Environment and Theoretical Structure of Financial Accounting

advertisement

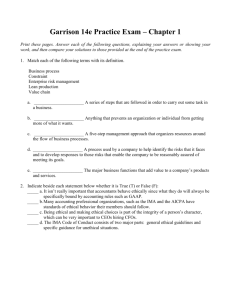

Environment and Theoretical Structure of Financial Accounting Sid Glandon, DBA, CPA Associate Professor of Accounting 1 Financial Accounting Financial reporting is the process of providing relevant financial information to third-party users Investors Creditors Financial intermediaries 2 Capital Markets Primary markets Debt and equity instruments are sold based on anticipated cash flows Interest Dividends Capital gains Secondary market Investors trade 3 Accrual vs. Cash Accounting Accrual accounting provides a more realistic representation of periodic financial results 4 Financial Statements Balance Sheet Statement of Income Statement of Cash Flows Statement of Shareholders’ Equity Notes to the Financial Statements 5 Standards Establishment of accounting standards is a political process Standards setting bodies Committee on Accounting Procedures Accounting Principles Board Financial Accounting Standards Board 6 Financial Accounting and Reporting Standards Securities and Exchange Commission American Institute of Certified Public Accountants (AICPA) Committee on Accounting Procedures (CAP) Accounting Principles Board (APB) Financial Accounting Standards Board (FASB) 7 Financial Reporting Reform Public Company Accounting Reform and Investor Protection Act of 2002 Sarbanes-Oxley (SOX) Public Company Accounting Oversight Board (PCAOB) Standards setting body for publicly traded companies and their auditors 8 Conceptual Framework Statements of Financial Accounting Concepts #1 Objectives of Financial Reporting #2 Qualitative Characteristics of Accounting Information #6 Elements of Financial Statements #5 Recognition and Measurement in Financial Statements 9 Objectives of Financial Reporting Provide information: Useful for decision making Helps in predicting cash flows About economic resources, claims to resources and changes in resources and claims 10 Qualitative Characteristics Understandability (user-specific quality) Decision Usefulness (overriding objective) Primary qualities Relevance Reliability Predictive value Feedback value Timeliness Verifiability Neutrality Representational faithfulness Secondary Comparability Consistency Materiality 11 Constraints Cost effectiveness Materiality Conservatism 12 Elements of Financial Statements Assets Liabilities Equity Investments by owners Revenues Gains Expenses Losses Comprehensive income 13 Recognition and Measurement Recognition Item is an element that is measurable, relevant and reliable Measurement Unit of measurement Attribute to be measured Historical cost Net realizable value Present value of future cash flows 14 Recognition and Measurement Concepts Assumptions Economic entity Going concern Perodicity Monetary unit Principles Historical cost Realization Matching Full disclosure 15 AICPA Code of Ethics Preamble, self-discipline Responsibilities, sensitive professional and moral judgments Public Trust, serve the public interest Integrity, highest sense of integrity Objectivity and Independence, objective and independent in fact and appearance Due Care, professional’s technical and ethical standards Scope and Nature of Services, qualified to provide 16 Model for Ethical Decisions Step 1, Determine the facts of the situation Step 2, Identify the ethical issue and the stakeholders Step 3, Identify the values related to the situation Step 4, Specify the alternative courses of action Step 5, Evaluate the courses of action in terms of their consistency with the values identified Step 6, Identify the consequences of each possible course of action Step 7, Make your decision and take any indicated action 17