THE WORLD OF THE TRANSNATIONAL CORPORATION

advertisement

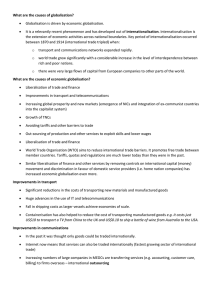

THE WORLD OF THE TRANSNATIONAL CORPORATION Kondratieff Waves – cyclical patterns of growth & stagnation 50-75 year periodicity Nikolai Kondratieff (1892 - 1938) Growth Decline K1: 1770/80 1810/20 1830/40 K2: 1830/40 1870/75 1890/96 K3: 1890/96 1914/20 1930/40 K4: 1930/40 1967/73 1980/90 K5: 1980/90 1998/2000 2008/14 K6: 2014 ??????? High correlation with technological change Explanation for the waves’ dynamism focuses upon contradictions between: Short-term interests of individual capitalists Long-term behavior of collective capital Comparison of the US and world economies, late 18th century-present Correspondence with political and economic changes K1 leaders (late C18th): Britain, France, Belgium K2 leaders (1840s): Britain, France, Belgium, Germany, northeastern USA K3 leaders (1890s): Germany, northeastern USA, Netherlands K4 leaders (1940s): USA (S. California), Japan K5 leaders (1980s): USA (S. California), Japan, Taiwan, S. Korea, China K6 leaders? (early C21st): USA (S. California), China, India, Brazil?? THE TRANSITION TO GLOBAL CAPITALISM 17th century: Internationalization of MERCHANT CAPITAL (trade) mid-19th century: Internationalization of FINANCE CAPITAL (loans and speculative capital) 20th century: Internationalization of PRODUCTION CAPITAL (manufacturing) Links to colonialism/ neo-colonialism: Many of today’s TNCs have their origins in the colonial era Imperial Chemical Industries [ICI] Royal Dutch Shell Imperial Tobacco [British American Tobacco today], Lucky Strike, Rothmans, Kool, Dunhill, Benson & Hedges US insurance companies associated with slave trade (Lehman Brothers, Aetna, JPMorgan, Chase, New York Life, Wachovia, FleetBoston, AIG) Use of colonies for RAW MATERIALS and as MARKETS Countries can GEOGRAPHICALLY OFFSET economic crisis by diverting production elsewhere (flooding of foreign markets) The Global Economy on the Eve of the First World War The Global Economy at the Height of US Power Little change Little Change EVOLUTION OF U.S. TRANSNATIONAL CORPORATE ACTIVITY Phase 1 (mid-19th century to 1940): Early period dominated by foreign direct investment (FDI) to obtain raw materials (oil, minerals) for domestic mfg.; later, entry into Canadian & some European markets Phase 2 (1945-1970): FDI and overseas production to penetrate foreign consumer markets Marshall Plan allowed US TNCs to penetrate W. Europe Establishment of $ under Bretton Woods as principal reserve currency gave the US immense power to shape the global economy; allowed the US to print money to fuel borrowing for industry or buying dollardenominated goods (eg oil) 1957-67: 20% of all new US machinery plants, 25% of new chemical plants, and over 30% of new transport equipment plants were located abroad By 1970: almost 75% of US imports were transactions b/w the domestic and foreign subsidiaries of US TNCs Employment in overseas manufacturing plants of US TNCs, 1966 & 1977 Source: N.G. Howenstein (1982) – Growth of US multinational companies, 1966-77, Survey of Current Business, 62, 4, Table 6. Phase 3 (1970s ): Collapse of Bretton Woods and increased strength of $ Growing imports from abroad; European and Japanese TNCs penetrate the US market US TNCs redeploy capital to lower cost production regions (Europe & LDCs) – e.g. Nike Initially produced in US and UK Japan S. Korea and Taiwan Indonesia, Malaysia, China, Vietnam Between one-third and two-thirds of global trade is now intra-firm trade between TNCs’ different subsidiaries US TNC Employment, 1989-2009 (millions) www.economicpopulist.org/content/government-finally-shows-what-we-already-know-shipping-jobs-overseas-big-problem US-based Share of Employment by US TNCs for selected years (%) www.economicpopulist.org/content/multinational-corporations-are-hiringabroad Change in US TNCs’ Domestic vs. Foreign Employment (%) www.economicpopulist.org/content/multinational-corporations-are-hiringabroad Understanding TNCs’ Dynamics – the Product Life Cycle Understanding TNCs’ Dynamics – the Product Life Cycle Lowell, MA New England US South Global South Paths of TNC evolution The product life cycle as an evolutionary sequence of US TNCs’ development 1900-1920s 1920s-1940s 1950s 1960s-1970s 1980s-present TNCs as networks within networks HOW DID THE US ECONOMY WORK PRIOR TO 1970? 1. Destruction of pre-war competitors US emerges as world’s “economic hegemon” US pushes “laissez faire” policies 2. Aid packages to Europe and Japan encouraged US economy to expand Marshall Plan for Europe economic benefits to US companies political implications for world geopolitics 3. Importance of BRETTON WOODS AGREEMENT 1944 conference in NH; Set the US $ as the world’s “reserve currency” – Value of the US $ set at 1 oz gold = $35 Stimulus to US banking sector • constant demand for US currency as traders must hold $ to access commodities priced in dollars – oil, gold, wheat, cattle, coffee etc. Mfg. sectors benefitted because US lent money to other nations so they could buy US goods. Allowed US to enjoy benefits of “seigniorage” – acquiring resources through the printing of money. Allowed US to print dollars to cover any trade deficit Established new key international organizations Established new key international organizations i) International Monetary Fund (IMF) Ensure convertibility of currencies & fixed exchange rates linked to price of gold ii) International Bank for Reconstruction and Development (IBRD –“World Bank”) Ensure international flow of capital Foster “development” in LDCs iii) International Trade Organization (ITO) Designed to reduce barriers to world trade (soon failed) Replaced in 1948 w/ General Agreement on Tariffs and Trade (GATT) GATT: Operated under aegis of UN; periodic “negotiating rounds” 4 principles to reduce barriers in mfg realm: Reciprocity: mutual reduction of tariffs Non-discrimination: Members not to grant preferential treatment to one country over others • “Most-favored-nation rule” -- all members to be treated as favorably as the most favored Transparency: Members expected to replace non-tariff barriers (whose effects are hard to detect/ measure) w/ tariffs (which are more open to scrutiny) Developing Countries: LDCs were to be granted favorable trade treatment under a special set of provisions 4. Role of the central (federal) state dramatically changed relative to pre-1930s Greatly expanded role of federal govt as result of FDR’s NEW DEAL; followed KEYNESIAN POLICIES Fed govt stimulates CONSUMPTION stimulation of PRODUCTION Defense spending (“Military-industrial complex”) Investment in infrastructure (e.g., Interstate Highway System) 1949 Housing Act stimulate suburbanization Emergence of Fordism Role of federal govt was to REGULATE relationship b/w PRODUCTION and CONSUMPTION MASS PRODUCTION MASS CONSUMPTION INTERVENTIONIST CENTRAL STATE Geographic reorganization of US industry Much industry moved from urban to suburban areas Much industry moved to the South and SouthWest (“SNOWBELT TO SUNBELT SHIFT”) • Cheap labor • Anti-union “Right To Work” laws THE US ECONOMY, 1945 TO LATE 1960s Economy performing fairly well in 1940s & 50s (growth stage of 4th Kondratieff) “Golden age” of US post-war capitalism Real Wages rising until 1970s www.thestreet.com/story/11480568/1/us-standard-of-living-has-fallen-more-than-50-opinion.html 1960s: GNP grew 4.1% per yr (50% for the decade) Productivity grew 3.3% per yr Ave. family disposible income increased 30% in real terms The “Affluent Society” (John Kenneth Galbraith) BUT: by early 1970s significant economic changes GNP increasing only 2.9% per yr Productivity increasing at 1.3% per yr Unemployment increasing • early 1970s: 5% • mid-80s: › 10% Inflation increasing • 1960s: 2-3% per yr • Mid-70s: 10% per yr • 1980: 13.5% per yr THE NEW INTERNATIONAL DIVISION OF LABOR Growing Deindustrialization: Usual scapegoat is OPEC oil price hike in 1973 (quadrupled price of oil) -- BUT, evidence is questionable • based on business cycle, US should have gone into recession in 1960s; markets for consumer durables becoming saturated • recession delayed by govt spending (Vietnam War, space race, War on Poverty) • Govt spending stimulated inflation • purchasing power of the $ declined; $ no longer worth in real terms what Gold Standard says it is • Nixon ends direct convertibility of $ into gold (abandons Bretton Woods) OPEC price rise can be read as a defensive move; related to deeper structural problems in US economy Having the dollar as the world’s central currency during Bretton Woods era had advantages: US could run chronic trade deficits and still maintain a strong currency – it could print money to make up the shortfall. US consumers benefitted (cheap foreign goods). US investors in overseas markets benefitted ($ buys more foreign currency/ goods) US military could maintain foreign bases more cheaply. BUT: US workers engaged in tradable goods industries (primarily manufacturing) were hurt because imports were cheap and exports expensive. By the late 1960s/ early 1970s things had changed: • WW2 competitors had rebuilt their economies • Ideology of “free trade” reduced protection from cheap imports • Time-space compression TNCs could more easily coordinate offshore activities capital flight CHARACTERISTICS OF THE POST-BRETTON WOODS ECONOMY 1. Shift from AGRICULTURE & MANUFACTURING to SERVICES Mfg as % of total emploment: 1947: 33% 1977: 24% 1997: 16% 2012: 9% Mfg as % contribution to GDP: 1947: 26% 1977: 22% 1997: 15% 2012: 12% Manufacturing absolute numbers Manufacturing job loss in recent decades http://economistsview.typepad.com/economistsview/2005/10/the_decline_in_.html 2005 2. Shift from more LABOR INTENSIVE forms of work to more CAPITAL INTENSIVE forms (automation, robotics) (1948-2011) 3. Trend towards OLIGOPOLY among corporations Age of acquisitions and mergers; huge though diversified corporations 4. Redeployment of capital by corporations in search of NEW MARKETS and LOWER PRODUCTION COSTS growing economic internationalization as TNCs exploit “Time-space compression” As the pace of economic life has increased, TNCs “need” to have flexibility • growing use of contingent workers who are easily hired and fired • growing use of just-in-time inventory control and delivery by some Export Processing Zones (EPZs) in the Global South (2003) Overseas investments are a growing source of profit for US corporations Source: Moody (1988: 112), An Injury to All; US Statistical Abstract US Private assets held abroad Proportion of profits made abroad by US TNCs 1950 $ 19b 1950 3.4% 1960 $ 49b 1960 5.9% 1970 $ 119b 1970 9.4% 1980 $ 701b 1980 15.6% 1994 $2,233b 1994 18.4% Worsening of workers’ situations NYT Aug 28, 2006 Growing inequality Emergence of a low-wage economy for many workers Falling real wages and minimum wage Of the 25 million jobs created in the US in the 1990s “boom”, only 18% paid more than the national average. Average hourly earnings, 1964-2008 (2008 $) FEDERAL MINIMUM WAGE, ADJUSTED FOR INFLATION A quarter of jobs in the US pay below the federal poverty line for a family of four ($23,050 – $10.60 per hour for a full-time worker) 5. Changed role for the central state Shift from DEMAND MANAGEMENT “stimulator of the economy” to SUPPLY SIDE “pursuer of deregulation” – Milton Friedman (Univ of Chicago) • Replacement of “bottom-up” economic policies of New Deal w/ “trickle-down” policies Decentralization – “New Federalism” Individual states playing a greater role in economic development Allows TNCs to play states against each other for incentives Company, state, date subsidies per job created Nissan, TN, 1980 $11,000 Saturn, TN, 1985 $13,000 Toyota, KY, 1985 $50,000 BMW, SC, 1992 $68,000 Mercedes-Benz, AL, 1993 Nissan, MS, 2000 $169,000 $73,750 Searchable data base at: www.nytimes.com/interactive/2012/12/01/us/g overnment-incentives.html 6. New international organizations, e.g. WORLD TRADE ORGANIZATION By 1980s GATT becoming increasingly irrelevant; GATT had dealt w/ mfg but did not cover agricultural commodities and services WTO came into being on Jan 1, 1995 Unlike GATT, WTO treaty created permanent organization to enforce trade rules and assess penalties CRISIS AND RESTRUCTURING POST-1970s 1. Economic slow down in core industrial countries and FALLING PROFIT RATES Rates of economic growth in OECD countries: 1963-1973: 5-6% per yr 1973-1978: 2-3% per yr 1979-1982: ‹ 1% per yr Associated w/ decline phase of 4th Kondratieff Falling levels of demand for BUILDING, MINING, FACTORY EQUIPMENT (eg ships, vehicles, machinery, machine tools) and hence for STEEL 2. Growth Of Inflation Financing for Vietnam war stimulated inflation in late 1960s Inflation reduced profits increased problems of capital accumulation CAPITAL INVESTMENT financed not by profits but by BORROWING ROLE OF FEDERAL RESERVE SYSTEM “The Fed” can EXPAND or CONTRACT the MONEY SUPPLY to control MONETARY POLICY (different from FISCAL POLICY) ELEMENTS OF THE FRS: 12 Regional Reserve Banks – these operate the DISCOUNT WINDOW Federal Open Market Committee (located at NY Fed Res Bank) Regional Reserve Banks: Commercial banks borrow from the RRBs to make up temporary shortages in their required reserves By loaning money to commercial banks, RRBs expand the money supply Interest rate (“Discount rate”) charged by RRBs to commercial banks affects how much money the latter will borrow and at what price Federal Open Market Committee: Expands the money supply through buying govt. securities (e.g. Treasury bonds) Buying govt securities creates money in a dealer’s account Contracts the money supply through selling govt securities takes money out of the system Fed moved against INFLATION by increasing the PRIME RATE to 21.5% (by June 1982) to cause a RECESSION (known as the “Reagan recession”) This was a calculated decision to favor FINANCE CAPITAL over MANUFACTURING CAPITAL worst recession since the Great Depression. Unemployment peaked at 9 million and 17,000 businesses failed Why? If inflation is running too high relative to interest rates, lenders lose out But, debtors do well Loan Amount $100 Interest 5% $105 Inflation 10% $110 Loan Amount $100 Interest 10% $110 Inflation 5% $105 Implications? Makes borrowing much more expensive, especially as firms have become more reliant on borrowing to finance investment Retarded TECHNOLOGICAL INVESTMENT Hindered COMPETITIVENESS But, simultaneously, inflation increased some LABOR COSTS RECESSION in both: CAPITAL-INTENSIVE industry e.g. steel, shipbuilding, automobiles, consumer durables LABOR INTENSIVE industry e.g. textiles, clothing, footware Boom for FINANCIAL SECTOR as foreign investors buy $ 3. Increased International Currency Instability i) End of Bretton Woods FLOATING EXCHANGE RATES Issue of Over/ Under-valuation of currencies If currencies are STRONG (eg $, £) industrial production is RETARDED because EXPORTS are expensive Equally, IMPORTS from abroad are relatively CHEAPER If currencies are WEAK (eg DM, ¥, Swiss Franc) industrial production is STIMULATED because EXPORTS are cheaper Equally, IMPORTS from abroad are relatively MORE EXPENSIVE Assume the Japanese Yen (¥) exchanges at ¥100 = $1 For an American to buy a Japanese car priced at ¥2000,000 = $20,000 For a Japanese to buy an American car priced at $20,000 = ¥2000,000 Situation 1: the dollar strengthens against the yen ($1 = ¥200 instead of ¥100 ) For an American to buy a Japanese car priced at ¥2000,000 = $10,000 (instead of $20,000) For a Japanese to buy an American car priced at $20,000 = ¥4000,000 (instead of ¥2000,000) Japanese imports become cheaper; US exports become more expensive Situation 2: the dollar weakens against the yen ($1 = ¥50 instead of ¥100 ) For an American to buy a Japanese car priced at ¥2000,000 = $40,000 (instead of $20,000) For a Japanese to buy an American car priced at $20,000 = ¥1000,000 (instead of ¥2000,000) US exports become cheaper; Japanese imports become more expensive The value of the dollar over time June 1982: interest rates hit 21.5% Strong dollar loss of international competitiveness & significant import penetration Proportion of sales accounted for by imports (%) 1980 1985 Clothing & textiles 34 55 Shoes 50 81 7 25 35 40 Computers Autos US Exports and Imports, 1970-1998 www.census.gov/statab/freq/99s1323.txt Manufactured goods Agricultural goods Deficit in mfg The loss of export competitiveness and competition from cheap imports affected different parts of the US in different ways Import-vulnerable & export-oriented sectors Share of regional Mfg accounted for by export-oriented, import-vulnerable, and non-traded goods in 1985 Decline in share of production workers in mfg employment, 1978-1985, by region ii) Problem of INTERNATIONAL DEBT CRISIS 1973 OPEC oil price increase PETRO-DOLLAR surpluses US and Western Banks flooded w/ $ Many Global South countries borrowed heavily in 1970s PROBLEMS: Financial instability in 1980s as Global South countries defaulted on debts Strong incentive for Global South countries to increase EXPORTS to earn foreign exchange Structural Adjustment Programs (SAPs) imposed on defaulting Global South nations IMPACT: Many LABOR INTENSIVE industries in Global North countries faced INTENSE COMPETITION 4. RESSURGENCE OF POLITICAL VOLATILITY (“NEW COLD WAR” of 1980s) Reduced possibilities for trade b/w EAST and WEST, and trade involving CENTRAL AMERICA, MIDDLE EAST, SOUTHEAST ASIA US Govt efforts to stabilize regimes encouragement of OVERSEAS INVESTMENT by US TNCs (e.g., Philippines) 5. GROWING INTERNATIONAL COMPETITION FOR US post-1970 stagnation of world markets aggressive role played by govt in NICs US losing role as economic hegemon Growing industrialization of some LDCs GLOBAL RESTRUCTURING HAS RELIED ON 3 ELEMENTS 1. Transformation of political and economic relationship b/w capital and labor Introduction of robotics and labor saving technology loss of high wage mfg jobs Threat of capital flight has allowed corporations to play workers and communities against each other •undermines bargaining power of workers •encourages states and communities to compete for investment 2. New roles for central government and public sector Deregulation of economies and markets has made capital flight easier shift from investment in COLLECTIVE CONSUMPTION (schools, hospitals, community services) towards PRIVATIZATION 3. Creation of a NEW INTERNATIONAL DIVISION OF LABOR as TNCs exploit TIME-SPACE COMPRESSION TNCs searching for new markets and labor sources Reduction of relative distances b/w places Pace of social life has increased Need for TNCs to be able to be “flexible” growing use of contingent workers Emergence of low wage mfg economy