FC-lrSr-2012

Profits, Shutdown, Long Run and FC

© 1998,2010 by Peter Berck

Profits

• We know that a firm maximizes its profits when p = mc or when q = 0.

• But which?

• Profits are Revenues less Costs

– Profits are PQ – C(Q)

– = Q { P – AC(Q) }

Profits vs Earnings

• Opportunity cost: what something would earn in its next best use. E.g. what you would earn if you were not working for your parents.

• What your money would earn if it were not invested in this firm. This is the opportunity cost of capital

• Roughly: Earnings = Revenue – VC

• Profits = Revenue – VC – Opportunity cost of capital.

Profits = 0

• Profits = 0 means that the capital invested in the firm earns its opportunity cost.

• Investing in this firm is just as good as investing in other firms, not better, not worse.

P

P - AC(q*)

MC

AC

P - AC(q*)

AVC

AC(q*) q*

Q

P

Profit Box

MC

AC

P - AC(q*)

AVC

AC(q*)

Box is P - AC(q*) high and q* wide q* {P - AC(q*) = Pq* - C(q*) = p q*

Q

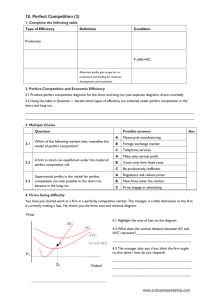

Categorizing Cost

• VC are costs exclusive of fixed capital

• FC is the financial obligation to pay for fixed capital

Shutdown

• Let q* given by mc(q*) = p be quantity that maximizes profit among those quantities that are nonzero.

• if q = 0, shutdown, profit is -FC

• if pq* - vc(q*) < 0 then profit is

– {pq* - vc(q*)} - FC < -FC

– firm maximizes profits by setting q = o

– called shutdown

Shutdown Point

• pq* - vc(q*) = q* (p - avc(q*) )

– so shutdown if p - avc(q*) <0

– but the minimum point of the U shaped avc curve comes where mc(q) = avc(q), so

– the least price at which the firm operates is the minimum point of avc.

P s

Shutdown Point, P

s

At P

P s s p

= {P s

- AC(q*)} q*. By construction,

=AVC(q*) so p

= {AVC(q*) - AC(q*)} q* p

MC

= {-AFC(q*)} q* = -FC.

AC

For any lower price, profit is less so P point at which production is not zero.

s

AVC gives minimum

Q q*

Firm’s Supply Curve

• A firm’s supply curve is its marginal cost curve above average variable cost

Are all costs Present and Accounted for?

• Suppose firm uses clean air as part of production process and doesn’t pay for it???

• suppose value of clean air used is t per unit of output. (value of lost breathing!)

• t is the external cost of making the output

• mc are the private or internal costs of making output

• where external (jargon: externality) means external to the firm

Case for regulation

• firm sets p = mc

– doesn’t account for t cause doesn’t pay t

• social cost is private + external = mc +t

– correct answer is mc + t = p

• Charging a tax of t, the costs borne by society and not paid by firm, “internalizes the externality” (yuck) and makes the firm pay all the costs of its operation

p p c p1 p firm

The picture

What happens to quantity of polluting output?

Price to consumers, to firm?

Tax revenue?

Firms’ profits

?

mc + t mc

D q q2 q1

Long Run

• Each firm with U-shaped cost curves has a particular fixed capital stock

• In short run, capital stock is fixed and so is number of firms

• Long run, number of firms (hence capital) varies.

Entry and Exit

• If profits are positive, firms enter

• If profits are negative firms exit

– Each firm is the same as the other firms

– Each firm has U shaped cost curves

• We define Long run supply and Long Run

Competitive Equilibrium

Supply from 4 Firms

Supply from N identical firms is

S

N

(p) = N S(p) where S is the supply curve for a single firm.

MC

AC

AVC

S

4

Q

Short run supply

when there are 2, 3 or 4 firms

MC

AC

AVC

S

2

S

3

S

4

Q

Short Run Equilibrium

• Three firms, so supply is S

3

• D = S

3 determines price, P

• Output per firm is q*, total output 3 q*

• Profits per firm are green box

MC

AC

S

3

P

D

3q* q* Q

Positive Profit means Entry

• Firm enters; New supply S

4

• S

4

= D at new lower price, p’

• Profits = 0

MC

AC

S

3

S

4 p’ q’ Q

Long Run Supply

• Since firms enter at prices above p’ and leave at prices below, p’ is the price in the long run and by adjusting number of firms any amount of output will be made at this price. Q= any and p = p’ is the long run supply curve

MC

S

3

S

4 p’ q’ Q

Long Run Competitive Equilibrium

• P = MC(q’) for each firm (and p’ > AVC min

)

• P = D(N q’)

• Profits = 0

MC

S

3

S

4 p’ q’ Q

Who pays for pollution in the long run model?

• Recall: C(Q with a tax) > C(Q with TBES) >C(Q)

– Tax and TBES are set to use same technique, but with tax have to pay for remaining pollution

• So AC(Q with a tax) > AC(Q with TBES) >AC(Q)

p’

Who pays?

Which is more effective tax tbes q’ Q

Grandfathering

• CAA allowed older more polluting power plants to run forever. Only when they were altered did they have to comply with more stringent rules.

• Two types of firms: new expensive clean firms

– Old cheap dirty firms

– Number of old firms is fixed-cause new firms have to be clean

• Example is swedish paper.

Long-Run Equilibrium: High- and Low-Cost

9-26

© 2011 Pearson Addison-Wesley. All rights reserved.

Features..

• The short run supply curve for 10 firms—find the little section of it that shows up on the next graph

• What are profits of new firms after the demand shift

• What are profits of the old firms after the demand shift

Grandfathering.

9-28

© 2011 Pearson Addison-Wesley. All rights reserved.

Grandfathering in CAA and CWA

• New plants were held to more stringent standards than old plants.

• For CAA it was power plants and refineries that mattered.

• Destructive. Modifying plants to make them more efficient (good) results in losing grandfather status. Hence plants are inefficient.

Why do old firms fight to retain grandfathered status?

• Profits.

• How do they fight?

• Contribute (indirectly and now directly) to their favorite politician.

– No bill gets written without consulting the lobbyists and industry

• Infinite litigation. Every year they litigate they collect profits. Compare cost of lawyers to profits from grandfathered status

In retrospect

• Air would have been much better off with a small charge—fraction of a cent per kwh– that was used to buy pollution control equipment.

• Water would be much cleaner if US had continued to subsidize sewage treatment plants.