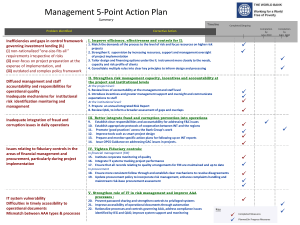

Management 5-Point Action Plan Summary

advertisement

Management 5-Point Action Plan Summary October 2010 Timeline Completed/Implemented Problem Identified Inefficiencies and gaps in control framework governing investment lending (IL) (i) non-rationalized “one-size-fits all ” requirements irrespective of risks (ii) over-focus on project preparation at the expense of implementation, and (iii) outdated and complex policy framework Diffused management and staff accountability and responsibilities for operational quality Inadequate mechanisms for institutional risk identification monitoring and management Inadequate integration of fraud and corruption issues in daily operations Issues relating to fiduciary controls in the areas of financial management and procurement, particularly during project implementation IT system vulnerability Difficulties in timely accessibility to operational documents Mismatch between AAA types & processes Corrective Action I. Improve efficiency, effectiveness and controls for IL 1. Match the demands of the process to the level of risk and focus resources on higher risk projects 2. Strengthen IL supervision by increasing resources, support and management oversight of project implementation 3. Tailor design and financing options under the IL instrument more closely to the needs, capacity and risk profile of clients 4. Consolidate multiple rules into clear key principles to inform design and processing II. Strengthen risk management capacity, incentives and accountability at the project and institutional levels At the project level: 5. Review lines of accountability at the management and staff level 6. Introduce incentives and greater management support and oversight and communicate expectations to staff At the institutional level: 7. Prepare an annual Integrated Risk Report 8. Review QAG, to inform a broader assessment of gaps and overlaps III. 9. 10. 11. 12. 13. 14. Better integrate fraud and corruption prevention into operations Establish clear responsibilities and accountability for addressing F&C issues Establish appropriate protocols of cooperation between INT and the regions Promote ‘good practices’ across the Bank Group’s work Improve tools such as smart project design Prepare and monitor specific action plans for following up on INT reports Issue OPCS Guidance on addressing GAC issues in projects. IV. Tighten Fiduciary controls: In financial management (FM) 15. Institute corporate monitoring of quality 16. Integrate IT systems tracking project performance 17. Ensure that all records relating to quality arrangements for FM are maintained and up to date In procurement 18. Ensure more consistent follow through and establish clear mechanisms to resolve disagreements 19. Update procurement policy to incorporate risk management, enhance complaints handling and mainstream risk-base procurement assessment V. Strengthen role of IT in risk management and improve AAA processes : 20. Prevent password sharing and strengthen controls to privileged systems 21. Improve accessibility of operational documents through automation 22. Rationalize processes and controls governing AAA, address compliance issues identified by IEG and QAG; improve system support and monitoring Completion by June 2011