domestic transfer pricing provisions ca .tp ostwal

advertisement

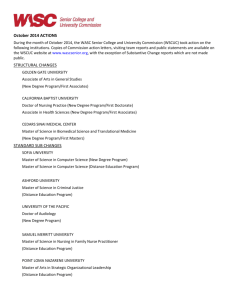

The Institute of Chartered Accountants of India EASTERN INDIA REGIONAL COUNCIL Opportunities for Chartered Accountants in International taxation - C.A. T. P. Ostwal T.P.Ostwal & Associates May 2013 1 Introduction TP was earlier limited to ‘International Transactions’ The Finance Act 2012, extends the scope of TP provision to ‘Specified Domestic Transactions’ between related parties w.e.f. 1 April 2012 The SC in the case of CIT vs Glaxo Smithkline Asia Pvt Ltd [2010-195Taxman 35 (SC)] recommended introduction of domestic TP provisions SDT previously reported/certified but onus on revenue authorities Obligation now on taxpayer to report/ document and substantiate the arm’s length nature of such transactions Shift from generic FMV concept to focused ALP concept These new provisions would have ramifications across industries which benefit from the said preferential tax policies such as SEZ units, infrastructure developers or operators, telecom services, industrial park developers, power generation or transmission etc. Apart from this, business conglomerates having significant intra-group dealing would be largely impacted T.P.Ostwal & Associates 2nd May 2013 2 SDT – Intent of the Law T.P.Ostwal & Associates 2nd May 2013 3 Intent of Indian TP Regulations (International transactions) Shifting of Profits India Overseas Associated Enterprise (AE Co.) Indian Co. Tax @ 32.45% Tax @ lower rate approx 10% Shifting of Losses Tax Saving for the Group – Loss to Indian revenue T.P.Ostwal & Associates 2nd May 2013 4 Intent of Indian TP Regulations… (Domestic transactions) India India Shifting of expenses/losses Indian Co. Tax Holiday undertaking Tax Exemption Related Enterprise in Domestic Tariff Area (DTA) Tax @32.45% Shifting of income/profits Tax Saving for the Group – Loss to Indian revenue T.P.Ostwal & Associates 2nd May 2013 5 Intent of Indian TP Regulations… (Domestic transactions) Particulars (Ordinary Situation) Co. X (SEZ) Co. Y (DTA) Income 500 1000 Income from related party 100 - Expenses 300 800 Expense to related party - 100 Profit/ Loss 300 100 Tax rate applicable 0% 32.45% Tax - 32.45 (100*32.45%) Particulars (Planned Situation) Co. X (SEZ) Co. Y (DTA) Income 500 1000 Income from related party 200 - Expenses 300 800 Expense to related party - 200 Profit/ Loss 400 - Tax rate applicable 0% 32.45% Tax - - T.P.Ostwal & Associates Loss to Revenue – Tax Saving to the Group 2nd May 2013 6 Intent of TP Regulations… (Domestic transactions) Shifting of expenses India Indian Co. Loss making India Related Enterprise Profit making Tax @ 32.45% Reduced tax due to shifting of profits Tax @ 32.45% No tax or reduced tax due to loss Shifting of income Tax Saving for the Group – Loss to Indian revenue T.P.Ostwal & Associates 2nd May 2013 7 Intent of TP Regulations…(Domestic transactions) Particulars (Ordinary Situation) Co. X (DTA) Co. Y (DTA) Income 500 1000 Income from related party 100 - Expenses 700 800 Expense to related party - 100 Profit/ Loss (100) 100 Tax rate applicable 32.45% 32.45% Tax - 32.45 (100*32.45%) Particulars (Planned Situation) Co. X (DTA) Co. Y (DTA) Income 500 1000 Income from related party 150 - Expenses 700 800 Expense to related party - 150 Profit/ Loss (50) 50 Tax rate applicable 32.45% 32.45% Tax - 16.23 (50*32.45%) Present Loss to Revenue* – Tax Saving to the Group * By shifting of income from a profit making company to a loss making company, the group could reduce its tax liability by 16.23 for the current year, though the impact will be reversed in future years given carry forward of losses. T.P.Ostwal & Associates 2nd May 2013 8 Section 92BA – Meaning of SDT (inserted by Finance Act, 2012 w.e.f. AY 2013-14 i.e. current FY) For the purposes of this section and sections 92, 92C, 92D and 92E, “specified domestic transaction” in case of an assessee means any of the following transactions, not being an international transaction, namely:(i) any expenditure in respect of which payment has been made or is to be made to a person referred to in section 40A(2)(b); (ii) any transaction referred to in section 80A; (iii) any transfer of goods or services referred to in sub-section (8) of section 80-IA; (iv) any business transacted between the assessee and other person as referred to in section 80IA (10); (v) any transaction, referred to in any other section under Chapter VIA or section 10AA, to which provisions of section 80-IA(8) or section 80-IA(10) are applicable; or (vi) any other transaction as may be prescribed, and where the aggregate of such transactions entered into by the assessee in the previous year exceeds a sum of five crore rupees. T.P.Ostwal & Associates 2nd May 2013 9 Overview of Provisions of Section 92BA Inter unit transfer of goods & services by undertakings to which profit-linked deductions apply Expenditure incurred between related parties defined under section 40A Any other transaction that may be specified SDT Transactions between undertakings, to which profit-linked deductions apply, having close connection T.P.Ostwal & Associates 2nd May 2013 10 S. 10AA uses the term close connection. S. 40A(2)(b) uses the term Related party. S. 80IA (8) inter unit. S. 80IA (10) uses the term close connection. S. 92A uses the term Associated Enterprises. No guidance or limited guidance on the meaning of close connectionS 42 (2) of ITA 1922,”Where a person not resident or not ordinarily resident in the taxable territories carries on business with a person resident in the taxable territories, and it appears to the Income-tax Officer that owing to the close connection between such persons the course of business is so arranged that the business done by the resident person with the person not resident or not ordinarily resident produces to the resident either no profits or less than the ordinary profits which might be expected to arise in that business, .the profits derived therefrom, or which may reasonably be deemed to have been derived therefrom, shall be chargeable to income-tax in the name of the resident person who shall be deemed to be, for all the purposes of this Act, the assessee in respect of such income-tax.“ [1958] 34 ITR 368 (SC)SUPREME COURT OF INDIA Mazagaon Dock Ltd.vs. C.I.T. Excess Profits Tax s T.P.Ostwal & Associates 2nd May 2013 11 Section 92BA Analysed...... For the purpose of sec. 92, 92C, 92D and 92E Section 92 Relevance with provisions of Sec 92BA : Computation of income having regard to ALP 92A : Meaning of AE 92B : Meaning of International transaction 92C : Methods of computation of ALP 92CA: Reference to TPO 92CB : Safe harbour rules 92CC : Advance Pricing agreement 92CD : Effect of TP agreement 92D : Maintenance of information and documents 92E : CA’s Report 92F : Definitions: Accountant, ALP, Enterprise, PE, Specified date, Transaction* * Sec 92F – Definitions does not define terms relevant for domestic TP transactions T.P.Ostwal & Associates 2nd May 2013 12 Sec. 92 – Computation of income from international transaction having regard to ALP (1) Computation of income from international transaction having regard to ALP. (2) mutual agreement etc for allocation or apportionment or expense shall be determined having regard to ALP. contribution to any cost or (newly inserted) (2A) Any allowance for an expenditure or interest or allocation of any cost or expense or any income in relation to specified domestic transaction shall be computed having regard to ALP. (3) section does not apply if the effect is reducing the income or increasing the loss. T.P.Ostwal & Associates 2nd May 2013 13 Sec. 92 C – Computation of ALP The words “specified domestic transaction” has been inserted appropriately in various sub-sec. (1) Any of the following methods, being most appropriate method : (a) Comparable uncontrolled price method; (b) Resale price method; (c) Cost plus method; refer rule 10B (d) Profit split method; (e) Transactional net margin method; (f) other method of determination of arm’s length price (any method that takes in to account the price which has been charged or paid or would have been charged or paid for same or similar uncontrolled transaction with or between non – associated enterprises) (2) Most appropriate method as per criteria laid down in rule 10C considering FAR analysis also. FAR : Functions performed, Assets employed, Risks assumed [Rule 10C(2)] T.P.Ostwal & Associates 2nd May 2013 14 Section 92CA - Reference To TPO The word “specified domestic transaction” inserted in various sub-sections. (1) AO may refer the computation of ALP to TPO (2) TPO to issue notice to Assessee to produce evidence in support of ALP (2A) Any other international transaction coming to notice of TPO* (2B) Non-furnishing of CA’s report and TPO’s power * (3) TPO shall pass the order determining ALP (4) AO to compute total income accordingly (7) TPO’s power of summons (s.131), survey (s.133A) and collecting information u/s 133(6)applies even in Domestic Transaction Sec. 144C (15)(b)…..Reference to DRP • AO to forward draft of proposed order to eligible assessee • eligible assessee means – any person in whose case order u/s 92CA is passed * 92CA (2A ) & (2B) do not cover specified domestic transactions and hence the TPO cannot suo moto upon the transaction coming to his notice apply the TP provisions T.P.Ostwal & Associates 2nd May 2013 15 Section 92D : Maintenance and keeping information and document by persons entering into an international transaction Entity Related Price Related Transaction Related Profile of Industry Transaction terms Agreements Profile of group FAR related Invoices Profile of related parties Economic Analysis (method selection, comparable benchmarking) Pricing related correspondence (letters, e-mails, fax, etc.) Forecasts, budgets, estimates The onus of proving SDT at ALP is on tax payer T.P.Ostwal & Associates 2nd May 2013 16 Section 271 –Penalty Implications Sr. No. 1 Type of penalty Section Penalty quantified a) Failure to maintain prescribed information/ documents (b) Failure to report any such transaction or 271AA 2% of transaction value 271G 2% of transaction value (c) Furnish incorrect information 2 Failure to furnish information/ documents during assessment u/s 92D 3 Adjustment to taxpayer’s income during assessment 4 Failure to furnish accountant’s report u/s 92E 271(1)(c) 271BA 100% to 300% of tax on adjustment amount INR 100,000 T.P.Ostwal & Associates 2nd May 2013 17 Section 40A(2) – Transactions covered Mapping to be done for the company’s transactions with domestic Related Parties Primary reliance on disclosures u/s 40A(2)(b) and Related Party Schedule Different divisions enter into different transactions with various group companies Broad categories of transactions likely to be covered : Payment of royalty charges Payment of interest Purchase of goods and services T.P.Ostwal & Associates 2nd May 2013 18 Sec 40A (2)(b) – Related Party Sr.No Relationship can exists any time during the year Payer / assessee Payee (i) Individual Any relative [defined in sec. 2(41) to mean husband, wife, brother, sister, lineal ascendant or descendant] * Definition of Relative u/s 56(2) not relevant (ii) Company any director or relative of such director Firm (includes LLP) any partner or relative of such partner AOP any member or relative of such member HUF any member or relative of such member (iii) Any Assessee any individual having substantial interest in the assessee’s business or relative of such individual (iv) Any assessee a Company, Firm, AOP, HUF having substantial interest in the assessees business or any director, partner, member or relative of such director, partner or member or (newly inserted) any other company carrying on business or profession in which the first mentioned company has substantial interest. A Ltd. (holding co) X Ltd. (subsidiary co) Y Ltd. (subsidiary co) T.P.Ostwal & Associates 2nd May 2013 19 Type of transactions covered (illustrations for payments made by a Company) … Case 1 - Director or any relative of the Director of the taxpayer – Section 40A(2)(b)(ii) Case 2 - To an individual who has substantial interest in the business or profession of the taxpayer or relative of such individual – Section 40A(2)(b)(iii) Assessee (Taxpayer) Director Substantial interest >20% Assessee (Taxpayer) Relative Mr. A Mr. D Mr. C Mr. A Mr. D Relative Mr. C Relative Covered transactions Holding Structure T.P.Ostwal & Associates 2nd May 2013 20 Type of transactions covered (illustrations for payments made by a Company) … Case 4 – Any other company carrying on business in which the first mentioned company has substantial interest – Section 40A(2)(b)(iv) Case 3 – To a Company having substantial interest in the business of the taxpayer or any director of such company or relative of the director – Section 40A(2)(b)(iv) Mr. D A Ltd Assessee (Taxpayer) Substantial interest >20% Substantial interest >20% C Ltd Substantial interest >20% Relative Director Assessee (Taxpayer) Substantial interest >20% Mr. C A Ltd B Ltd Covered transactions Holding Structure T.P.Ostwal & Associates 2nd May 2013 21 Type of transactions covered (illustrations for payments made by a Company) … Case 5 – To a Company of which a director has a substantial interest in the business of the taxpayer or any director of such company or relative of the director – Section 40A(2)(b)(v) Director B Ltd Substantial interest >20% Mr. A Relative Mr. C Assessee (Taxpayer) Mr. D Covered transactions Holding Structure T.P.Ostwal & Associates 2nd May 2013 22 Type of transactions covered (illustrations for payments made by a Company)… Substantial interest >20% Assessee (Taxpayer) Case 7 – Any director or relative of the director of taxpayer having substantial interest in that person– Section 40A(2)(b)(vi)(B) A Ltd Substantial interest >20% Assessee (Taxpayer) B Ltd D Ltd Mr C Relative Case 6 – To a Company in which the taxpayer has substantial interest in the business of the company – Section 40A(2)(b)(vi)(B) Substantial interest >20% Mr B Covered transactions Holding Structure T.P.Ostwal & Associates 2nd May 2013 23 Type of transactions covered (illustrations for payments made by a Company)… Transaction Covered A&B A B D C E A&C A&D A&E B&C D&E C&D D&E T.P.Ostwal & Associates 2nd May 2013 24 Thus for Company A payments to following persons are covered 1 2 3 • Company B having 20% or more voting power in A; • any other company in which Company B has 20% or more voting power; • a company in which A has 20% or more voting power; • any company of which a director has 20% or more voting power in A; • any company in which a director of A has 20% or more voting power; • any director of A or of Company B or to any relative of such director; & • any individual having 20% or more voting power in A or any relative of such individual. T.P.Ostwal & Associates 2nd May 2013 25 Tax burden, if transaction not at ALP X Ltd. (non-tax holiday) Sale at 120 v/s ALP i.e. 100 Sale at 120 v/s ALP i.e. 100 X Ltd. (tax holiday) Sale at ` 80 v/s ALP i.e. ` 100 X Ltd. (tax holiday) Y Ltd. (non-tax holiday) Disallowance of ` 20 to Y Ltd [40A(2)(b)] Y Ltd. (non-tax holiday) Double Adjustment Tax holiday on 20 not allowed to X Ltd – [80IA(10)] (more than ordinary profits) Disallowance of 20 to Y Ltd [40A(2)(b)] Y Ltd. (non-tax holiday) Inefficient pricing structure – reduced tax holiday benefit since sale price is lower than ALP T.P.Ostwal & Associates 2nd May 2013 26 Section 80IA (8) & 80IA (10) – Deduction in respect of profits and gains from industrial undertaking or enterprise engaged in infrastructure development, etc. 80IA (8) 80IA (10) Inter-unit transaction of goods or services • Business transacted with any person generates more than ordinary profits • Owing to either close connection or any other reason Applicable where transfer is not at market value Applicable to tax holiday units earning more than ordinary profit Onus on tax payer • Primary onus on taxpayer • Onus on tax authorities as well T.P.Ostwal & Associates 2nd May 2013 27 Other Sections under Chapter VI-A......to which s. 80-IA(8) or (10) are applicable 80-IA Income from Infrastructure, Telecommunication, Industrial Park & Power sector etc. 80-IAB Income of an undertaking or enterprise engaged in development of SEZ 80-IB Income from certain Industrial undertaking and Housing Projects etc. 80-IC Income from certain Industrial undertaking set up in Sikkim, HP...etc. 80-ID Income from hotels etc in Delhi, Faridabad and other specified districts. 80-IE Income from eligible business undertaking in North Eastern States T.P.Ostwal & Associates 2nd May 2013 28 Implication post - budget 2012 for SDT FMV ALP No method prescribed for computing FMV Six methods prescribed for computing ALP No documentation required to be maintained Contemporaneous documentation required to be maintained Other than reporting in tax audit report, no statutory compliance Accountant’s report signed by a CA to be filed Assessment done by the AO Assessment done by the TPO T.P.Ostwal & Associates 2nd May 2013 29 Points for Consideration Whether the threshold limit of Rs. 5 crore applies to the aggregate amount under all the relevant sections taken together OR under each section separately i.e. 40A(2), 80A, 80-IA(8), 80-IA(10), 10AA etc. ? Whether payment for capital expenditure Or expenditure capitalized is also covered ? Whether the provisions will apply in case the payer’s income is chargeable to tax under the head ‘Income from other sources’, because section 58(2) says –The provisions of section 40A shall, so far as may be, apply in computing the income chargeable under the head “Income from other sources” as they apply in computing the income chargeable under the head “Profits and gains of business or profession” ? Whether new provision applies to Public Charitable Trust paying remuneration to related persons. Co-operative Societies Social Clubs having a business undertaking Transfer pricing provisions are not applicable in case where income is not chargeable to tax at all. Correlative adjustments - if excessive or unreasonable expenses are disallowed in the hands of tax payer at time of the assessment then corresponding adjustment to the income of the recipient will not be allowed in the hands of recipient of income. Hence, it would lead to double taxation in India. T.P.Ostwal & Associates 2nd May 2013 30 Challenges Type of payments/ transactions • Salary and Bonuses paid to the partners Challenges • Benchmarking? • Whether the limit as mentioned in section 40 (b) would be the ALP? • Remuneration paid to the Directors • Benchmarking? • Whether the limit as mentioned in Schedule XIII would be the ALP? • Transfer of land • Whether the rates mentioned in the ready reckoner be considered as ALP? • Joint Development agreements • Benchmarking? • Project management fees • Benchmarking? • Allocation of expenses between the • Whether these allocation would be SDT – Sec same taxpayer having an eligible 80-IA(10)? unit and non-eligible unit • Directly v/s Indirectly • Definition of Related Party T.P.Ostwal & Associates 2nd May 2013 31 Going Forward To Identify and map the relationship between domestic related parties specified u/s 40A(2)(b) Identify and map the SDT Revisit the pricing mechanism applied by the company for SDT applying the most appropriate prescribed methods To implement TP regulations in FY 2011-12 itself although not statutorily required so that systems can be improved for FY 2012-13. To note that variations in profits of tax holiday units for FY 2013 compared to FY 2012 may raise concerns from tax officers. Availability of APA The onus of proving SDT at ALP is on the tax payer T.P.Ostwal & Associates 2nd May 2013 32 CASE STUDY 1 Jan 2013 T P Ostwal & Associates @ 33 Case Study 1 Facts • HCO, an Indian company, is a manufacturer of FMCG products. It has four Indian subsidiaries; namely IndCo1, IndCo2, IndCo3 and IndCo4 in different segment of FMCG products. Neither HCO nor its subsidiaries (except IndCo4) enjoy any profit linked deduction under Chapter VIA or sec 10AA. HCO also has 21% shareholding in UK Co (a company incorporated in UK) and 79% shareholding of UK Co is held by others. • HCO has taken two loans i.e. one from Bank1 at an interest rate of 14% and other from an unrelated party at an interest rate of 13%. • HCO has advanced following loans to its subsidiaries: • IndCo1 at an interest rate of 16%. • IndCo2 at an interest rate of 10% as the company is suffering huge losses. • Interest-free loan to IndCo3 as it is a startup company and loan given are primarily to provide seed funding to develop a sound strategy and transform its ideas and innovations into demand and gain market share. • Interest-free loan to IndCo4 and it is utilized for its SEZ Unit u/s 10AA so that it is working efficiently. Jan 2013 T P Ostwal & Associates @ 34 (contd)… Case Study 1 • HCO given an interest free loan to UK Co • IndCo1 has taken a loan from Bank2 at an interest rate of 14% for which HCO has given a guarantee to Bank2. HCO does not charge any guarantee fee to IndCo1. • IndCo1 has also taken another loan from Bank 3 at an interest rate of 14%. For this loan, HCO has given a letter of comfort to Bank3, as sole shareholder of IndCo1that it will exert its influence to ensure that IndCo1 would meet its liabilities to Bank 3 in the agreed manner. Moreover; HCO has confirmed that no changes are planned in the ownership structures of the subsidiaries for the terms of loans. • HCO has provided a performance guarantee to IndCo3 to make IndCo3 eligible to bid on a project. If the bid is successful, HCO will then add substance to IndCo3 in the form of providing further working capital finance, making it sufficiently robust to operate the project on its own and in turn making the performance guarantee “a mere formality,” . A guarantee in this context confers an economic benefit and allows IndCo3 to bid and perchance to win and thus is compensable. Whereas if the bid is not successful, the guarantee will be “of little practical value or benefit to the subsidiary and should be regarded as a non-compensable shareholder activity because the subsidiary derives no benefit from the guarantee. • In each company, the specified domestic transactions exceed threshold limit of Rs 50 million for all four subsidiaries. Jan 2013 T P Ostwal & Associates @ 35 (contd)… Case Study 1 Question Analyze the applicability of the Domestic TP provisions in the hands on HCO, IndCo1, IndCo2, IndCo3 and IndCo4 as well as UK Co in respect of their financial dealings. H Co contends that no guarantee fees is chargeable due to the fact that IndCo1 was inadequately capitalized and it was its benefit to give guarantee on the basis of which bank loan were obtained by IndCo1 at the same rate of interest without any benefits to HCO. Jan 2013 T P Ostwal & Associates @ 36 (contd)… Case Study 1 India HCO Loan from Bank1 @ 14% Loan against bank guarantee from Bank 2 @ 16% Loan from Bank 3@16% Against Letter of Comfort of H CO Jan 2013 Loan @ 17% Loan @ 10% Interest free loan IndCo1 IndCo2 IndCo3 UK Loan from Unrelated Party @13% Interest free loan IndCo4 SEZ Unit u/s10AA Interest free loan UK Co 21% by H Co Performance Guarantee of H CO T P Ostwal & Associates @ 37 (contd)… Case Study 1 For IndCo1 1. Loan taken from HCO a. Loan taken by IndCo1 from HCO at interest rate of 17% for which Interest payment by IndCo1 u/s 40A(2)(b) constitutes SDT(u/s 92BA) and hence IndCo1 will be liable to comply with Domestic TP provisions. b. Interest payment to related party needs to be benchmarked by selecting the most appropriate method u/s 92C r.w Rule 10B and Rule 10C for computation of arm’s length price. c. IndCo1 has also taken two other loans. First, loan taken from Bank2 at an interest rate of 16%. Second, loan taken from Bank3 at an interest rate of 16%. Therefore, CUP Method is the most appropriate method. Thus, ALP interest rate works out to be 16% (arithmetic mean of 16% and 16%). d. Having regard to the facts, the Assessing Officer possibly will try to make TP adjustment by disallowing excess interest of 1% (17%-16%) ,not being arms length but the fact needs to be demonstrated that other loans are with guarantees and without that there could be an extra charge by the bank (normally I.T. dept. takes 3% as guarantee fees in other cases and hence if appropriate adjustment is made to the rate of interest with such guarantee commission the lending rate of bank would go up by almost 3% and hence interest paid is at arms length.)However it is not established then IndCo1 would be exposed to penalty u/s 271(1)(c) r.w.t. Explanation 7 as deemed to be concealment of income or furnishing inaccurate particulars in respect of addition to income by way of TP adjustment. e. IndCo1 may be exposed to penalty u/s 271G if it has defaulted on maintenance of TP documentation and/or u/s 271BA if it has defaulted on furnishing of TP audit report. Jan 2013 T P Ostwal & Associates @ 38 (contd)… Case Study 1 For IndCo1 (contd)… 2. Guarantee given by HCO for loan taken from Bank2 Since no guarantee fees is paid by IndCo1, provisions of sec 40A(2)(b) r.w.s. 92BA are not applicable. Therefore, this transaction is not SDT u/s 92BA. 3. Letter of Comfort given by HCO for loan taken from Bank3 Since no consideration is paid by IndCo1, provisions of sec 40A(2)(b) r.w.s. 92BA are not applicable. Therefore, this transaction is not SDT u/s 92BA. For HCO (w.r.t IndCo1 Transaction) i. 17% Interest is received by HCO on loan given to IndCo1 is not covered u/s 40A(2)(b) and hence it does not constitute SDT(u/s 92BA) for HCO. ii. HCO has given guarantee to Bank2 on loan taken by IndCo1 and HCO has not charged any guarantee fee for the same. Only expenditure on payment made or to be made to related party is covered u/s 40A(2)(b) and thus even if there was any receipt or nonreceipt of guarantee fee income, it would not have been covered u/s 40A(2)(b). Thus, it is not SDT (u/s 92BA) for HCO. iii. HCO has also given letter of comfort to Bank3 on loan taken by IndCo1 and no monetary benefit is received for this transaction. Therefore, it does not constitute SDT (u/s 92BA) for HCO. Jan 2013 T P Ostwal & Associates @ 39 (contd)… Case Study 1 For IndCo2 a) Loan taken by IndCo2 from HCO at interest rate of 10% for which Interest payment by IndCo1 u/s 40A(2)(b) constitutes SDT(u/s 92BA) and hence IndCo1 will be liable to comply with Domestic TP provisions. b) Interest payment to related party needs to be benchmarked by selecting the most appropriate method u/s 92C r.w. Rule 10B and Rule 10C for computation of arm’s length price. c) Having regard to the facts, CUP Method is the most appropriate method wherein External CUP can be applied for benchmarking the transaction by adopting PLR of any nationalized banks in India or by adopting rate of interest paid by HCO on loans taken from bank i.e. 14% and IndCo1’s borrowings @16%. Thus, ALP interest rate works out to be above 10%. d) In this case, interest rate of 10% is lesser than ALP interest rate. Therefore, transaction entered into by IndCo2 of interest payment to related party is at arm’s length. Therefore, no TP adjustments is warranted in this case. For HCO (w.r.t IndCo2 Transaction) 10% Interest is received by HCO on loan given to IndCo2 is not covered u/s 40A(2)(b) and hence it does not constitute SDT (u/s 92BA) for HCO. Jan 2013 T P Ostwal & Associates @ 40 (contd)… Case Study 1 For IndCo3 1. Interest free Loan taken from HCO a. Since no interest is paid by IndCo3, provisions of sec 40A(2)(b) r.w.s. 92BA are not applicable. Therefore, this transaction is not SDT u/s 92BA. b. But, interest free loan taken from related party is required to be reported in TP Audit Report i.e Form 3CEB. IndCo3 may be exposed to penalty u/s 271G if it has defaulted on maintenance of TP documentation and/or u/s 271BA if it has defaulted on furnishing of TP audit report. 2. Performance guarantee given by HCO for loan taken from Bank3 Since no consideration is paid by IndCo1, provisions of sec 40A(2)(b) r.w.s. 92BA are not applicable. Therefore, this transaction is not SDT u/s 92BA For HCO (w.r.t IndCo3 Transaction) 1. HCO has given an interest free loan to IndCo3. It has not charged any interest to IndCo3 as IndCo3 is a startup company. Only expenditure on payment made or to be made to related party is covered u/s 40A(2)(b) and thus even if there was any receipt or non-receipt of interest, it would not have been covered u/s 40A(2)(b). Thus, it is not SDT (u/s 92BA) for HCO. 2. HCO has provided a performance guarantee to IndCo3 to make IndCo3 eligible to bid on a project. HCO has not charged any guarantee fee for the same. Only expenditure on payment made or to be made to related party is covered u/s 40A(2)(b) and thus even if there was any receipt or non-receipt of guarantee fee income, it would not have been covered u/s 40A(2)(b). Thus, it is not SDT (u/s 92BA) for HCO. Jan 2013 T P Ostwal & Associates @ 41 (contd)… Case Study 1 For IndCo4 1. Interest free loan taken by IndCo4 (having an eligible unit ie SEZ unit u/s 10AA) from HCO (non eligible unit) and utilized the said loan for its sec 10AA unit. 2. We have to analyze whether the said transaction is falling within the any of the provisions of section 92BA i e whether it is SDT ? 3. As per section 92BA(v) any transaction , referred to in section 10AA to which provisions of section 80IA(10) are applicable is SDT. As per section 80IA(10) where an eligible unit enters into SDT with any other person, then for the purpose of availing benefit under section 80-IA, the transaction recorded in the books of accounts of eligible unit should correspond to the ALP of such goods or services worked out as per section 92C. 4. However, Sec 80IA(10) is attracted only to those transactions in which, when it appears to the AO that, owing to the close connection between the assessee carrying on the eligible business (to which section 80IA applies) and any other person, or for any other reason, the course of business between them is so arranged that the business transacted between them produces to the assessee more than the ordinary profits which might be expected to arise in such eligible business. 5. Thus, it is clear that the onus of proving that provisions of s. 80-IA(10) are attracted and that the business affairs are so arranged that it produces more than ordinary profits is on the AO and AO may deny deduction u/s10AA on the ground that interest free loan given by HCO to IndCo4 was to enable IndCo4 to earn more than ordinary profits by invoking provisions of sec 10AA(9) r.w.s. 80-IA(10) r.w.s. 92BA(v). (contd)….. Jan 2013 T P Ostwal & Associates @ 42 (contd)… Case Study 1 For IndCo4 1. Therefore, in the given case if the IndCo 4 believes that business transacted with HCO is bonafide and it cannot be considered as tax evading arrangement then such transaction may not be regarded as SDT in terms of s. 92BA(V).Ind Co4 can also take an argument that MAT provisions are applicable to 10AA units also hence there is no incentive to shift profit to 10AA unit by not charging any interest for the loan utilised for 10AA unit. Hence, provisions of section 80IA(10) r.w.s 92BA(V) are not applicable to such transaction. 2. IndCo4 may be exposed to penalty u/s 271G if it has defaulted on maintenance of TP documentation and/or u/s 271BA if it has defaulted on furnishing of TP audit report . For HCO (w.r.t IndCo4 Transaction) HCO has given an interest free loan to IndCo4. IndCo4 has utilized interest free loan for its SEZ Unit u/s 10AA. Only expenditure on payment made or to be made to related party is covered u/s 40A(2)(b) and thus even if there was any receipt or non-receipt of interest, it would not have been covered u/s 40A(2)(b). Thus, it is not SDT (u/s 92BA) for HCO. Jan 2013 T P Ostwal & Associates @ 43 (contd)… Case Study 1 For UK Co. No tax effect in the hands of UK Co as UK Co is not to be assessed to tax in India. Hence it is neither covered by SDT no by international transaction u/s 92B. For HCO (w.r.t UK Co Transaction) HCO has given an interest free loan to UK Co in which HCO has only 21% shareholding. Therefore, UK Co is not an associated enterprises u/s 92A(2)(b).But UK Co would become a related party (of HCO) u/s 40A(2)(b)(iv) for a loan given to Non-Resident Related Party. Only expenditure on payment made or to be made to related party is covered u/s 40A(2)(b) and thus even if there was any receipt or non-receipt of interest, it would not have been covered u/s 40A(2)(b). Thus, it is not SDT (u/s 92BA) for HCO. Jan 2013 T P Ostwal & Associates @ 44 CASE STUDY 2 Jan 2013 T P Ostwal & Associates @ 45 Case Study 2 Facts • A Co, an Indian company, is engaged in business of polyester films. It has substantial interest in B Co and has a wholly owned subsidiary D Inc in USA. Both A Co and B Co are units covered u/s 10AA. • A Co has its own R&D Centre which develops the technology for product research, design and development and enhances efficiency in production of polyester films. • A Co manufactures raw materials namely, dimethyl terephthalate, terephthalic acid and ethylene glycol and sells it to B Co. • A Co licenses technical know-how and formulas to B Co for processing of raw materials into finished goods i.e. polyester films. • B Co processes the raw materials into finished goods i.e. Polyester films and sells the finished goods to A Co at Rs. 100 per sq ft. B Co has also made a miniscule sale to third parties at Rs 120 per sq ft. • Royalty is charged for (use of tech know how by B Co) by A Co to B Co at the rate of 3% on sale of total polyester films to A Co as well as third parties. • A Co also purchase polyester films but of substantially different qualities from third parties at Rs. 80 per sq ft. Jan 2013 T P Ostwal & Associates @ 46 (contd)… Case Study 2 • C Co, an agent, provides marketing and sales promotion services to A Co for which it charges commission at 7% of sales made by A Co. A Co cuts polyester films into large master rolls and slit to precision widths before delivery to customer and packages as per customer requirement. • A Co sells polyester films to Indian customers at Rs. 125 per sq. ft. • D Inc is the face of A Co in US and overseas markets. A Co sells polyester films to the associated enterprise D Inc (USA) at cost plus 10% mark-up. • A Co follows Just‐in‐Time approach to manage inventory which in turn helps in balanced production and maintenance of required stock level of raw materials and finished goods. • Research on various geographical areas where market can be developed is done by C Co. Market development includes focus on existing customers and also on potential customers. Selling and distribution activities as well as after-sales activities are undertaken by C Co. • A Co and B Co perform administration functions independently for their respective organizations based on policies framed. Jan 2013 T P Ostwal & Associates @ 47 (contd)… Case Study 2 • All three companies (A Co, B Co and D Inc) deploy its tangible assets in the form of fixed assets and working capital for manufacturing and sale operations. The tangible assets include office facilities, warehouses, material handling equipments, computer hardware, quality control equipments, etc. • B Co does not have significant exposure to market risk since it is primarily involved in the processing of raw materials to finished goods polyester films. A Co has a significant exposure to market risks in order to meet consumer needs. • A Co bears a significant exposure to technology risk as the changes of finished goods i.e. quality of polyester films becoming obsolete is high and thus, it is a challenge for the company to keep up with the developments in technology in order to face market competition. Whereas B Co faces almost no technology risk as it uses technology of A Co and processing job has lesser chances of technology becoming obsolete. • All major credit risks related to sales are borne by A Co whereas B Co faces less / no risk since its major sales are to A Co and a miniscule amount of sales to third parties. A Co is exposed to foreign currency fluctuation risk due to export of polyester films to its associated enterprises abroad. • Operating Margin on Total Cost for: • • Jan 2013 A Co – 8% whereas Comparables – 13% B Co – 6% whereas Comparables – 9.5% T P Ostwal & Associates @ 48 (contd)… Case Study 2 Question 1. Analyze of the applicability of Domestic TP provisions in the hands of B Co in respect of following transactions:• Purchase of Raw Materials by B Co • Purchase of Polyester films by A Co • Royalty paid by B Co 2. Analyze the applicability of transfer pricing provisions in respect of international transaction for sale of polyester films by A Co to its associated enterprise D Inc USA. Jan 2013 T P Ostwal & Associates @ 49 (contd)… Case Study 2 Third Parties Purchase of Polyester Film of substantially different quality Royalty Paid for Tech Know-how Sale of Polyester Films A Co Commission Paid @7% B Co (Substantial Interest held by A Co) Sale of Manufactured Raw Materials Sale of Polyester Films Third Parties Sale of Polyester Films Customers C Co India USA Sale of Polyester Films D Inc (WOS of A Co) Jan 2013 T P Ostwal & Associates @ 50 (contd)… Case Study 2 Analysis Applicability of Domestic TP - B Co Transaction 1:- Purchase of Raw Materials by B Co from A Co Category Level of Intensity Functions Performed 1. Market development 2. Product development 3. Manufacturing 4. Quality control 5. Post sales activities 6. General management functions 7. Corporate strategy determination 8. Finance, accounting, treasury & legal 9. Human resource management Assets Employed 1. Tangibles 2. Intangibles Risks Assumed 1. Market risk 2. Product liability risk 3. Technology risk 4. Research & Development risk 5. Credit risk 6. Inventory risk Jan 2013 T P Ostwal & Associates @ B Co A Co 51 (contd)… Case Study 2 Transaction 1:- Purchase of Raw Materials by B Co from A Co Criteria Analysis Result / comments Company Profile • • Manufactures and markets polyester films Earns Operating profit margin (entity level) of 6% FAR Analysis • • B Co is a manufacturer and seller of polyester films B Co is simpler and comparable For benchmarking, the operating profit margins of data is available and hence, comparable companies have been compared with selected as the tested party the operating profit margin of B Co at entity level as well as with reference to operating margins earned on the sale transactions with associated enterprises. Selection of Methodology • • CUP: Unavailability of internal/external CUP data CPM or TNMM could be RPM: Taxpayer is a manufacturer and not a reseller selected as most appropriate of products method PSM: Routine manufacturer hence not applicable CPM: May be applied if reliable cost data is available TNMM: Relatively less stringent comparability standards and external comparable’s data available on public database • • • Jan 2013 T P Ostwal & Associates @ Arm’s length nature of revenue to be tested 52 (contd)… Case Study 2 Transaction 2 :- Purchase of Polyester films by A Co from B Co Level of Intensity Category Functions Performed 1. Product development 2. Manufacturing 3. Quality control 4. Post sales activities 5. General management functions 6. Corporate strategy determination 7. Finance, accounting, treasury & legal 8. Human resource management Assets Employed 1. Tangibles 2. Intangibles Risks Assumed 1. Market risk 2. Product liability risk 3. Technology risk 4. Research & Development risk 5. Credit risk 6. Inventory risk Jan 2013 T P Ostwal & Associates @ A Co B Co 53 (contd)… Case Study 2 Transaction 2 :- Purchase of Polyester films by A Co from B Co Criteria Company Profile (A Co.) Analysis • • Result / comments Trader of polyester films (besides being Arm’s length nature of revenue manufacturer of raw material) to be tested Earns Operating profit margin (entity level) of 8% • • A Co is a trader of polyester films A Co. is simpler and comparable For benchmarking, the operating profit margins of data is available and hence, comparable companies have been compared with selected as the tested party the operating profit margin of the A Co at entity level Selection of • Methodology • CUP: Unavailability of internal/external CUP data RPM or TNMM could be RPM: A Co is cutting rolls into different sizes to selected as the most make the product marketable and is not making appropriate method substantial value addition to it and therefore, A Co is a pure reseller of products CPM: Unavailability of comparable data at gross level PSM: Routine manufacturer/trader hence not applicable TNMM: Relatively less stringent comparability standards and external comparable’s data available on public database FAR Analysis • • • Jan 2013 T P Ostwal & Associates @ 54 (contd)… Case Study 2 Transaction for royalty paid by B Co to A Co Since data on uncontrolled comparable transactions (i.e. rates of royalty) is not available in public domain, benchmarking of payment of royalty by B Co to A Co. could be done by applying External TNMM International transaction for sale of polyester films by A Co to its associated enterprise D Inc USA. Being an international transaction, all the transfer pricing provisions relating to international transaction would be applicable and the transaction would be benchmarked u/s 92C r.w. Rule 10B and Rule 10 C. Jan 2013 T P Ostwal & Associates @ 55 CASE STUDY 3 Jan 2013 T P Ostwal & Associates @ 56 Case Study 3 Facts 1. US Co is having a permanent establishment (PE) in India, Mr. A, a director of US Co, is deputed to Indian PE in financial year 2013 – 14 i.e from 1st December 2013. 2. Salary is paid to Mr. A by US Co and PE in India for respective periods worked in both (US Co and Indian PE). 3. Mr. A is a non-resident in India for the financial year 2013-14. 4. Indian PE (taxed on net basis) has claimed deduction for salary paid to Mr. A in its return of income for FY 2013-14. Question 1. Whether domestic transfer pricing provisions are applicable to Indian PE for salary paid to Mr. A? 2. Assume Indian PE is a subsidiary company of US Co and Mr. A is a nonresident and is also a Director of subsidiary company getting salary from subsidiary company. Whether payments made to director is a specified domestic transaction? Jan 2013 T P Ostwal & Associates @ 57 (contd)… Case Study 3 Where US Co has PE in India Salary paid by US Co (1/4/2013 to 30/11/2013) US CO Mr. A Director of US CO USA India Salary paid by Indian PE (1/12/2013 to 31/03/2014) Jan 2013 T P Ostwal & Associates @ Indian PE 58 (contd)… Case Study 3 Where Ind Co is Subsidiary of US Co US CO Salary paid USA Mr. A Director of Ind Co & US CO India Ind Co Salary paid (WOS) Jan 2013 T P Ostwal & Associates @ 59 Case Study 3 • Salary paid to Mr. A is not an International Transaction in terms of s. 92B r.w.s. 92A since data on shareholding of Mr A is not given. Therefore, Mr.A is not an AE of US Co as defined u/s 92A. But if Mr. A held at least 26% of shares in US Co, it would constitute as an international transaction and any salary paid to Mr. A would be regarded as an international transaction. • However, if he does not hold any shares still Mr. A is a director of US Co and hence covered as a related party u/s 40A(2)(b)(ii). • Since payment is made to related party covered by s. 40A(2)(b), the transaction constitutes SDT in terms of s. 92BA(i) • Being SDT, salary payment to Mr. A will be liable to Domestic TP and PE will be required to benchmark it to ALP, maintain documentation and furnish TP audit report. • Salary paid to Mr. A is required to reported in TP Audit Report i.e Form 3CEB by Indian PE. Thus, Indian PE may also be exposed to penalty u/s 271G if it has defaulted on maintenance of TP documentation and/or u/s 271BA if it has defaulted on furnishing of TP audit report. • Million dollar question is how do you demonstrate it to be at Arms Length. Jan 2013 T P Ostwal & Associates @ 60 Disclaimer The information provided in this presentation is for informational purposes only, and should not be construed as legal advice on any subject matter. No recipients of this presentation, clients or otherwise, should act or refrain from acting on the basis of any content included in this presentation without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from an attorney licensed in the recipient's state. The content of this presentation contains general information and may not be accurate or reflect current legal developments, verdicts or settlements. T.P.Ostwal Associates expressly disclaims all liability in respect to actions taken or not taken based on any or all the contents of this presentation. 61 Jan 2013 T P Ostwal & Associates @ T. P. Ostwal & Associates CHARTERED ACCOUNTANTS 4th Floor, Bharat House, 104 Mumbai Samachar Marg, fort, MUMBAI-400001. Tel No.: +91-22-40693900 Fax No.: +91-22-40693999 Mobile:+919004660107 Email: fca@vsnl.com THANK YOU T.P.Ostwal & Associates May 2013 62