as a repair, can keep the property until the service is paid for Suretyship ● Places a third party primarily liable for a debt ● Discharged by: o The debtor paying the debt in full o The creditor changing the contract without the surety’s consent ● Right of Contribution o Any cosurety who pays the full amount can file against the other cosureties for their proportionate amounts Guaranty ● Guarantor will pay if principal debtor fails to ● Creditor must sue debtor first ● Must be in writing and signed by guarantor Unsecured Debts ● Creditor may take unsecured debts: o o When debt is small If debtor has very good credit rating ● Upon default, creditor must sue debtor ● Creditor follows costly process to collect Garnishment ● Creditor’s claim must be shown valid and fair in court ● Creditor receives portion of debtor’s wages directly from debtor’s employers ● Total amount garnished is limited to 25 percent of the debtor’s pay Summary Creditors give money to debtors, but their primary concern is that the loan will be paid promptly. Creditors use secured debts to protect themselves from a defaulting debtor. There are pledges, which allow the creditor to have possession of a piece of the debtor’s property until the debt is paid. A lien gives the creditor the right to sell a property in the case of a default. There are also some secured debts that involve third parties, such as a suretyship and the guaranty relationship. Creditors may take an unsecured debt, however they must go through a costly procedure to sue in the case of a default. 33-2 Legal Protection of debtors and credit card users Isaac Roer/William Crawford Laws protecting unfair practice 1. setting maximum interest rates 2. requiring clear and complete disclosure of loan/lease terms. 3. Changing the terms of unconscionable contracts 4. Correcting specific abuses of the credit system 5. requiring the creditor to record a public notice when certain debts have been paid 6. allowing the debtor to take bankruptcy and thereby cancel most debts and start afresh Over-charging without options 1. Judge may refuse contractual obligations 2. Refuse to enforce the contract without the unreasonable charge 3. limit the clause's application so the contract becomes fair. Federal equal credit opportunity act 1. May not refuse based on sex, statues, race, religion. 2. May not ask the applicants marital statues 3. A creditor may not stop married women from using maiden name for their accounts. 4. Request info about birth control practices, or child carrying abilities or ideas. 5. married individuals have the right to see the credit history of both sides of a joint account Federal fair credit billing act 1. Creditors must mail bills at least 2 weeks before they are due and must be able to be acknowledged in 30 days 2. Creditors cannot send extensive letters for billing 3. Credit card holders may withhold payment for defective goods without being liable for the entire amount Credit repair organization act Credit repair companies cannot make false claims about its services, charge until they complete promised service, perform any service without a written contract and must have completed a 3 day wait period, Contracts with a repair service specifications the payment terms must include the total cost of the services repair companys name address and contact info a detailed description of the services performed How long it will take for the results guarantees offered Credit card requirements Card holder had asked for and received the credit card or had signed/used the card. Card issuer had given adequate notice of the possible liability for unauthorised use. Card issuer had provided the cardholder with a description of hot to notify the card is lost or stolen Credit card requirements Card issuer had provided positive means for identification on the card such as space for the holder’s signature or photograph Unauthorized use happend before cardholder notified issuer that card was lost or stolen Summmummummummary This section talks about nothing because books can’t speak but written upon the pages is things about liability. It went into detail about both the pledger and the pledgee. also the requirements that insurers and credit card issuers must follow. Chapter 33 Section 3-Bankruptcy James Welch and Abbie Huber Chapter 7-Liquidation • Involves the sale for cash of bank accounts, stocks, and bonds of the debtor who further distribute the proceeds to creditors • Results in the discharge of most of the debtor’s financial obligations • Chapter 7 bankruptcy can be denied if the debtors have income above the median income for similarly sized families in their state Chapter 11-Reorganization • Designed to keep a business organization (corporations, partnerships, or sole proprietorships) in operation with no liquidation • All creditors affected must accept this plan to reorganize • Chapter 11 procedure is for businesses whose debt does not exceed $2,000,000 Chapter 12-Debt Relief for Family Farms • Under this chapter, an individual, couple, or sometimes a corporation or partnership can file a petition for relief • The limit on total debt is more than $3,000,000 and the debt that must come from the farming operation is 50% Chapter 13-Extended Time Payment Plan • Available only to individuals who have regular income • Debtor must have unsecured debts less than $336,900 or secured debts less than $1,010,650 • Debtor must submit a plan of payment of debts within 3-5 years Required Information Filing In either voluntary or involuntary bankruptcy proceedings, the debtor must file the following information with the court: • A list of all creditors and amount owed to each • A list of all property owned, including property claimed to be exempt from seizure • A statement explaining the debtor’s financial affairs • A list of current income and expenses Non-Dischargeable Debts • Certain taxes • Alimony and child support • Claims against the debtor for property obtained by fraud, embezzlement, or larceny • Judgments against the debtor for willful and malicious injury to another • Student loans owed to the government or to a nonprofit school of higher learning, unless the loan was due more than seven years before the bankruptcy • Judgments against the debtor resulting from drunk driving Exempt Property • Real property, including co-op or mobile home, to $18,450 • Life insurance payments for person the debtor depended on for support • Life insurance policy with loan value, in dividends or interest to $9,850 • Alimony and child support • Pensions and retirement benefits • Public assistance • Social security • Unused portion of homestead exemption Exempt Property Cont. • • • • • • • • • • $475 per item of household goods up to a total of $9,850 Health aids Jewelry to $1,225 Motor vehicle to $2,950 Personal injury compensation payments to $18,450 Wrongful death payments Crime victims compensation Unemployment compensation Veterans’ benefits Tools of the debtor’s trade, books, and equipment to $1,850 Summary • In this section of Chapter 33, we learned the different forms of bankruptcy and the stages of each bankruptcy procedure. We also learned about the different forms of Chapter 7 under voluntary and involuntary bankruptcy. What we found interesting was the leeway allowed to farmers under Chapter 12 bankruptcy.