Human Resource Management 11e.

advertisement

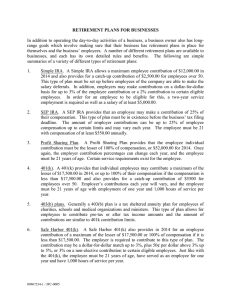

Managing Employee Benefits Benefits • Benefit An indirect compensation given to an employee or group of employees as a part of organizational membership. • Strategic Perspectives on Benefits Benefits absorb social costs for health care and retirement. Benefits influence employee decisions about employers (e.g., recruitment and retirement). Benefits are increasingly seen as entitlements. Benefit costs average over 40% of total payroll costs. How the Typical Benefits Dollar Is Spent Source: Based on information from the U.S. Department of Labor, Bureau of Labor Statistics, National Compensation Survey: Employee Benefits in Private Industry in the United States, 2003; and Employee Benefits Study, 2003 ed. (Washington, DC: U.S. Chamber of Commerce, 2004). Strategic Benefits Considerations Benefit Design • Decisions Affecting Benefit Design: How much total compensation? What part of total compensation should benefits comprise? What expense levels are acceptable for each benefit? Which employees should get which benefits? What are we getting in return for the benefit? How will offering benefits affect turnover, recruiting, and retention of employees? How flexible should the benefits package be? Common Measurements of Benefits Effectiveness Benefits as a percentage of payroll (pattern over a multiyear period) Benefits expenditures per full-time equivalent (FTE) employee Benefits costs by employee group (full-time vs. part-time, union vs. non-union, office, management, professional, technical, etc.) Benefits administration costs (including staff time multiplied by the staff pay and benefits costs per hour) Health-care benefits costs per participating employee Security Benefits • Worker’s Compensation Benefits provided to persons injured on the job. • Unemployment Compensation A Federal/state payroll tax that funds state unemployment systems. Involuntary unemployment and actively seeking work is required for persons to claim benefit. • Supplemental Unemployment Benefits (SUB) A union-negotiated benefit provision that pays a supplemental amount to laid-off employees who are drawing unemployment compensation. Security Benefits (cont’d) • Severance Pay A security benefit voluntarily offered by employer to employees who lose their jobs. Payments are determined by the employee’s level within the organization and years of employment. Other benefits (e.g., outplacement and continued health insurance) may be offered in lieu of cash severance payments. Retirement Benefits • Book VI of the Labor Code of the Philippines, under the heading Post Employment covers the employee's retirement and benefits and social insurance. The section covers the support and funds an employee benefits for retirement from the Government under the stipulation of the Philippine law, either through pensions or savings. The term 'employee' represents an individual who is legally employed under the Philippine law, or any person compulsorily covered by the SSS under Republic Act 1161 or any person compulsorily covered by the GSIS under the Commonwealth Act 186. REPUBLIC ACT NO. 7641 REPUBLIC ACT NO. 7641 • The term 'retirement plan' (or superannuation) refers to a pension (benefits in retirement) granted when an employee retires from work upon reaching the retirement age established in the collective bargaining agreement or other applicable employment contract. Characteristically, the retirement benefit plan is a life annuity, a financial contract wherein the life insurance company GSIS or SSS makes a series of payments to the annuitant in the future in exchange for a series of regular immediate payments, prior to the onset of the annuity. REPUBLIC ACT NO. 7641 • Under existing laws and any collective bargaining agreement and other agreements, when the annuity is in effect, the employee is entitled to receive the employee retirement benefits, or in the strictest sense, the pension according to the amount as he/she has earned. Provided, however, that the employee's retirement benefits shall not be less than those provided therein under any collective bargaining and other agreements. NATIONAL HEALTH INSURANCE ACT OF 1995 • AN ACT INSTITUTING A NATIONAL HEALTH INSURANCE PROGRAM FOR ALL FILIPINOS AND ESTABLISHING THE PHILIPPINE HEALTH INSURANCE CORPORATION FOR THE PURPOSE. • There is hereby created the National Health Insurance Program which shall provide health insurance coverage and ensure affordable, acceptable, available and accessible health care services for all citizens of the Philippines, in accordance with policies and specific provisions of this Act. This social insurance program shall serve as the means for the healthy to help pay for the care of the sick and for those who can afford medical care to subsidize those who cannot. • There is hereby created a Philippine Health Insurance Corporation, which shall have the status of a tax-exempt government corporation attached to the Department of Health for policy coordination and guidance. REPUBLIC ACT NO. 7841 HOME DEVELOPMENT MUTUAL FUND LAW OF 1980 • The government, in pursuit of the constitutional mandates on the promotion of public welfare through ample social services, as well as its humanist commitment to the interest of the working groups, in relation particularly to their need for decent shelter, has established the Home Development Mutual Fund - a system of employee-employer contributions for housing purposes. THE GOVERNMENT SERVICE INSURANCE SYSTEM ACT OF 1997 • Compulsory Membership. - Membership in the GSIS shall be compulsory for all employees receiving compensation who have not reached the compulsory retirement age, irrespective of employment status, except members of the Armed Forces of the Philippines and the Philippine National Police, subject to the condition that they must settle first their financial obligation with the GSIS, and contractuals who have no employer and employee relationship with the agencies they serve. • Except for the members of the judiciary and constitutional commissions who shall have life insurance only, all members of the GSIS shall have life insurance, retirement, and all other social security protections such as disability, survivorship, separation, and unemployment benefits. REPUBLIC ACT NO. 8291 SOCIAL SECURITY ACT OF 1997 REPUBLIC ACT NO. 8282 Other Benefits Credit Unions Purchase Discounts Stock Investment Family-Care Benefits Family-Oriented Benefits Social and Recreational Relocation Expenses Benefits Life, Disability, Legal Insurances Educational Assistance Time-Off Benefits • Holiday Pay Eligibility • Vacation Pay Eligibility and scheduling • Leaves of Absence • Paid Time-Off (PTO) Plans Combine all sick leave, vacation time, and holidays into a total number of hours or days that employees can take off with pay. Flexible Benefits • Flexible Benefit Plan A plan (flex or cafeteria plan) that allows employees to select the benefits they prefer from groups of benefits established by the employer. • Problems with Flexible Plans Inappropriate benefits package choices Adverse selection and use of specific benefits by higher-risk employees Higher administrative const