Innovative Metropolitan Areas in the South

advertisement

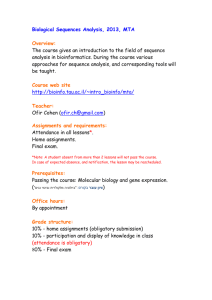

INNOVATIVE METROPOLITAN AREAS IN THE SOUTH: HOW COMPETITIVE ARE SOUTH CAROLINA’S CITIES? by David L. Barkley and Mark S. Henry Professors and Co-Directors Regional Economic Development Laboratory Department of Applied Economics & Statistics Clemson University THE NEW ECONOMY THE KNOWLEDGE ECONOMY THE GLOBAL ECONOMY Changes in Technologies Changes in Production Practices Changes in Location of Economic Activity Changes in the Demand for Labor Industry Clusters Clusters of Innovation Regional Innovation Systems Table 1. Examples of State and Local Programs to Encourage Research and Innovation Program Location Funding Stowers Institute for Medical Research Kansas City, MO/KS $2 billion endowment California Institute for Regenerative Medicine State-wide $3 billion over 10 years North Carolina Bio-Technology Research Campus Kannapolis, NC $1 billion endowment The Ohio Third Frontier Project State-wide $500 million Scripps Florida Palm Beach, FL $510 million Kentucky Research Challenge Trust Fund State-wide $340 million Donald Danforth Plant Sciences Center St. Louis, MO $150 million Hudson-Alpha Institute for Biotechnology Huntsville, AL $130 million Translational Genomics Research Institute Phoenix, AZ $100 million Louisiana Optical Network Initiative State-wide $40 million Grow Wisconsin Business Incubators State-wide $30 million Table 2. Selected Measures of Metropolitan Innovative Environment A. Innovative Activity PATENT: Number of patents issued per 1000 population (USPTO, 1990-99) ARD: Academic R&D expenditures per 1000 population (NSF, 1998-2000) SED: Doctorates awarded in science and engineering per 1000 population (NSF, 1998-2000) GSS Graduate science and engineering students per 1000 population (NS, 1998-2000) ETEC: Percentage of employment in technical professions – computer science; engineering except civil; natural, physical, and social science (BLS, 2000) Table 2. Selected Measures of Metropolitan Innovative Environment (cont.) B. Labor Force Quality PHSG: Percentage of adult population (25+) that are high school graduates (CBP, 2000) PCG: Percentage of adult population (25+) that are college graduates (CBP, 2000) PWP: Percentage of population (age 16-64) that are employed (Census, 2000) Table 2. Selected Measures of Metropolitan Innovative Environment (cont.) C. Entrepreneurial Environment PCEST: Percentage change in number of establishments (CBP, 1990-2000) PEL2O: Percentage of establishments with fewer than 20 employees (BLS, 2000) INC500: Number of Inc 500 companies per 100,000 population (www.inc500.com, 2000) VCAP: Venture capital investments ($) per capita (Price Waterhouse Coopers, 2000) EMB: Percentage of employment in managerial and business professions (BLS, 2000) Table 2. Selected Measures of Metropolitan Innovative Environment (cont.) D. Agglomeration Economics HTEMP: Percentage of employment in high-technology industries (CBP, 2000) HTEST: Percentage of establishments in high technology industries (CBP, 2000) ITEMP: Percentage of employment in information technology industries (CBP, 2000) ITEST: Percentage of establishments in information technology industries (CBP, 2000) E. Competitiveness in Global Economy EXPORTS: Exports as a percent of gross metropolitan product, metro areas ranked in quantiles (DOC, 1999) Table 3. Metropolitan Areas in Regional Innovation Systems Cluster Groupings 1. Outliers (4) Atlanta, GA CMSA Austin, TX MSA Raleigh, Durham, Chapel Hill, NC CMSA Baton Rouge, LA MSA 2. High (12) Dallas-Fort Worth-Arlington, TX CMSA Houston-Galveston-Brazoria, TX CMSA Huntsville, AL MSA Melbourne-Titusville-Palm Bay, FL MSA Orlando, FL MSA Pensacola, FL MSA Richmond-Petersburg, VA MSA San Antonio, TX MSA Sarasota-Bradenton, FL MSA Tampa-St. Petersbusrg-Clearwater, FL MSA Tulsa, OK MSA West Palm Beach-Boca Raton, FL MSA Table 3. Metropolitan Areas in Regional Innovation Systems Cluster Groupings (cont.) 3. College Towns (5) Athens, GA MSA Bryan-College Station, TX MSA Charlottesville, VA MSA Gainesville, FL MSA Tallahassee, FL MSA 4. Medium (20) Augusta-Aiken, GA-SC MSA Birmingham, AL MSA Charleston-North Charleston, SC MSA Charlotte-Gastonia-Rock Hill, NC-SC MSA Cincinnati-Hamilton, OH-KY-IN MSA Columbia, SC MSA Greensboro--Winston-Salem–High Point, NC MSA Greenville-Spartanburg-Anderson, SC MSA Jackson, MS MSA Jacksonville, FL MSA Knoxville, TN MSA Lexington, KY-IN MSA Memphis, TN-AR-MS MSA Nashville, TN MSA New Orleans, LA MSA Norfolk-Virginia Beach-Newport News, VA-NC MSA Oklahoma City, OK MSA Roanoke, VA MSA Wilmington, NC MSA Table 3. Metropolitan Areas in Regional Innovation Systems Cluster Groupings (cont.) 5. Below Average (47) Abilene, TX MSA Albany, GA MSA Alexandria, LA MSA Amarillo, TX MSA Ashville, NC MSA Auburn-Opelika, AL MSA Beaumont-Port Arthur, TX MSA Biloxi-Gulfport-Pascagoula, MS MSA Chattanooga, TN-GA MSA Clarksville-Hopkinsville, TN-KY MSA Columbus, GA MSA Corpus Christi, TX MSA Decatur, AL MSA Dothan, AL MSA Enid, OK MSA Evansville-Henderson, IN-KY MSA Fayetteville, NC MSA Fayetteville-Springdale-Rogers, AR MSA Florence, SC MSA Fort Smith, AR-OK MSA Fort Walton Beach, FL MSA Goldsboro, NC MSA Greenville, NC MSA Hattiesburg, MS MSA Hickory-Morganton-Lenoir, NC MSA Jackson, TN MSA Jacksonville, NC MSA Jonesboro, AR MSA Killeen-Temple, TX MSA Lafayette, LA MSA Lake Charles, LA MSA Lakeland-Winter Haven, FL MSA Lawton, OK MSA Little Rock-North Little Rock, AR MSA Long View-Marshall, TX MSA Lubbock, TX MSA Lynchburg, VA MSA Table 3. Metropolitan Areas in Regional Innovation Systems Cluster Groupings (cont.) 5. Below Average (47) (cont.) Macon, GA MSA Mobile, AL MSA Monroe, LA MSA Montgomery, AL MSA Myrtle Beach, SC MSA Odessa-Midland, TX MSA Owensboro, KY MSA Panama City, FL MSA Pine Bluff, AR MSA Rocky Mount, NC MSA San Angelo, TX MSA Savannah, GA MSA Sherman-Denison, TX MSA Shreveport-Bossier City, LA MSA Sumter, SC MSA Tuscaloosa, AL MSA Tyler, TX MSA Victoria, TX MSA Waco, TX MSA Wichita Falls, TX MSA 6. Low (18) Anniston, AL MSA Brownsville-Harlingen-San Benito, TX MSA Danville, VA MSA Daytona Beach, FL MSA El Paso, TX MSA Florence, AL MSA Fort Myers-Cape Coral, FL MSA Fort Pierce-Port St. Lucie, FL MSA Gadsden, AL MSA Houma, LA MSA Huntington-Ashland, WY-KY-OH MSA Johnson City-Kingsport-Bristol, TN-VA MSA Laredo, TX MSA McAllen-Edinburg-Mission, TX MSA Naples, FL MSA Ocala, FL MSA Punta Gorda, FL MSA Texarkana, TX-Texarkana, AR MSA Table 4. Changes in Aggregate Economic Activity by Cluster Groupings, 1990-2000 Cluster Grouping Change in Employment (%) Change in Population (%) A. Metro Counties Outliers (32)a 62.26 44.27 High (58) 42.20 28.25 College Towns (13) 42.61 31.74 Medium (113) 34.51 20.27 Below Average (106) 26.88 14.69 Low (33) 24.27 17.87 a Number of metro or nonmetro counties in the cluster grouping. Table 5. Changes in Aggregate Economic Activity by Cluster Groupings, 1990-2000 Cluster Grouping Change in Employment (%) Change in Population (%) B. Nonmetro Counties Outliers (31) 32.74 23.00 High (40) 31.27 22.01 College Towns (24) 25.29 22.22 Medium (136) 21.33 12.25 Below Average (315) 15.89 7.06 Low (42) 19.55 12.83 Rural LMAs (349) 17.88 10.39 Table 6. Patents Per 1000 People by Southern Metropolitan Area, 1995-1999 Leading Southern Metropolitan Areas 1. Austin-San Marcos 2. Baton Rouge 4.28 3.71 3. 4. 5. 6. 7. 8. Raleigh-Durham-Chapel Hill Gainesville, FL West Palm Beach-Boca Raton Houston Dallas-Fort Worth-Arlington Melbourne-Titusville-Palm Bay 2.66 1.96 1.75 1.52 1.49 1.45 South Carolina Metropolitan Areas 14. Greenville-Spartanburg-Anderson 29. Florence 31. Charlotte-Gastonia-Rock Hill 50. Charleston 51. Columbia 64. Augusta-Aiken 82. Myrtle Beach 104. Sumter 1.16 .79 .75 .56 .54 .39 .31 .17 Table 7. Total R&D Expenditures at Universities and Colleges, 1998-2000 Area Total R&D 1998-2000 R&D Expenditures Per Capita Leading Southern Metropolitan Areas 1. Bryan-College Station, TX 2. Athens, GA 3. Gainesville, FL 4. Baton Rouge, LA 5. Hattiesburg, MS 6. Charlottseville, VA 7. Auburn-Opelika, AL 8. Raleigh-Durham-Chapel Hill, NC 1,193,191,000 713,914,000 893,001,000 703,565,000 388,843,000 410,689,000 260,924,000 2,550,055,000 $7.81 4.63 4.09 3.62 3.46 2.56 2.26 2.12 South Carolina Metropolitan Areas 16. Columbia 20. Charleston 21. Greenville-Spartanburg-Anderson 22. Augusta-Aiken 54. Charlotte-Gastonia-Rock Hill 68. Myrtle Beach NR Florence NR Sumter 305,927,000 179,002,000 306,074,000 133,100,000 36,745,000 1,638,000 0 0 $.57 .33 .32 .28 .02 .01 0 0 Source: National Science Foundation Table 8. Percentage of Metropolitan Labor Force in Professional Occupations, 2000* Leading Southern Metropolitan Areas 1. Huntsville 2. Raleigh-Durham-Chapel Hill 3. Melbourne-Titusville-Palm Bay 4. Austin 5. Dallas-Fort Worth-Arlington 6. Houston 7. Tallahassee 8. Atlanta South Carolina Metropolitan Areas 13. Charlotte-Gastonia-Rock Hills 31. Columbia 38. Greenville-Spartanburg-Anderson 39. Augusta-Aiken 40. Charleston 69. Sumter 81. Myrtle Beach 87. Florence 10.1% 8.5 8.1 7.7 6.3 5.9 5.1 4.7 3.9% 3.2 2.9 2.9 2.8 1.8 1.6 1.5 * Professional occupations include Computer and Mathematical Operations (15-000); Life, Physical and Social Science. Occupations (19-0000); and Architecture and Engineering Occupations (17-0000) Table 9. Share of Adult Population with College Degrees, 2000. Leading Southern Metropolitan Areas 1. Charlottseville 2. Raleigh-Durham-Chapel Hill 3. Gainesville, FL 4. Bryan-College Station 5. Austin 6. Tallahassee 7. Athens, GA 8. Atlanta 40.1% 38.9 38.7 37.0 36.7 36.7 34.1 32.0 South Carolina Metropolitan Areas 10. Columbia 19. Charlotte-Gastonia-Rock Hill 23. Charleston 58. Augusta-Aiken 60. Greenville-Spartanburg-Anderson 74. Florence 75. Myrtle Beach 99. Sumter 29.2% 26.5 25.0 20.9 20.7 18.7 18.7 15.8 Source: U.S. Census, 2000 Table 10. Share of Adult Population with High School Diplomas Leading Southern Metropolitan Areas 1. Gainesville, FL 2. Fort Walton Beach 3. Melbourne-Titusville-Palm Bay 4. Tallahassee 5. Raleigh-Durham-Chapel Hill 6. Lawton, OK 7. Fayetteville, NC 8. Austin 88.1% 88.0 86.3 85.9 85.4 85.2 85.0 84.8 South Carolina Metropolitan Areas 11. 40. 44. 52. 66. 93. 99. 108. Columbia Charleston Myrtle Beach Charlotte-Gastonia-Rock Hill Augusta-Aiken Greenville-Spartanburg-Anderson Sumter Florence Source: U.S. Census, 2000. 84.3% 81.3 81.15 80.5 78.9 75.4 74.3 73.1 Table 11. Venture Capital Investments in the South, by State, 1995-2005 State Deals Investments (millions) Texas Virginia 2154 1098 $18,403 8,340 $ 883 1,178 Florida Georgia 833 1026 8,037 6,834 503 835 North Carolina Tennessee 869 273 5,755 1,921 715 338 South Carolina Alabama 87 130 1,089 817 271 184 Louisiana Kentucky 83 93 631 500 141 124 Oklahoma Mississippi Arkansas 67 28 26 446 338 68 129 119 25 Source: PriceWaterhouseCooper Money Tree Investments Per Capita Table 12. Share of Establishments in Professional, Scientific, and Technical Services Industries (NAICS 54), 1997 Leading Southern Metropolitan Areas 1. Miami – Fort Lauderdale, Fl 2. Richmond – Petersburg, VA 3. Tallahassee, Fl 4. Austin-San Marcos 5. Atlanta 6. West Palm Beach – Boca Raton, FL 7. Huntington-Ashland, WVA-KY-OH 8. Raleigh-Durham-Chapel Hill, NC 27.7% 14.1 12.7 12.7 12.2 12.1 11.4 11.4 South Carolina Metropolitan Areas 25. Augusta-Aiken 40. Charleston 48. Charlotte-Gastonia-Rock Hill 73. Greenville-Spartanburg-Anderson 76. Columbia 90. Sumter 102. Myrtle Beach 109. Florence 9.5% 8.4 8.0 7.1 6.8 6.2 5.8 5.4 * Source: 1997 Economic Census ** NAICS 54 activities include legal advice and representation; accounting, bookkeeping, and payroll services; architectural, engineering, and specialized design services; computer services; consulting services; research services; advertising services; photographic services; translation and interpretation services; veterinary services; and other professional, scientific, and technical services. Table 13. Entrepreneurial Growth Companies as a Share of Business in Labor Market Areas, 1991-1996. Entrepreneurial Growth Companies - Annual employment growth rate > 15% - Employment growth > 100% for 1991-96 Southern Metropolitan Areas Labor Market Area Austin Atlanta Nashville Pensacola Raleigh Little Rock Charlotte United States Average Florence Green.-Spart.-Ander. Columbia Augusta-Aiken Charleston Sumter Companies 20,915 69,279 24,458 10,863 25,768 13,036 28,383 12,091 22,771 13,577 9,106 12,350 3,185 High Growth 1,514 4,479 1,465 643 1,507 757 1,544 567 1,049 607 393 507 118 Source: National Commission on Entrepreneurship, 2001. Share 7.2% 6.5 6.0 5.9 5.8 5.8 5.4 4.7 4.7 4.6 4.5 4.3 4.1 3.7 Table 14. Change in Utility Patent Activity 1992-2004, Southern States State North Carolina Georgia Texas U.S. Kentucky Alabama Tennessee Florida South Carolina Mississippi Virginia Arkansans Louisiana Oklahoma 1992-93-94 Average 925 727 3542 274 262 560 1842 432 390 770 2471 Percentage Change +97.8% +81.5% +69.3% +60.4% +57.5% +48.9% +37.5% +34.2% 426 114 874 127 441 572 564 151 1117 156 393 476 +32.4% +32.4% +27.8% 22.8% -11.0% -16.7% Source: U.S. Patent and Trademark Office, April 2005. 2002-03-04 Average 1830 1319 5995 Rank Among Southern Metro Areas Top 25% (1-29) (30-59) (60-89) ? G-S-A Florence Charlotte Charleston Columbia Augusta-Aiken Myrtle Beach Columbia Charlotte Charleston Augusta-Aiken G-S-A Florence Myrtle Beach Augusta-Aiken Charleston Charlotte ? G-S-A Columbia ? ? Bottom 25% (90-117) Sumter Sumter Innovative Activity (Patents) Human Capital (College Graduates) Sumter Myrtle Beach Florence Entrepreneurial Support (Professional Services) Local Quality of Life Figure 1. Ranking of South Carolina Metropolitan Areas Across Regional Innovation System Indicators REGIONAL ECONOMIC DEVELOPMENT RESEARCH LABORATORY CLEMSON UNIVERSITY http://cherokee.agecon.clemson/redrl.htm Innovation Policies for Non-RIS Regions (Rosenfeld, 2002 and Tödtling, 2004) Industry Clusters • Support clusters in new industries related to existing industrial base • Strengthen emerging/potential clusters in the region Innovation Policies for Non-RIS Regions (Rosenfeld, 2002 and Tödtling, 2004) (Continued) New Firms • • Promote entrepreneurship and new firm development Attract cluster-related firms Innovation Policies for Non-RIS Regions (Rosenfeld, 2002 and Tödtling, 2004) (Continued) Knowledge and Innovation • Develop cluster-specific technology centers • Attract branches of national research organizations • Build up and attract new labor skills Innovation Policies for Non-RIS Regions (Rosenfeld, 2002 and Tödtling, 2004) (Continued) Networks • • Link firms to local and external knowledge providers Technology transfer programs