Handout 5

advertisement

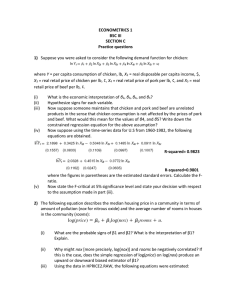

Research Method Lecture 5 (Ch6) Multiple regression: Further issues © 1 Effects of data scaling on OLS statistics. Consider the following labor supply equation for married women. Hours =β0+ β1(non wife income)+ β2(experience)+ β3(education)+ β4(# kids aged less than 6)+ u Hours: the woman’s annual hours worked Non wife income: wife’s non labor income (such as husband’ s income) in $1000. Estimate the model using MROZ.dta 2 Question: What is the effect of measuring non-wife-income in $1 instead of in $1000? What is the effect of measuring wife’s labor supply in days-equivalent (i.e., days=hours/8)? 3 Standardizing a variable The effects of some variables, such as test scores, are often difficult to interpret: For example, what does it mean by the effect of increasing the test score by 1 point on wage? In such case, it is often better to standardize the variable first, then include it in the model. That is; include the following variable instead. (TestScore TestScore) (Sample standard deviation of TestScore) 4 Then coefficient on the variable will tell you the effect when test score increases by one standard deviation from the mean. 5 Example Using HPRICE2.dta, estimate the effect of environment (measured by nox) on housing price. Standardize nox before including in the model. In the model, include (crime), (dist), (rooms) and (stratio). 6 . use "D:\My Documents\IUJ_teaching\Research Methodology\Wooldridge Econometrics resources\data\HPRICE2.DTA", clear . . egen sd_nox=sd(nox) . egen mean_nox=mean(nox) . . gen nox_standardized=(nox-mean_nox)/sd_nox . . reg price nox_standardized crime dist rooms stratio Source SS df MS Model Residual 2.7223e+10 1.5603e+10 5 5.4445e+09 500 31205611.6 Total 4.2826e+10 505 price Coef. nox_standa~d crime dist rooms stratio _cons -3135.118 -153.601 -1026.806 6735.498 -1149.204 5851.014 84803032 Std. Err. 410.1726 32.92883 188.1079 393.6037 127.4287 4075.662 Number of obs F( 5, 500) Prob > F R-squared Adj R-squared Root MSE t -7.64 -4.66 -5.46 17.11 -9.02 1.44 P>|t| 0.000 0.000 0.000 0.000 0.000 0.152 = = = = = = 506 174.47 0.0000 0.6357 0.6320 5586.2 [95% Conf. Interval] -3940.993 -218.2969 -1396.386 5962.177 -1399.566 -2156.519 -2329.244 -88.90505 -657.227 7508.819 -898.8422 13858.55 7 Including quadratic terms Often you would like to capture ‘diminishing marginal returns’. For example, the effect of experience on wage may face diminishing marginal returns. To capture such effects, include quadratic term. Log(wage) =β0+β1(experience)+β2(experience)2+u If β2 is negative, experience faces diminishing marginal returns. 8 Note that the effect of education is given by ∂log(wage)/∂(experience) =β1+ 2β2(experience) So, the effect changes with experience. Exercise 1: Use MROZ.dta, estimate the above equation. What is the effect of increasing experience by 1 year on wage evaluated at the average experience? Exercise 2: What is the effect of increasing experience by 1 year on wage for those with experience equal to 1? 9 . use "D:\My Documents\IUJ_teaching\Research Methodology\Wooldridge Econometrics resources\data\MROZ.DTA", clear . reg lwage exper expersq Source SS df MS Model 9.38142005 2 4.69071002 Residual 213.946021 425 .503402402 Total 223.327441 427 .523015084 lwage Coef. Std. Err. t P>|t| Number of obs = F( 2, 425) = Prob > F = R-squared = Adj R-squared = Root MSE = 428 9.32 0.0001 0.0420 0.0375 .70951 [95% Conf. Interval] exper .0476388 .0140012 3.40 0.001 .0201185 .0751591 expersq -.0010159 .0004177 -2.43 0.015 -.0018369 -.0001949 _cons .8075371 .1000761 8.07 0.000 .6108314 1.004243 10 Interaction terms Consider you estimate the following production function Log(Q)=β0+β1log(labor)+β2log(capital)+u This model assumes that the effect of labor on output is independent of the effect of capital. But, workers may be more productive if they have more capital. So in reality, there is an interaction effect 11 between labor and capital. To capture such interaction effects, you can include an interaction term, like: Log(Q)=β0+β1log(labor)+β2log(capital) +β3log(labor)log(capital)+ u The effect of labor on output is now give as ∂log(Q)/∂log(labor) =β1+β3log(capital) So the effect of labor depends on the amount of capital. 12 Exercise: using HPRICE1.dta, estimate the following model Price=β0+β1sqrft+β2bdrms+β3(sqrft)(bdrms)+ u Question 1: Is there positive or negative interaction effect between the size of the house and the # of bedrooms? Question 2: What is the effect (sqrft) on price of house evaluated at the average # of bedrooms? Question 3: What is the effect of (bdrms) on price 13 of house evaluated at the average size of house? . do "C:\Users\SHINGO~1\AppData\Local\Temp\STD04000000.tmp" . use "D:\My Documents\IUJ_teaching\Research Methodology\Wooldridge Econometrics resources\data\HPRICE1.DTA", clear . gen sqrft_bdrms=sqrft*bdrms . reg price sqrft bdrms sqrft_bdrms Source SS Model Residual 600164.068 317690.438 3 200054.689 84 3782.02902 Total 917854.506 87 10550.0518 price sqrft bdrms sqrft_bdrms _cons df Coef. Std. Err. .0326205 -35.95534 .023448 181.6908 .0436415 24.01237 .0101573 92.18885 MS Number of obs = F( 3, 84) = Prob > F = R-squared = Adj R-squared = Root MSE = 88 52.90 0.0000 0.6539 0.6415 61.498 t P>|t| [95% Conf. Interval] 0.75 -1.50 2.31 1.97 0.457 0.138 0.023 0.052 -.0541655 -83.70657 .0032491 -1.636817 .1194065 11.79589 .043647 365.0184 14 Adjusted R-squared The usual R-squared is given by R2 1 Almost ˆ 2 but different SSR SSR / n 1 SST SST / n 2 Almost S y but different The adjusted R-squared is given by SSR /( n k 1) R 1 SST /( n 1) 2 It is equal to ˆ 2 It is equal to S 2 y 15 The usual R squared always increases if you add additional variables (even if it does not make sense to add some variables). The adjusted R squared imposes a penalty to adding additional variables because it divides SSR by (n-k-1). The adjust R squared can also be written as R 2 1 (1 R 2 )(n 1) /( n k 1) 16 Controlling for too many factors in regression After learning the omitted variable bias, one may be tempted to control for as many factors as possible. But this often lead students to control for factors that shouldn’t be controlled for. Next slide shows the example. 17 Suppose you would like to see the effect of beer tax on traffic fatalities. The idea is that beer tax will reduce beer consumption, which would lead to fewer fatalities. So you may estimate (Fatalities)=β0+β1(beer tax) +β2(Percentage of male in town) +β3(percentage of young drivers) +β(other variables)+u 18 Question is whether you should also control beer consumption. Like: (Fatalities)=β0+β1(beer tax) +β2(beer consumption) +β3(Percentage of male in town) +β4(percentage of young drivers) +β(other variables)+u The answer to this question is NO. Beer tax would affect fatalities mainly by reducing beer consumption. So, it does not make sense to hold beer consumption constant when you examine 19 the effect of beer tax on fatalities. Different models serve different purposes Suppose that you would like to estimate the gender salary gap among academic economists. One possible model is to include female dummy together with rank dummies. Log(salary)=β0+β1(Female) +β2(FullProf) +β3(AssocProf) +(other variables)+u 20 The above model estimates the gender salary gap while holding rank constant. Thus, the female coefficient captures the gender salary gap within each rank. However, females may be discriminated in terms of promotions as well, and this would indirectly cause gender salary gap. 21 If you would like to evaluate the gender salary gap that is caused by (i) discrimination in terms of salary and (ii) the discrimination in terms of promotion combined, it makes sense to drop rank variables from the model. When you drop rank variables (i.e., FullProf and AssocProf), then female coefficient will show the salary gap that is caused by salary discrimination and promotion discrimination combined. 22