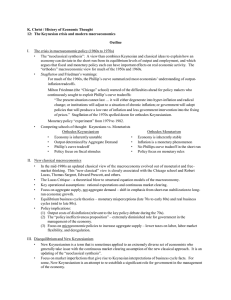

Ch16-- Macroeconomic Viewpoints

advertisement

Macroeconomic Viewpoints: Classical Keynesian Monetarist New Classical New Keynesian Classical Economics: Laissez - Faire Real GDP is determined by aggregate supply The equilibrium price level is determined by the money supply. Full employment is the norm Supply creates its own demand – The classical view prevailed before the Great Depression. 2 The Classical Model •Real GDP is determined by aggregate supply •The price level is determined by aggregate demand. 3 Keynesian Economics: Economic Activism John Maynard Keynes, The General Theory of Employment, Interest, and Money (1936) Emphasizes aggregate demand in determining GDP and employment. Assumes fixed prices (horizontal AS) at relevant levels of GDP. inflation is not a risk when unemployment is high. Government must stabilize an inherently unstable macroeconomy – Use demand management policies • Fiscal policy • Monetary policy 4 The Fixed-Price Keynesian Model 5 Monetarism: Return to Laissez - Faire Milton Friedman, Studies in the Quantity Theory of Money (1956) _______________, The Role of Monetary Policy (1968) Emphasizes role of money supply in determining real GDP and price level. Business cycles are largely the result of discretionary monetary policy Monetary mischief Activist policy is wrong: Too Much Too Late 6 Monetarism: Return to Laissez-Faire Efforts to increase real GDP through expansionary monetary policy Accelerating Inflation. “Inflation is everywhere and at all times a monetary phenomenon.” Economic policy operates with long and variable lags accurate timing nearly impossible. Don’t mess with the macroeconomy 7 Long and Variable Policy Lags 1. Recognition Lag: policymakers need time to realize that there is a problem. – 2. Reaction Lag: they need time to formulate an appropriate policy response. – 3. Effect Lag: policy takes time to implement and work through the economy. Countercyclical policies can become procyclical policies, worsening fluctuations Don’t mess with the macroeconomy – 8 9 10 New Classical Economics: Policy Ineffectiveness Arose in the 1970s in response to stagflation. Wages and prices are perfectly flexible. Markets are always in equilibrium. Markets work! Expectations are rational only unexpected changes in policy can affect output and employment. – Changes in real GDP result from unexpected changes in the prices level. 11 New Classical “Policy” Most observed unemployment is voluntary. Only unanticipated policies can have any effect. “policy ineffectiveness proposition”. Therefore, attempt no activist policy. Follow predictable and stable monetary and fiscal policies for long run employment and price stability. 12 New Classical Economics 13 New Keynesians: Policy Can Work Incorporate rational expectations But prices and wages are “sticky” in short run. Disequilibrium prevails. – Price-wage stickiness: impediments to adjustment exist (contracts, adjustment costs, etc.) Activist policies can work – Stabilize the economy/make things better! – The private sector is an important source of shifts in aggregate demand. – Monetary and fiscal policies should be used to offset drops in private sector spending. 14 The Modern Keynesian Model 15