Quiz for Chapter 16 - the Home Page for Voyager2.DVC.edu.

advertisement

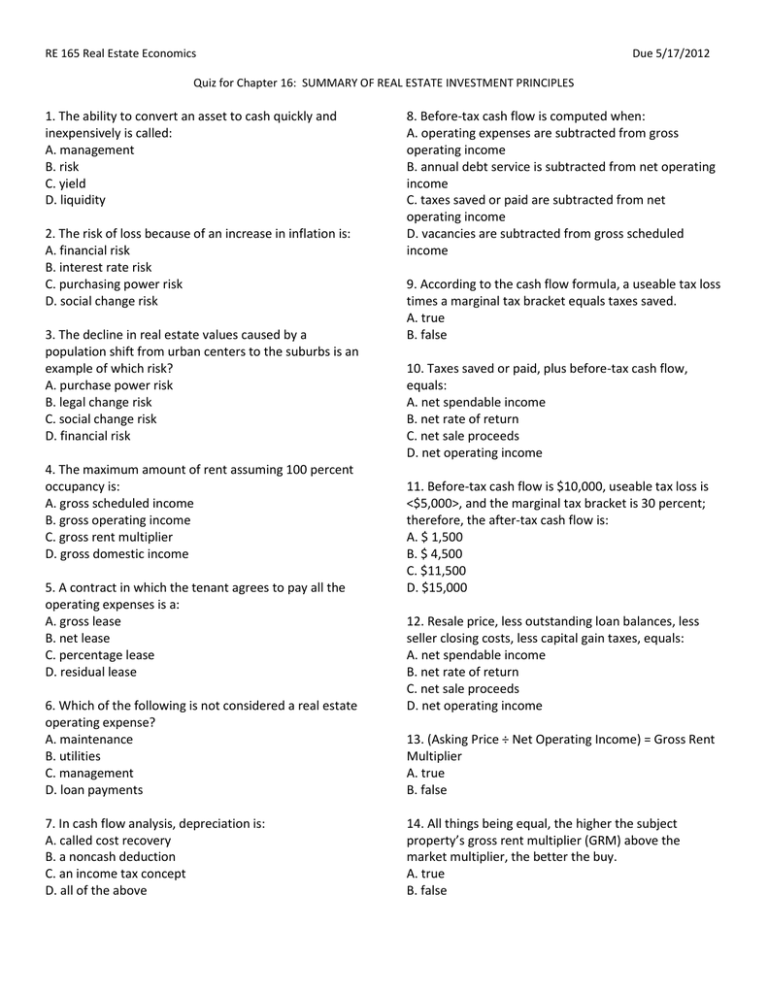

RE 165 Real Estate Economics Due 5/17/2012 Quiz for Chapter 16: SUMMARY OF REAL ESTATE INVESTMENT PRINCIPLES 1. The ability to convert an asset to cash quickly and inexpensively is called: A. management B. risk C. yield D. liquidity 2. The risk of loss because of an increase in inflation is: A. financial risk B. interest rate risk C. purchasing power risk D. social change risk 3. The decline in real estate values caused by a population shift from urban centers to the suburbs is an example of which risk? A. purchase power risk B. legal change risk C. social change risk D. financial risk 4. The maximum amount of rent assuming 100 percent occupancy is: A. gross scheduled income B. gross operating income C. gross rent multiplier D. gross domestic income 5. A contract in which the tenant agrees to pay all the operating expenses is a: A. gross lease B. net lease C. percentage lease D. residual lease 6. Which of the following is not considered a real estate operating expense? A. maintenance B. utilities C. management D. loan payments 7. In cash flow analysis, depreciation is: A. called cost recovery B. a noncash deduction C. an income tax concept D. all of the above 8. Before-tax cash flow is computed when: A. operating expenses are subtracted from gross operating income B. annual debt service is subtracted from net operating income C. taxes saved or paid are subtracted from net operating income D. vacancies are subtracted from gross scheduled income 9. According to the cash flow formula, a useable tax loss times a marginal tax bracket equals taxes saved. A. true B. false 10. Taxes saved or paid, plus before-tax cash flow, equals: A. net spendable income B. net rate of return C. net sale proceeds D. net operating income 11. Before-tax cash flow is $10,000, useable tax loss is <$5,000>, and the marginal tax bracket is 30 percent; therefore, the after-tax cash flow is: A. $ 1,500 B. $ 4,500 C. $11,500 D. $15,000 12. Resale price, less outstanding loan balances, less seller closing costs, less capital gain taxes, equals: A. net spendable income B. net rate of return C. net sale proceeds D. net operating income 13. (Asking Price ÷ Net Operating Income) = Gross Rent Multiplier A. true B. false 14. All things being equal, the higher the subject property’s gross rent multiplier (GRM) above the market multiplier, the better the buy. A. true B. false RE 165 Real Estate Economics Quiz for Chapter 16: SUMMARY OF REAL ESTATE INVESTMENT PRINCIPLES 15. Comparable Property 1 sold for $500,000, with a gross scheduled income of $62,500. Comparable Property 2 sold for $450,000, with a gross scheduled income of $56,250. The subject property’s gross scheduled income is $57,100. Based only on this information, the estimated market price of the subject property is: A. $456,800 B. $420,500 C. $357,200 D. $318,750 16. The gross rent multiplier approach is most often used to estimate the probable resale price of: A. single-family homes B. apartment properties C. commercial properties D. industrial properties 17. Net Operating Income ÷ Price = Capitalization Rate A. true B. false 18. All things being equal, the higher the subject property’s capitalization rate over the prevailing market capitalization rate, the worse the buy. A. true B. false 19. The discount rate that reduces the future cash flows to a present value just equal to the amount of money invested is called the: A. cash on cash rate of return B. equity cap rate C. internal rate of return D. accounting rate of return Due 5/17/2012