october 5 and 28 in cmt - AB Freeman School of Business

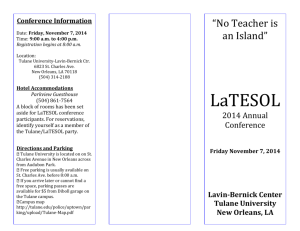

advertisement

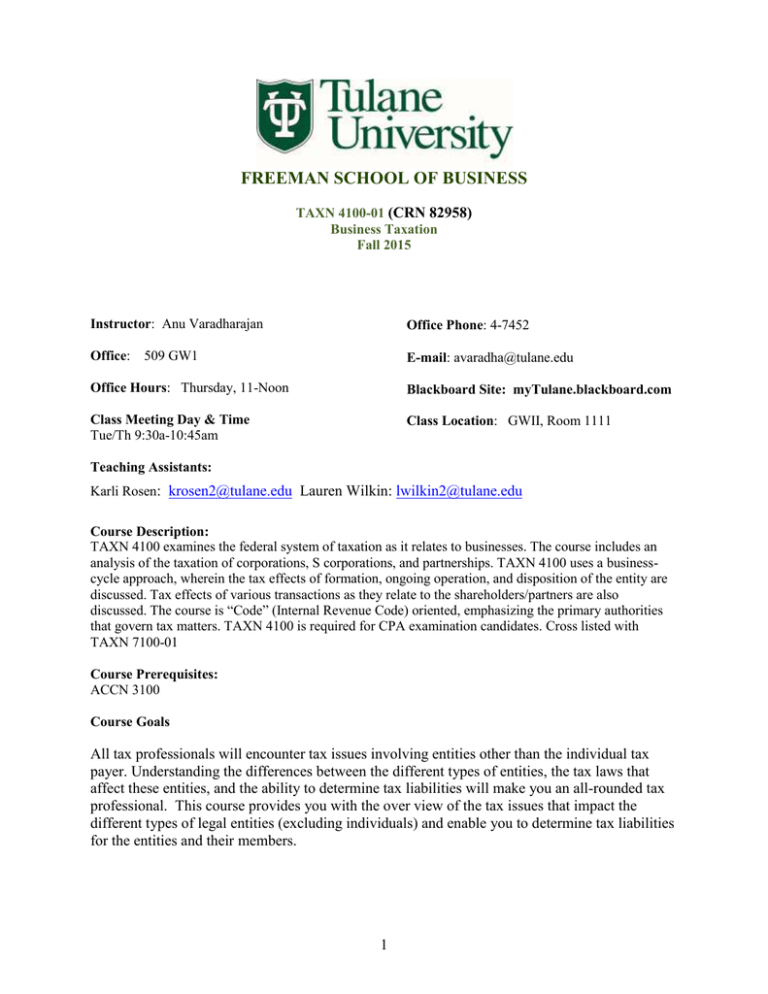

FREEMAN SCHOOL OF BUSINESS TAXN 4100-01 (CRN 82958) Business Taxation Fall 2015 Instructor: Anu Varadharajan Office Phone: 4-7452 Office: 509 GW1 E-mail: avaradha@tulane.edu Office Hours: Thursday, 11-Noon Blackboard Site: myTulane.blackboard.com Class Meeting Day & Time Tue/Th 9:30a-10:45am Class Location: GWII, Room 1111 Teaching Assistants: Karli Rosen: krosen2@tulane.edu Lauren Wilkin: lwilkin2@tulane.edu Course Description: TAXN 4100 examines the federal system of taxation as it relates to businesses. The course includes an analysis of the taxation of corporations, S corporations, and partnerships. TAXN 4100 uses a businesscycle approach, wherein the tax effects of formation, ongoing operation, and disposition of the entity are discussed. Tax effects of various transactions as they relate to the shareholders/partners are also discussed. The course is “Code” (Internal Revenue Code) oriented, emphasizing the primary authorities that govern tax matters. TAXN 4100 is required for CPA examination candidates. Cross listed with TAXN 7100-01 Course Prerequisites: ACCN 3100 Course Goals All tax professionals will encounter tax issues involving entities other than the individual tax payer. Understanding the differences between the different types of entities, the tax laws that affect these entities, and the ability to determine tax liabilities will make you an all-rounded tax professional. This course provides you with the over view of the tax issues that impact the different types of legal entities (excluding individuals) and enable you to determine tax liabilities for the entities and their members. 1 Student Learning Objectives Explain the differences between the different types of entities with respect to their formation, operation and liquidation Discuss the tax effects on the shareholder / member for each of these entities Discuss the pros-cons for each of type of entity – both tax and non-tax issues Calculate the tax liability for a corporation Prepare a simple corporate tax return, partnership return and S corporation return Course Material Text: South-Western Federal Taxation 2014: Corporations, Partnerships, Estates and Trusts, 37th Edition, Hoffman/Raabe/Smith/Maloney Tax Research Services – To access readings on the Code or to undertake tax research, all registered students have access to electronic tax library via Checkpoint. Grading This course follows the faculty approved grading guidelines of a maximum class average GPA in the range of 2.700 to 3.000 for core classes and a maximum class average GPA in the range of 3.000-3.333 for business elective classes. Please note the stated average class GPA range is a maximum average range and the class average GPA range could be lower. Class Attendance Attendance is mandatory. You are encouraged to come to class having read all the material beforehand. You are expected to attend class. This means that you are expected to arrive on time and to remain for the entire class period. If you do miss a class, it is your responsibility to ensure that you obtain any handouts or assignments and understand the material covered in the class missed. Also, because this is an accelerated class you will need to diligently prepare for each session in order to keep up with the material. Falling behind in such a compressed class will make it more difficult to be successful in this class. Finally, because we will not be using laptops or tablets in class, I request that you not turn on or use your laptops or tablets during class unless you are asked to do so. Statement about Academic Integrity This class will be conducted in full accordance with Tulane’s policies about academic integrity including, but not limited to, the Code of Academic Integrity and the Code of Student Conduct. These can be found at: http://tulane.edu/college/code.cfm and http://tulane.edu/studentaffairs/conduct/code.cfm Freeman Educational Norms and Expectations This class will be conducted in full accordance with Freeman’s Educational Norms and Expectations. Please reread the Norms and Expectations, which can be found at http://www.freeman.tulane.edu/students/bsm/pdf/Expected%20Behavioral%20Norms.pdf 2 Learning Disabilities Under the Americans with Disability Act and the Section 504 of the Rehabilitation Act, if you have a disability, you may have the right to an accommodation; however, the right is contingent upon you taking certain steps. You should review the steps that you need to take, as well as Tulane’s policy concerning accommodations at http://tulane.edu/studentaffairs/disability/accommodations.cfm Any student with a disability, in need of course or examination accommodation, should request an accommodation through the University’s Office of Disability Services (ODS) located in the Mechanical Engineering Building. At the beginning of the semester, please provide me with a copy of your approved ODS accommodation form. I am committed to working with ODS to ensure that I provide you with all approved accommodations. If you do not deliver the approved accommodation form to me, I will not know that ODS approved your accommodation and I will have no basis to provide those accommodations. PLEASE NOTE: For students with extended time accommodation, you are to take your exams within the Freeman School, please take your Exam Request Form to Suite 200 at least four business days before the exam and the Office of Undergraduate Programs will schedule your exam. You must begin your exam when the class normally would begin. For all other accommodations, please take your form to ODS and they will schedule your exam. Specific Course Policies Keys to success To successfully master the principles of corporate taxation you will need to practice applying the concepts we discuss in class. The theory underlying corporate taxation is straightforward; the application is where everything gets complicated and your understanding of these concepts is truly tested. E-mail, BlackBoard and class notes I will communicate with you regularly via e-mail; you are responsible for the content of these messages. I will use the e-mail account that appears in the class roster to create a class mailing list. This e-mail address is the one that appears with your name in the Tulane directory. The BlackBoard page maintained for this class also provides useful course information. You should access this page on a regular basis to ensure you are up to date and aware of what is going on in this class. Additionally, class notes for each class (a PowerPoint file) will be posted to BlackBoard the day before the class meeting. You will find the tax return project information here, as well. Evaluation A rigorous academic environment will be maintained in this class. Tentative course evaluation (subject to change) Midterms (2 each) Corporate Tax Return Partnership Tax Return Final Exam (2 parts comprehensive) Total 200 points 50 points 50 points 200 points 500 points 3 All quizzes, midterms and final exam are CLOSED BOOK. You may be allowed an index card for each midterm and final exam – I will clarify this later in the semester. The final exam is comprehensive and will have two parts: a take-home part (worked in a group) and an in-class exam. The in-class exam will take place during your regularly scheduled class on Tuesday, December 1, 2015. The take-home part will be due on Thursday, December 3 by 5 pm in my office. NO LATE EXAMS WILL BE ACCEPTED. NO MAKE-UP ASSESSMENTS WILL BE GIVEN UNDER ANY CIRCUMSTANCE. I will assign your groups. I recommend you sit with your group members in class so you get used to working with each other. These are the group members you will be working with all semester. All assignments are due on the date agreed upon. I WILL NOT ACCEPT LATE SUBMISSIONS UNDER ANY CIRCUMSTANCE. Grade disputes: You have one week from when I return the exam to discuss any grade changes. I will NOT discuss grades after that time. 4 CLASS Tuesday 1 18-Aug 2 3 25-Aug 27-Aug 1-Sep 6 7 3-Sep 8-Sep 8 9 11 15-Sep 17-Sep 22-Sep 12 13 15 29-Sep 1-Oct 6-Oct Different types of entities Ch 2 Pages 1-6; Ch 13 Pages 1-18 Operating a C-Corp - Tax Year, Method of Accounting Ch 2 Pages 7-37 Operating a C-Corp Depreciation, Amortization Ch 2 Pages 7-37 Quiz 1; Operating a C-Corp Property Disposition, Business Expenses Ch 2 Pages 7-37 Corporate Tax liability, Booktax differences Forming a Corporation Ch 4, Pages 1-19 Forming a Corporation Ch 4, Pages 1-19 Midterm 1 - Entire Class Period 24-Sep 14 End of Chapter Problems Working with tax law Online research - working with checkpoint Operating a C-Corp - Charitable contributions, Dividends rec'd NOL, DPAD 10-Sep 10 Readings Introduction / what is a tax? 20-Aug 4 5 Thursday Topics Distributions from corporation Ch 5, Pages 2-9 Liquidation Ch 6 Pages 1-13 Tax Return Prep - In class assignment Forming a Partnership 5 Ch 10 Pages 1-15 Ch 2: Qn 1, 4, 34, 35, 37 Ch 13: 2, 5, 38, 16 17 8-Oct 13-Oct Operating a Partnership Ch 10 Pages 17-42 Operating a Partnership Ch 10 Pages 17-42 FALL BREAK OCTOBER 15 - OCTOBER 18, 2015 18 20-Oct 19 20 22-Oct 27-Oct 21 22 24 3-Nov 26 10-Nov 28 17-Nov Liquidating a partnership Operating an S Corporation S Corporation shareholder issues Single vs Double taxation 19-Nov 24-Nov Ch 11 Pages 19 24 S Corporation shareholder issues 12-Nov 27 Distribution from Partnership Partnership consequences Midterm 2 - Entire Class Period 5-Nov 25 Ch 11 Pages 2-14 Liquidating a partnership 29-Oct 23 Quiz 2; Distribution from Partnership - partner consequences Ch 13: Pages 5-18 Quiz 3 / Catch up Class Review Class, Final Exam Take-Home portion given out THANKSGIVING BREAK NOVEMBER 25 - NOVEMBER 29, 2015 FINAL EXAM: December 1, 2015 6