Situation Analysis - Samuel Price's ePortfolio

advertisement

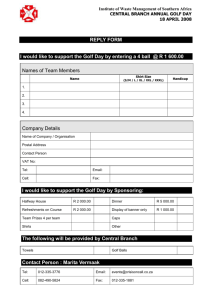

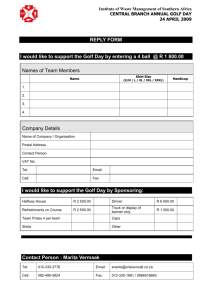

www.toptiergolf.com TOP TIER GOLF BALLS “IT’S NOT JUST THE BEST, ITS TOP TIER!” Situation Analysis Marketing 4562-001 Sam Price 10/9/2012 The GPS-1 Golf Ball that can make losing Golf Balls a thing of the past. This Golf Ball would be compatible with an Application that shows the location of the Golf Ball on the course. Our goal would be to partner with Golf Logix, who provides an application that shows a map of each hole on every public and private Golf course. Finally, we would use a reflective paint on the ball that would help golfers spot the ball in the open. This would work up to 50 to 100 yards from the tee box. I believe this offers an optimal advantage for each golfer, making it a must have. 1 www.toptiergolf.com Table of Contents 2.1 Company Overview………………………………………………………………………....2 2.1.1. Goals………………………………………………………………………….….2 2.1.2. Strategic Assets…………………………………………………………............. 2 2.1.3. Core Competencies……………………………………………………………....2 2.2 Market Overview…………………………………………………………………………....3 2.2.1. Customers………………………………………………………………………..3 2.2.2. Collaborators…………………………………………………………………….6 2.2.3. Competitors……………………………………………………………………...7 2.2.4. Context………………………………………………………………………......8 2.3 SWOT Analysis…………………………………………………………………………….9 2.3.1. Strengths……………………………………………………………………..….9 2.3.2. Weaknesses………………………………………………………………..…….9 2.3.3.Opportunities……………………………………………………………………10 2.3.4 Threats………………………………………………………………………..…10 2.4 Target Customers…………………………………………………………………...……..10 References……………………………………………………………………………...……...12 Exhibits………………………………………………………………………………………...13 2 www.toptiergolf.com Marketing Plan Top Tier Golf Balls October 2012 2. Situation Analysis 2.1. Company Overview 2.1.1 Goals Top Tier Golf Balls Inc. was incorporated in North Carolina on October 1, 2012. The corporate headquarters are located at 4259 B Fire Tower Rd, Greenville, North Carolina, 28590, where we currently have our support staff, manufacturing, and customer support. Our company goal is to develop the GPS-N1 Golf Ball into the number one choice for the golf player. An in-house strategic goal would be to develop social media networks to market our brand to consumers. One thousand followers on Facebook/Twitter would be a target goal. 2.1.2. Strategic Assets Our anticipated start up staff would be 20 employees, whom all are employed in the United States. Our anticipated infrastructure would be the (1) CEO, (2) Executive Design Officer’s, (3) Market Researchers, (4) Sales Department, and (5) Customer Service Department. Other strategic assets include intellectual property (pending patent application on both the GPS, reflective paint, and other materials used). In addition, our anticipated price would be $50 dollars a box (each box would include 12 balls). 2.1.3 Core Competencies Our core competency is producing a high end, top of the line golf ball that all customers feel meets their standards. We are currently exploring more manufacturing ideas that can better enhance our distribution channels. With this, we plan to hire and train expert salespeople on our GPS system that can help enhance our brand image. With these efforts combined, a customer base can be established. 2.2. Market Overview 2.2.1. Customers The game of golf has continued to grow in popularity over the years and this provides an optimal opportunity for many sporting goods businesses. With the rapid incline, more retailers are carrying golf products. During this transition; the demographic, geographic, psychographic, and behavioral attributes have changed. According to Umbrella Media, golfers can now be classified 3 www.toptiergolf.com into three profiles (Golf demographics, 2006). These buyer segments are occasional golfers, core golfers, and avid golfers. The following shows demographics for those segments: Occasional Golfers: U.S. Population (Age 18+) = 13,500,000. Average Income is $77,700, 87% are homeowners, 78% are married, and 42% have at least one child. o 65% are male with a average age of 44.3 years Two-thirds (64%) are between 18 and 49 60 % have an A.S, B.S, or graduate degree 46% are managers/professionals 77% are employed full time (Golf demographics, 2006) o 35% are female, average age of 44.5 years Slightly over two-thirds (68%) are between 18 and 49 53% have an A.S, B.S, or graduate degree 35% are managers/professionals 45% are employed full time (Golf demographics, 2006) Core Golfers: U.S. Population (Age 18+) = 7,900,000. Average household income is $79,900, 91% are homeowners, 78% are married, and 32% have at least one child. o 70% are male with a average age of 44.3 years One-thirds (29%) are between 18 and 49 55 % have an A.S, B.S, or graduate degree 44% are managers/professionals 70% are employed full time (Golf demographics, 2006) o 30% are female, average age of 44.5 years Slightly over one-thirds (38%) are between 18 and 49 48% have an A.S, B.S, or graduate degree 33% are managers/professionals 42% are employed full time (Golf demographics, 2006) Avid Golfers: U.S. Population (Age 18+) = 8,200,000. Average household income is $82,800, 92% are homeowners, 79% are married, and 17% have at least one child. o 69% are male with a average age of 44.3 years Almost half (48%) are between 18 and 49 58% have an A.S, B.S, or graduate degree 32% are managers/professionals 49% are employed full time (Golf demographics, 2006) 4 www.toptiergolf.com o 31% are female, average age of 44.5 years One-fifth (21%) are between 18 and 49 45% have an A.S, B.S, or graduate degree 36% are managers/professionals 35% are employed full time. (Golf demographics, 2006) An important question that must be answered is Exhibit 1 “What is the perception of the game of golf?” We see the demographics above but what are people’s perception of the Affordability, Accessibility, Environment, Economic benefit, and Healthiness of golf? Exhibit 1 represents a survey done by SGMA (Sporting Goods Manufacturers Association). This information remains important because it provides us with how successful golf is. Without the game, the ball doesn’t matter. (Abrams, 2011) Exhibit 2 (SimplyMap, 2011) In terms of geographic characteristics, we characterized our statistics by the amount of sporting goods sales in 2011. The overall market produced 73 million dollars in sales. For Top Tier Golf Balls, we believe this offers a great opportunity for us to succeed. In Exhibit 2, it shows the total dollar amount of sporting goods sales in each state. In addition we researched our home state and broke down sales by county. This allows us to determine which markets have the highest sales in North Carolina. Those numbers are shown in Exhibit 3: Exhibit 3: Rank 1 2 3 4 5 6 7 8 9 Name Wake County, NC Mecklenburg County, NC Guilford County, NC Forsyth County, NC Cabarrus County, NC Durham County, NC Buncombe County, NC New Hanover County, NC Gaston County, NC Value Rank Name 258,685.00 13 Dare County, NC 241,451.00 14 Orange County, NC 123,302.00 15 Onslow County, NC 92,986.00 16 Alamance County, NC 86,310.00 17 Moore County, NC 81,129.00 18 Wayne County, NC 80,209.00 19 Carteret County, NC 61,285.00 20 Nash County, NC 52,478.00 21 Craven County, NC 5 Value 30,629.00 25,850.00 20,228.00 19,525.00 17,249.00 15,107.00 14,158.00 14,017.00 12,855.00 www.toptiergolf.com 10 Catawba County, NC 11 Cumberland County, NC 12 Pitt County, NC 50,606.00 45,152.00 40,046.00 22 Rowan County, NC 23 Watauga County, NC 24 Wilson County, NC 12,722.00 11,904.00 11,247.00 (SimplyMap, 2011) Finally, our growth and profitability has a direct correlation to all the research provided above. This research allows us to properly position our product in order to reach the customers eye. We can do this through retailers such as Dicks Sporting Goods, Hibbett Sports, Pro Golf, etc. In addition, marketing our product nationally on the Golf Channel and other media outlets could help establish brand awareness. 2.2.2 Collaborators Consumers who are interested in purchasing our golf ball can visit (1) Retailers (brick mortar locations carrying sporting goods), (2) Online, (3) Television/Media, and Golf Logix (Phone Application). This offers our customers a convenience by allowing multiple options for purchasing. 1) Occasional Golfers: a. Retailers: Companies such as Dicks Sporting Goods would collaborate in pricing, distribution, branding, and channel offering. By putting Top Tier Golf Balls in retailers that are nationally recognized, we can establish a brand image for our ball. The incentives that the retailer offers can also add value. In addition, their employees can communicate benefits to the customer. 2) Core Golfers: a. Online: Retailers can provide incentives online just as well as they can in store. One loss would be salesperson communication, but many customers have turned to online shopping. Some opportunities could exist with QVC, golf-related websites, ESPN, etc. Also, our company website would provide ordering options and information. 3) Avid Golfers: a. Television/Media: Commercials and advertisements on the golf channel, ESPN, etc. could help reach our target market. Most golfers watch these channels, therefore enhancing the viewing of our ads. b. Golf Logix: Golf Logix is an app for phones that allows the golfer to see every hole on every public/private golf course. By collaborating with Golf Logix, we could enhance their app to show the GPS location of the ball after each shot. That would include distance and a hot/cold indication once the golfer is close. With our partnership, both Top Tier Golf Balls and Golf Logix would team up in marketing 6 www.toptiergolf.com for each other’s product. Golf Logix would also offer us a customer base incentive. 2.2.3. Competitors The competitors of our GPS golf balls offer many products including clubs, accessories, and equipment. Based on the buyer segments identified in 2.2.1, the competitors for each segment are: 1) Occasional Golfers: a. Nike: “Nike Inc. was established in 1962 by Phil Knight and Bill Bowerman” (Schmidt, 2012). “Nike’s principal business activity is the design, development and worldwide marketing of high quality footwear, apparel, and equipment/accessory products” (Schmidt, 2012). Currently, Nike Inc. holds an established market share of 3.8%. However, this represents all of their business segments. 2) Core Golfers: a. Callaway Golf Company: Callaway Golf was established in 1982 and was reincorporated in 1999. “The company designs, develops, manufactures and markets golf clubs (drivers, fairway woods, irons, wedges and putters) and golf balls” (Schmidt, 2012). Exhibit 4 represents the total market share for Callaway golf in comparison to the overall market. i. Exhibit 4: (Schmidt, 2012) b. “Over the five years to 2012, firm revenue is expected to contract 6.9% annually on average to $418.7 million” (Schmidt, 2012). Like others in this industry, Callaway experienced difficulty from 2007 to 2012. The experienced difficulty was cited to be “due to the effects of the recession and rising import penetration” (Schmidt, 2012) Exhibit 5 represents Callaway Golf’s financial performance: i. Exhibit 5: 7 www.toptiergolf.com (Schmidt, 2012) 3) Avid Golfers: a. Radar Golf: Developed by Chris Savarese. “Sells high-performance balls, implanted with a pepper-granule-size microchip, and a locating device. Using positioning system technology with a range of 30 to 100 feet, the locating device produces an audio tone that becomes faster as you near the missing ball” (Grass, 2011). 2.2.4. Context In relation to our three buyer segments, the five factors of the environment include: 1) Occasional Golfers: a. Economic: Currently the industry is “Declining.” Cost could be a make or break in a purchase decision. b. Technological: Not a must have, many prefer cheaper priced technology. c. Sociocultural: More consumers are buying and playing the sport. d. Regulatory: Pricing for the average box of golf balls are anywhere from $16.99 to $24.50. e. Physical: Exhibit 1 (page 3) shows that 58% of consumers believe that golf helps with providing a healthy lifestyle. 2) Core Golfers: a. Economic: The declining economy has been an issue for some sporting goods manufacturers. This could cause a toss up with a purchasing decision. Depends on the competitors pricing. b. Technological: More intrigued about technological advancements. More likely to pay a premium price. c. Sociocultural: The average age has changed over the years as more young people are beginning to play the game. d. Regulatory: Many are young players, advertise to parents. 8 www.toptiergolf.com e. Physical: Many consumers now walk rather than ride a cart for exercise. 3) Avid Golfers: a. Economic: Outsourcing presents an opportunity to increase profit margin due to cheaper cost overseas. b. Technological: Most sales for Top Tiers Golf ball could come from this buyer segment. Typically spends the most on golf products. c. Sociocultural: Most people are becoming more tech. savvy. d. Regulatory: Currently patents are pending on the GPS technology as well as the reflective paint. e. Physical: For most golfers, the most popular time of the year for golf is in the summer, fall, and spring. 2.3. SWOT Analysis (Exhibit 6) Strengths Weaknesses 1) Technology 1) Presence in International Market 2) Top Engineers 2) Price Versus Competitors 3) Only GPS Golf Ball on the Market 3) Possible Ball Regulations Opportunities Threats 1) Golf taking off Overseas 1) Knock-off's 2) Golf Accessories 2) New Entrants 3) PGA Player/Tournament Sponsors 3) Declining U.S. Economy 2.3.1 Strengths Technology: The technology in the GPS-N1 is unmatched by any competitor. The GPS technology and design of the ball is unparalleled to other top name brands. The size of the GPS has no effect to the quality or carry of the ball. Some minor modifications were made, but these changes had a positive impact. Top Engineers: The development of the GPS-N1 proves that Top Tier has the best product design engineers in the industry. Top Tier is the first to engineer a way to embed a tiny GPS locater in the core of the ball. In addition, the reflective paint used on the ball is also a feature that differentiates Top Tier from its competitors. Only GPS Golf Ball on the Market: As mentioned above, other companies such as Radar Golf has developed locaters that use audio sounds to determine how close the player is from the ball. This does not compare to the GPS feature, which with Golf Logix shows the exact location of the ball. 2.3.2. Weaknesses 9 www.toptiergolf.com Presence in International Market: While the middle class is being established internationally (golf taking off overseas), Top Tier currently has not researched or tried to test market that area. With the youth of this company, we believe Top Tier is better positioned to market itself in the United States first. Price versus Competitors: The price of our ball will be higher than the average ball because of the technology included. This could be a weakness as competitors could maintain customer loyalty with the cheaper price. Possible Ball Regulations: The non-pro golfer would have no issue with using this ball. However, if we attempt to market our ball to professional tournaments there’s a chance that this technology may not be approved. 2.3.3. Opportunities Golf taking off Overseas: If Top Tier is successful in the United States; the popularity of golf overseas could offer more opportunities. Golf Accessories: There’s the opportunity to expand the brand into other products such as hats, gloves, polo’s, and etc. PGA Player/Tournament Sponsors: If approved, there’s the opportunity to have player sponsorships and tournament sponsorships. It could be from the college ranks to the professional ranks. This could provide increased brand awareness and recognition. 2.3.4. Threats Knock-offs: With patents pending, there’s always the chance of knock-offs. However, a benefit is that this technology would be extremely difficult to copy. New Entrants: Companies like Callaway, Nike, and Radar Golf could quickly develop product design teams to come up with a competing product. Especially if Top Tier shows extended success. Declining U.S. Economy: With the declining economy, some consumers may stick to purchasing cheaper golf balls. While we can market that a customer can find their ball, it may be a struggle to build that image from scratch. 2.4. Target Customers With researching each our three buyers segments, Top Trier Golf balls can use the knowledge discovered to position it’s product to the right target customers. In this case, our target customers are the avid golfers and core golfers. Those two segments possess the attributes that meet our product attributes. Since our ball will cost higher than most competitors, the core and avid golfers would be more likely to want and buy the technology. The occasional golfer will not be targeted as apart of our marketing scheme but can still be reached through collaborators such as retailers and online shops. This offers the opportunity for customers that may transition from the occasional golfer to the core or avid golfer. As we further 10 www.toptiergolf.com research and investigate target markets, we can make decisions on how to better reach and serve our customers. 11 www.toptiergolf.com References Abrams, J. (2011, 07). Growing golf. Retrieved from http://www.nationalclub.org/news/2011/08/01/news_articles/growing_golf/ Golf demographics. (2009). Retrieved from http://www.umbrellamedia.com/products/golfmedia/golf-demographics Grass, J. (2011). Gps golf ball. Retrieved from http://www.radargolf.com/news/articles/072007.asp Schmidt, D. (2012, 08). Athletic & sporting goods manufacturing in the us. Retrieved from http://clients1.ibisworld.com.jproxy.lib.ecu.edu/reports/us/industry/default.aspx?entid=895 SimplyMap. (2011). Retrieved from http://ww.simplymap.com.jproxy.lib.ecu.edu 12 www.toptiergolf.com Exhibits Exhibit 1: Exhibit 2: Exhibit 3: Rank 1 2 3 Name Wake County, NC Mecklenburg County, NC Guilford County, NC 4 5 6 7 8 9 10 Forsyth County, NC Cabarrus County, NC Durham County, NC Buncombe County, NC New Hanover County, NC Gaston County, NC Catawba County, NC 11 Cumberland County, NC 12 Pitt County, NC Value Rank 258,685.00 13 241,451.00 14 123,302.00 15 92,986.00 86,310.00 81,129.00 80,209.00 61,285.00 52,478.00 50,606.00 16 17 18 19 20 21 22 45,152.00 40,046.00 23 24 13 Name Dare County, NC Orange County, NC Onslow County, NC Alamance County, NC Moore County, NC Wayne County, NC Carteret County, NC Nash County, NC Craven County, NC Rowan County, NC Watauga County, NC Wilson County, NC Value 30,629.00 25,850.00 20,228.00 19,525.00 17,249.00 15,107.00 14,158.00 14,017.00 12,855.00 12,722.00 11,904.00 11,247.00 www.toptiergolf.com Exhibit 4: Exhibit 5: Exhibit 6: Strengths Weaknesses 1) Technology 1) Presence in International Market 2) Top Engineers 2) Price Versus Competitors 3) Only GPS Golf Ball on the Market 3) Possible Ball Regulations Opportunities Threats 1) Golf taking off Overseas 1) Knock-off's 2) Golf Accessories 2) New Entrants 3) PGA Player/Tournament Sponsors 3) Declining U.S. Economy 14