Deutsche Bank screenshow template

advertisement

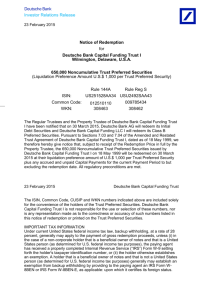

Deutsche Bank Gustavo Cañonero August 24, 2011 Deutsche Bank Perspectivas Económicas Globales: América Latina y Argentina Pre-Coloquio Centro, IDEA Rosario, 24 de Agosto, 2011 Gustavo Cañonero, Managing Director Chief Economist Emerging Markets Deutsche Bank Securities All prices are those current at the end of the previous trading session unless otherwise indicated. Prices are sourced from local exchanges via Reuters, Bloomberg and other vendors. Data is sourced from Deutsche Bank and subject companies. Deutsche Bank does and seeks to do business with companies covered in its research reports. Thus, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. DISCLOSURES AND ANALYST CERTIFICATIONS ARE LOCATED IN APPENDIX 1. MICA(P) 007/05/2010 Deutsche Bank Gustavo Cañonero Gustavo Cañonero Gustavo.canonero@db.com August 24, 2011 (212) 250 – 7530 Fernando Losada Fernando.losada@db.com (212) 250 - 3162 INDICE I. G7: Problemas Estructurales y Consecuencias. De EEUU a EU/Japón. II. EM: Creciente “Decoupling” de Largo Plazo, pero Sincronización en el Corto III. América Latina: Perspectiva Regional IV. Argentina Deutsche Bank Gustavo Cañonero August 24, 2011 I. Problemas Globales y Consecuencias Deutsche Bank Gustavo Cañonero August 24, 2011 EEUU: La recuperación se volvió a desacelerar Index ISM composite index (50+ = econ expand, ls) %qoq, AR Real GDP growth (rs) 65 9 60 6 55 3 50 0 45 -3 40 -6 35 -9 1997 Source: 1999 2001 ISM, Haver Analytics, DB Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 2003 2005 2007 2009 2011 EEUU: Y los pronósticos del crecimiento han caído Source: Bloomberg Finance LP, DB Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 EEUU: La recuperación ha sido históricamente más lenta de todos modos % Percent deviation of GDP from potential % Average of previous 10 recessions 6 Current recession/recovery 6 4 4 2 2 0 0 -2 -2 -4 Shaded area shows range during 10 previous recessions -6 -8 -4 -6 -8 -7 -6 -5 -4 -3 -2 -1 0 Source: 1 2 3 4 5 6 7 8 9 10 11 12 "0" implies recession end quarter BEA, CBO, Haver Analytics, DB Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 EEUU: En gran parte por el proceso de desendeudamiento privado… Ratio Ratio Household debt/ income 1.4 1.4 1.2 1.2 1.0 1.0 0.8 0.8 0.6 0.6 0.4 0.4 0.2 0.2 50 Source: 55 60 65 70 FRB, Haver Analytics, DB Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 75 80 85 90 95 00 05 10 ...que explica la permanente vulnerabilidad del consumo privado desde 2008 % 3m % chg, AR Personal saving rate (LS) 9 Real consumer spending (RS) 6 8 4 7 2 6 0 5 -2 4 Dec-08 -4 Source: Dec-09 BEA, DB Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 Dec-10 EEUU: Además, la alta deuda pública limita los márgenes de política y crea mayor incertidumbre % of GDP 200 180 160 % of GDP Federal debt Admin 2012 budget + CBO L-T Fiscal commission/Obama(?) Forecasts 200 180 160 140 120 140 120 100 100 80 60 80 60 40 20 40 20 0 0 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010 2020 2030 2040 Source: usgovernmentspending.com, Fiscal Commission, CBO, DB Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 EEUU: La cobertura de salud es parte del problema, complicando la economía política de cualquier solución % of GDP % of GDP CBO projections under current policies 25 25 20 20 15 15 Medicare and Medicaid spending with inflation premium of: 2-1/2% 10 10 1% 5 5 Social security 0 1962 1970 1978 1986 Source: CBO, DB Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 1994 2002 2010 2018 2026 2034 2042 0 2050 Ranking de riesgo país: EEUU es sólo un ejemplo (Basado en déficits externos y deuda pública) Index Index More risky 50 45 40 35 30 25 20 15 10 5 0 Numbers on top are 5Y CDS spreads 50 377 109 250 Gustavo Cañonero August 24, 2011 Germany Finland Netherlands Austria Belgium France Japan UK Spain US Ireland Italy Portugal 50 OECD, Haver Analytics, DB Global Markets Research Deutsche Bank 162 102 Greece Source: Less risky 50 45 40 35 30 25 20 15 10 5 0 II. EM: Desacoplados pero Sincronizados Deutsche Bank Gustavo Cañonero August 24, 2011 El crecimiento de mercados emergentes también se desacelera, aunque mantiene buen ritmo por ahora Indicadores de producción manufacturera EM: Desacoplados pero no aislados (%YoY) PMI Indices 60 8 55 6 50 4 45 2 40 G7 Trend EM cycle G7 cycle 0 Asia LatAm EMEA 35 EM trend -2 -4 30 Jul-06 Jul-07 Jul-08 Jul-09 Jul-10 Source: IMF, Haver, DB Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 Jul-11 -6 1980 1985 1990 1995 2000 2005 2010 Mayor asociación entre emergentes genera menor dependencia hacia los países desarrollados, pero mayor apertura mas sincronización de ciclos Destino de comercio exterior (X+M %PBI) 70% JAPAN EU US EMASIA EMEA LATAM Exportaciones por productos (% PBI) 35.0% 60% 30.0% 50% 25.0% 40% 20.0% 30% 15.0% 20% 10.0% 10% 5.0% 0% 0.0% LATAM EMEA Source: Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 EM ASIA Others LATAM Fuels & energy Industrial goods EMEA Primary goods EMASIA III. Perspectiva para América Latina Fuerte crecimiento jaqueado por la posible depresión global Deutsche Bank Gustavo Cañonero August 24, 2011 Crecimiento económico sigue pero la desaceleración es inevitable Crecimiento del PBI % YoY 10 2009 Inflación 2010 2011 % YoY 30 2012 8 2009 25 6 2010 2011 2012 20 4 15 2 0 10 -2 5 -4 0 -6 -8 -5 ARG BRA CHI COL MEX PEN VEN ARG BRA (% yoy unless stated) 2009 2010 2011 2012 Real GDP growth 5 4 3 2 1 0 -1 -2 -3 -4 -5 BRA CHI COL MEX Source: Global Market Research Deutsche Bank MEX PEN VEN Gustavo Cañonero August 24, 2011 PEN VEN 2009 2010E 2011F 2012F -2.5 6.1 4.1 3.9 Priv. consumption -0.5 5.6 4.9 4.5 Investment -9.5 13.6 7.3 5.8 6.3 8.4 8.2 7.9 Exports, USD bn 609.8 776.8 889.7 942.4 Imports, USD bn 534.9 703.8 813.2 897.2 Industrial production -7.6 7.3 4.8 4.5 Unemployment (%) 7.8 6.8 6.5 6.5 Fiscal bal. (% of GDP) -3.0 -2.4 -2.2 -2.1 CA bal. (% of GDP) -0.4 -0.8 -1.0 -1.7 Inflation ARG COL Proyecciones Saldo de cuenta corriente % GDP CHI Aunque las bases sólidas se mantienen 2009 Crec. PBI (%) Argentina Brasil Chile Colombia Mexico Peru Venezuela -3.1 -0.6 -1.7 0.8 -6.5 0.9 -2.9 2010E 2011F 9.2 7.5 5.2 4.3 5.5 8.8 -1.4 6.9 3.5 5.9 5.1 4.1 6.2 2.8 2012F 3.1 3.4 5.5 5.4 3.7 5.7 2.8 2009 Inflación (eop,%) Argentina 14.8 Brasil 4.3 Chile -1.5 Colombia 2.0 Mexico 3.6 Peru 0.3 Venezuela 26.9 2010E 2011F 2012F 25.2 5.9 3.0 3.2 4.4 2.1 27.2 24.1 6.3 4.1 3.4 3.4 3.1 24.0 26.8 5.1 3.3 3.4 3.5 2.6 25.0 DB_Forecast DB_Forecast _CURRENT_ACCT_BAL Actual_Release_Value DB_Forecast DB_Forecast DB_Forecast 2009 2010E 2011F 2012F Cuenta Corriente(%PBI) Argentina 3.2 1.4 0.3 -0.8 Brasil -1.5 -2.3 -2.2 -3.0 Chile 1.6 1.9 0.4 -0.6 Colombia -2.3 -3.7 -2.9 -2.9 Mexico -0.6 -0.6 -0.9 -1.0 Peru 0.2 -1.6 -1.7 -2.5 Venezuela 2.2 4.6 4.3 2.6 Source: Global Market Research Deutsche Bank Gustavo Cañonero August 24, 2011 _FX_RATE Fx (eop) Argentina Brasil Chile Colombia Mexico Peru Venezuela 31-Dec-11 31-Dec-12 2009 2010 2011F 2012F 3.80 1.74 506 2044 13.09 2.90 2.15 3.98 1.67 468 1908 12.34 2.80 4.30 4.28 1.60 480 1790 11.90 2.80 4.30 5.13 1.75 505 1800 12.25 2.90 5.20 En LA, la performance económica reciente ha tenido mucho de suerte y poco de inversión, Colombia y Perú las excepciones Estimaciones utilizando cálculos de equilibrio parcial Avg. Per Capita Growth 2004-2008 Growth Change 2004-08 vs 1990-2003 5.35 10.96 6.88 4.41 3.91 3.89 3.58 3.79 1.08 2.37 3.17 1.19 -1.24 -0.20 2.56 -0.28 -1.06 3.12 3.62 -0.15 -2.03 -5.92 -2.72 -3.34 1.68 2.97 3.35 2.85 -1.43 0.29 3.80 -0.06 -1.23 -2.01 0.13 0.35 -4.48 -0.37 -0.87 -1.40 1.02 0.05 -0.30 2.27 0.44 1.40 -0.44 3.73 0.68 -1.76 -3.63 -4.13 6.25 4.41 2.80 0.79 EMEA CZE HUN ISR POL ROM RUS SAS TUR 4.94 4.80 3.03 3.08 5.44 7.41 7.39 3.74 4.65 3.89 3.80 1.47 1.31 1.98 7.29 8.79 3.88 2.60 -0.67 -1.55 -1.02 -1.25 -1.42 2.80 -2.92 0.67 -0.68 -0.75 2.00 -5.13 1.17 1.39 -2.32 -1.55 0.25 -1.81 0.85 0.20 -0.59 -0.27 0.78 0.20 6.50 1.30 -1.28 -0.92 0.19 -0.92 0.00 -0.62 -1.85 1.03 -2.46 -2.75 5.38 2.95 9.13 1.66 1.85 8.46 5.73 4.12 9.11 LATAM ARG BRA CHL COL MEX PER VEN 5.12 7.39 3.65 3.81 3.88 2.35 6.33 8.43 3.86 5.93 3.28 -0.18 2.78 0.87 4.90 9.40 0.85 0.52 -0.05 -1.63 4.12 0.66 2.17 0.13 2.09 2.78 2.54 2.19 1.84 -0.01 2.01 3.28 3.56 2.12 0.63 5.32 3.03 0.69 2.47 10.67 -0.84 1.84 -1.78 -3.99 -0.01 -1.43 -0.47 -0.03 -1.80 -1.33 1.94 -2.07 -6.20 0.96 -1.29 -4.64 EM ASIA CHN IND IDN KOR MYS PHL THA Source: IMF, World Bank, and Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 Estimated Contribution to Growth Acceleration Production Macro Manufacture Factors Variables ToT Share Residual IV. Argentina Deutsche Bank Gustavo Cañonero August 24, 2011 Argentina: lista para sobresalir o para volver a defraudar! El crecimiento se mantiene fuerte pero las política económica se enfrenta con condicionantes crecientes. El gasto público no ha sustituido ni promovido la inversión privada. Sin inversión, las políticas expansivas generan aún más inflación. Y la inflación es un “impuesto” regresivo. El tipo de cambio no puede ser la única herramienta para mantener la inflación estable. El peso aún no está sobrevaluado pero su apreciación es muy rápida. La probable reelección con un fuerte mandato de la Presidente CFK puede ser una gran oportunidad para corregir algunas limitaciones del modelo actual. De lo contrario la salida de capitales puede continuar y la moderación será impuesta por el ahorro precautorio del sector privado. El contexto internacional le está dando a la Argentina la oportunidad del centenio….. Deutsche Bank Gustavo Cañonero August 24, 2011 El crecimiento económico post default fue posible dado un tipo de cambio competitivo a nivel internacional, excelentes términos de intercambio, una sólida recuperación en Brasil y una significativa reducción de la carga de la deuda externa. FUERTE DEVALUACION COMPETITIVA – El abandono de la convertibilidad en el 2002 generó Contribuciones externas al crecimiento actual ToT (1990=100) (RHS) REER w/Bs.As. City Index (1990=100) 350 170 160 300 una depreciación del peso de más del 100% en términos reales. – Entre 2002-2010 el peso se mantuvo, en promedio, un 43% más competitivo que en la década anterior. Hoy todavía es un 13% más débil que en esa década. 150 140 250 130 120 200 110 100 150 90 100 MEJORAS EN LOS TÉRMINOS DE INTERCAMBIO – Los términos de intercambio mejoraron 44% desde 2002, a una tasa anual del 5.5%. EL CRECIMIENTO BRASILERO SE DUPLICÓ – Brasil absorve la mayor parte de las exportaciónes industriales argentinas, aprox. 8% del PBI. 80 DISMINUCIÓN SIGNIFICATIVA DE LA DEUDA – Los Source: MinFin and DB Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 servicios de la deuda externa disminuyeron notablemente: de 15% del PBI en 2001 a 8% del PBI en 2010. – Del mismo modo, los servicios de la deuda para el sector público disminuyeron del 10% del PBI al 5%. Expansión fiscal ha sido uno de los motores de crecimiento El comportamiento de los números fiscales % GDP 2007 2008 2009 2010 2011 Primary surplus Nominal balance 3.22 1.16 3.20 1.44 1.60 -0.66 1.84 0.22 0.50 -0.80 CB profits* Other rents 0.18 0.35 0.52 0.30 0.46 0.99 1.56 0.80 0.58 0.60 Transfers to private priv.sector sec. Export taxes 3.54 2.56 4.46 3.55 4.84 2.96 5.56 3.34 6.35 3.04 M emo item: Primary spending 17.3 18.4 22.4 23.8 25.2 Source: MECON and DB Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 El alto crecimiento económico no generó aumento de la inversión ni de la capacidad productiva debido a la fuerte intervención estatal. El resultado: aumento de la inflación. Crecimiento sin inversión Unemployment rate % (lfh) 25 3.00 20 2.50 2.00 15 1.50 10 1.00 5 0.50 0 - Source: MECON and DB Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 45% 40% 35% Capital stock/GDP Unemployment (%) Capital stock/GDP (rhs) Notable aumento de la inflación 30% 25% 20% 15% 10% 5% 0% -5% CPI-BsAs City, YoY CPI-Indec, YoY El financiamiento fácil también se esta acabando Deterioro del balance del BCRA USD mn Mayores necesidades netas de financiamiento 15-May-07 15-May-11 31-Dec-11 ASSETS Net international reserves Public bonds Advances to the government Others 64,705 39,612 11,590 5,961 7,542 102,815 52,031 30,825 11,323 8,636 103,805 48,031 30,666 14,027 11,081 LIABILITIES Base money Deposits in other currencies Government deposits BCRA letters and notes Others 57,006 26,775 2,289 1,641 20,243 6,058 92,767 42,205 9,325 8,193 24,896 8,148 101,814 48,722 11,894 3,203 26,904 11,091 M emo items NIR/Assets NIR/Money base NIR/CB intruments 61% 148% 69% 51% 123% 56% 46% 99% 47% Source: MECON and DB Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 USD mn 2010 2011 2012 Net capital payments Net interest payments Warrants (excluding est.public holdings) 4776 2900 0 5000 3100 1543 4700 3070 2106 Total financing needs Primary Surplus Net financing needs 7676 6401 1275 9643 4201 5442 9876 4653 5223 BCRA reserves BCRA advances 9500 1981 9877 2411 0 979 Mientras tanto, la holgura externa se reduce debido a un tipo de cambio más fuerte y el aumento de la demanda NETA por energía. Balanza comercial y energética 20,000 15,000 10,000 5,000 0 Trade Balance -5,000 Energy Balance -10,000 2004 2005 Source: MECON and DB Global Markets Research Deutsche Bank Gustavo Cañonero August 24, 2011 2006 2007 2008 2009 2010 2011 2012 La salida de capitales refleja las dudas sobre la sustentabilidad y, eventualmente, puede imponer un ajuste forzado e innecesario. Aumento de la salida de capitales en los últimos meses Change in assets abroad (USD bn 3MMA, LHS) 1 15% 0 10% -1 5% -2 0% -3 -5% -4 -10% -5 -15% -6 -20% Source: MECON and DB Global Markets Research Deutsche Bank GDP growth (YoY, RHS) Gustavo Cañonero August 24, 2011 Global Disclaimer The information and opinions in this report were prepared by Deutsche Bank AG or one of its affiliates (collectively "Deutsche Bank"). The information herein is believed to be reliable and has been obtained from public sources believed to be reliable. Deutsche Bank makes no representation as to the accuracy or completeness of such information. Deutsche Bank may engage in securities transactions, on a proprietary basis or otherwise, in a manner inconsistent with the view taken in this research report. In addition, others within Deutsche Bank, including strategists and sales staff, may take a view that is inconsistent with that taken in this research report. Opinions, estimates and projections in this report constitute the current judgement of the author as of the date of this report. They do not necessarily reflect the opinions of Deutsche Bank and are subject to change without notice. Deutsche Bank has no obligation to update, modify or amend this report or to otherwise notify a recipient thereof in the event that any opinion, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. Prices and availability of financial instruments are subject to change without notice. This report is provided for informational purposes only. It is not an offer or a solicitation of an offer to buy or sell any financial instruments or to participate in any particular trading strategy. Target prices are inherently imprecise and a product of the analyst judgement. As a result of Deutsche Bank’s recent acquisition of BHF-Bank AG, a security may be covered by more than one analyst within the Deutsche Bank group. Each of these analysts may use differing methodologies to value the security; as a result, the recommendations may differ and the price targets and estimates of each may vary widely. Deutsche Bank has instituted a new policy whereby analysts may choose not to set or maintain a target price of certain issuers under coverage with a Hold rating. In particular, this will typically occur for "Hold" rated stocks having a market cap smaller than most other companies in its sector or region. We believe that such policy will allow us to make best use of our resources. Please visit our website at http://gm.db.com to determine the target price of any stock. The financial instruments discussed in this report may not be suitable for all investors and investors must make their own informed investment decisions. Stock transactions can lead to losses as a result of price fluctuations and other factors. If a financial instrument is denominated in a currency other than an investor's currency, a change in exchange rates may adversely affect the investment. Past performance is not necessarily indicative of future results. Deutsche Bank may with respect to securities covered by this report, sell to or buy from customers on a principal basis, and consider this report in deciding to trade on a proprietary basis. Unless governing law provides otherwise, all transactions should be executed through the Deutsche Bank entity in the investor's home jurisdiction. In the U.S. this report is approved and/or distributed by Deutsche Bank Securities Inc., a member of the NYSE, the NASD, NFA and SIPC. In Germany this report is approved and/or communicated by Deutsche Bank AG Frankfurt authorized by the BaFin. In the United Kingdom this report is approved and/or communicated by Deutsche Bank AG London, a member of the London Stock Exchange and regulated by the Financial Services Authority for the conduct of investment business in the UK and authorized by the BaFin. This report is distributed in Hong Kong by Deutsche Bank AG, Hong Kong Branch, in Korea by Deutsche Securities Korea Co. This report is distributed in Singapore by Deutsche Bank AG, Singapore Branch, and recipients in Singapore of this report are to contact Deutsche Bank AG, Singapore Branch in respect of any matters arising from, or in connection with, this report. Where this report is issued or promulgated in Singapore to a person who is not an accredited investor, expert investor or institutional investor (as defined in the applicable Singapore laws and regulations), Deutsche Bank AG, Singapore Branch accepts legal responsibility to such person for the contents of this report. In Japan this report is approved and/or distributed by Deutsche Securities Inc. The information contained in this report does not constitute the provision of investment advice. In Australia, retail clients should obtain a copy of a Product Disclosure Statement (PDS) relating to any financial product referred to in this report and consider the PDS before making any decision about whether to acquire the product. Deutsche Bank AG Johannesburg is incorporated in the Federal Republic of Germany (Branch Register Number in South Africa: 1998/003298/10). Additional information relative to securities, other financial products or issuers discussed in this report is available upon request. This report may not be reproduced, distributed or published by any person for any purpose without Deutsche Bank's prior written consent. Please cite source when quoting. Copyright © 2011 Deutsche Bank AG Deutsche Bank Gustavo Cañonero August 24, 2011