Presentation

advertisement

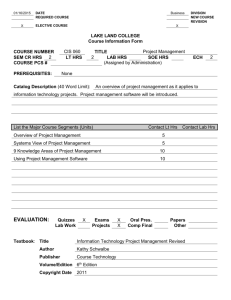

Eric Lee Programme Manager LiPACE, OUHK 15th January 2014 你 的 終 身 學 習 伙 伴 Your lifelong learning partner 2 Course Aims Financial Markets and Operations aims to provide: an alternative learning platform to students with interest and inclination in the financial services industries; the students to experience the real-life financial markets and operations; and opportunities for the students to understand their career development and further studies. 你 的 終 身 學 習 伙 伴 Your lifelong learning partner 3 Course Learning Outcomes Upon completion of the subject, students should be able to: explain the importance and contribution of the financial industry in an economy; apply basic financial concepts and financial analysis to make investment decision; describe the features and applications of different financial products; explain professional ethics and demonstrate positive value and attitude related to the financial industry; develop self-understanding for further studies and career development in the related field. 你 的 終 身 學 習 伙 伴 Your lifelong learning partner 4 Course Structure Stage of Introduction (33 hours) Stage of Understanding (117 hours) 8a. Financial Planning and Wealth Management (30 hrs) 3. Financial Products (60 hrs) 1. Overview of the Financial Industries in Hong Kong (12 hrs) 1.1 Role and Importance of the Financial Industries in Hong Kong Stage of Further Development (Elective Course) (30 Hours) 3.1 Equity Securities 3.5 Insurance 3.2 Debt Securities 3.6 Foreign Exchange 8a.1 An overview of the Financial Planning Profession 3.3 Derivatives and Structured Products 3.7 Deposit 8a.2 Basic Concepts and Principles of Financial Planning 1.2 Components of Financial System (Financial Institutions, Financial Market and Financial Instruments) 3.4 Mutual Funds 8a.3 Financial Planning Components 1.3 Monetary Policy and Financial Stability 5.1 Basic Fundamental Analysis 8a.4 Personal Profiling, Risk Profiling and Life-cycle Analysis 2. Basic Concepts of Finance (21 hrs) 5.2 Basic Technical Analysis 8a.5 Related regulations in Hong Kong 2.1 Concepts and Functions of Money 5.3 Basic Investment Strategies 8a.6 Career Development 2.2 Time Value of Money 6. Seminars and Workshops (15 hrs) 8b. Banking Operation (30 hrs) 2.3 Investment Risk and Return 6.1 Regulations and Investor Protection 8b.1 Retail Banking Business 2.4 Role of Financial Intermediaries 6.2 Career Prospect and Development of Financial Industry 8b.2 Finance of International Trade 6.3 Ethical issues in Financial Industry 8b.3 Treasury Markets and Operations 6.4 Professional Responsibilities 8b.4 Compliance and Control 6.5 Overview the Stock Markets in Mainland China 8b.5 Code of Banking Practice 7. Visits to Financial Institutions and Regulatory Bodies (9 hrs) 8b.6 Career Development 5. Investment Strategies (12 hrs) 你 的 終 身 學 習 伙 伴 Your lifelong learning partner 5 Assessment Tasks Task Task Name No. 1 Group Presentation on Overview of the Financial Services Industry in Hong Kong Assessment Method Oral Presentation 2 Written Test 3 4 5 6 7 8 Quiz (Overview of Financial Services Industry and Basic Concepts of Finance) Assignment (Investment Strategies) Reflective report on the visits and seminars Group Project (Financial Products) Test I (Financial Products, Rules and Regulations of Financial Services Industries, and Investment Strategies) Project (on elective module) Test II (on elective module) Case Study Written Report Written Project and oral presentation Written Test Written project and oral presentation (Individual) Written Test Brief Task Description Assessment/ Submission Date Contribution to Final Score (%) Students are required to form a group (4 to 5 students) to compare and contrast the benefits of two selected sectors of the financial services industry, and present the facts and views in about 5 minutes. Year 1 October 5% Year 1 November 10% Sit a 1-hour written test consisting of multiple choice questions and structured questions. Each student is required to solve a real-life financial problems/cases and evaluate financial proposals by applying tools and concepts of securities analysis and investment strategies. Each student is required to complete a about 600 words reflective report about the ethics, and positive value and attitude. Students in group of 4 to 5 students each will tackle financial investment problems by analyzing different types of financial products, and give recommendation(s)/solution(s). Each group is required to report the progress of about 2 minutes in the class periodically. They should submit a final written project (about 800 words) and give an oral presentation of about 10 minutes which may take the form of lecture, role-play, etc. Group assessment will carry 80% and individual assessment will carry 20%. Sit a 2-hour written test consisting of multiple choice questions, short questions and essay-type questions. 7a: Financial Planning and Wealth Management 7b: Banking Operations Each student is required to apply relevant concepts and tools to the given scenario and write a proposal of about 500 words, plus an oral presentation of about 5 minutes. 8a: Financial Planning and Wealth Management 8b: Banking Operations Sit a 2-hour written test consisting of multiple choice questions, short questions and essay-type/structured questions on the respective elective. Year 1 Jun Year 1 Aug 5% 10% Year 1 September 25% Year 1 September 20% Year 2 December 10% Year 2 December 15% 你 的 終 身 學 習 伙 伴 Your lifelong learning partner 6 Main Features 1. 2. 3. 4. A project will be conducts throughout the core course which aims to enhance students’ presentation skills, interpersonal skills, analytical skills and engagement. 3 visits to Financial Institutions and Regulatory Bodies 5 seminars and workshops 2 elective courses, i.e. Financial Planning and Wealth Management, and Banking Operations 你 的 終 身 學 習 伙 伴 Your lifelong learning partner 7 Q&A 你 的 終 身 學 習 伙 伴 Your lifelong learning partner 8 Thank You! Website: Email: General Hotline: www.ouhk.edu.hk/lipace lipace@ouhk.edu.hk 3120 9988 (1-1-2) 2291 6238 (Full Time Programmes) 你 的 終 身 學 習 伙 伴 Your lifelong learning partner