Using Financial Indicators to Communicate with

advertisement

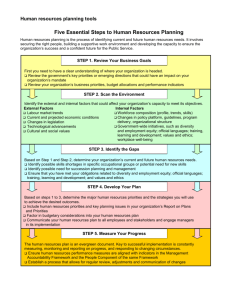

Using Key Indicators as a Tool to Communicate with Your Lender … or, How to Keep Your Loans in Place in 2007 Jeff Baldwin Emma Shinn 1 Multiple Choice Quiz: 1. When your banker asks you for your plan, the best approach in communicating with your banker is to: a.Give them a plan, and make it look really good b.Give them a plan that is so confusing they won’t be able to tell how well you are doing c.Don’t give them anything d.None of the above 2 Multiple Choice Quiz: 2. When you are about to miss your plan, the best approach in communicating with your banker is to: a.Act like everything is going to be okay and you will catch up in December b.Present so much detail he won’t be able to figure out what is going on c.Don’t say anything and hope it will get better d.None of the above 3 Communicating with Your Lender Topics include … 1. Builder Financing 101 … a few basics about capital requirements and sources 2. The Lender’s Point of View … your capacity to service debt 3. Key Indicators Used by Lenders … how they evaluate your health 4 1.1.Builder BuilderFinancing Financing101 101 Builders often need financing for: Work in process Spec inventory Other working capital Land acquisition and development Other fixed assets, ventures or investments 5 Capital Requirements and Sources Ask yourself the following questions: How will the funds be used? What sources of financing provide funds for this purpose? How much financing is needed? Who provides financing of this size and duration? REMEMBER! Don’t finance long-term assets with short-term debt! What collateral is available? What sources of financing do/do not require collateral? How quickly is financing needed? What sources are most easily approachable? REMEMBER! Investors take a long time to decide! 6 The answers to these questions will help you target the right sources and types of financing … And avoid the common mistake of financing a long term need, such as land development, with short term borrowing 7 Three Important Steps 1. Know your requirements: – Purpose, size, timing 2. Determine the appropriate type and source of financing: – Work in process or other working capital loan – Construction loans – Land acquisition & development, or other “project” loans – Other capital investment 3. Present a business plan which demonstrates that cash flow will service the debt 8 Demonstrate Your Strategic Thinking Process Analysis Strategic Decisions Detailed Planning Business Plan Market Definition Competitive Analysis Market Targeting Market Segmentation Market Positioning Financial Plan Marketing Programs Production Products Operating Results Financial Condition Management Sources of Funds Users of Funds Management Plan Production Plan Market Plan Management & Staffing Revenue & Expenses Cash Flow 9 Provide financial projections that: Demonstrate your “strategic” thinking Demonstrate sound execution strategies Are consistent with your business plan Are supported by key assumptions Identify the key revenue and cost drivers and include the key performance indicators … 10 2. Lender’s Point of View… In order to obtain the most appropriate financing, the builder needs to understand the concerns of the lender. 11 Capacity to Service Debt Banks usually consider the big picture … Sources: Government publications •Domestic and foreign influences and bank policy ECONOMIC PERSPECTIVE: •Regulation and policy •Technological change •Market / customer expectations INDUSTRY PERSPECTIVE: Sources: Internet, databases, regional news services and industry specific publications •Industry life cycle •Industry benchmarks •Competitive pressures •Capacity (supply and demand) OPERATIONAL PERSPECTIVE: Sources: Business plan, •Management site visit and meetings, •Processes and controls industry expertise •Production efficiencies •SWOT analysis 12 Currently, there are Red Flags at all levels … ECONOMIC PERSPECTIVE: •Federal deficit •Interest rates •Market expectations INDUSTRY PERSPECTIVE: •Mortgage defaults •Sales decline •Inventory levels OPERATIONAL PERSPECTIVE: •Management experience •Cycle times •Inventory levels: land & WIP 13 When you ask lenders about the current environment: “… what do you look at for home builder loans that is different from the past?” Many respond with two words: Staying Power 14 How do lenders evaluate “Staying Power”? Debt to equity Liquidity, i.e., current ratio and working capital Components of working capital, i.e., inventory, specs, etc. Note that all of these are balance sheet indicators – which many builders ignore 15 One thing has not changed … The single most important factor in the bank’s decision to lend, is the company’s … Capacity to service debt Lender’s often evaluate this by looking at several key indicators. 16 3. Key Indicators Used by Lenders Key indicators are criteria that help to evaluate the financial condition, or health, of a company. These criteria include both financial ratios and other signs that point to the health - or sickness - of a company. 17 Key Financial Indicators Lenders examine key indicators related to these areas: Liquidity and financial stability Balance sheet and capital structure Turnover of assets Cash Flow Operating performance – Return on assets – Return on equity – Benchmark to industry standards Sales trends 18 Key Financial Indicators Definitions of the most common financial ratios: Ratio Current Ratio Definition Current Assets / Current Liabilities Asset Turnover Sales / Total Assets Debt to Equity Total Liabilities / Net Worth Net Profit Margin Net Profit / Sales Return on Assets Net Profit / Total Assets Return on Equity Net Profit / Total Equity 19 Key Financial Indicators The primary financial ratios used : Ratio Best Okay Red Flag Debt to Equity < 2.5 ~ 4.0 > 7.0 Current Ratio > 1.5 ~ 1.2 < 1.0 Net Profit to Sales > 10% ~ 4% <0 Gross Profit to Sales > 25% ~ 20% < 15% 20 Key Financial Indicators The secondary financial ratios used: Ratio Best Okay Red Flag Return on Assets > 25% ~ 10% < 5% Asset Turnover >3 ~2 <1 Inventory Turnover >2 ~2 <2 Specs to Total Inventory < 10% ~ 25% > 50% 21 Key Financial Indicators Other financial ratios sometimes used: Ratio Best Okay Red Flag Operating Expenses to Sales > 12% ~ 16% > 20% Revenues to Working Capital > 10 12-14 > 17 Months of Interest Carried > 24 18 > 18 Profit on Equity > 50% 25-40% < 15% Percentage of Profit Distributed > 50% ~ 50% > 70% 22 When bankers are concerned about the accuracy and reliability of financial statements provided by a company, they often consider other indicators: • Track record of meeting sales and delivery commitments • Cash balances • Credit history and terms that suppliers are offering • Supporting evidence that tax payments and payroll obligations are current • Sales prices and trends • Sales pace and trends • Reputation among competitors, creditors, and 23 within industry Footnote: Your lender is likely to have their own criteria – talk to them to find out what they are looking for. 24 Remember . . . Your lender is your most important “Strategic Alliance” … Get them in the loop, and keep them there. 25