5. Interpreting Accounting Data

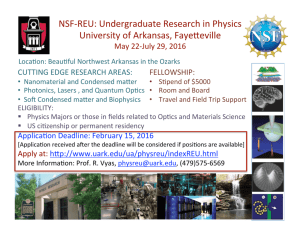

advertisement

Interpreting Accounting Data Interpreting Accounting Data We know That Accounting provides information for decision making However, the figures on any one set of financial statements are not especially revealing by themselves. The gain significance when compared to other Financial statements (either past ones or ones from other companies). They also become more important when they are expressed in a manner that indicates developing trends. Interpreting Accounting Data We know That Accounting provides information for: 1. Owners (or Management) 2. Creditors (or Banks considering lending money to the company) 3. Investors (when deciding whether to invest in the company) Interpreting Accounting Data Accounting Analysis There are 5 components that can be used when analyzing a company 1. Analysis of Comparative Financial Statements 2. Condensed Statement Analysis 3. Trend Analysis 4. Ratio Analysis 5. Comparison with a similar business & Analysis of Non-Financial Factors Analysis of Comparative Statements Comparative financial statements illustrate changes over several years Please open your textbook to page 659 and notice the changes in the Comparative Income Statement for McEwan Enterprises Interpreting Accounting Data What can you tell me about the difference in between Income Statements in 20-2 from 20-1 Revenue? COGS? Operating Expenses? Net Income? Condensed Financial Statements Condensed Statements (Income & Balance Sheet) provide single totals for key items on the statements Many of you saw these statements in your annual reports yesterday Please open your textbook to page 662 and notice how Cosentino Enterprises has a Condensed Income Statement to show the key amounts for each year Condensed Income Statements This can also be shown in Percentage (%) form. (bottom of 662) To change an Income Statement to Percentage Form, you will need to 1. Give a 100% Value to Net Sales 2. Divide all other numbers by the Net Sales total to get their percentage Example: Net Sales 450,000 Cost of Goods Sold 367,500 Condensed Balance Sheet Companies may also use Condensed Balance Sheets to compare Assets, Liabilities, and Owner’s Equity Page 663 You would calculate the Percentage of Current Assets, Fixed Assets, Current Liabilities, Long-Term Liabilities, and Owner’s Equity by using Total Assets as your base figure (like Net Sales in the Income Statement) Condensed Income Statements On page 664, you will see what a Common-Size Statement looks like Common-Size Statements show key items as percentages (from previous years), without dollar values Condensed Financial Statements My question is simple: Why do companies include these condensed financial statements in the annual report? Summarize lots of information into a few lines Easier to spot trends occuring within the business Example: Cost of Goods Sold becoming a larger part of the costs Direct your attention to one particular area of concern to focus on in further reports Trend Analysis Trend Analysis is used to forecast future results A company chooses a “base year” to which all other years are compared Example: Net Income in 2009 was $45 300,2010 was $46 400, 2011 $47 230 What would a reasonable projection for 2012? Trend Analysis Please see page 665 and Consentino Enterprises What conclusions can we make? Interpreting Accounting Data Practice Makes Perfect! Answer Questions 1,2,7,9,11,12 on page 666 Page 667 Ex 2,4,8,9