Globalization of Major Manufacturing Sectors

advertisement

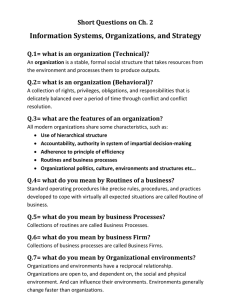

Globalization of Major Manufacturing Sectors • Textiles & Garments: classic case of laborcost deviation Figure 7.8 • Steel – Movement to rapidly industrializing countries (Figure 7.10) • Automobiles (Figure 7.13, 7.14) • Electronics (Figure 7.16, 7.17) • S-Curves – Figure 7.15 – the concept is drawn from the industrial design literature – File on line is from MIT Opencourseware site – www.ocw.mit.edu Changing Geography of U.S. Manufacturing 1990-2000 % Change Manufacturing Employment Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa -6% -13% 16% 8% -7% 10% -23% -18% -23% -5% 5% -13% 22% -4% 8% 10% U.S. Total -3% Kansas 12% Kentucky 12% Louisiana 0% Maine -16% Maryland -12% Massachusetts -16% Michigan 5% Minnesota 10% Mississippi -5% Missouri -8% Montana 11% Nebraska 19% Nevada 68% New Hampshire 1% New Jersey -20% New Mexico 2% New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming -22% -8% 48% -2% 8% 9% -9% -26% -9% 45% -2% 11% 22% 5% -9% -4% -7% 10% 21% Date of Maximum Employment in Manufacturing Urban-Rural Manufacturing Trend 1991-2004 International Movement of U.S. Manufacturing • Rise of F.D.I. • Shifting locations of F.D.I. – 1945-1960 Canada & Latin America – 1950’s Western Europe – 1960’s onward – a global reach • Cumulative employment abroad of 500 largest U.S. corporations equaled domestic employment • Most investment in advanced economies Global Employment of U.S. MNC’s China? Key Trends for U.S. Manufacturers • Large overseas markets pull U.S. manufacturers into them • The growth of nontariff barriers are forcing localization of production abroad • Regional trading blocs push investment strategies and pull firms into these organizations to get benefits • Shifting exchange rates are pushing firms to be flexible as to where they have capacity • New manufacturing methods are reshaping the distribution of manufacturing capacity • Large factories in low-skill labor regions are not sustainable The Rise of Flexible Production Systems • The historic development of manufacturing moving from fragmented small-scale facilities to vertically integrated corporations – The Fordist Paradigm • The contemporary development of other paradigms – just-in-time; total-qualitycontrol; flexible manufacturing systems – Fig. 7.21 • Consequences of these new developments on plant size and labor force skills From Fordist to Flexible Production The End of Fordism? The Flexibility Debate • Are we not only entering a new long-wave, where IT is the driving force, but also a new long-wave in which the basic structure of productive relations is in massive shift? • The Fordist paradigm - implicit in the oligoplistic model - but also linked to consumption and the regulation of society/consumption • Limits to the flexibility argument – can all industry move in this direction? NO! A new regime of accumulation? (1) The emergence of clusters of small firms, including co-ops (2) Flexibility related to new machines (3) Labor’s new position - functional flexibility (multiskilling) - numeric flexibility - financial flexibility - more part-time, flex time, telecommuting (4) Changes in market place conditions - mass markets break down - rise of niche (craft) markets Fordism Low technological innovation Fixed product lines, long runs Mass marketing Steep hierarchy, vertical chains of command Mechanistic organization Vertical and horizontal integration Central planning bureaucracy Mass unions, centralized wage-bargaining Unified class formations, dualistic political systems Institutionalized class compromises Standardized forms of welfare Prescribed courses in education Standardized assessment (O level) Class parties, nationwide Post-Fordism Accelerated innovation High variety of product, short runs Market diversification & niching Flat hierarchy, more lateral communication Organismic organization Autonomous profit centers; network Systems; internal markets within firm; outsourcing Professionalism, entrepreneurialism Localized bargaining, core and periphery; workforce divided; no corporatism Pluralistic class formations; multi-party systems Fragmented political markets Consumer choice in welfare Credit transfer, modularity, self-guided instruction, independent study Teacher-based assessment (GCSE) or selfassessment Social Movements; multi-parties; regional diversification Emergence of Flexible Specialization • Fragmentation of the Fordist firm - vertical disintegration (shedding non-central functions; outsourcing) and Market fragmentation (niche) • Adoption of new technologies, especially those dependent upon computers and telecommunications (CAD/CAM/FMS) • Labor force adjustments – functional flexibility (multiskilling) – numeric flexibility (adjusting quantities by task) – financial flexibility (wage rate adjustment) – more part time, short-term, temporary work Flexible specialization & new industrial spaces • Piore & Sabel - The Second Industrial Divide - craft-based districts in Italy, Germany, Denmark • Clusters of high tech industry - Silicon Valley; Route 128; Austin • Wooden boats in Pt. Townsend WA; Log homes in Bitterroot Valley MT • The movie industry Debates over aspects of the flexibility thesis Flexible Specialization and Regional Industrial Agglomerations: The Case of the U.S. Motion Picture Industry by Michael Storper & Susan Christopherson • Historically, an oligopoly of – theaters – studio production facilities – actors/production specialists – spatially clustered in Southern California • Vertical disintegration: 1950’s - 1970’s, with consequences in the 1980’s Productions by Organization Type 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% Independent Major Mini-major 1960 1965 1970 1975 1980 151 190 207 243 222 Number of productions per year The Proliferation of Establishments Production Companies Rental Studios Properties Editing Lighting Recording/Sound Film Processing Film effects Market Research Artist representatives/talent agencies Total 1966 563 13 66 4 2 20 43 10 3 242 966 1974 709 24 33 31 16 33 76 27 5 359 1313 1981 1473 67 184 113 23 187 55 42 24 344 2512 Establishments in the Entertainment Industry 19681997 1968 666 490 Motion pictures except TV Motion picture & tape for TV Services allied to motion picture production NA Total 1156 1974 1279 978 716 2973 1981 1023 1420 1077 3520 1997 data from U.S. County Business Patterns; in the 1987 revision of the SIC code motion pictures was combined into a single industry 1997 8916 6343 15259 The Decreasing Size Per Establishment Combined Motion Pictures and TV Motion Pictures Television Allied Services 1969 23.2 21.2 NA 1974 11.2 20.8 21.3 1981 25 24.1 16.9 1997 7.4 10.7 California’s domination of the industry - measured by jobs Jobs California-pictures New York-pictures Others-pictures California-allied services NA New York-allied services NA Others-allied services NA 1968 15449 6687 3713 1974 20329 4596 9753 1981 40433 8625 10779 1997 31791 8169 25578 9663 3110 2501 12205 3135 2829 125935 7897 41089 Structural Trends – Motion Pictures & Television • Retention of core activities: TV & Major films & channels of distribution • Forced divestiture of theater chains • Development of generic specialists subcontracting with specific producers for a given film & narrow scope; linked to major studios; many part-time workers; “project orientation,” FLEXIBILITY • Product diversification: TV, Video, Film • Establishments clustered in California, while filming locations have dispersed The Post-Fordist System is also more efficient Role of IT within and between firms; logistics revolution Business Process Reengineering • Division of labor rationalized • Employees are empowered to a greater degree • Tasks are harmonized in other than a linear sequence • Processed batches have multiple versions, allowing scale economies simultaneous with custom producton • Work is undertaken where it makes most sense geographically (recall the 787 production system) • Internal structures are simplified / more coordinated and more decentralized Downsizing as a consequence • The growing angst over outsourcing • The debate over its magnitude • The debate over what to do for workers impacted • The debate over public policy towards it • The expectation that IT will fuel dramatic restructuring, accompanied by logistical sophistication: Friedman’s “flatteners” Friedman’s Ten Flatteners: •Outsourcing •Offshoring •Open- Sourcing •Insourcing •Supply Chaining •In-forming (search engines) •The Internet •Fall of the Berlin Wall •Netscape’s Public Offering •Work Flow Software •The Steroids (Digital, Mobile, Personal and Virtual) He argues together they have allowed unparalleled collaboration The “New Economy” • Rising productivity compared to recent years • The growing importance of IT producing industries • The growing productivity in IT using industries • Finally, investment in IT appears to be having an economy-wide impact Labor Productivity and IT Intensity All Less IT Intensive GDP/FTE Growth Error in Legend! Source: Digital Economy 2003 A Common Outcome of this Turbulence: The Product Life Cycle Demand Conditions Very few buyers Competitive Structure Very few competitors Growing number of buyers Entry of new competitors Technology Rapid change Less rapid change Peak demand Declining demand Steep falloff in demand Shakeout of weakest competitors Stable Exit of some population competitors of competitors Some change, but increasingly stable technology Sales Volume Initial Growth development Maturity Decline Obsolescence Examples of the Product Life Cycle Fashion clothes Automobiles Generations of Boeing airplanes …….but not all products follow this trajectory: Levi 501 shrink-to-fit jeans “Coke” & name brands that play off product stability: Tiffany; L.L Bean; Campbell’s Soup Spatial Reorganization within Large Business Organizations •Dynamism in firm activities: their size, number, function, and geographic configuration •Inherent flexibility of multiplant firms - either insitu change or locational shift LOCATIONAL SHIFTS IN SITU CHANGE Expansion of existing capital stock Replacement of existing capital stock Reduction of existing capital stock partial divestiture Investment at new location(s) opening of branch plant(s) Acquisition of plant(s) owned by another firm Divestment of existing plant(s) closure or disposal Relocation of entire plant and equipment Healey’s adjustment framework 1 O + Operating Plant Product A Product B Product C 2 4 3 Plant Shut Down Transfer of Production Initial Conditions 2 1 2 1 + 3 4 Specialization 3 +1 +2 +3 +4 +3 4 Partial concentration Complete concentration at an existing site at a new site 1 Mixed +2 Evolution of Global Corporations Stage I 2 Stage II • • 1 • • • • 1 o 2 3 Headquarters • Production plant o Sales subsidiary + Licensing arrangement Acquisition Exports + 4 3 Stage III 5 • 2 • • • 1 3 + 4 Evolution of Global Corporations Stage IV • 6 • 2 • • • ••1 • o 8 3 Headquarters • 7 5 • Stage V • • 4 • 6 9 • 2 Production plant o Sales subsidiary + Licensing arrangement Acquisition Exports • 5 • • • 1 • 8 3 7 4 • 9 Summary • Global concentrations of manufacturing, but they are not static • Capital moves from place to place in the search for profit • Multinational corporations and processes of FDI have reshaped the geography of manufacturing • Today Schumpeter’s process of “creative destruction” is fueled by IT, logistics, and the rise of new production regimes built around more flexible manufacturing systems