Module 3 - Solomon Islands Chamber of Commerce and Industries

advertisement

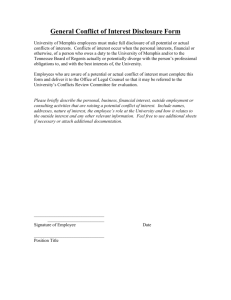

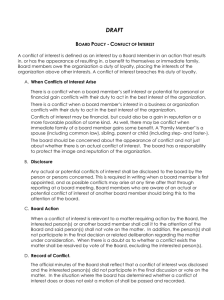

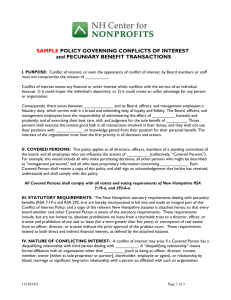

CORPORATE GOVERNANCE TRAINING MODULE 3: CONFLICTS OF INTEREST ADB Private Sector Development Initiative Corporate and Financial Governance Training Solomon Islands Dr Ann Wardrop La Trobe University Session Acknowledgments 2 These materials were produced by the Asian Development Bank’s Pacific Private Sector Development Initiative (PSDI). PSDI is a regional technical assistance facility co-financed by the Asian Development Bank, Australian Aid and the New Zealand Aid Programme. Session Outline: Conflicts of Interest 3 Conflicts of Interest Introduction Sources of rules about conflicts of interest General law: the fiduciary relationship Fiduciary duties Test for for conflict of interest Remedies for breach of fiduciary conflict duty Defence: fully informed consent Session outline: Conflicts of Interest 4 The Companies Act 2009 Section 67 Consequences of breach of conflict provisions Remedies against the director Can the company set aside a transaction where director has a conflict? Company model rules and conflicts Public company interests register Sum up and checklist for conflicts Session Outline: Conflicts of Interest 5 State-Owned Enterprises Introduction State-Owned Enterprise Act Regulations concerning conflicts Directors’ obligations of disclosure and no participation Appointments Case study of directors and SOEs Introduction 6 Questions relating to conflicts of interest are central to corporate governance. They are therefore a key issue for the board. A broad ethical view should be taken to the issue of conflicts of interest rather than narrowly focussing on what amounts to a breach of the legal requirements relating to conflicts of interest. Sources of rules about conflicts of interest and directors 7 General law rules Judge made law concerning the fiduciary relationship between the director and the company Statute Companies Act 2009 State-Owned Enterprises Act including relevant SOE Act, and State Owned Enterprises Regulations 2010 Sources of rules about conflicts The company’s rules, codes of conduct or policies and expectations (company culture about ethical behaviour) For example, compare a sales company where directors may be involved in hospitality events that involve gifts, and compare this situation to an auditor or law enforcement person who would be compromised by such behaviour. 1 Director’s employment contract Codes of conduct or professional rules applying to the particular industry AICD, Conflicts of Interest (2010, p 7) General law: the fiduciary relationship 9 The law concerning fiduciary relationships is relevant to directors’ duties concerning conflicts under the general law. Solomon Island general law recognises that directors are in a fiduciary relationship with the company, see Emery v Hashimoto [1995] SBHC 114 General law: the fiduciary relationship 10 What is a ‘fiduciary relationship’ and what are the legal implications of being in such a relationship? The general law recognises that in particular kinds of relationships one person (the fiduciary) has a great deal of opportunity to abuse a position of trust and confidence that has been placed in them by another person (the principal). General law: the fiduciary relationship 11 To protect the person vulnerable to abuse, the law developed strict rules applying to fiduciaries to encourage the fiduciary to be loyal to the principal and not to abuse their position of power. General law: the fiduciary relationship 12 Thus the law requires a fiduciary to put the other party’s interests first. In a competition between interests, a fiduciary cannot prefer his or her own interests over the other party. A fiduciary must act with the utmost loyalty to the other party. These ideas are expressed in two fundamental duties that the law applies to fiduciaries. General law: the fiduciary duties 13 A fiduciary is under a duty: not to put themselves in a position where their personal interests or duties to some third party conflict with the interests of their principal (the no conflict duty); and not to make a profit out of the relationship they have with their principal (the no profit duty) except with the fully informed consent of the principal. General law: the fiduciary duties 14 These duties for the most part overlap. That is, where a director has the opportunity of making a profit because of their relationship with the company, they will generally be in a conflict of interest and duty situation. The fiduciary duties apply to: executive, non executive and shadow directors (shadow directors are described in s 72 Companies Act 2009). They can also apply to senior employees. Examples of conflict of interest 15 The classic example of a conflict is where a company buys from or sells to one of its director’s own personal businesses. Director’s duty to the company is to get the lowest possible price (buy) or highest price (sell) these are the opposite of what the director wants for their own personal interest. Director therefore has a conflict of interest. Examples of conflict of interest 16 Other clear examples include where a director: is involved in company decisions to contract with or benefit the director’s friends or family; is involved in decisions to write off a debt the director owes to the company; is involved in a decision about his or her remuneration. Examples of conflicts of interest 17 All the previous examples involved a conflict between the director’s own personal interest and the company’s interest. A conflict can arise when the director has nothing personal to be gained but owes a duty to a third party that may conflict with his or her duty to the company. Examples of conflicts of interest 18 For example, the director is a director of both Red Company and Blue Company. Blue Company is selling goods to Red Company. Looking at this from the perspective of Red Company, the director has a conflict between his or her duty to Red Company to ensure the lowest price is paid with his or her duty to Blue Company to ensure the highest price is obtained. Sometimes it is difficult to say whether or not there is a possible conflict 19 There may be other situations where because of particular facts it is not clear whether a director has a conflict of interest. For example: Company set up to act as the agent and manager for a syndicate of 20 people to purchase particular land for development by the syndicate. One member of the syndicate was a director of the company. There were discussions about buying new land for development with some of the members of the syndicate but it was recognised a new syndicate would need to be formed to purchase the further land. The director then fell out with everyone and resigned as director. The company bid at the auction for the new land for syndicate no 2 and the ex director bid for the land for himself. The ex director was the successful bidder. The company claimed the ex director had breached his fiduciary duty by having a conflict of interest and taking up a corporate opportunity that belonged to the company. The court held that there had been no breach of fiduciary duty because the ex director had not known about the sale of the land from information he’d gained as a director (it was public knowledge the land was available before purchasing it was discussed by syndicate no 2) and the company was not in the business of investing in land. Its only activity was to manage the first development as agent for syndicate no 1and to act as agent for other purchases on instructions from others. The company did nothing on its own account and its attendance at the second auction was merely as agent (for syndicate no 2), therefore the ex director did not breach his fiduciary duty and there was no conflict. General law: test for conflict 20 The general law only prohibits conflicts where there is a ‘real sensible possibility of a conflict of interest’. The test is an objective test. That is: Would a reasonable person think there was a real sensible possibility of a conflict in all the facts and circumstances of the case? General law: test for conflict 21 The question is not whether you were actually influenced or whether or not you think you can make the decision without taking your own interests into account. It does not matter that a director actually acts with perfect honesty. If a reasonable person would think there is or was a real sensible possibility of a conflict then the director is or was in a conflict situation and the fiduciary rules apply. Tip Test for Conflict To help answer whether you have a real sensible possibility of there being a conflict, ask the following question: Would a reasonable person knowing the relevant facts and circumstances think that your interest in the matter was of such nature that it could influence your behaviour (such as a vote)? Australian Institute of Company Directors, Conflicts of Interest (2010, p 7) General law: duty very strict 23 Finally, it doesn’t matter that the transaction in which the director has an interest is one that is profitable for the company. A director will still breach his or her duty if there is a conflict. General law: test for conflict 24 Exercise Director of Purple Company is owed $500 by Green Company. It is proposed that Purple Company buys goods worth $1000 from Green Company. Do you think this represents a real sensible possibility of a conflict of interest for the director of Purple Company? What facts, if any, would make a difference to your answer? Exercise 25 Can you think of any other examples in your business where conflicts could arise? General law: remedies for breach of fiduciary conflict duty 26 Generally, the duty is owed to the company, so it will be the company that has a remedy. The remedies at general law relate to the transaction and to an action against the director. General Law: remedies for breach of fiduciary conflict duty 27 General law: the company can set aside a contract the company has entered into in which the director has a conflict of interest or duty where the third party knows or ought to have known of the conflict. General law: remedies for breach of fiduciary conflict duty 28 The director must account to the company for any profit the director has made out of the contract (even if the contract can’t be set aside e.g. because the other party to the transaction did not know of the director’s conflict). If the company suffers loss as a result of the contract, the company may be able to sue the director for equitable compensation (damages) if the company would not have contracted if it had known of the conflict. Exercise: remedies 29 Director of a finance company has delegated authority from the board to lend up to $100,000 without taking it to a full board meeting. The director lends $100,000 to his cousin for a 20 year term. The interest rate is 2% below the market rate. General law defence: fully informed consent 30 At general law, it is possible for the principal to consent to a fiduciary’s breach of fiduciary duty if the principal gives fully informed consent to the breach. For example, director may obtain the consent of the company for his business to sell goods to the company by obtaining prior approval of the contract at a meeting of all the company’s shareholders. General law defence: fully informed consent 31 For fully informed consent of the company to be effective: The nature and extent of the director’s interest must be disclosed to the shareholders, e.g. what profit, if any, the director is making out of the transaction; what kind of interest or conflict the director has in the transaction; General law defence: fully informed consent 32 Must disclose any pertinent facts the director knows about the transaction. Should disclose the fact that what is proposed is a breach of the director’s duty unless consent is obtained. General law defence: fully informed consent 33 Ultimately precisely what has to be disclosed to the shareholders will depend on the facts and circumstances of each case and on the level of sophistication of the persons to whom you are disclosing. General law: when will approval by the shareholders with fully informed consent not be effective? 34 While the company in general meeting can approve a transaction that would be in breach of a director’s duties because it was a conflict situation, a bare majority cannot a approve a conflict that amounts to a misapplication of company property. E.g. a sale at an undervalue. If the company is insolvent, even approval of all shareholders will not be effective to approve a misapplication of company property. General law: when will approval by the shareholders with fully informed consent not be effective? 35 In short, the majority in general meeting of a solvent company (that will remain solvent after the transaction) cannot approve a breach of director’s fiduciary duty not to be in conflict if the breach amounts to dishonesty, or disloyalty to the company or not acting in the best interests of the company (e.g. the sale at an undervalue). If the company is insolvent or will be insolvent after the transaction, even approval of all shareholders will not absolve the director because at that point duties are owed to creditors of the company. The Companies Act 2009 36 Director must not exercise any powers as a director if the director is directly or indirectly materially interested in the exercise of the power, except in certain circumstances (see later). S 67 The Companies Act 37 ‘exercising a power as a director’ this includes: voting powers relating to managing, and directing and supervising the management of the business and the affairs of the company: e.g. signing documents making decisions and directing staff The Companies Act 38 ‘Exercising a power as a director’ does not include conflict situations where no power is exercised e.g. Director works for another company Director gives advice to a competing company These kinds of conflicts will be covered by the general law obligation not to have a conflict or other sections of the Act dealing with directors duties e.g. duty to act in good faith and in the manner the director believes to be in the interests of the company (s 64) or the company’s rules/policies Companies Act provisions relevant to conflicts of interest ‘materially interested in the exercise of that power’ No definition of ‘material’ in the Act It is probable ‘material’ means ‘relevant’ rather than ‘significant’. In other words ‘is the conflict potentially relevant to a director’s motivation’ in exercising the power? So ‘material’ is similar to ‘is there a real sensible possibility of conflict’ under the general law formulation.1 Peter Watts, Directors' Powers and Duties (2009, p 231) When there will not be a breach of s 67 40 If the Act expressly authorises the director to exercise the power despite that interest; or If the director has reasonable grounds for believing the co will satisfy the solvency test after the power is exercised and EITHER The company rules authorise the exercise of the power after the director discloses the nature and extent of their interest in writing to the board and at least one member of the board is not interested in the transaction; or if there is no non-interested director, disclosure in writing is made to all shareholders other than the director or When there will not be a breach of s 67 41 OR (remember solvency test also to be satisfied) the exercise of the power is approved by all shareholders at a meeting convened under s 50 of the Act following disclosure of the nature and extent of the director’s interest to all shareholders who are not otherwise aware of those matters. Exercise 42 Red Company has significant assets and is financially healthy. Red Company Rule 10 provides: A director can exercise any power in relation to a transaction in which she is materially interested provided she has disclosed in writing the nature and extent of her interest in the transaction to the board if there is at least one director who is not interested in the transaction, or if there is no such director, disclosure is made to all shareholders other than the director. Exercise 43 Red company has 5 directors and is proposing to enter into a logging joint venture with Pink Company whose majority owner is Red Co’s managing director’s cousin. The remaining 4 directors of Red Company hold between them 49% of the shares in Pink Company. All of Pink Company’s directors are independent. (a) To manage these conflicts, what procedure should the directors of Red Company take to comply with s 67? (b) Suppose there was no Rule 10, what should the directors of Red Company do? Consequences of conflict of interest 44 A director who exercises a power and fails to disclose his or her interest as required under s 67 contravenes the Act and breaches his or her duty to comply with the Act under s 65. Also breaches model rules (see later). The director also breaches their general law fiduciary duty because they have a conflict of interest. The director will be liable to account for any profits made by him or her from the transaction and will be liable to pay equitable compensation (damages) if the company would not have entered the transaction if it had known of the conflict. Can the company set aside the transaction if a director has a conflict of interest? 45 This is governed by ss 107 and 108. Section 107: Any transaction entered into by the company in which a director is indirectly or directly materially interested in can be set aside by the company if it so chooses. UNLESS Can the company set aside the transaction if a director has a conflict? 46 The Act or the company rules expressly authorise entry into the transaction; OR The transaction was approved by all shareholders under s 50 following disclosure of the director’s interest to all shareholders who were not otherwise aware of the transaction; OR Can the company set aside the transaction if the company has a conflict? 47 The other party to the transaction is not a director or a person associated with the director (e.g. a parent, child, or spouse of the director or the director is a director, employee or trustee of that other person or the director has a material financial interest in that other person); and that other person did not know of the interest of the director; or The company received fair value under the transaction Setting aside the contract where director breached other duties 48 Section 108 provides that the company can set aside a transaction where a director breaches his or her duties of good faith and acting in the best interests of the company (s 64), or where the the director contravenes the Act (s 65) or contravenes the company’s rules (s 66) if: The other party to the transaction is the director or a person associated with the director; or The other party to the transaction knows or ought to know of the director’s breach and the co does not receive fair value. Example 1: no disclosure 49 Director of Red Company has a majority shareholding in another company that sells land to Red Company for market value. The directors of Red Company and its shareholders are not told of this conflict. There is no company rule that authorises the company to enter into the transaction. EG 1 Answer: no disclosure example 50 The company can set aside the transaction despite receiving market value because: the seller is a person associated with the director (the director has a material financial interest in the seller – the majority shareholding); and there has been no approval by all shareholders under section 50; and The company’s rules or the Act do not expressly authorise the transaction. EG 1 Answer: no disclosure example 51 In addition to a right to set aside the contract, the company could: require the director to account for any profit that he or she made personally out of the transaction (e.g. suppose the seller company declared dividends to its shareholders solely as a result of the sale of its property to Red Company); or obtain damages from the director if Red Co could show it would not have entered the transaction if it had known of the conflict (e.g. suppose even though market price was paid at the time the contract was signed the property market crashed 2 weeks later and the property is now worth 50% of what Red Company paid for it). Example 2: disclosure and insolvency 52 Green company is in financial difficulty. All the directors know this. Its company rules provide that a director can exercise a power of a director despite the director being interested in the exercise of that power provided the director discloses his or her interest as required under the Companies Act. The board decides to sell some of the company’s income producing assets to the managing director’s company. The MD gives notice of her interest to the board that has at least one independent director. The board (including the MD) unanimously approves the sale. As a result of the sale Green Company becomes insolvent. EG 2 answer: disclosure and insolvency 53 Assuming there are no reasonable grounds for believing the company would be solvent after exercising her vote, the MD is in breach of ss 67 (conflicts) and 65 of the Act (duty not to contravene the Act) and probably best interests duty (s 64) and probably duty of care (s 69). Can the company avoid the transaction? The transaction can be avoided by Green Company because under s 108 the MD breached her directors’ duties under s 64 and 65 and the other party to the transaction is a company that is associated with the director. EG 2 answer: disclosure and insolvency 54 What liability will the MD have to the co? Account for any profit she has made out of the deal with Green Company; or Pay compensation for any loss Green Company has suffered as a result of the transaction. The other directors will at least have breached their duty of care, diligence, and skill (s 69). How do the model company rules deal with conflicts? 55 None of the model company rules in schedules 2 – 4 allow a conflicted director to exercise a power after giving notice to the directors or the shareholders (where relevant) where the company will be solvent after the exercise of the power All of the model company rules require a director who is materially interested in any transaction or a proposed transaction to notify the board or shareholders (where relevant) of the nature and extent of the interest within 10 working days. (Remember any breach by a director of company rules is a breach of a director’s duty under s 66) How do the model company rules deal with conflicts? 56 Public companies have more detailed requirements about disclosure contained in the Schedule 4 model rules. They are contained in Schedule 4 clauses 59 and 63. In particular a public company must maintain an interests register Public Company Interests Register 57 Any director or shareholder is entitled to inspect the interests register and the annual report of the company must contain all entries in the register for the relevant accounting period. The interests register must contain various things but in particular it must contain details of any: Indemnity or insurance provided for the director Remuneration or other benefits of the directors Disclosure of any material interests Public Company Interests Register 58 A director can make a general disclosure in the interests register that the director is a director or employee or shareholder of another company or is otherwise associated with another company or person. (Schedule 4 clause 63(5)) Such a general disclosure will mean the director has complied with his or her obligations under the Company’s rules to notify the company of their interest in material transactions (Schedule 4 clause 63(6)) To Sum Up 59 As you can see the legal rules relating to conflicts of interest are complex. The precise legal answer to any problem on conflicts will depend on what is in the company rules and how those rules are drafted. Remember that merely declaring your interest may not be enough in some situations (even if the rules say you can act after disclosure). Because disclosing your interest will not help if you are not acting in good faith or the conflict results in harm to the company because the contract arising from the contract is unfair to the company. Disclosure doesn’t cure dishonesty or bad faith You must also look to any contract of employment, company, industry or professional codes of conduct or policies. To Sum Up 60 If you have a conflict or possible conflict As soon as possible notify the board in writing or the shareholders where there is no disinterested director on the board. Ensure details are put into the interests register (if the company is required to have one or has one as a matter of policy) Do not act in relation to the matter unless you can satisfy yourself that you can act following appropriate disclosures. You may have to consider resigning or removing the conflict if the conflict cannot be managed within the requirements of the law and company rules. AICD, Conflicts of Interest (2010, p 13) To sum up 61 What is clear is that the board should have policies to deal with conflicts to ensure the Act is complied with and which also promotes ethical behaviour. Checklist for conflicts 1 62 First understand and decide how conflicts are to be handled in light of the legal requirements under the Act and the company rules but also in light of what is ethical and what is acceptable to your other directors. This will be the company policy. Once the policy is worked out document it. The policy should at least: Based on AICD, Conflicts of Interest (2010, pp 28-32) Checklist for conflicts 1 63 Set out a list of key conflicts (e.g. what relationships or transactions will raise a conflict) Set out the legal requirements, at a minimum what is required under s 67 and the company rules. Set out what the company requires and expects of its directors in relation to conflicts in addition to complying with the legal requirements Checklist for conflicts 64 Document what board papers a director can receive, if any, in relation to a matter in which the director has a conflict. Set out what happens to a director if procedures are not followed. Set out a mechanism to record conflicts e.g. register of interests (required for a public company under schedule 4 model rules). Require declaration of conflicts on the board agenda as a standing item for the beginning of each board meeting. Checklist for conflicts 65 Training: ensure all directors are trained on what the company regards as conflicts upon induction and throughout their term as directors. Set up a mechanism to review policies and procedures relating to conflicts State Owned Enterprises Introduction 66 If the SOE is registered under the Companies Act the Companies Act applies in addition to the State Owned Enterprises Act 2007. State Owned Enterprises Regulations 2010 set out the duties of SOE directors. Must act in good faith and in what the director believes to be the best interests of the SOE Must exercise powers for a proper purpose Must not act or agree to act in a manner that contravenes the Act, the Companies Act, the rules of the SOE or any other establishing legislation State Owned Enterprises Introduction 67 Duty not to engage in reckless trading Must not agree to incurring an obligation unless believes on reasonable grounds the obligation can be met Must not disclose information that obtains in capacity as director or employee of SOE except in certain circumstances Must exercise the care, diligence, and skill SOEs and conflicts: SOE Regs 2010 68 Directors will be subject to fiduciary duties regarding conflicts of interest. SOE Act Regulations 2010 (regs 25-27) Immediately upon becoming aware that the director is interested in a transaction or a proposed transaction, directors must enter in the interests register and disclose to the board The nature and monetary value of the director’s interest If monetary value can’t be quantified then the nature and extent of that interest SOEs and conflicts: the Regulations 69 Director does not have to enter the interest in the register or notify the board if: The transaction or proposed transaction is between the director and the SOE; and The transaction or proposed transaction is to be entered into in the ordinary course of the SOE’s business and on usual terms and conditions. SOE and conflicts: the Regulations 70 Director can enter a general notice in the interests register to the effect the director is: a shareholder director officer or trustee of a named company or other person and is to be regarded as interested in any transaction the SOE has with that named company or other person. SOE and conflicts: the Regulations 71 Such a general notice is sufficient disclosure of interest under the regulations for that transaction. The board must notify the Accountable Ministers in writing within 10 days of the disclosure of an interest to it together with a copy of the entry on the interests register. The Responsible Minister must table in the National Parliament a copy of the notice within 5 days of receiving the notice. If Parliament is not sitting the notice must be lodged with the Clerk. SOE interested director must not participate 72 SOE Act Regulations, reg 27 A director who is interested in a transaction or proposed transaction may not: vote on a matter relating to the transaction; or attend a meeting of directors at which a matter relating to the transaction arises and be included in a quorum; or sign a document in relation to the transaction on behalf of the SOE; or do any thing in his or her capacity as a director in relation to the transaction. SOE and conflicts: the regulations 73 Failure of a director to comply with the obligation to notify the board and enter the details in the interests register will not of itself affect the validity of a transaction entered into by the company or the director (reg 25(4)). If the company is also registered under the Companies Act the provisions regarding conflicts will apply to the extent they are not inconsistent with the SOE Act. (Dealt with in more detail in SOE module) Appointment of directors and conflicts 74 Regulation 11: a preferred candidate must provide the Accountable Ministers with a written notice, among other things, disclosing the nature and extent of all interests that he or she has at that time or is likely have in matters relating to a SOE A person who has any conflict of interest that is of such significance that it would impede the person’s ability to carry out his or her duties as a director of the SOE is disqualified from being appointed or holding office as a director of a SOE (reg 12(1)(i). Exercise 75 Case study