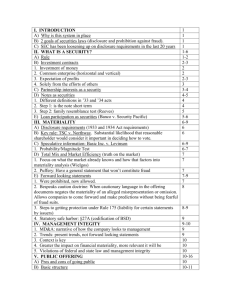

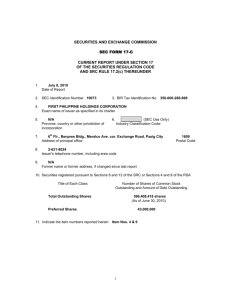

Liability under Securities Act of 1933

advertisement