Correct

advertisement

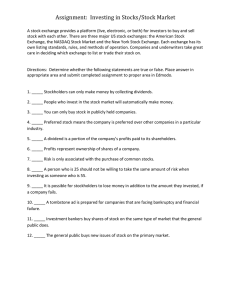

Home of the Bulls and the Bears Can you think of a product that has been so wildly successful that you wish you were the person who originally thought of it? Imagine how well off you would be if you had started Nike, the athletic shoe company! The truth is, you don’t have to be the next hamburger magnate or the brains behind a hot-selling tennis shoe. With a little money and a lot of ingenuity, you can get a cut of the action, too. How? By investing in the stock market. When you buy stock in a company, you become a part owner. And with ownership comes the opportunity to cash in on the company’s success. Taking Stock • Only companies that are incorporated under state and federal laws can “go public,” or sell stock. • There are two basic types of stock: – Common and Preferred. • Common stock …is the most common! – Dividends – the money paid to stockholders – are determined by the corporation’s board of directors. – If the company had a good year, the board might increase the dividend. Common Stock… • Is the most common! • Dividends – The money paid to stockholders, – Are determined by the corporations board of directors. • If the company had a good year, the board might increase the dividend, and… • If the company had a bad year, or if the board decides the corporation needs to reinvest some of its profits to make it stronger, it may decide to cut the dividend or even omit it! Preferred Stock • Is so called because its stockholders receive preferential treatment. • Preferred shareholders are paid their dividends first and the dividend is not based on the corporation’s profits. The amount is fixed. • Even if the company has a very profitable year, the stockholder only receives the specified amount. It can be withheld if business is down but must be paid later. More on Preferred Stock • Preferred stock is less risky than common stock, but it does not offer the opportunity for exceptionally high dividends. • AND… most preferred stock carries no voting rights, whereas common stockholders vote for members of the board of directors and decide important issues. The New York Stock Exchange • Stock is bought and sold on stock exchanges. • The largest and most prestigious is the New York Stock Exchange, abbreviated NYSE. • The “Big Board,” as it is called is located on Wall Street in New York City. The Origins of the NYSE • In the 1700’s an informal gathering took place for merchants and traders to buy and sell stocks of banks and insurance companies. • In 1792, they decided to meet at the same time every day under an old sycamore tree on Wall Street to take orders to buy and sell stocks. On the Floor of the NYSE • At 9:30 a.m. EST every business day, the world’s most fascinating financial drama begins and ends at 4:00 p.m. • The trading floor is the size of a football field and five stories high. • The floor is described as “organized chaos.” • It is noisy and crowded as brokers, clerks and messengers dart about (no running is allowed) the four rooms that make up the trading floor. • All 3,000 people who work here buy and sell stock for customers at the best possible price. Other Exchanges • The American Stock Exchange – abbreviated ASE or AMEX. – Formed 60 years after the NYSE. • The National Association of Securities Dealers Automated Quotation System – NASDAQ, an automated communications system lists about 5,000 companies. – This is the Over-the-Counter market, OTC, and offers shares of smaller, younger companies. – Almost all new issues trade here before graduating to the NYSE or AMEX. High-Tech Trading • One of the strengths of the system is fairness; an order for 100 shares from a factory worker in Detroit competes equally with an order for a million shares from the nation’s largest pension fund. • Thousands of electronic devices on the trading floor practically eliminate paperwork and processing errors. • Every trade on the NYSE floor is recorded on the stock ticker, an electronic device that reports transactions shortly after they occur. • An order placed in Los Angeles can be processed in New York within 30 seconds. Bulls and Bears • Popularly used to describe ups and downs in the market. • If the market is called bearish, that means more people want to sell stocks than buy them. Share prices then fall. • If it is bullish, more people want to buy than sell, and prices rise. Reading the Stock Tables • The newspaper, particularly the financial section, is an investor’s best friend. • Stories printed daily provide clues that can help investors spot trends useful in developing investment strategies. • The daily stock market quotations report on the previous day’s trading activity. • Reading the newspaper stock table is not difficult. The total value of the stock listed on the NYSE is $3.9 trillion, making the exchange the largest in the world. Here’s the Information • 1.Company Name – The name of the company is abbreviated. The names are alphabetized by the company’s full name, not by the abbreviation. • 2.Dividend (DIV) - This indicates the ANNUAL payment per share. Dividends are usually paid quarterly, every four months the stockholder will be paid ¼ the amount shown. Info Continued • 3.Price Earnings Ratio (PE) – The PE ration, or yield, is the price of the stock divided by its earnings per share. High PE stocks are typically young, fast growing companies. • 4.Sales Volume or Number of Shares Traded – The trading volume for the day is listed in hundreds. If the number is 56, then 5,600 shares were traded that day. If a “z” precedes the number, then that was the actual number of shares traded. i.e. z30 means 30 shares were traded, not 3,000. Info Continued • 5.Close – This number is the last trading price recorded when the market closed for the day. It represents the price of one share. • 6.Net Change or Change – This is the difference between the last closing price reported for the day and the last closing price reported for the preceding day. A “-” before the number indicates the stock price was down by that amount. A “+” indicates the stock price was up by that amount. Stock Table Footnotes • 1. pf – This indicates the listing is for preferred stock – shares that have a fixed rate of return. (If there is no “pf” following the company’s name, it is common stock.) • 2. s – This means the company has had a stock split within the last 12 months. • 3. n – This stands for “new issue.” It means the stock has just been offered within the last 12 months. Footnotes Continued • 4. u – This letter next to the 52-week high figure means the price is a new high within the last 52 weeks. • 5. d – This letter next to the 52-week low figure indicates the price is a new low within the last 52 weeks. • 6. v – Trading halted. • 7. vj – In bankruptcy or receivership. Buy Low, Sell High… • When you decide to buy stock, the first person you want to talk to is a stockbroker. • Stockbrokers work for a stock brokerage, or brokerage house. • They buy and sell for you, and for this service, they earn a commission or fee. CharlesSchwab Orders to Buy, Orders to Sell • When a stockbroker buys or sells stock for a customer, it is called “placing an order”. • There are different types of orders: – A market order is an order to buy or sell immediately at the best price available. – Buying “at the market” is the most common form of trading. – A limit order specifies a price; • Example: You tell the broker to buy 100 shares of Nike at $50.25 per share, but the price has climbed to $50.75 by the time your order reaches the floor, no sale will take place. Round Lots and Odd Lots • Stock orders can be placed in either round lots or odd lots – A round lot is 100 shares, – Any order less than 100 shares is considered an odd lot. Fluctuating Prices • Fluctuations in the price of a stock during the trading day can be explained by supply and demand. – When a lot of people want to buy; the stock price will rise. – When most people want to sell, the price will fall. • The price may rise or fall due to: – Factors affecting the company or industry. – Whether the stock market as a whole is moving up or down. – Current events, either national or global. – Or for no apparent reason! AP Business What Causes the Market to • Ups and downs in the stock market are perfectly normal; the bear and the bull balancing each other. • When many people rush to sell their shares, the balance is thrown off and gets out of kilter. • In stock market terms…IT CRASHES. • The greatest crash to date occurred in 1929, thereafter known as Black Thursday. What Happened on Black Thursday • Stock prices plummeted as investors suddenly decided to sell their stocks for a profit. • As other investors saw stock prices begin to fall, they too hurried to sell. • The frenzy of selling activity had a negative impact on the country for years afterward. • With nobody investing money in the stock market, businesses could not grow. • When businesses failed, people lost their jobs, and without paychecks they could not buy goods and services. • Still more businesses failed and there was a tremendous economic decline lasting about 12 years. Takeovers, Mergers and Tender Offers • A merger is the acquisition of one company by another. – It occurs when one company purchases enough shares of another company’s stock in order to have a controlling interest. – Mergers must be approved by the company’s board of directors and shareholders. • If the merger does not have the cooperation of the target company’s board, it is called a takeover… Takeovers • A takeover is accomplished in one of three ways: – By buying up a company’s stock on the open market, – Buying its stock through private transactions, – Or issuing a tender offer to the company’s board of directors. • A tender offer is an offer to buy a company’s stock at a stated price and by a stated time. • To gain control of the target company, the tender offer price is usually above the current market price. – A takeover becomes hostile when the target seriously objects to being acquired and nothing, not even a higher price, is likely to change the board’s mind. Other Stock Concepts • Stock split - is the division of a corporation’s outstanding shares into a larger number of shares; – Example: a 2-for-1 split by a company with 1,000,000 shares outstanding would increase the total shares outstanding to 2,000,000. – A stockholder with 100 shares before the split would have 200 shares after the split. – The immediate value of the new stock would be half the value of the old. – Stock splits make the company’s shares more affordable, thereby attracting more investors. Other Stock Concepts… • Oversubscribed – Stockbrokers begin taking orders for new stock offerings before the new stock is issued. • Sometimes this results in more buyers for an offering than there are shares. • The stock becomes oversubscribed and the price usually goes up when it comes out – a classic example of supply and demand. • Brokers refer to the stock as a “ hot issue .” Other Stock Concepts… • Buy-Backs – When a company buys back a portion of its stock, usually because the stock has fallen below a certain price. • Shares reacquired by the company revert to treasury stock, meaning: – The stock can be sold later for a profit if the price rises. – It does not pay a dividend or vote. • After a buyback, the remainder of issued and outstanding shares usually increase in value. People Invest For Growth or Income • A growth stock is one that pays low dividends, or no dividend, but is very likely to increase in value over time. • When you buy a growth stock, you hope to make a profit by later selling for more than you paid. • An income stock is one that has a strong record of paying dividends and is likely to continue. • If you want income, look for stocks with high dividend yields. • The yield is the percentage of a stock’s price that is paid out to the investor each year. Let’s Figure Yield • To calculate a stock’s yield, divide the annual cash dividend per share by the price of the stock. – Example: You have stock worth $100 a share and you get a dividend of $2.50 per share each quarter, or $10 a year. • 10/100 = .10 or 10% means the yield (sometimes called “return”) on your stock is 10% What the Indexes Indicate • The Dow Jones Industrial Average – Developed in the 1800’s by Charles Dow, an editor of The Wall Street Journal, • He believed he could track rises and falls in the stock market by looking at the performance of a handful of carefully selected stocks. – There are 30 stocks used to compute the Dow Jones Average. • A complex weighted average of those 30 stock prices is calculated to determine the daily change in the average. • The result is a clear reflection of the stock’s performance and the overall market in general. • Some companies included in the Dow are: General Electric, McDonald’s Corp., Exxon, Dupont and AT&T. A New Day is Dawning… • The market is open to ALL investors. It is a level playing field because all buyers and sellers are anonymous. A hundred years ago, it was unusual for women to be involved in the stock market. In fact, they were not allowed on the floor. Today, women play active roles in the market. Buy! Buy! Buy! Sell! Sell! Sell! Catch you at the open!