Business concept - sgitt-otri

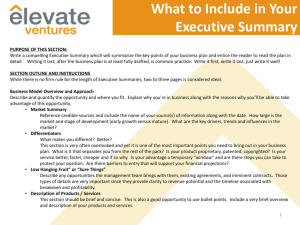

advertisement

From Research To Business Concept Assessing commercial potential and develop the business proposition www.knowledge2innovation.eu Purpose of the material The purpose of this training material is to provide research staff with hands-on advice, good examples, tools (e.g. check-lists and templates) and the typical tips and tricks, which are useful when determining the market value of a research project and when approaching investors or business partners. The ambition is not to go into detail, there is a multitude of books that already do this better, but to provide a first introduction. www.knowledge2innovation.eu - www.knowledge2innovation.eu - Demystifying the market Solvency Reports Balance Vertrieb Production Research Tools Taxes Capital PR Software Technology Team Investors Financing Development Potential Business plan Venture capital Soft funding Product USP Partner Idea Cash-flow Deal Share Communication Assets Management IT Networks Cooperation Negotiations Service Market Demand Support Guidelines Business development Marketing Licensing Customers Statutes 4P IPR Top-down vs. bottom-up Patents Intellectual property PLC Due Diligence Human capital www.knowledge2innovation.eu - Liabilities Typical misconceptions „The technology will sell itself!“ „First product development, the rest will come later“ „My technology is the best!...“ „…there are no competitors!“ „Venture capital investors are all criminals, who want to take over my company!“ Citations matter, the rest can come later! „Small and slow means low risk!“ „It‘s not ready yet!“ www.knowledge2innovation.eu „Scale-up“ The two topics of the presentation Assessing the commercial potential Creating a business proposal 1. Key markets 1. What is a business plan? 2. Commercialisation strategy 2. How to write a business plan? 3. Internal valorisation 3. Who are potential investors? 4. Tools and methods 4. What will I be asked? www.knowledge2innovation.eu - Part 1 Commercial potential www.knowledge2innovation.eu - Part 1: Key markets Objective: Assess all potential market applications for your technology. There will be more than you think! Advantages: Save costs and time in the R&D process Maximise sources for funding Maximise the success of the actual business Prevents: Development of the “wrong” product Unattractive IPR Unattractive business case www.knowledge2innovation.eu - Part 1: How to identify potential markets Colleagues, experts, professionals (e.g. scientific experts, intermediaries, technology transfer specialists, industry professionals) ? Market Creativity techniques (e.g. brainstorming, 6-3-5 method, analogies) Market studies (e.g. non-public & public sources, primary & secondary sources, Google, commercial databases and market studies, interviews and questionnaires) www.knowledge2innovation.eu - Example 1: The story of The Microwave www.knowledge2innovation.eu - It all started with the Magnetron.. www.knowledge2innovation.eu - And melting chocolate.. www.knowledge2innovation.eu - And ended up with.. www.knowledge2innovation.eu - And maybe some less commercial products.. www.knowledge2innovation.eu - Example: The patent www.knowledge2innovation.eu - Example 2: SmartFreshTM www.knowledge2innovation.eu - Example 3: Splenda® Sweetener www.knowledge2innovation.eu Part 1: Evaluation and selection criteria Evaluate the market applications you have identified Current situation Competitors Current status of the market? Geographical markets? Actors and market share? Products? Market segment Their strengths/weaknesses? Market share and prices? What is your USP? Who are they? Size? Growth? Match product – demand? Differentiation? Niches? Sales? www.knowledge2innovation.eu - Always be prepared to rethink your proposal! Part 1: Selecting a commercial strategy Many options Select the one you are most comfortable with Risk vs. reward Different strategies Low risk – low gain Medium risk – medium gain High risk – high gain e.g. contract research, fee-for-service and patenting & licensing e.g. joint venture, startup company e.g. EU projects (Further development and research through a public funded programme) www.knowledge2innovation.eu - Part 1: Increase value thr. internal valorisation Value (in Euro) is determined by market knowledge and market maturity The more information about the market and the actual value of your product you have, allows you to better put a value on your product The closer you are to a proof-of-concept, the higher the value of your product (idea stage: high uncertainty and risk = lower value; first sales: lower uncertainty and risk = higher value) Increase value through Market knowledge (incl. business case/plan) Professional IP strategy Validation studies / publications Prototype Demonstrators available to customers Pilot customers / first sales www.knowledge2innovation.eu - Questions? www.knowledge2innovation.eu - Part 2 Attracting investors www.knowledge2innovation.eu - Part 2: Who can finance my idea? Out of my own pocket My employer (e.g. many universities/PRO have internal funding programmes and can help to finance smaller amounts or through the use of equipment/personal) Early stage/ smaller investments Public financiers (e.g. regional, national and international bodies all have programmes to support technology development, early stage companies and SME) Banks (e.g. through loans) Business angels (individuals/benefactors, steady increase over the last 10 years, usually contributing with cash, expertise and networks) Venture capital (private companies focusing on creating revenues through early stage investments in high potential, high risk ventures, contributing with cash, expertise and networks) www.knowledge2innovation.eu - Later stage/ larger investments Part 2: How do I present my idea? Usually through a business plan Why do I need a business plan? Point of departure for your company A living document combining current status with future vision Forces you to constantly rethink and reassess your business idea Marketing material for your business idea Gives investors insight into your concept Can be evaluated www.knowledge2innovation.eu - Part 2: What is the aim of the business plan? The business plan shall convincingly show: How the idea will be developed and successfully exploited The capabilities and experience of the team responsible How the associated costs will be financed (incl. future rounds) Proposed exit mechanisms and timing Key questions that shall be addressed: What is unique about the idea? How is it protected (IPR)? Who will buy it and why? What price will it sell at and what will it cost to deliver? Who will be the competition and how will it be resisted? When will the company start having income and will break-even be reached? www.knowledge2innovation.eu - Part 2: Instructions for writing a business plan Keep it short (no more than 30 pages) Adapt the content towards the relevant target group (i.e. several versions okay!) Supporting data is best presented in the appendix Aim for an easily understandable language (not too technical) Mesmerise the reader Use sources for backing up facts and figures The information should be sufficiently concrete to base decisions on Ask colleagues and experts for feedback There is never a final version of a business plan, only a latest version! www.knowledge2innovation.eu - Part 2: Components of a business plan (1 of 3) Executive summary Capture the interest of a reader Summarise the most important details Keep it short (1-2 pages) Business concept Describe in a clear and understandable way how your business idea solves a problem Focus on the USP Cover IPR Go easy on technical detail and use graphics to illustrate your product Management team General rule: The people behind the idea are just as important as the idea itself! Present the members and their distinguishing features Do not be afraid to point out which competencies you lack www.knowledge2innovation.eu - Example: Executive Summary Type of Business CatchMabs will be a specialist biotechnology company with a focus on agroindustrial applications for designer affinity proteins. Company Summary CatchMabs will apply specially constructed protein molecules to capture valuable or harmful compounds from bulk industrial waste flows, using affinity chromatography columns. These molecules, called industrial molecular affinity bodies (iMab), have the ability to bind with specific organic compounds, much like antibodies do in blood. The proprietary, stable molecule design allows for application in bulk scale industrial process flows. We will supply complete purification solutions with immobilized affinity bodies at unprecedented low prices bringing together two separate worlds: molecular protein engineering and agro-industrial processing industries. Etc… Source: Kubr, T., Marchesi, H., Ilar, D., Kienhuis, H., Starting up - Achieving success with professional business planning, McKinsey & Company, 2003 www.knowledge2innovation.eu Example: Management Team The start-up team combines decades of experience in molecular and processing technology in agro industry and is complemented with commercial business and financial backgrounds. Dr. Peter C. Sijmons (founder, technology acquisition and strategy) has a long track record in plant biotechnology. After a PhD in plant physiology, he was one of the first science employees of Mogen in Leiden, now a Zeneca Subsidiary… Henk-Jan de Ruiter MSc (co-founder, early stage development / finance) is involved in start-up and financing of innovative companies and public-private (real-estate) projects. He was manager of a seed-capital fund… Sijmons will be the CEO during the start-up phase, but when the growth of CatchMabs requires additional expertise, a CEO with a strong business background will be attracted to strengthen the management team and Sijmons will transfer to another management position in CatchMabs. Tournois and De Ruiter are actively involved in the establishment of CatchMabs but will eventually transfer to a board position. A start-up team of scientists and technicians with relevant hands-on experience is already selected and will be available for CatchMabs on short notice… Source: Kubr, T., Marchesi, H., Ilar, D., Kienhuis, H., Starting up - Achieving success with professional business planning, McKinsey & Company, 2003 www.knowledge2innovation.eu Part 2: Components of a business plan (2 of 3) Marketing Who are your customers (segmentation)? Who are your competitors and which substitutes exist? How will you position your product? How large is the market and what will be your market share? Business system and organisation The business system described the activities that need to be performed to deliver your product to the customers Organisation: How are the responsibilities allocated? What characterises how you work together in your organisation (corporate culture)? Realisation structure How will you realise your business idea? Use work packages and milestones to visualise and to reduce risk. How will the work packages and milestones change as the company grows? www.knowledge2innovation.eu - Example: Business System CatchMabs will focus on R&D and the development of applications for the iMabs technology. Within the agro-industry it will be active in product development, marketing and sales. For other sectors these activities will be organized in spin-offs, joint-ventures or licensed partner companies. CatchMabs will generate three forms of revenue: • Bulk sales of iMabs for industrial applications kg quantities, production outsourced to third party manufacturers) • Royalties related to the value of recovered products (depending on quality and stability of our iMabs, market price of the target product, etc) • Licenses to sectors outside our core-business (pharma, chemical, etc.) Source: Kubr, T., Marchesi, H., Ilar, D., Kienhuis, H., Starting up - Achieving success with professional business planning, McKinsey & Company, 2001 www.knowledge2innovation.eu Example: Business System Source: Kubr, T., Marchesi, H., Ilar, D., Kienhuis, H., Starting up - Achieving success with professional business planning, McKinsey & Company, 2001 www.knowledge2innovation.eu Example: Realization Structure Source: Kubr, T., Marchesi, H., Ilar, D., Kienhuis, H., Starting up - Achieving success with professional business planning, McKinsey & Company, 2003 www.knowledge2innovation.eu Part 2: Components of a business plan (3 of 3) Risks Be open about the risks you see. What risks can threaten the success of your company? How will you mitigate these risks? Base case vs. best case scenarios How will you survive and tackle a worst case scenario? Financing Cash-flow, profit/loss statements, balance sheets are a requirement. Forecasts for the next 3-5 years What is the financial requirement until break-even? Where will this capital come from? What does the deal for potential investors look like and how will investors realise their profits? Appendices www.knowledge2innovation.eu - Example: Financing Our growth forecasts predict a break-even in the 4th operational year, with sales volume (excluding subsidies) reaching €2.4 million in year 4 and €13.8 million in year 5. Sales and gross margin can grow at a high rate as a result of royalty income on industrial applications and license fee income. Net income is expected to reach €7.5 million in year 5. The founders have provided start-up equity of €140,000. An initial investment of €250,000 in equity and debt is planned from a launching customer, matched by the Biopartner investment fund. Combined with subsidies, this will suffice for the proof-of-concept for industrial applications that is based on our proprietary technology. Once the technology is validated, venture capital will be attracted for product development and marketing activities into different industrial sectors. Already at this stage, the valuation of the company can be substantial, as is illustrated by comparable technology platforms, yielding a high ROI for the first investors. Source: Kubr, T., Marchesi, H., Ilar, D., Kienhuis, H., Starting up - Achieving success with professional business planning, McKinsey & Company, 2003 www.knowledge2innovation.eu Part 2: Check-lists and templates www.knowledge2innovation.eu - Questions? www.knowledge2innovation.eu - Thanks for listening! XX Person, Company www.xxxxxx.com; xxx@.abccom +xx xxxx (office); + xx xxxx (cell) www.knowledge2innovation.eu -